The local share market has recovered slightly from yesterday's heavy losses, while the Australian Energy Regulator has revealed power prices will rise by around 20 per cent in several states.

Wall Street rebounded overnight as largely on-target inflation data and waning fears over contagion in the banking sector cooled investors' nerves.

See how the trading day unfolds on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:15pm AEDT

By David Chau

- ASX 200 +0.9% at 7,068 points

- All Ords +0.9% at 7,263 points

- Australian dollar +0.1% at 66.87 US cents

- Hang Seng +1.2% at 19,475

- Shanghai Composite +0.6% at 3,265

- Nikkei 225 +0.1% at 27,255

-

Brent crude +1.4% to $US78.52 / barrel

- Spot gold -0.1% at $US1,900.53 / ounce

- Iron ore +0.4% to $US132 / tonne

- Bitcoin +0.8% to $US24,818

ASX relief rally

By David Chau

The Australian share market has finished trading with solid gains, essentially tracking a relief rally on Wall Street.

The ASX 200 closed 0.9 per cent higher, at 7,068 points.

Today's best performing stocks were in tech-related sectors, including PEXA (+6.4%), Link Administration (+6%), Xero (+4%) and Block (+3.9%), along with coal miners Coronado Global Resources (+5.4%) and Whitehaven Coal (+3.7%).

On the flip side, miners were some of the weakest performers including Evolution Mining (-3.2%) and Chalice Mining (-1.8%), along with Domino's Pizza (-1.7%), Allkem (-1.5%) and Imugene (-4%).

Investors piled back into stocks as as worries about contagion in the banking sector (following the collapse of Silicon Valley Bank) last week eased.

Investors were also relieved after February's US inflation report on Tuesday (local time) showed consumer prices rising by 0.4% (with a year-on-year gain of 6%).

US rate hike bets

That was in line with analyst expectations, as there were worries that stronger than expected data might lead the Fed to go for jumbo-sized (50 basis point) hikes to battle inflation.

As recently as last week, markets were braced for the return of large Fed hikes but the swift collapse of SVB has changed those expectations, with market pricing in an 80% chance of a 25 basis point hike next week.

"It does feel like the 50 basis point move for this month's meeting that was speculated about especially after [Fed chair Jerome] Powell's commentary to the Senate Banking Committee," said Robert Carnell, regional head of research, Asia Pacific at ING.

Nobody's expecting that anymore."

US bond market recovers from plunge

US Treasury yields extended their gains into the Asia-Pacific trading hours, after sharp declines at the start of the week.

The yield on 10-year Treasury notes was up 3.8 basis points to 3.674%.

The two-year US Treasury yield, which typically moves in step with interest rate expectations, was up 6.9 basis points at 4.294% (but far off last week's peak of 5.084%).

This was an improvement compared to yesterday, when the US two-year bond yield recorded its biggest three-day plunge since 1987 (as investors fled to safety in the wake of Silicon Valley Bank’s collapse).

Australian dollar lifted by China's data, confirming economic recovery

By David Chau

The Australian dollar was up 0.2% to 66.95 US cents, by 3:10pm AEDT.

Earlier today, it had jumped as high as 67.1 US cents before retreating slightly.

The boost came after China released its latest data, confirming its economy was recovering from the damage of prolonged COVID lockdowns.

Retail sales in the first two months jumped 3.5% from a year before (reversing a 1.8% annual fall seen in December). The result was in line with analysts' expectations.

Industrial output in the January-February period was 2.4% higher than a year earlier, data by the National Bureau of Statistics (NBS) showed. (This was slightly below expectations for a 2.6% gain, according to a Reuters economist poll).

However, property investment in the January-February period fell again as home buyers and developers remained cautious despite a slew of supportive government policies.

This mixed data portrayed an uneven recovery in economic activity following China's abrupt abandonment late last year of its three-year-long campaign to control COVID-19.

It pointed to "a steady rather than accelerating momentum", said Zhou Hao, chief economist at Guotai Junan International. It indicated that strong policy support was needed to unleash the growth potential, he said.

OpenAI set to release new AI model

By David Chau

Startup tech company OpenAI says it is beginning to release a powerful artificial intelligence model known as GPT-4, setting the stage for human-like technology to proliferate and more competition between its backer Microsoft and Alphabet's Google.

OpenAI, which created the chatbot sensation ChatGPT, said in a blog post that its latest technology was "multimodal", meaning images as well as text prompts could spur it to generate content.

The text-input feature will be available to ChatGPT Plus subscribers and to software developers, with a waitlist, while the image-input ability remains a preview of its research.

For more on this, you can read the ABC's coverage here:

EPA's concerns over Woodside's emissions time frame

By David Chau

West Australia's environmental watchdog is concerned a major gas plant in the Pilbara does not plan to reduce its carbon dioxide emissions fast enough in the worldwide effort to limit global warming.

The Environmental Protection Authority has aired concerns that Woodside's Pluto Liquid Natural Gas facility (on the Burrup Peninsula, about 1,500 kilometres north of Perth) is making limited reductions to its proposed emissions between 2030 and 2050.

The regulator also states there is an "urgent" need for an inquiry into putting conditions on the facility that ensure its emissions do not accelerate the weathering of World-Heritage-nominated rock art on the peninsula.

The EPA released a report on Monday highlighting its concerns with how fast Woodside would reduce emissions at Pluto and the five-year targets it set to reach milestones.

For more on this, here's the story from Peter de Kruijff and Alice Angeloni:

Sun Cable rescue deal attracts 'strong interest'

By David Chau

It looks like there might be some hope for the recently-collapsed Sun Cable after all.

It's the company behind a massive solar farm and power export project planned for the Northern Territory, which went into voluntary administration.

It all came apart for Sun Cable when its two biggest investors (billionaires Andrew Forrest and Mike Cannon-Brookes) had a disagreement on the funding and direction of the company.

The administrators FTI Consulting said there was "strong interest" from multiple parties, which have submitted non-binding indicative takeover offers.

FTI said the next step was to upgrade some of these into binding proposals by late April, with the hope of completing the rescue deal by the end of May.

It also confirmed the shortlisted list of bidders include parties that are not existing Sun Cable shareholders.

For more on this deal, you can read this informative piece by Daniel Mercer:

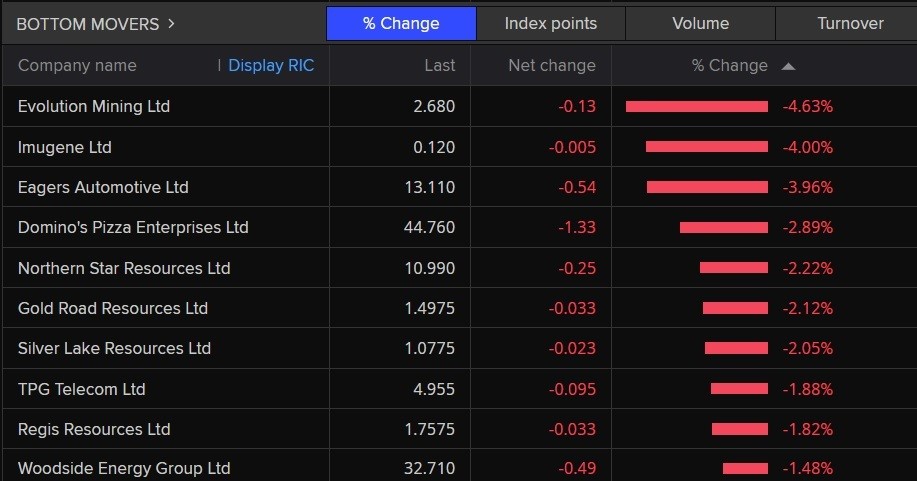

Worst performers are gold miners

By David Chau

Most of today's weakest performers on the ASX 200 are gold stocks.

The precious metal's price dropped on Tuesday as a rise in US Treasury yields took the shine off bullion's recent rise (that was driven by the US banking crisis).

Spot gold fell 0.2% to $1,909.55 per ounce overnight.

Considered a hedge against economic uncertainties, gold becomes a more attractive bet in a low interest-rate environment.

Bullion prices had jumped more than 2% in the previous two sessions as investors sought cover after the collapse of US lender Silicon Valley Bank (SVB) spooked the market.

"As long as the contagion risks stemming from the ongoing SVB saga remain, potentially ramping up recession risks along the way, safe-haven assets are set to remain well bid in the interim," said Han Tan, chief market analyst at Exinity.

"We expect a greater-than-even chance of spot gold staying above the psychologically important $US1,900 in the lead-up to next week's FOMC [US Federal Open Markets Committee] meeting, provided that the US dollar remains subdued and risk-off mode remains in place."

ASX loses steam at midday

By David Chau

The Australian share market is still trading higher at midday, but has lost much of its earlier momentum.

The ASX 200 was up 0.2% to 7,024 points, by 12pm AEDT.

Today's best performing stocks are mainly in the technology, healthcare and resource sectors:

Watch: Chris Bowen on 'absolutely vital' government intervention in energy market

By David Chau

Energy minister Chris Bowen has been out and about this morning talking about the Australian Energy Regulator's decision to increase electricity prices.

He's acknowledged the forthcoming price rises will hurt Australians already doing it tough, but the situation could have been far worse.

Here's some of what he had to say about the 'vital' role the federal government has played:

Oil falls to three-month low

By David Chau

Oil prices dropped over 4% to a three-month low after a US inflation report and the recent US bank failures sparked fears of a fresh financial crisis that could reduce future oil demand.

Brent crude futures fell 4.1%, to settle at $US77.45 a barrel, while US West Texas Intermediate (WTI) crude dropped 4.6%, to settle at $US71.33.

They were the lowest closes for both benchmarks since December 9 and their biggest one-day percentage declines since early January.

In addition, both contracts fell into technically oversold territory for the first time in weeks.

Shockwaves from Silicon Valley Bank's collapse triggered big moves in bank shares as investors fretted over the financial health of some lenders, in spite of assurances from US President Joe Biden and other global policymakers.

"The market is either anticipating a recession in the future or it could be that one or more funds had to raise cash and reduce the risk on their books because they are concerned about liquidity after the bank failures," said Phil Flynn, an analyst at Price Futures Group.

US inflation in line with market expectations

In the United States, consumer prices increased solidly in February as Americans faced persistently higher costs for rents and food.

This poses a dilemma for the US Federal Reserve, whose fight against inflation has been complicated by the collapse of two regional banks.

"Crude prices are falling after a mostly in-line inflation report sealed the deal for at least one more Fed rate hike," said Edward Moya, senior market analyst at data and analytics firm OANDA.

Data showed the US consumer price undex (CPI) increased 0.4% in February (compared with a 0.5% rise in January).

That slight slowdown in consumer price growth prompted investors to price in a smaller rate hike by the Fed in March.

The Fed is now seen raising its benchmark rate by just 0.25 percentage points next week (down from a previously expected 0.5 percentage points), and delivering another hike of the same size in May.

The Fed's next two-day meeting starts next Tuesday.

"The Fed’s tightening work is not done just yet and the chances are growing that they will send the economy into a mild recession, and risks remain that it could be a severe one," Mr Moya added.

Business owners feeling the pinch

By David Chau

Small businesses are already seeing customers cut back on spending as interest rate hikes hit households.

Consumer sentiment remains near 30-year lows according to Westpac, while NAB's latest survey shows business confidence has turned negative and trading conditions have slipped.

Some sectors are being hit harder than others, according to Emilia Terzon who filed this story for The Business:

ASX rises 0.7% in morning trade

By David Chau

Australian shares have lifted in morning trade, as concerns of financial contagion from the collapse of Silicon Valley Bank subsided.

The ASX 200 was up 0.7% to 7,056 points, by 10:20am AEDT, with the financial and technology sectors driving the gains.

Some of today's best performers include lithium stocks Liontown Resources (+6%), Pilbara Minerals (+4.2%) and Sayona Mining (+3.5%), along with electronic payments firm Block (+4.6%) and Challenger (+4.1%).

On the flip side, gold miners are among today's weakest performers,, including Ramelius Resources (-3%), Northern Star Resources (-2.9%) and Evolution Mining (-2.9%).

Though that was after gold stocks surged in recent days, so there is an element of 'profit taking'.

Watch: Australian Energy Regulator chair Clare Savage explains today's default market offer

By Kate Ainsworth

If you missed it earlier, you can catch Madeleine Morris's full chat with AER Chair Clare Savage on their draft decision on News Breakfast below:

Pessimism abounds as ASX erases all its gains since January

By David Chau

The new trading day will begin shortly, but it's worth recapping the abysmal performance on the Australian share market recently.

The ASX 200 is down 0.4% since the year began.

This means market has wiped out ALL the gains it has made since the start of 2023. (At its peak, in February, the benchmark index was up 7.4% over the year.)

Since then, the market's bets on how high inflation will climb (and how much interest rates will rise) have fluctuated wildly.

Now the market is pricing in an almost 90% chance that the Reserve Bank will leave the cash rate on hold at its next meeting in April — and the rest are betting on a rate cut.

If you want a quick and easy summary, here's my finance report from last night's 7pm News bulletin:

Victorian default offer to see energy prices increase by 30 per cent

By Kate Ainsworth

Victoria's Essential Services Commission (ESC) has released its default offer, with an even larger 30 per cent increase in household electricity prices and 31 per cent for small businesses.

The ESC said a typical household bill would rise from $1,403 to $1,829 per year, while small businesses could expect an increase from $5,620 to about $7,358.

The ESC says the increases are "primarily due to significant rises in wholesale electricity costs driven by energy market volatility in 2022" but is in line with the AER's draft offer.

"The dollar figure increases set out in the draft decision are in keeping with proposed default market offer increases announced in other jurisdictions today," Commission Chairperson Kate Symons said.

"We understand the impacts on consumers amid a broader environment of cost-of-living concerns and we urge Victorians to take advantage of government support programs offering power price relief,” she said.

Worried about the power price rise ahead? AER says to shop around

By Kate Ainsworth

If you're nervous about (already high) power prices and what it means for your household budget after this morning's news, the Australian Energy Regulator advises you to shop around to get a better deal.

"We encourage consumers to shop around for the best electricity deal for your circumstances. The AER’s free and independent comparison website can help: www.energymadeeasy.gov.au," Chair Clare Savage said.

"If you’re struggling to pay your bills, contact your retailer as soon as possible because under national energy laws they must assist you."

Chris Bowen says AER's draft Default Market Offer proof government action is working

By Kate Ainsworth

Energy minister Chris Bowen says the Australian Energy Regulator's draft Default Market Offer (DMO) for electricity is proof that the government's intervention is working to help consumers battle rising energy prices.

Last year the federal government intervened to cap coal and gas prices to help reduce the pain from energy price spikes largely driven by Russia's war in Ukraine.

Mr Bowen says that government action helped prevent consumers from paying even higher prices, and has helped stave off even higher prices come July 1.

"The government, faced with large increases in the DMO, urgently acted to curb spiralling prices of gas and coal and shield Australian families and businesses from the worst of these energy price spikes," he said.

"Today's draft increases are up to 29 percentage points lower than the AER projected in late 2022, more than halving the increase that was expected before the government acted on skyrocketing coal and gas prices.

"This means hundreds of dollars (between $268 and $530) of additional increase avoided for households, and up to $1,243 additional increase avoided for small business customers."

AER chair hopeful energy prices won't rise further in coming years

By Kate Ainsworth

With signs interest rate rises may be easing and inflation is coming under control, could the budgetary pain be easing for households when it comes to power prices?

AER Chair Clare Savage has told News Breakfast that she's optimistic conditions in the wholesale energy market will ease, and that will translate to electricity prices here.

"We'll make our final decision in May, so we will continue to monitor those wholesale markets between now and May," Ms Savage said.

"We'll update the estimates at that time and also respond to any feedback we get from stakeholders.

"So it's hard to tell where it will go from here, but we're hopeful that we'll continue to see prices no higher than what we're offering today."

Australian consumers set to cut spending as interest rates surge

By David Chau

Australia's economy is still holding up on the back of solid household spending, but there are warning signs that a severe downturn may be possible in the coming months.

The latest figures show that business confidence is falling, and consumer confidence has plummetted to levels last seen during the 1990s recession.

Data also shows consumers are beginning to reduce their spending as cost-of-living pressures impact household budgets.

For more on this, check out this story by Kate Ainsworth and Emilia Terzon:

Facebook sacks additional 10,000 workers

By David Chau

Facebook's parent company Meta is planning to slash another 10,000 jobs — and will not fill 5,000 open positions as the social media giant cuts costs.

Chief executive Mark Zuckerberg said the company would reduce the size of its recruiting team and make further cuts in its tech groups in April, followed by its business groups in May.

In February it posted lower fourth-quarter profit and revenue, hurt by a downturn in the online advertising market and competition from rivals such as TikTok.

The latest job cuts comes after the company slashed 11,000 jobs in November.

For more on this, you can read our coverage here:

ABC/Reuters