McDonald’s (MCD) stock has been on fire, hitting a record a number of times, even as the S&P 500 and Nasdaq remain trapped in a tight trading range.

The burger giant's shares have risen in six straight trading weeks, as the bulls rode a wave of momentum into its earnings report.

MCD reported earnings before the open, delivering a top- and bottom-line beat. Revenue of $5.9 billion rose 4.3% year over year, while earnings of $2.63 a share beat expectations by 29 cents. Comparable sales grew 12.6%.

Don't Miss: Trading the S&P 500 and Nasdaq as Earnings Season Revs Up

Defensive stocks have been on a tear lately, and leading that run has been McDonald’s. Shortly after the open, the stock raced to all-time highs -- but has since retreated.

With today’s reversal, it should have the bulls looking to buy, not sell. Here’s why.

Trading McDonald’s Stock

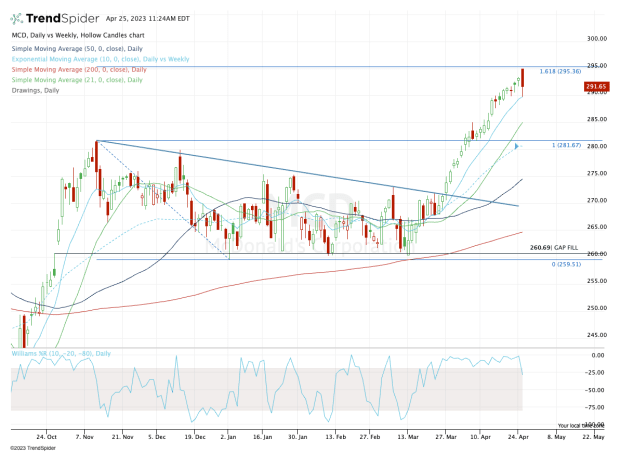

Chart courtesy of TrendSpider.com

Say what you will about this market, the environment has been anything but easy.

Coming into 2023, megacap tech stocks were under pressure and the Nasdaq looked ready to roll over. Then, of course, megacap tech took off, dragging the indexes higher.

McDonald’s stock initially lagged the broader market and is now topping all the major U.S. indexes with its 16.5% year-to-date gain.

Watching MCD pull back after the earnings report, aggressive bulls are buying the dip to the rising 10-day moving average. This is a key short-term moving average, which hasn’t been tested in more than a month.

Buyers should be buying the dip down to this measure. If it holds, a run back to the post-earnings high near $295 could be in order. Note that this level comes into play near the 161.8% extension from the previous trading range.

Don't Miss: Wynn Stock: Bulls Are Betting on a Breakout

When I look at the chart for McDonald’s stock, I see six months of sideways consolidation, followed by a long-awaited breakout. When the shares cleared the $281 to $282 area, it opened the door to the $295 area. What now?

If the 10-day holds, look for a potential retest of the post-earnings high, then $300. If the 10-day fails as support, we may see a further dip to the $285 area and the rising 21-day moving average.

Finally, increased selling pressure could put a retest of the prior high in play at $281.67.

If the 10-week moving average rises to this area at the time of the pullback -- meaning McDonald’s stock tests the 10-week moving average and retests the prior high -- it would be a high-probability buy-the-dip setup for the bulls.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.