KEY POINTS

- MicroStrategy completed a notes offering this week and soon after acquired 11,931 more Bitcoins

- Bitcoin dropped to the low end of $64,000 Thursday after struggling to stick above $65,000

- Bitcoin whales also bought the dip last week, with a 20K collective purchase in a single day

Software company MicroStrategy has capitalized on Bitcoin's recent dip, boosting its substantial BTC treasury with proceeds from the recently completed convertible senior notes offering.

The company, which said earlier this year that it was transitioning into a "Bitcoin development" firm, first announced Thursday that it completed its convertible notes offering of $800 million earlier this week. When it announced its latest notes offering, the company said it will use the net proceeds from the notes sales "to acquire additional Bitcoin and for general corporate purposes."

Interestingly, the company founded by Bitcoin maximalist Michael Saylor made the offering as more companies follow its lead in adopting a BTC strategy for business growth.

Later on Thursday, MicroStrategy said it purchased approximately 11,931 more BTC for an estimated $786 million in cash, using the proceeds from its latest offering. "As of June 20, 2024, MicroStrategy, together with its subsidiaries, held an aggregate of approximately 226,331 Bitcoins," it said in a U.S. Securities and Exchange Commission (SEC) filing.

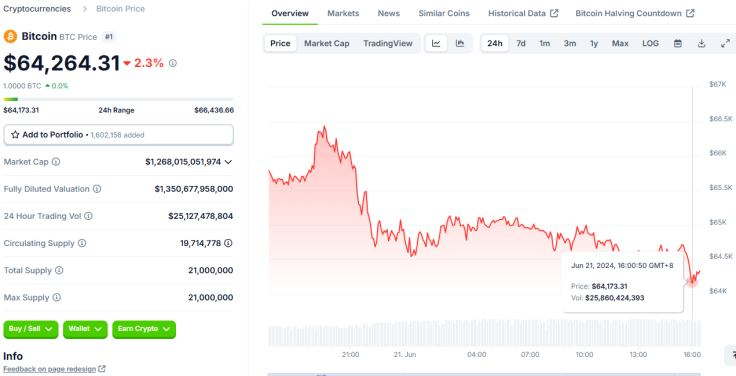

The purchase of nearly 12,000 BTC was made during Bitcoin's downturn. The world's largest cryptocurrency by market value had been trading above $65,000 on Thursday and ended the day on the $64,000 lows, as per data from CoinGecko. As of early Friday, the digital asset is trading at around $64,100 and $64,200.

Eric Weiss, another known Bitcoin maxi, commented on Saylor's post about the latest addition to MicroStrategy's already massive haul, saying "this is how you turn a $1 billion company into a $34 billion company in less than 4 years."

One Bitcoiner said MicroStrategy's latest buy was "excellent timing," and @cozypront, a known maximalist for the Solana blockchain, said Saylor "will be the richest man in the world sooner or later." Saylor is currently ranked 718 on Forbes' Real-Time Billionaires List. However, it's a different story on the outlet's 2024 Richest Crypto and Bitcoin Billionaires rankings, Saylor sits comfortably on the 4th spot.

In the latter list, Saylor is only behind Giancarlo Devasini, the majority owner at stablecoin titan Tether, Brian Armstrong, the co-founder of crypto exchange giant Coinbase, and Changpeng Zhao, the jailed founder and former CEO of the world's largest crypto exchange by trading volume, Binance.

Meanwhile, MicroStrategy isn't the sole dip buyer. Last week, BTC whales also accumulated more Bitcoins – 20,000 BTC in a single day – when the digital currency plunged to $66,000 from trading at the high end of $67,000.