Meta (META) stock has been the best FAANG stock so far in 2023. In fact, it’s neck-and-neck with Nvidia (NVDA) for the best performance from a stock with a market cap in excess of $500 billion.

Nvidia is up 96.6% so far this year, while Meta is up 93%. Both stocks are up about 165% from their 52-week lows (which occurred in the fourth quarter).

On a year-to-date basis, Meta stock trounces its FAANG competition. Apple (AAPL) is the next-best performer, up about 33% so far in 2023.

Don't Miss: Will Apple Stock Hit 52-Week Highs? Check the Chart.

Like many of its FAANG peers, Meta recently reported earnings and investors gobbled up the stock after the print.

The shares closed higher by 14% in the first trading session after the report, which was a top- and bottom-line beat. After such a strong rally ahead of the results, Meta had to report a good quarter for the stock to continue higher.

Now the stock is trying to avoid its fifth straight daily decline and the bulls are wondering whether this is a dip they should be buying. Let’s have a look at the chart.

Buy the Dip in Meta Stock?

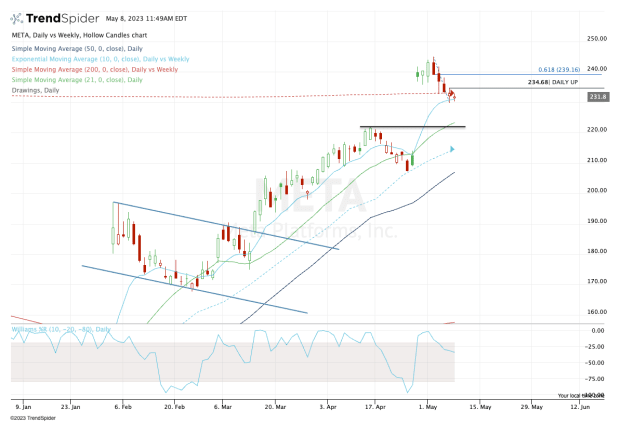

Chart courtesy of TrendSpider.com

The price action in Meta reminds me a bit of Salesforce (CRM), another stock that has been quite strong this year. Both stocks are in a tango with their 200-week moving averages, although Meta has handled its better.

That’s as its post-earnings gap-up sent the shares above this measure, while the stock is now trying to hold the level on the pullback. Further, it’s trading down into the 10-day moving average, a measure of active support.

Aggressive bulls can buy right in this area and look for a move back to the upside. Conservative buyers can wait for a rotation over the prior day’s high. If it comes today, it will require a move above $234.68.

Don't Miss: AMD and Microsoft Team Up to Fuel AI Ambitions. Time to Buy?

It wouldn’t be the worst thing to see an inside day — where today’s range is completely contained within the prior day’s range, which is currently the case — and then a rotation through today’s high.

Either way, it should have bulls looking for a rebound up to the $237 to $239 area, then $240-plus. Above $240 and the $245 level is in play, which is right near the 2023 high.

If the $230 area can’t hold as support, it wouldn’t be the worst thing to see a pullback down into the low $220s along with a tag of the 21-day and 10-week moving averages.

As long as one of these areas hold as support, I’d consider the bulls to be in control of Meta stock.