Micron (MU) stock is taking a modest hit on earnings, down about 3% on the day. At Thursday’s low, shares were down just over 5%.

The reaction is not great and it’s weighing on the semiconductor space as a whole, as Nvidia (NVDA), Advanced Micro Devices (AMD,) and others are under pressure.

Of course, it doesn’t help that the broader market is under pressure as well. Given the broad-market selloff, I’m actually surprised Micron stock isn’t down more.

That’s as CEO Sanjay Mehrotra said, “due to the significant supply demand mismatch entering calendar 2023, we expect that profitability will remain challenged throughout 2023.”

That came alongside a top- and bottom-line miss for its fiscal first-quarter results. While revenue guidance was okay, profit guidance for next quarter badly missed the mark.

The firm will also slash its workforce by 10%.

Trading Micron Stock on Earnings

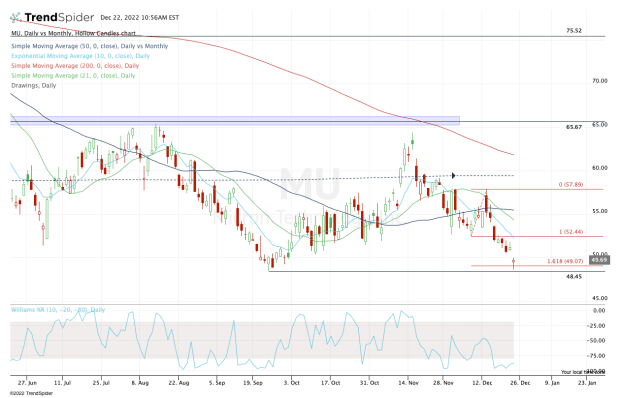

Chart courtesy of TrendSpider.com

When looking at the chart, it’s clear that Micron stock has been under pressure. The stock is currently down in five of the last six weeks, with its one weekly gain coming from a 0.35% advance in the stock price.

However, the stock is finding some support near $49.

That’s as it trades into the 161.8% downside extension of the short-term range and as it neared a retest of its current 52-week low at $48.45.

It’s hard to believe this stock was hitting all-time highs in January.

From here, it’s pretty simple. Either Micron can hold the $48.50 to $49 area as support or it can’t.

If it can hold it, then traders can look for a gap-fill back up toward $50.75 and potentially look for a test of the declining 10-day moving average.

If Micron stock can’t hold this area, then the $45 to $46 area could be in play. There we find the 78.6% retracement from the all-time high down to the covid 2020 low.

Given the current trend, the odds aren’t stacking in the bulls’ favor despite this morning’s bounce.

If the current support area holds, then there may be a decent counter-trend rally at hand. That said, the predominant trend at play is to the downside. Should support fail, keep an eye on $45 to $46.