Ahead of this week's anticipated interest rates hike, CoreLogic and QV crunch the sales data to discover which sunny suburbs are hardest hit by the property slump – and which ones are bucking the trend

When Bruce and Janet Deihl listed their three-bedroom Normandale property for sale this year, they dared to dream of pulling in more than $1 million. That's what sites such as OneRoof and Homes.co.nz were brightly promising them.

Instead, after weeks on the market, Ray White real estate agency sold the 805 square metre property in May for what seemed like a paltry $737,000. "We missed the boat with the market," says Bruce Deihl ruefully. "What we got was, I think, a little bit disappointing because we'd been led to believe that it could be worth more than that. But that's life."

This week, the Reserve Bank is widely anticipated to raise the official cash rate another 50 basis points (0.5 percentage points) to 2.5 percent. This increases the price the banks and other lenders pay for their money, forcing them to also raise rates, or suck up the OCR hike in their margins.

The market is forecasting further rate rises so, for communities like Normandale, that means house prices continuing to drop. Last month's sale price may have been a disappointment to the Deihls, but it was a big gain on the $207,500 they bought it for in 2003 – and at least they sold it.

There are other listed properties in Normandale that are sitting stubbornly unsold, or have been withdrawn from market by frustrated vendors, as it gets harder and harder to sell. The same is true the length of the Upper and Lower Hutt Valley. QV general manager David Nagel is predicting house values in some areas will drop by 20 percent.

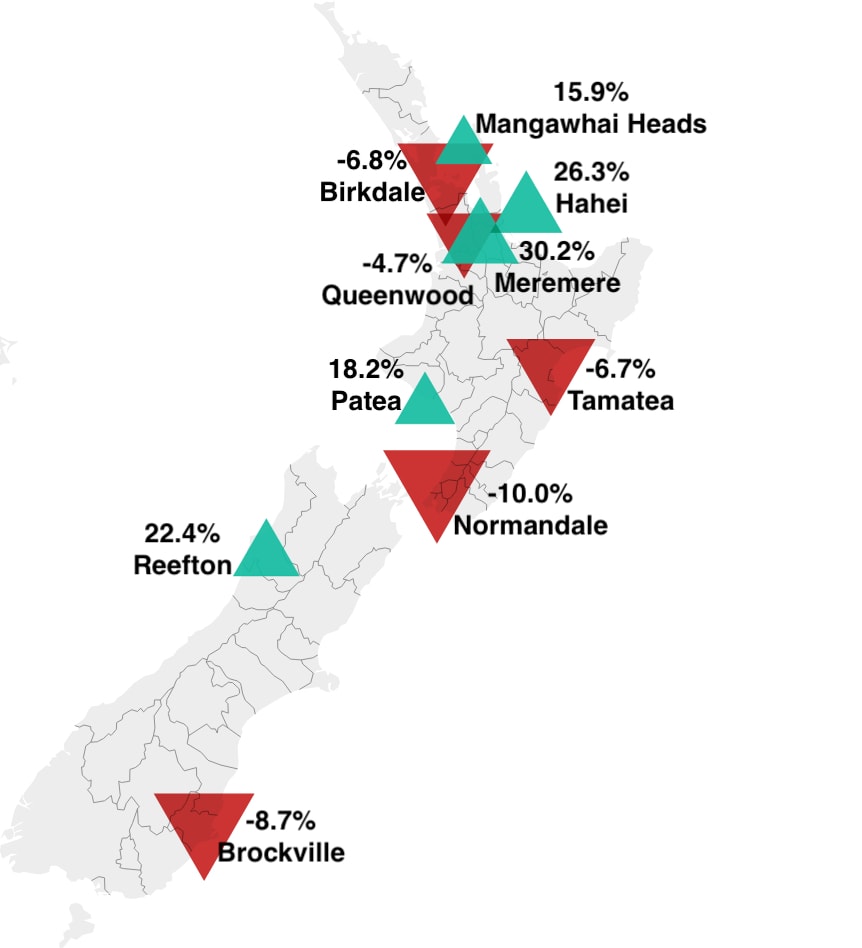

Why are there such enormous discrepancies between communities such as Normandale where house values have dropped an unprecedented 10 percent this year, according to CoreLogic, and others such as Reefton, Patea, Hahei and Mangawhai Heads, still enjoying double-digit rises?

“Maybe the animal spirits have really reversed quickly too, as listings have risen and shifted pricing power to buyers.” – Kelvin Davidson, CoreLogic

The biggest rise this year, in the six months since prices peaked just before Christmas, is a small community in north Waikato. Meremere is better known for its disused power station, its dragway, and a few tired houses visible from state highway 1 as motorists accelerate towards the Bombay Hills and Auckland.

But, according to CoreLogic, its house values have climbed a breathtaking 30.2 percent.

Kelvin Davidson, chief property economist at CoreLogic, says it’s tricky to pick out trends at the granular suburb-level, but it's apparent that parts of Auckland and Upper and Lower Hutt have been hardest hit so far.

"One clear factor could be that they had large upswings, perhaps with ‘exuberance’ carrying prices above fundamentals," he suggests. "Affordability got stretched, so that set the scene for larger falls now. To be fair, many other parts of New Zealand are stretched too, so I’d expect the falls to continue to spread.

"I tend to agree with the Reserve Bank – maybe a 12 to 15 percent drop over a 12-month period, or so. That was broadly the experience of the GFC too."

The GFC showed it could take several years for prices to recover to their peak. The pre-GFC peak of 2007 wasn't regained until 2012. "So back then, it was a ‘bath tub’ – fall, long flat patch, then eventual rise. Mortgage rates fell back then; whereas they’re going up now. So I’d anticipate a recovery taking just as long this time."

The ups and downs of 2022 house values

"The biggest cause for me is definitely the credit environment – tighter official regulation from the Reserve Bank, tighter internal policies at the banks, and higher mortgage rates. Maybe the animal spirits have really reversed quickly too, as listings have risen and shifted pricing power to buyers."

At QV, Nagel delivered an internal presentation to the organisation, casting doubt on predictions that the downturn will be short-lived. He argues those forecasts are simply a response to some banks dropping some mortgage rates this month.

"Returning expats helped over the past two years, but now with many leaving the country, the property market is vulnerable." – David Nagel, QV

"Most are forecasting the Reserve Bank to add a further 50 pts to the OCR this week," Nagel says. "There’ll likely be a further 100pts increase at least before we get on top of inflation. So the medium term trend is for mortgage rates to rise. This will have a negative impact on house prices."

Nagel warns of the impact of an outflow of young workers, which would drain demand from the rental market as well.

"What will be equally concerning is the much talked about 'brain drain' to Aussie and beyond as our youth search for higher wages, and life experience having not having had the customary travel opportunities since 2019," he says. "While not normally home owners, these people are renters, so landlords will be watching closely to see what impacts this likely exodus has on rents and vacancies, especially with rising ownership costs from mortgage and interest deductibility increases."

House price change in six months from Dec 2021 peak ($)

To a degree, that will be countered by inbound overseas workers – but that's not yet balancing the exodus.

"With the borders barely open to migrants, we’re currently struggling to break even on net migration gain," Nagel says. "This is a big lever in house values, with much of the previous cycle driven by very high migration, which the 70-80,000 net gain needing somewhere to live. Returning expats helped over the past two years, but now with many leaving the country, the property market is vulnerable."

Nagel agrees the total decline will vary from one community to the next, depending on how high their prices had previously risen, and other local economic factors. "We’ll likely see corrections up to 20 percent in extreme cases, but more likely 10 to 12 percent for the majority of New Zealand."

"Considering we’ve had gains close to 30 percent per annum in some locations over the past 18 to 24 months, plus we’re at close to full employment currently, this is not going to cause havoc for the majority of homeowners, but may put pressure on those that purchased at the peak."

Sun setting on some suburbs

Nobody is watching the market more closely than the real estate agents who make their livings from it. Alice Pearson works with The Professionals in the Hutt Valley; she markets properties in Normandale and says the agency has had some ups and downs.

She struggles to understand why values have dropped quite so much in Normandale, one of a string of hillside suburbs overlooking the Hutt Valley. "Most people who move to the western hills, they stay in the western hills," she says, "so what we've seen is probably a result of less turnover. Some young families will move into the area, but it's more common that you'll see people moving within those areas."

She describes one three-bedroom house that she's had on the market, across the other side of Normandale from the Deihls' property. "It's been a real struggle to sell, for absolutely no reason. It's a beautiful home and last year probably would have sold in two weeks."

She has some houses that have sold, while nearby houses get no offers. "There's no rhyme or reason – they're around the corner from each other. Very different homes but such good locations."

"Prices were so high last year, so it's been a hard landing. It wasn't sustainable, it was going to happen eventually. But of course, it's hard if you were just one or two months off being able to achieve that high price."

Prices as low as that paid for the Deihls' property, she says, are "unusual".

Bruce Deihl remains perplexed at the speed of the property downturn, but philosophical. Normandale is a suburb that seems to have all the fundamentals right.

He and his wife would walk over to Benedict's Cafe, in neighbouring Maungaraki, for cake and a coffee. "We used to go walking most nights and it was really good for for exercise," he says. "Walking on the hills is really good. Gets the heart rate going.

"The house gets the morning sun really well. Our neighbours were nice. Yeah. It was quite a quite a good community. So I just don't know why it would be lower now than other areas."