Shares of Meta (META) are having a field day on Thursday, up about 14% after the social-media giant reported better-than-expected earnings.

The move is enough to send the shares to 52-week highs -- and now they're approaching a major inflection point.

The report comes on the heels of solid quarterly results from Alphabet (GOOGL) (GOOG) and Microsoft (MSFT), though only the latter was able to put together a decent rally yesterday.

Don't Miss: Microsoft Stock Pops on Earnings. Is $320 the Next Level?

In any regard, Meta continues to impress investors. The firm delivered a top- and bottom-line beat, as revenue grew 2.7% to $28.65 billion, topping estimates of $27.41 billion.

As a result, some have made the case about how to classify Meta, noting that it’s not a growth stock but that the shares aren’t cheap.

But Wall Street doesn’t seem to care — at least not today — as the stock powers higher.

The best-performing FAANG stock from the first quarter continues to be the best-performing FAANG stock of the second quarter and now sports a year-to-date gain of 100%.

Trading Meta Stock on Earnings

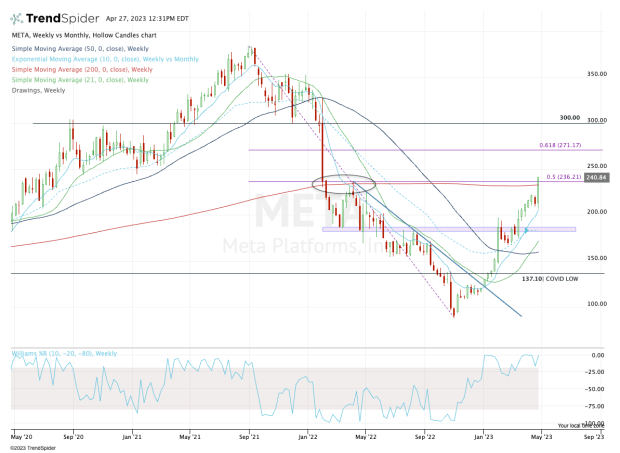

Chart courtesy of TrendSpider.com

If we were to look at the daily chart, it would look like smooth sailing for Meta stock after the earnings report. When we zoom out to the weekly chart, however, we get a better sense of the bigger picture.

For instance, earlier this year the stock was able to push through the key $180 to $185 area and continues to ride the 10-week moving average higher.

Now the shares are powering higher, pushing through the 200-week moving average and the 50% retracement near $235.

Don't Miss: Alphabet Faces AI Challenge, Trades Flat. Here's the Chart Setup.

As you can see, this was a huge inflection point in February and April 2022. At that time, this zone quickly flipped from support to resistance, telling active investors that it was time to bail and seek other investments.

If the stock cannot hold above this area, the bulls can look for a pullback into the $220s. If it does hold above this zone and clears $250, then the 61.8% retracement near $270 is the next meaningful upside target.

Above that and investors will likely set their sights on the $300 level.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.

.png?w=600)