When it comes to dining out, the U.S. is clearly a nation divided. Restaurant stocks tell the tale. As the whole industry grapples with rising food and labor costs, consumers are turning stingy. Fast-food giant McDonald's is leading a retreat from higher prices. Yet newer names, like Cava Group and Sweetgreen, are thriving. And Chipotle Mexican Grill continues its quarter-by-quarter power climb.

Across the restaurant industry, price increases have dulled lower-income Americans' appetites for fast food and fast-casual dining. Restaurants face rising competition from prepared foods at grocery stores as consumers look to squeeze more from their dollars. When people do dine out, healthier food, or meals that can feed multiple persons on a single ticket, often win out.

Trends With McDonald's Stock, Starbucks Restaurant Stocks

So on the one hand, McDonald's is backtracking after scaling up its menu. It's launching a limited-time $5 value menu to try to tempt back lower-income customers pinched by surging food prices. Fellow fast-food chain Wendy's has followed suit, announcing a $3 breakfast combo. Burger King relaunched a $5 menu, aiming to roll it out before McDonald's.

McDonald's executives recently noted traffic is slowing in all major markets. Starbucks reported a 7% slowdown in transactions at U.S. stores. Olive Garden-parent Darden Restaurants said it was seeing fewer visits from diners with an annual household income below $75,000.

Highlighting restaurants' troubles, Red Lobster, the largest seafood restaurant chain in the U.S., filed for bankruptcy in May. It failed to recapture customers after the coronavirus pandemic, as menu prices moved higher.

Against that backdrop, a select group of restaurant stocks — led by Cava, Sweetgreen and Chipotle — are carving out a growing piece of a dwindling pie.

Some offer good "perceived" value to consumers, partly by working to bring down the effective cost per person. Others are simply new and interesting, tapping into changing consumer preferences. These tend to be growth companies behind some of the leading restaurant stocks, with expanding store counts and solid earnings, according to analysts.

"People are eating out significantly less at restaurants overall," Wedbush Securities restaurants analyst Nick Setyan told IBD, referring to restaurant stocks. "Overall, the 40 or so publicly traded restaurants out there, they haven't done well. There are only a handful of names that are the outperformers."

"All the money is going there," he added of the top restaurant stocks.

Chipotle Stock, Cava, Sweetgreen Are Top Performers

The 54 stocks in the IBD-tracked restaurant stocks group are up collectively more than 23% this year, according to MarketSurge charts. That is nearly double the pace of the S&P 500.

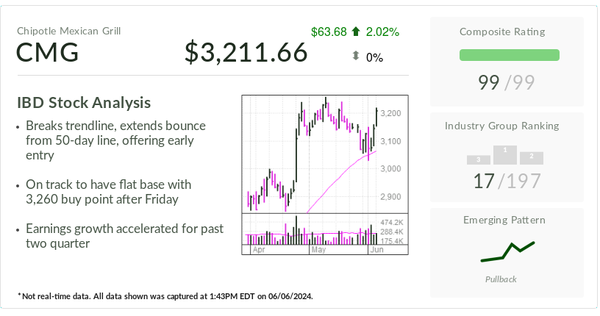

Chipotle stock is one of the year's top performers in the S&P 500 index, gaining around 40%, despite a pullback from highs in May.

Cava has surged more than 99% in 2024, hitting a record high 96.93 on May 30.

Wingstop has rallied 50% this year, peaking at 410.95 on June 5. Meanwhile, Texas Roadhouse stock is up 39% on the year.

And while Starbucks is sinking, drive-through coffee shop chain Dutch Bros has rallied 22% as it continues to draw lines around the corner at many locations.

Domino's Pizza is rebounding from a couple of difficult years, rising 25% in 2024. And Sweetgreen has hammered out a 197% gain this year, despite not yet turning a profit. Sweetgreen is a MarketSurge Growth 250 stock.

Other Restaurant Stocks Lag

But the industry group's outperformance masks serious weakness in many restaurant stocks. McDonald's stock is down 12% on the year. Starbucks is trading nearly 15% lower, after paring a bigger loss with a five-week rebound. McDonald's and Starbucks have the highest market capitalizations in the IBD restaurant stocks group.

Burger King and Tim Horton's owner Restaurant Brands International, Wendy's and Darden Restaurants are also trading lower in 2024.

Morgan Stanley analyst Brian Harbour said in an interview that higher-end and middle-income customers have not changed much how they are spending on restaurants. However, he added that lower-income consumers are under more pressure and "have been pulling back more from how much they are spending."

This is hitting traditional fast-food operations, according to the analyst.

"There's just a smaller cohort of winners fundamentally, and so I think that's definitely what you've seen translate to the stocks," Harbour said.

What These Restaurant Stocks Have In Common

The restaurant stocks bucking the broad industry trend have several aspects in common, according to observers.

In many cases, the companies provide a solid value proposition to customers grappling with a high-cost environment.

Domino's coupon-packages give it a per-person cost advantage. The company offered 50% off all pizzas June 6-9. Wingstop's platters also provide a strong per-person value.

"They have really high value-perception scores and their businesses are set up in a way where they can make a lot of money as they emphasize" that advantage, Setyan said of the top-performing restaurant stocks.

Texas Roadhouse has held down the price of its steak dinners enough to make the restaurant competitive with grocery stores, according to Setyan.

Setyan says that every time grocery inflation falls substantially below restaurant inflation, restaurant sales face pressure as lower-income households shift spending toward groceries.

Restaurant Same-Store Sales On The March

Among restaurant stocks, Chipotle and Texas Roadhouse are leading those showing some longer-term strength.

The last time Chipotle saw a same-store sales decrease was in Q2 2020. Chipotle's full-year diluted earnings per share rose 34% in 2023 and 44% in 2022. FactSet analysts expect to see a 24% gain, to $55.69, this year. The consensus has full-year earnings hitting $130.93 per share in 2029.

Similarly, Texas Roadhouse last saw a same-store sales decline in Q4 2020. The steak-centric chain is expected to see 30% profit growth this year.

Among the newer names, Cava same-store sales growth and margins will be closely watched in the second quarter. In Q1, same-store sales growth edged up 2.3% — slowing for the fourth consecutive quarter. The chain also saw a restaurant-level profit margin of 25.2% for the quarter, easing from 25.4% last year.

The company noted that the same-restaurant sales growth figure came on a 3.5% increase to menu prices, which was offset by a 1.2% decline in guest traffic. Cava reported 11.4% same-restaurant sales growth in Q4.

Pizza And Chicken In This Economy

In late April, Domino's Pizza reported a better-than-expected 22% jump in Q1 earnings. Revenue growth accelerated for the second quarter in a row, increasing 6% to $1.085 billion.

Domino's Pizza attributed the sales growth to higher supply-chain revenues — food sold by the company to its stores — as well as higher order volumes and greater U.S. franchise royalties. It noted positive order counts for its carryout and delivery businesses for the second quarter in a row.

Domino's U.S. same-store sales rose 5.6% for the quarter after increasing 3.6% for the period in 2023.

Addison, Texas-based Wingstop announced in early May that first-quarter EPS soared 66%, and revenue increased 34%. Domestic same-store sales grew 21.6% in Q1, although same-store sales growth at company-owned sites slowed to 6.2%, from 10.3% a year ago.

The restaurant chain expects low double-digit domestic same-store sales growth for the full year.

"The broader market backdrop is that quality growth companies continue to perform well regardless of (price-to-earnings) valuation" among restaurant stocks, Harbour said. "There's still stock market momentum behind the quality growth cohort."

Working to Bring Back Customers

Stephen Zagor, an adjunct professor at Columbia Business School who focuses on the restaurant industry, told IBD that before the coronavirus pandemic, some people ate at a fast-food restaurant every day because it was cheaper than going to a supermarket.

"You could go to a McDonald's or a Taco Bell or a Burger King and, with no labor, eat very economically," Zagor said. "That appealed to some of the lower-income segments of the country."

As inflation has increased restaurants' labor and operating costs and pushed menu prices higher, the lower-income consumer is changing behavior.

In March, fast-food prices were 33% higher than in 2019, according to the Department of Labor. Grocery prices were up 26%.

"Consumers continue to be even more discriminating with every dollar they spend as they face elevated prices in their day-to-day spending, which is putting pressure on the industry," McDonald's Chief Executive Chris Kempczinski said during the April 30 first-quarter earnings call.

To tempt back consumers, restaurants are working to bring down the effective cost per person. They do this by offering promotions and more value items.

"The (menu) price of a Big Mac meal is not going to go down most likely over time," Harbour said. "But if you get customers cheaper items, their cost per person effectively falls."

Harbour added that current inflation and interest rate views point to a rebound in spending among lower-income customers in 2025.

"We'll see how that plays out," he said.

Restaurant Stocks To Watch

Among the restaurant stocks drawing attention, Sweetgreen is one company that has yet to turn a profit. Sweetgreen stock came public in a November 2021 IPO. It is expected to deliver losses through at least 2029, according to FactSet. Many investors, however, remain infatuated with the restaurant chain.

On May 10, Sweetgreen reported a Q1 loss of 23 cents per share, narrowed from 30 cents per share a year earlier. Revenue for the salad and bowl-style meal server leapt 26% to $157.9 million. Same-store sales rose 5% in Q1 as the company noted its protein plates are seeing strong demand.

Sweetgreen lifted its 2024 revenue guidance to between $660 million and $675 million, up from its prior outlook of $655 million to $670 million. Analysts estimate a 15% full-year sales jump to $673.1 million.

Cava Stock: 'New Guy On The Block'

Meanwhile, Cava in late May reported Q1 earnings of 12 cents per share, improving from a loss of $1.30 per share last year. Revenue leapt 30% to $256.3 million.

In 2023, Cava earnings hit 21 cents per share in their first year as a publicly traded company. Analysts expect the company's profits to increase 57%, to 33 cents per share in 2024. EPS is projected to grow to 79 cents per share by 2028, a 276% increase compared to 2023 levels.

Cava has innovated on a Mediterranean, bowl-style menu.

The restaurant chain has 325 locations across 25 states and Washington, D.C. Cava added 72 restaurants in 2023 and says unit count will grow at least 15% this year and next. The company has its eye on expansion, with a target of 1,000 restaurants by 2032.

According to Zagor, Cava is the "new guy on the block."

"It's really jumping into people's expectations of value and creativity and giving them something a little more interesting," Zagor said.

Cava benefits from a generally higher-income customer, according analysts.

Cava stock came public in a June 2023 IPO. The company turned profitable last year, as revenue jumped nearly 60% to $717.1 million.

The growth was driven by restaurant openings plus an 18% gain in same-store sales. Responding to market pressures, Cava raised prices by around 3% nationwide in January.

Restaurant Labor Costs And The Push For Automation

Observers see labor costs as potentially a more pressing issue for restaurants than food costs. Restaurants are looking to automation as an answer.

"Restaurants price in response to both of those things," Harbour said of labor and food costs. "More often labor is a structural pressure, and they do tend to price (their menus) in response to labor."

Zagor added that the new $20 minimum wage for fast-food workers in California could be a "big headwind" for the major restaurant chains.

"It's going to be challenging for the restaurant industry as a whole if that becomes something that catches on in other states quickly," he said.

Zagor believes increased labor costs are accelerating the development of automation in the restaurant industry.

Robots In The Kitchen: Cava And Sweetgreen

Cava has already automated pita bread and onion slicing. It is working on a system that tracks restaurants' activity in real time to better predict customer demand and staff workload.

Meanwhile, Sweetgreen is testing an automated salad assembly line dubbed "Infinite Kitchen."

"Sweetgreen looks at themselves as a technology company that sells food," Zagor said. "They have been a leader in trying to minimize labor through technology."

Kura Sushi USA has been at the forefront with automation to cut costs. The company has long used conveyor belts in lieu of servers to deliver a continuous stream of raw fish on beds of rice.

In 2022, Kura Sushi's U.S. locations added service robots, called Kur-B, that deliver drinks and condiments. In the kitchen, Kura has robots making sushi rice and other high-volume food.

Kura Sushi stock has gained 21% in 2024. After turning its first profit in three years in 2023, analysts project earnings will balloon another 650% by 2026.

Beyond Chipotle Stock: Founder Reveals Kernel Of Inspiration

Now, Chipotle founder Steve Ells appears to be betting on automation with his new enterprise, Kernel.

Ells, who left Chipotle in 2020, opened the first location of the plant-based fast-food restaurant in New York City this year. The operation is almost entirely automated with robots, and orders are taken online.

Kernel is also takeout only.

Kernel locations are expected to increase throughout New York City using $36 million in capital from private investment firms and tech companies.

"The New World Order of restaurants and food businesses is going to be heavily technology- and automated-focused," Zagor said.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor's Corner

Is Rivian A Buy Right Now After First-Quarter Earnings?

Market At Highs; Apple AI Push, Tesla Meeting, Fed Rate Outlook Loom