The Australian share market has dropped to its lowest level in five weeks, after the Reserve Bank announced a surprise interest rate hike yesterday.

NAB has passed on the Reserve Bank's full rate hike to its home loan customers, but only two of its savings accounts.

Meanwhile, renewed worries about the stability of the US banking system led to significant falls on Wall Street and oil prices sinking by about 5 per cent, ahead of a likely rate increase from the US Federal Reserve tomorrow.

See how the trading day unfolded on our live blog.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

NAB lifts interest rates after Reserve Bank's hike

By David Chau

National Australia Bank is the first major bank to confirm it will pass on the RBA's interest rate hike to its borrowers.

Its standard variable home loan rate will increase by 0.25 percentage points from May 12.

However, NAB is lifting rates by that level for just two of its savings products — the iSaver (introductory and standard variable rates) and Reward Saver (bonus interest rate).

Of course, one should read the fine print carefully. For instance, customers will only receive the iSaver's introductory rate for the first four months.

The other major banks have yet to announce the new rates on their home loans and savings accounts.

ASX falls for second straight day

By David Chau

The Australian share market has ended its day significantly lower, ahead of tomorrow's interest rate decision from the US Federal Reserve.

The ASX 200 index fell by 1 per cent, to close at 7,197 points, its lowest level since March 31.

Every sector posted losses, with energy (-2.5%) and financials (-2%) recording the steepest losses.

Eight out of every 10 stocks were in the red.

However, the worst performing stock was Amcor (-9.5%) after the packaging company downgraded its full-year earnings guidance.

Stocks like Polynovo (-6.2%), ARB Corporation (-5.7%), Ramsay Health Care (-4.8%), Fortescue Metals (-4.1%) and Beach Energy (-3.5%) also fell sharply.

On the flip side, the stocks which posted the largest gains were mainly gold miners after a 2% jump in the precious metal's price overnight.

Today's top performers include Gold Road Resources (+4.7%), Silver Lake Resources (+4.2%) and Evolution Mining (+3.7%).

The Australian dollar was steady at 66.7 US cents.

Market snapshot at 4:15pm AEST

By David Chau

-

ASX 200: -1% at 7,197 points

- All Ords: -1% at 7,389

- Australian dollar: +0.1% at 66.66 US cents

-

Spot gold: flat at $US2,015/ounce

- Brent crude: -0.1% at $US75.22/barrel

- Iron ore: +0.1% to $US102.05 / tonne

- Bitcoin: -0.9% at $US28,425

- Hang Seng: -1.8% at 19,585

- NZX 50: -1.1% at 11,908

- Nikkei and Shanghai Composite: closed for public holiday

Should we be worried about the US debt ceiling?

By David Chau

Markets are keeping a wary eye on the looming US debt ceiling.

While Democrat and Republican lawmakers are squabbling, Treasury Secretary Janet Yellen has warned the government might run out of money as soon as June 1.

"Either this game is over within a few weeks or we are going to see a suspension of the debt limit until later this year," said Rabobank strategist Philip Marey.

"In both cases, we are not likely to see any solution until financial markets start to panic."

AMP's deputy chief economist Diana Mousina says there may be significant consequences, depending on how US politicans resolve this matter:

"Congress will need to make an agreement on lifting or suspending the debt ceiling soon which will require a bill to be passed through both the House of Representatives (held by Republicans) and the Senate (held by the Democrats).

"History tells us that debt ceiling debates can be drawn-out because they are tied to other spending decisions and are often made at the last minute which leads to market volatility.

"The Republican House of Representatives has approved a bill to raise the debt ceiling for [around] one year but this is tied to spending cutbacks which the Democrats are unlikely to agree to in its current form.

"However, the Democrats will need to concede on some spending cutbacks to pass a bill."

As for Ms Mousina's final verdict:

"Investors should worry about the debates around the US debt ceiling that will happen over coming weeks.

"There is an immaterial risk of a default which we assign to be around 10-15% which would be a big negative for sharemarkets and would see big lifts in short-dated US government bond yields.

"A deal to raise the debt ceiling will likely also lead to less government spending which could add to recession risks."

US Fed expected to lift rates tomorrow, and cut rates by the end of 2023

By David Chau

The biggest economic event (for global markets) is tomorrow's interest rate decision by the US Federal Reserve.

Markets have priced in a 95% chance of the Fed lifting its benchmark interest rate by 0.25 percentage points tomorrow at 4am AEST.

That would bring the the fed funds rate target to a range of 5 –5.25%.

However, the more interesting part will be Fed chairman Jerome Powell's press conference right after the US rates decision, and if he offers any clues on where rates might go next.

Analysts are even predicting rate cuts in America by the end of this year!

Here's what we can expect, according to these experts:

Joseph Capurso (Commonwealth Bank, head of international economics):

"We expect the Australian dollar to dip under 66 US cents because we expect the FOMC [Federal Open Markets Committee] to be hawkish.

"The reaction by currencies will come from whether the post meeting statement and press conference are deemed ‘hawkish’ or ‘dovish’.

"We expect FOMC chair Powell to be hawkish compared to market expectations because inflation is too high and the labour market is too tight, although both indicators have moved in the right direction recently.

"Therefore, we expect US interest rates and the US dollar to increase materially tomorrow morning."

John Velis (BNY Mellon, foreign exchange and macro strategist):

"We think it very likely that this will be the final rate hike in this extraordinary policy cycle, although we’re not convinced that the Fed will declare that formally.

"In our view, the Fed’s preference to leave some ambiguity on the future course of rates stems from a still-stubborn inflation picture and a jobs market that remains somewhat tight, although showing some initial signs of loosening."

James Knightley (ING, chief international economist):

"Inflation remains 'unacceptably high', but banking stresses are leading to a tightening of lending conditions, which will do more to slow the economy than the likely 25 basis point hike on Wednesday (local time).

"While the Fed will leave the door ajar for further hikes, the need for higher policy rates is highly questionable.

"We expect 100 basis points of rate cuts before year-end."

"Historically, the Fed doesn’t leave it long before cutting rates – over the past 50 years the average period of time between the last rate hike cycle and the first rate cut has only been six months.

"This implies that if May is indeed the last rate hike in a typical cycle, we should expect a cut by around November."

ASX losses intensify in final hour

By David Chau

The local share market's losses have worsened in late-afternoon trade.

It appears investors are fretting over signs of a weakening US economy, the loss of confidence in US regional banks, and a likely rate interest hike from the Federal Reserve.

The ASX 200 was down 1.3% to 7,171 points by 3pm AEST, with every sector in the red.

Gold jumped nearly 2% to a three-week high above $2,000 an ounce, while oil prices dived by more than 5%.

Markets are all but certain the Fed will announce a 0.25 percentage point rate hike at 4am AEDT tomorrow.

If that happens, focus will be on whether or how hard Fed chair Jerome Powell pushes back on investors' expectations for rate cuts by year's end.

"The hike will be a contemplative one that acknowledges heightened two-way risks and narrower path to a soft-landing," said Vishnu Varathan, head of economics at Mizuho Bank in Singapore.

The Australian dollar has given back some of the huge gains it made on Tuesday. It surged above 67 US cents, following a surprise rate hike from the Reserve Bank of Australia.

The local currency has since drifted back to 66.6 US cents.

Market snapshot at 2:45pm AEST

By David Chau

-

ASX 200: -1.4% at 7,169 points

- All Ords: -1.4% at 7,359

- Australian dollar: +0.1% at 66.66 US cents

-

Spot gold: flat at $US2,017/ounce

- Brent crude: flat at $US75.32/barrel

- Iron ore: +0.1% to $US102.05 / tonne

- Bitcoin: -0.9% at $US28,425

- Hang Seng: -1.8% at 19,585

- NZX 50: -1.2% at 11,894

- Nikkei and Shanghai Composite: closed for public holiday

CALL OUT: What cost-of-living relief are you hoping for in the budget?

By Stephanie Chalmers

Stephanie Chalmers jumping in with a callout ahead of next Tuesday's Federal Budget.

We've heard Treasurer Jim Chalmers flag a 'substantial' cost-of-living package — and we're keen to hear from you what you'd like to see.

Among the responses so far, here are a few key concerns and suggestions being put forward:

- Increase JobSeeker for all ages

- Rent relief through freezes or increased assistance payments

- Scrap the Stage 3 tax cuts in favour of housing affordability measures

- Relief for small businesses on energy costs

- Change HECS indexation

- Increase incentives for GPs to bulk-bill

Whether you agree or disagree with what others have put forward, let us know.

And if you'd be willing to speak to one of our journalists, you can let us know too!

Economists say RBA is unlikely to hike as household consumption slows down

By David Chau

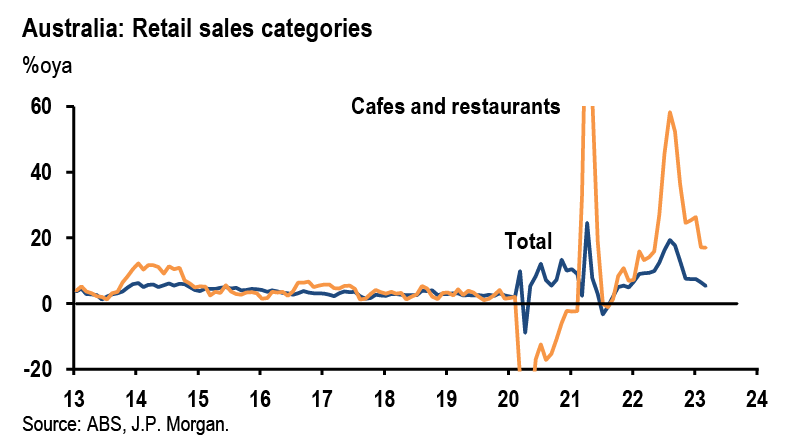

Here's what economists are saying about the ABS retail sales figures and its implications for the Reserve Bank's interest rate policies.

To recap, retail turnover rose to $35.3 billion in March (an increase of 0.4% over the previous month).

Expressed another way, it's up 5.4% in the year to March.

Marcel Thieliant (Capital Economics, head of Asia-Pacific):

"While retail sales values rose at a decent pace in March, we estimate that sales volumes fell the most since 2021’s lockdowns last quarter and that weakness has further to run.

"That in turn should prevent the Reserve Bank of Australia from raising rates any further over the coming months."

Tom Kennedy (JP Morgan):

"While marginally stronger than expected, the composition of spending was consistent with the idea that recent policy tightening is gaining traction and weighing on household spending.

"Non-discretionary food sales increased 1% m/m [month over month] whereas the remaining goods related sub-groups reported month-on-month declines.

"Yesterday’s RBA policy statement noted there is a great deal of uncertainty with respect to the consumption outlook, with higher interest rates / reduction in savings weighing on spending.

"We expect consumption will continue to slow from here, which alongside the anticipated declined in inflation should see the RBA remain on hold.

"With that in mind, risks are clearly skewed toward further policy tightening [more rate hikes] and we flag the upcoming wages (17 May) and monthly inflation (31 May) prints as the most important near-term [ABS] data."

Market snapshot at 12:15pm AEST

By David Chau

-

ASX 200: -1.1% at 7,188 points

- All Ords: -1.1% at 7,378

- Australian dollar: +0.2% at 66.7 US cents

-

Spot gold: +0.1% at $US2,017/ounce

- Brent crude: flat at $US75.30/barrel

- Iron ore: +0.1% to $US102.05 / tonne

- Bitcoin: -0.9% at $US28,425

- Hang Seng: -1.8% at 19,572

- NZX 50: -1.1% at 11,900

- Nikkei and Shanghai Composite: closed for public holiday

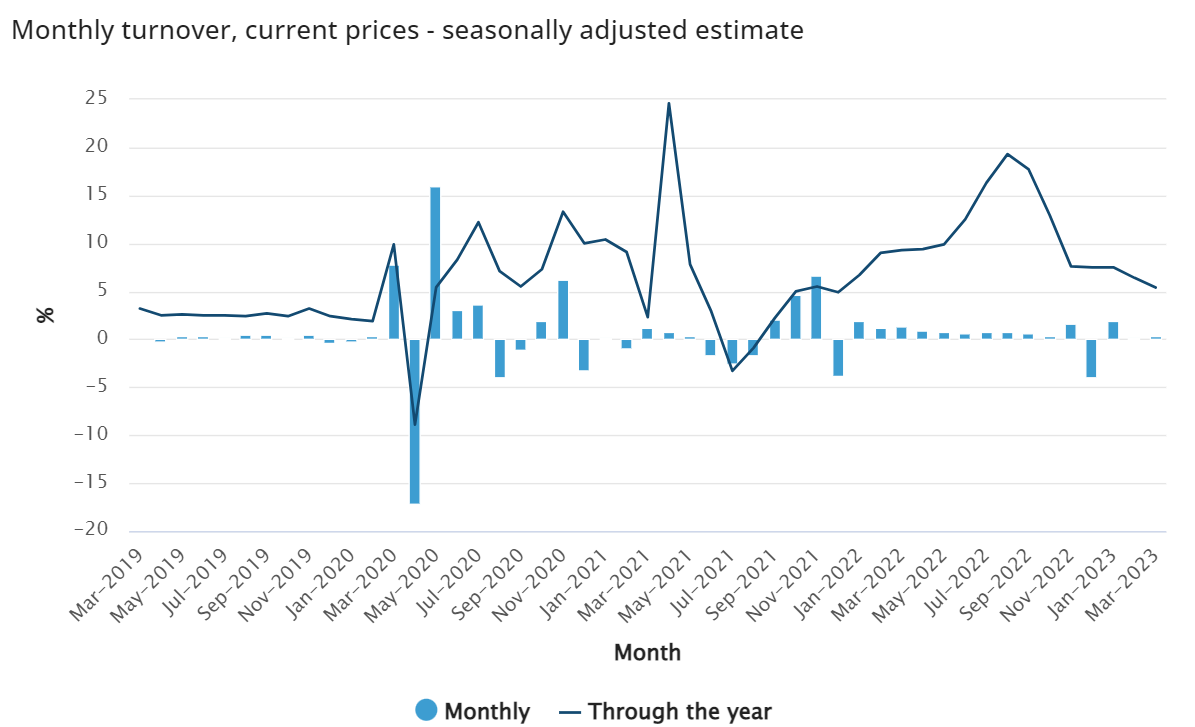

'Cost of living pressures' drive retail turnover up 0.4% in March

By David Chau

The Bureau of Statistics (ABS) has released its latest data, showing retail turnover lifted 0.4% to $35.3 billion in March (its third consecutive monthly increase).

But the result isn't as positive as it initially sounds.

When you consider the annual figure, retail turnover was up 5.4% in the year to March, a signifcant slowdown compared to the previous result (6.4% growth in the year to February).

So consumers are having to fork out extra cash.

It's not because they're buying more items. It's simply that they're having to pay higher prices for their goods.

High food inflation

Consumers scaled back their spending on "discretionary goods", which brings monthly turnover back to where it was six months ago, said Ben Dorber, ABS head of retail statistics.

The ABS noted the increase in March was driven by customers spending more on cafes, restaurants and takeaway food services (+1.5%) and food retailing (+1%).

“Food retailing has now recorded 13 consecutive monthly rises, largely driven by high food inflation,” Mr Dorber said.

“Businesses in cafes, restaurants and takeaway food services are passing on their rising costs to consumers through price rises, while also benefitting from strong demand driven by the continued return of large-scale cultural and sporting events.”

“Spending on non-food retailing has slowed in response to interest rate rises and increased cost of living pressures. This follows increased spending during and immediately following much of the COVID-19 pandemic period.”

In relation to non-food industries, clothing, footwear and personal accessory retailing (-1%) sufered the largest fall, followed by household goods (-0.4%) and department stores (-0.2%).

Short investor Hindenburg wipes 20% off the value of Carl Icahn's empire

By David Chau

Here's an interesting story from Reuters about a billionaire allegedly inflating the value of his wealth, and a short-selling firm trying to make a quick profit from this:

Hindenburg Research, the short investor whose reports on companies have erased a big chunk of their value, has criticised Icahn Enterprises LP (IEP) over the reporting of its finances.

This led to a 20% drop in the shares of activist investor Carl Icahn's firm.

The development represents a rare challenge for Icahn, 87, who is accustomed, as one of the pioneers of shareholder activism, to dressing down companies over their governance and transparency, but has not had to field such criticism himself.

'Ponzi-like' corporate structure

In a report published on Tuesday (local time), Hindenburg accused IEP of overvaluing its holdings and relying on a "Ponzi-like" structure to pay dividends.

The subsequent 20% plunge in IEP shares wiped $US2.9 billion off Icahn's net worth, leaving him with an estimated $US14.7 billion, according to Forbes.

Icahn said in an IEP statement that Hindenburg's "self-serving" report was aimed at generating profits at the expense of IEP's long-term shareholders.

"We stand by our public disclosures and we believe that IEP's performance will speak for itself over the long term as it always has," Icahn said.

Icahn's Sunny Isles Beach, Florida-based company hold his various investments in the energy, automotive, food packaging, real estate and other industries. He is IEP's controlling shareholder with an 85% stake.

Hindenburg said IEP's units are overvalued by more than 75% and that "IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables."

Driving the frothiness in IEP's stock, Hindenburg argued, is its dividend yield of 15.8%, the highest of any US large cap company by far.

Hindenburg accused Icahn of inflating the dividend yield by receiving his own dividend in stock rather than cash and making IEP sell new stock so it can meet the shareholder payouts.

"Icahn has been using money taken in from new investors to pay out dividends to old investors," said Hindenburg.

Hindenburg also offered examples it said showed IEP itself was valuing its holdings way above their market value.

In one instance, IEP allegeoldy marked its automotive parts division at $US381 million in December 2022, one month before a key subsidiary of that division filed for bankruptcy.

A representative for Grant Thornton LLP, which has served as IEP's auditor since 2004, declined to comment.

Hindenburg also took aim at the close relationship between investment bank Jefferies and Icahn.

The short seller noted that Jefferies, the only major brokerage to cover IEP, assumes in its equity research that Icahn's dividends will be paid in perpetuity even in a worst-case scenario, while at the same time profiting from arranging IEP's stock sales.

Jefferies did not respond to a request for comment.

IEP is the latest high-profile target of Hindenburg, which is run by Nathan Anderson and earlier this year went after India's Adani Group, knocking more than $US100 billion in value off the conglomerate's shares.

Last month, the short-seller took aim at Jack Dorsey-led Block. Its previous targets have included electric car maker Nikola Corp.

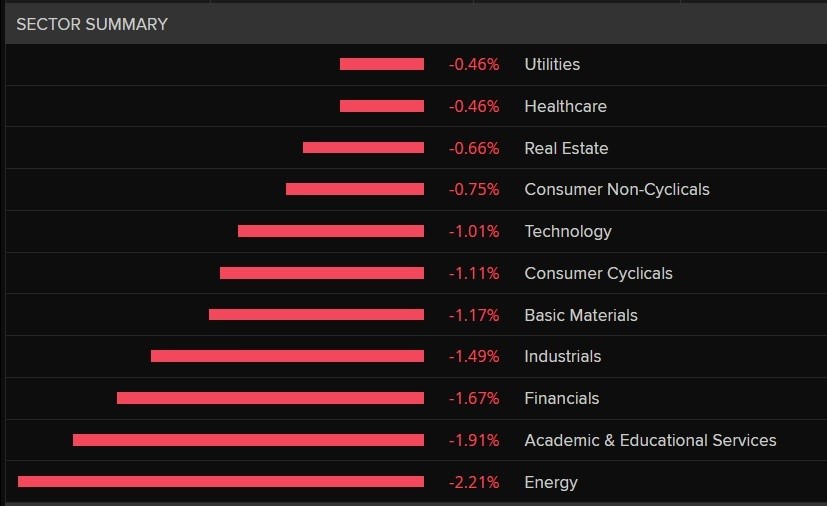

Best and worst performers on the Australian market

By David Chau

The ASX 200 has clawed back some of its early losses, but it's still down 0.8% at 10:50am AEST.

Here are today's best and worst performing stocks.

As you can see, gold miners are posting the largest gains, while energy stocks have fallen sharply.

It mainly has to do with the price of their underlying asset (in particular, a big rise in gold prices, and a sell-off in oil markets).

Shares of Amcor dropped by more than 7% after the packaging company downgraded its full-year earnings guidance.

Ramsay Healthcare fell 2.7% despite the private hospital operator reporting a significant rise in revenue (up 10.9% in nine months).

Banks, miners and oil stocks drag ASX lower

By David Chau

It's a deeply negative day for the share market, with every sector in the red.

Every sector was in the red with energy (-2.2%), financials (-1.7%) and industrials (-1.5%) faring worse than the others.

Australia's largest companies are the biggest drags on the market.

There have been sharp losses for the major banks Commonwealth Bank, Westpac, NAB and Westpac (down between 1.5% and 1.8% each).

Among the mining giants, BHP, Rio Tinto,and Fortescue Metals have dropped 0.9%, 1.4% and 2.9% respectively.

Gold miners shine, while ASX drops 1.1%

By David Chau

The local share market has begun its day sharply lower, after heavy losses on Wall Street overnight on worries about the stability of US regional banks and tomorrow's Federal Reserve rate hike.

By 10:30am AEST, the benchmark ASX 200 was down 1.1% to 7,191 points, with eight out of every 10 stocks in the red (in other words, most of them).

Energy was the worst peforming sector after a 5% plunge in oil prices overnight.

It has led to steep falls in the share price of Santos (-2.8%), Karoon Energy (-2.9%), Woodside Energy (-3%) and Paladin Energy (-3.2%).

On the flip side, today's best performing stocks are gold miners after a sharp rise in the precious metal's spot price.

Gold stocks like De Grey Mining (+7.4%), Gold Road Resources (+6.9%), Silver Lake Resources (+5.9%) and Evolution Mining (+5.3%) are enjoying the largest gains.

Market snapshot at 10:15am AEST

By David Chau

-

ASX 200: -1.2% at 7,181 points

- All Ords: -1.2% at 7,372

- Australian dollar: flat at 66.6 US cents

- Dow Jones: -1.1% to 33,685 points

- S&P 500: -1.2% to 4,120 points

- Nasdaq Composite: -1.1% to 12,081

- Stoxx 600: -1.2% at 461

- Spot gold: -0.1% at $US2,014.73/ounce

- Brent crude: flat at $US75.28/barrel

- Iron ore: +0.1% to $US102.05 / tonne

- Bitcoin: -0.2% at $US28,632

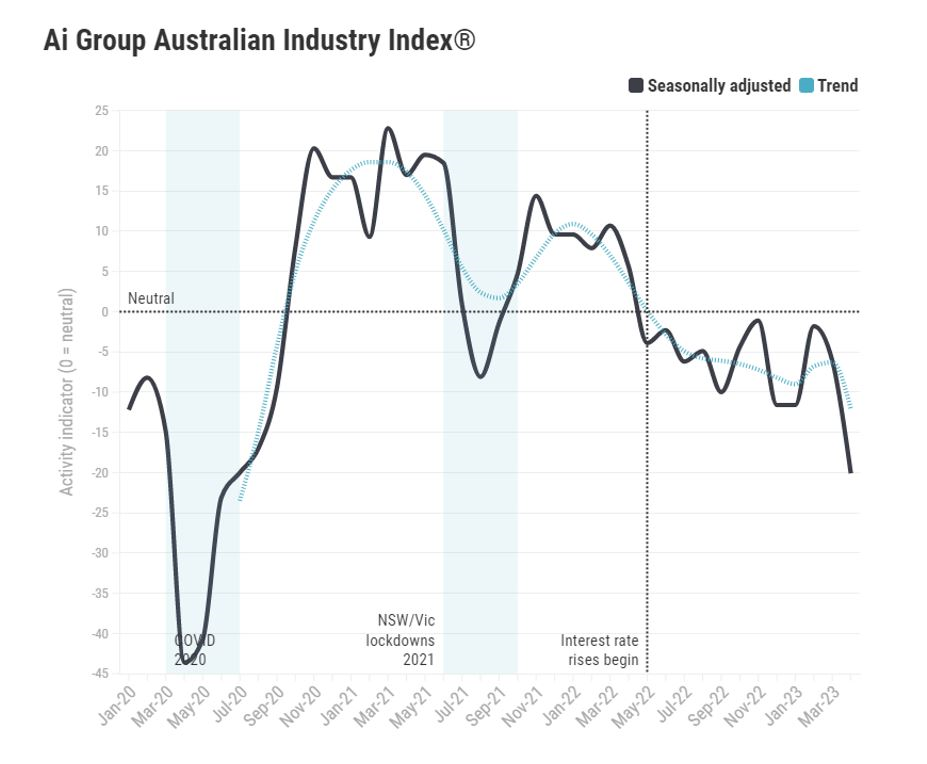

'Disappointing anniversary' for Australian industry, after 12 months of contraction

By David Chau

The Australian Industry Group has released its latest figures about the health of the nation's businesses, and it looks rather bleak.

Last month, the Ai Group Australian Industry Index dropped by 14 points to -20.1 points (seasonally adjusted).

This is a deeply negative result, particularly given this index (which tracks industrial activity) has shrunk for 12 months in row.

"Australian industry marks a disappointing anniversary in April – 12 months of continuous contraction," said Innes Willox, the chief executive of Ai Group.

"Activity and sales have fallen into contraction as demand is weakening, a pattern now affecting every subsector within industry.

"Yet price pressures and shortages for supply chains and labour remain acute, trapping industry between supply constraints and falling demand.

"Yesterday's decision by the Reserve Bank to raise interest rates, while necessary to contain inflation, will add more pain to businesses facing a worsening economic outlook."

The AiGroup noted that: "All industrial subsectors are in contraction following declines in April".

"Manufacturing, chemicals, food & beverage and business services reported steep falls."

RBA governor warns of further interest rate hikes

By David Chau

Persistent inflation and rebounding property prices are some of the reasons offered by the Reserve Bank governor for the shock decision to start raising interest rates again.

Philip Lowe has been trying to explain why the RBA decided to lift its cash rate target for the 11th time in a year, and he’s refusing to rule out further rate increases.

Here’s the latest analysis from senior business correspondent Peter Ryan.

Why the RBA can't stop lifting interest rates

By David Chau

Last month, the Reserve Bank said it wanted to "pause" its interest-rate-hiking cycle — to wait and see what impact its existing rate increases was having on the economy.

As it turned out, the RBA decided not to wait for very long.

Markets were blindsided by the bank's decision to lift rates by 0.25 percentage points yesterday, even though inflation has fallen sharply (but is still at extremely high levels).

If you're confused by what's going on, I recommend that you listen to the latest ABC News Daily podcast, which explains things simply:

European shares close at one-month low

By David Chau

European markets also had a rough session overnight.

The pan-European STOXX 600 index fell 1.2%, finishing at its worst level since early April.

Oil and gas shares were some of the biggest drags on the market.

They plunged 4.5%, roughly in line with plunging oil prices lower — on worries about a US bond default, weak economic data from China and expectations the US and Europe will raise interest rates again this week.

Shares of BP dropped 8.6%, after the company pared a share buyback plan but made a $US5 billion profit in the first quarter of 2023.

Investors were also refraining from risk-taking ahead of the US Federal Reserve's policy decision, that is likely to push the US central bank's benchmark overnight interest rate to its highest level in nearly 16 years.

"Nerves are rising about the debt ceiling standoff in the US, with the prospect that a default could shake the global economy, just as worries about further banking repercussions have been calmed for now," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

ECB expected to slow down its rate hikes

Markets also keenly awaited a rate decision by the European Central Bank (ECB) on Thursday evening (AEST), where it is widely seen hiking by 0.25 percentage points.

Derivatives markets also see European rates peaking at around 3.7% in November.

Boosting the case for a smaller interest-rate increase, data showed euro zone banks are turning off the credit taps and a key gauge of inflation is finally falling.

"The data are finally in and they suggest the ECB can slow down the pace of tightening from 50 to 25 bp [basis points]. That said, this does not need to be a dovish 25bp hike," said Davide Oneglia, senior economist at TS Lombard.

"The bigger question remains where the ECB will stop. The answer depends mostly on a mid-year US recession materialising and on the Fed response to it."

ABC/Reuters