Meta’s stock is down 49% year-to-date, as investors worry about the impact of TikTok, iOS policy changes and much else on the social media giant’s top and bottom lines.

Bulls are hoping that all this bad news has been more than priced in ahead of Meta’s latest earnings report. Among analysts polled by FactSet, the consensus is for Mark Zuckerberg’s company to post first-quarter revenue of $28.28 billion (up 8% annually) and GAAP EPS of $2.56 (down 23%).

Meta typically shares quarterly sales guidance and full-year spending guidance in its earnings report. The company’s second-quarter revenue consensus is currently at $30.7 billion (up 6%).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Meta’s earnings report, which is expected after the bell, along with an earnings call scheduled for 5:00 P.M. Eastern Time. (Please refresh your browser for updates.)

6:06 PM ET: Meta's call has ended. After going into earnings down 48% on the years, shares are up 17.9% after-hours to $206.30 after Meta posted results and guidance that were better than feared.

Q1 results were mixed -- revenue missed, while EPS beat -- and Q2 revenue guidance of $28B-$30B was below a $30.7B consensus. Separately (to the applause of investors), Meta cut its full-year GAAP cost/expense guidance to $87B-$92B from $90B-$95B, and Mark Zuckerberg stated on Meta's call that his company is looking to slow its spending growth as it tries to balance its long-term ambitions with slower near-term growth.

Thanks for joining us.

6:01 PM ET: Wehner: We expect there to be a sequential decline in MAUs in Europe in Q2, and because of that, we expect global MAUs to be flat to down. The way we calculate MAUs will affect Q1/Q2 comparisons.

5:59 PM ET: Regarding Reels ads, Sandberg says Meta has learned over time that there's value in automating the process of creating an ad campaign as much as possible. Says that a transition like this will always lead ad budgets to shift some from other offerings, but that Meta's ultimate goal is to keep growing the total size of advertiser budgets.

5:56 PM ET: Sandberg notes closing the ad-measurement loop requires a variety of efforts. Also reiterates that she thinks Meta's ad platform (aided by the company's first-party data) still gives it a very strong competitive advantage.

5:53 PM ET: Sandberg reiterates Meta is working to educate advertisers about best advertising practices. Also says the company has closed a large percentage of the measurement gap first caused by iOS policy changes, while adding that further closing it is more of a challenge with small businesses, since Meta has to work with them more on best practices.

5:51 PM ET: A question about regional growth rates, and one about near-term spending priorities.

Wehner: Growth slowed in all regions. Europe decelerated very meaningfully, partly due to the Ukraine war. North America was especially impacted by targeting/measurement headwinds. Ad impressions were down Y/Y in North America, so the pressure was demand-related. India was a strong point for the ad business in Q1.

Regarding spending plans, Zuck says he's Meta is shifting resources towards "high-priority areas." Insists he wants to make sure Meta's teams are disciplined about how they use resources.

Also, regarding employee attrition, he says times of volatility allow a company to find out who really wants to be there. Says he agrees with Wehner that Meta is doing alright overall in terms of retaining talent.

5:46 PM ET: Wehner says Meta continues having success in recruiting, as shown by its headcount growth. Also says employee retention is broadly in-line with pre-pandemic levels.

5:43 PM ET: Zuck: There are now millions of pieces of content that we could potentially show someone, and using AI to figure out what to show is a large opportunity. Social content from friends/family will remain important, but there's a lot of room to grow engagement by improving content discovery.

He also reiterates that improving Reels monetization will be a gradual process, and that Meta will be willing to show more Reels ads as the product improves.

"This is going to be a multi-year journey like Stories, but one that we're very optimistic about," says Sandberg. "Advertisers who are using [Reels ads] are seeing really promising results."

5:38 PM ET: A question about whether iOS headwinds could diminish later this year, and whether there could be more pressures related to iOS 16.

Wehner reiterates that Meta still expects a ~$10B 2022 impact from iOS changes, while adding it's not a precise estimate. He also says (in line with consensus estimates) Meta expects its Q3 growth rate to be higher than its Q2 growth rate, as it starts lapping the 1-year anniversary of ATT's arrival.

5:35 PM ET: A question about Meta's spending, and one about whether iOS headwinds got worse in Q1.

Zuck suggests the cycle for obtaining a payoff on Reality Labs spend will be relatively long compared with past investments. Says Meta has multiple teams in parallel working on AR/VR projects. Adds that Reality Labs spending will continue growing, but will eventually cool. Calls it a decade-long effort.

Regarding iOS headwinds, Wehner says Meta continues seeing them and factored them into its Q2 guidance. Notes that in addition to ATT (user-tracking opt-in requirements), Meta is seeing "incremental headwinds" related to iOS 15, and reiterates Meta is investing in AI-based solutions to help offset these headwinds.

5:31 PM ET: A question about Reels engagement and total time spent on Meta's apps, and one about how much of Meta's large 2022 capex is due to one-time investments.

Wehner: We think Reels is additive to overall engagement. Engagement for both Facebook and Instagram remain above pre-pandemic levels, both globally and in the U.S..

Regarding high 2022 capex, he notes supporting usage growth for services such as Reels is a factor, as are AI-related investments.

5:28 PM ET: The Q&A session is starting. Meta's stock is now up 19.2% AH to $208.55.

5:27 PM ET: Wehner: Our advertisers are adjusting to a new digital advertising landscape, while also dealing with a complex set of macro challenges.

5:26 PM ET: Wehner notes Europe MAUs/DAUs were impacted by the blocking of Meta's services in Russia, and that this will continue to be a headwind to user growth in Q2.

5:25 PM ET: Ad impressions rose 15% Y/Y, driven by Asia-Pac and Rest of World. Price per ad fell 8%, due to a mix shift towards regions and apps that monetize at lower rates.

For comparison, ad impressions were up 13% Y/Y in Q4, and price per ad fell 6%.

5:23 PM ET: Wehner recaps Meta's Q1 performance. He notes ad growth decelerated in Q1 due to e-commerce pressures, as well as targeting/measurement challenges (e.g., the iOS changes), Russia/Ukraine and forex headwinds.

5:22 PM ET: CFO Dave Wehner is talking.

5:21 PM ET: One note about Meta paring back its spending plans: Much like other big tech companies, Meta's stock is a key tool for hiring and retaining top engineering talent. Meta's management is probably well-aware of this...and of how its stock could get a boost from cooling spending growth.

5:20 PM ET: Sandberg says click-to-message ads are now a multi-billion dollars business that's seeing double-digit growth. She also says shopping ads that drive users to Facebook/Instagram storefronts are another big opportunity (and one that allows Meta to more easily measure ad conversions as it contends with iOS user-tracking changes).

5:16 PM ET: Regarding Reels, Sandberg says Meta has accelerated its efforts to improve the Reels ad format, and is leveraging what it's learned to make Stories ads work.

5:15 PM ET: Sandberg notes Meta saw strong growth in Asia-Pac and Rest of World, but a more challenging environment in North America and Europe. Also says Meta still saw strong growth in categories such as video and click-to-messaging ads.

5:14 PM ET: Sheryl Sandberg is now talking.

5:13 PM ET: Now onto Meta's VR efforts. Zuck talks up Meta's Horizon virtual-world platform. He also asserts Meta will be meaningfully better at monetization than others in the space.

5:11 PM ET: Zuck: We hope our AI investments will help create "a sustainable competitive advantage" against others in the industry.

5:10 PM ET: Zuck reiterates that Meta will improve Reels monetization over time, and compares the effort to past content transitions to mobile feed viewing and Stories viewing.

5:08 PM ET: He adds that Meta continues investing heavily in AI-based video recommendations, as more video viewing shifts from involving followed accounts to involving AI-based content discovery.

5:07 PM ET: Zuck says Reels now makes up more than 20% of the time that people now spend on Instagram, and that it's also seeing strong growth on Facebook.

5:06 PM ET: Zuck reiterates Meta's commitment to investing heavily in its Reality Labs unit, while adding short-term business headwinds could force some spending trade-offs.

5:05 PM ET: Investors apparently liked that remark: Shares are now up 17.7% AH.

5:05 PM ET: Zuck goes over various near-term headwinds, including the impact of Apple policy changes (he reiterates Meta's tech investments will help offset over time) and headwinds related to the war in Ukraine.

Notably, he also says Meta is looking to slow the pace of its business investments to reflect the slower growth it's seeing right now.

5:02 PM ET: Mark Zuckerberg is talking.

5:02 PM ET: Meta is going over its safe-harbor statement. Typically, Meta's calls feature prepared remarks from Mark Zuckerberg, COO Sheryl Sandberg and CFO Dave Wehner, after which the execs take questions from analysts.

5:00 PM ET: The call is starting.

4:58 PM ET: Meta's Q1 earnings call should kick off in a couple of minutes. I'll be covering.

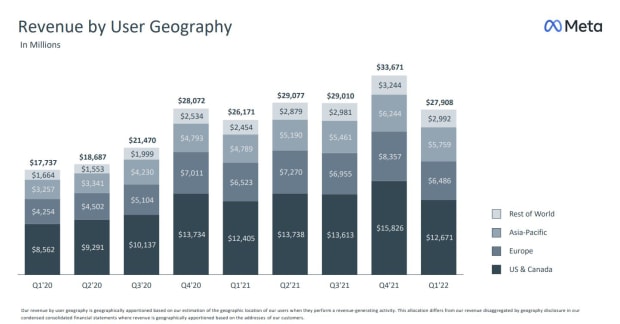

4:57 PM ET: Meta's quarterly revenue by region. The company saw double-digit Y/Y growth in the Asia-Pac and Rest of World regions, but (in line with comments about seeing late-Q1 headwinds related to Russia/Ukraine) a slight Y/Y decline in European revenue.

North American revenue, which is more impacted than many other regions by iOS policy changes due to the iPhone's high U.S. market share, grew a modest 2%.

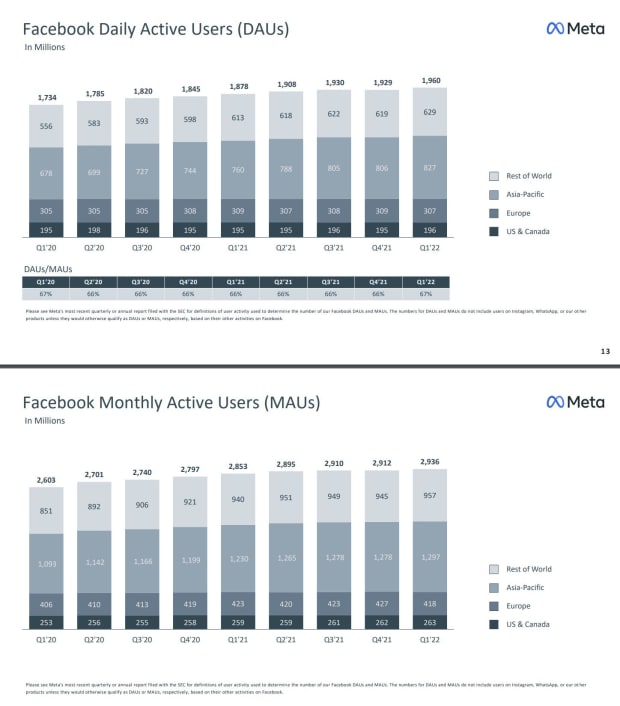

4:52 PM ET: Quarterly DAU/MAU growth for Facebook and Messenger by region. As has been the case for a while, the lion's share of growth in Q1 came from the Asia-Pac and Rest of World regions.

Notably, European DAUs/MAUs fell Q/Q in Q1. But (amid fears about TikTok's impact on U.S. engagement) they did grow slightly Q/Q in North America, which still accounts for 45% of Meta's revenue.

4:47 PM ET: Better-than-feared numbers from Meta, Pinterest and PayPal are giving a boost to other Internet stocks in after-hours trading. Amazon is up 1.9% AH, Shopify is up 2.1%, and Snap is up 5.4%.

4:43 PM ET: Meta's revised full-year spending guidance of $87B-$92B implies that costs/expenses will rise 22%-29% in 2022 relative to 2021. That suggests spending growth will cool off some later in the year (markets seem pleased by that), albeit while still likely outpacing revenue growth.

4:40 PM ET: Whereas revenue grew 7% Y/Y in Q1, Meta's GAAP costs and expenses rose 31% to $19.38B.

A 48% increase in R&D spend to $7.71B was the biggest contributor, followed by a 17% increase in cost of revenue (boosted by depreciation expenses related to Meta's heavy capex) to $6.01B.

4:34 PM ET: As expected, the Reality Labs segment remained a major drag on Meta's bottom line: It posted a $2.96B Q1 operating loss, up from $1.83B a year earlier though a little better than Q4 2021's $3.3B.

Facebook's "Family of Apps" operations, by comparison, generated $11.48B in operating income. That's down from $13.21B a year ago (heavy capex and R&D investments are near-term headwinds).

4:29 PM ET: Meta's ad revenue rose 6% Y/Y to $27B, missing a $27.5B consensus.

Reality Labs revenue, which mostly consists of VR headset sales, rose 30% to $695M, beating a $683M consensus. "Other" revenue, which includes things like payments fees, rose 9% to $215M.

4:24 PM ET: Here's Meta's Q1 report. And here's its Q1 slide deck.

4:20 PM ET: Giving EPS a boost: Meta spent $9.39B on buybacks in Q1. That follows $19.2B worth of buyback in Q4 (when the stock was much higher). The company still has $29.4B left on its buyback authorization.

4:19 PM ET: Facebook DAUs (they cover just the core Facebook app and Messenger) rose by 30M Q/Q and 80M Y/Y to 1.96B, slightly topping a 1.95B consensus.

Facebook MAUs rose by 30M Q/Q and 60M Y/Y to 2.94B, slightly missing a 2.96B consensus.

4:16 PM ET: Daily active users for Meta's app family rose by 50M Q/Q and 150M Y/Y to 2.87B. Monthly active users rose by 50M Q/Q and 190M Y/Y to 3.64B.

4:12 PM ET: Meta has added to its after-hours gains: Shares are now up 12.7% to $197.22.

4:11 PM ET: Regarding the Q2 sales guidance, Meta says it "reflects a continuation of the trends impacting revenue growth in the first quarter, including softness in the back half of the first quarter that coincided with the war in Ukraine."

The guidance also assumes a 3-point revenue headwind from currency swings (i.e., a strong dollar).

4:09 PM ET: Meta has cut its full-year cost/expense guidance to $87B-$92B from a prior $90B-$95B. The full-year capex guide remains at $29B-$34B.

4:08 PM ET: As previously noted, pre-earnings expectations were pretty low. For now, markets have declared Meta's numbers to be better than feared.

4:07 PM ET: Shares are up 8.6% after-hours.

4:06 PM ET: Meta guides for Q2 revenue of $28B-$30B, below a $30.7B consensus.

4:05 PM ET: Results are out. Q1 revenue of $27.91B misses a $28.28B consensus. EPS of $2.72 beats a $2.56 consensus.

4:00 PM ET: Meta closed down 3.3%. The Q1 report should be out any minute.

3:58 PM ET: Shares have dropped 2.8% in Wednesday trading ahead of Meta's report, on a day when the Nasdaq is close to flat. The decline comes after Alphabet beat Q1 sales estimates yesterday, but also reported softer-than-expected YouTube ad sales.

3:55 PM ET: With Meta’s stock having plunged this year to levels it first reached in 2017, it’s safe to say that pre-earnings expectations are fairly low.

3:53 PM ET: The FactSet consensus is for Meta to report Q1 revenue of $28.28B and GAAP EPS of $2.56. For Q2, the revenue consensus is at $30.7 billion.

3:51 PM ET: Hi, this is Eric Jhonsa. I’ll be live-blogging Meta’s earnings report and call.