The Australian share market has risen to a three-week high, while property prices have rebounded despite the Reserve Bank hiking interest rates for 10 months in a row.

Oil prices surged after the OPEC cartel (which includes Saudi Arabia, Iraq and other oil-producing nations) announced a surprise cut to their oil production, and Scott's Refrigerated Logistics is now in liquidation after creditors voted for the company to be wound up.

See how the trading day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:20pm AEST

By David Chau

That's all folks!

By David Chau

Logging out now at the end of another busy day in finance and business news.

I'll be back with you early tomorrow morning, for the latest developments in US and European markets.

That's it for the Scott's creditors meeting

By Kate Ainsworth

It took close to two hours, but the second creditors meeting for Scott's Refrigerated Logistics has just wrapped up.

There was a bit of ground to cover, and creditors had to vote on a number of resolutions to begin the company's liquidation process and next steps.

There were eight resolutions overall, but the big one was creditors voting that the company go into liquidation, which spells the end for Scott's altogether.

Where to from here? The appointed liquidators will begin winding down the company and paying back the company's debt in order of priority, including secured creditors, the liquidators themselves, and unsecured creditors.

During the meeting, McGrath Nichol said secured creditors, namely Gordon Brother and ScotPac, have priority over returns from Scott's Group assets, followed by employees. McGrath Nichol said it is unlikely unsecured creditors will receive any return, unless there are "meaningful recoveries" from voidable transactions.

All that said, liquidation takes time, and it will be some weeks before it is completely finalised — so while it's the end of the road for Scott's as a company, the fallout will continue for a few more weeks to come.

ASX closes 0.6% higher

By David Chau

The Australian share market has risen for its sixth day in a row, as worries about the stability of US and European banks continue to subside.

The ASX 200 finished 0.6% higher at 7,223 points, its highest level since March 9 — with every ASX sector (except mining) posting gains.

However, the standout was the energy sector (+2.2%), as oil prices surged after Saudi Arabia and other members of the OPEC+ cartel announced a surprise round of output cuts.

Today's best performing stocks include Lake Resources (+7.9%), Karoon Energy (+6.5%), Lynas Rare Earths (+4.4%), Beach Energy (+3.5%) and Seven Group Holdings (+3.7%).

On the flip side, the stocks which suffered the heaviest losses were Syrah Resources (-5.2%), Regis Resources (-4.6%), Capricorn Metals (-3.6%), Pilbara Minerals (-3.6%) and Perseus Mining (-3.4%).

Netwealth stocks plummet

The worst performing stock on the benchmark index was wealth management firm Netwealth Group (-7.5%).

This was after Netwealth slashed its expectations of net fund inflows for the current financial year. (In other words, how much money clients give them to invest)

Netwealth now expects its funds under administration (FUA) to be between $9 billion and $11 billion for this financial year (a downgrade from its previous forecast of $11 billion).

The firm attributed the lower forecast to market volatility and negative investor sentiment, making it tougher to forecast timings of transactions on a monthly or even quarterly basis.

'Material shortfall' not expected in Australia's east coast gas market, says ACCC

By David Chau

Austraila's east coast gas market could have enough supply to meet forecast demand from consumers in 2023, according to the nation's competition regulator.

This would be possible if LNG producers committed to supplying at least an additional 3 petajoules (PJ) of gas to the domestic market this year, over and above the already contracted levels, the Australian Competition and Consumer Commission (ACCC) said.

"The available data shows that the outlook for the east coast gas market has improved and the market is not expected to face a material shortfall in 2023," ACCC Chair Gina Cass-Gottlieb said in a statement.

In its interim March report, the ACCC said the supply-demand outlook had improved by 27 PJ since its forecast in January (due to a rise in production estimates and drop in uncontracted gas).

This improvement in the outlook prompted the Australian government to not activate its domestic gas security supply mechanism (for the July to September quarter).

The ACCC data was "one of the key inputs to not commence the notification period for the newly reformed Australian Domestic Gas Security Mechanism (ADGSM) for the upcoming quarter," Minister for Resources Madeleine King's office said in a statement.

East coast LNG producers are expected to have uncontracted gas in every quarter in 2023, which could be used to prevent any shortfalls, the ACCC said in its report.

The regulator expects LNG producers to have excess uncontracted gas in all quarters of 2023 - with 33 PJ of uncontracted gas expected in the third quarter which could be sold domestically, internationally as LNG spot cargoes, or stored, it added.

Scott's Refrigerated Logistics now in liquidation

By Kate Ainsworth

Creditors have just voted that Scott's be wound up and the six companies under the Scott's umbrella will be liquidated.

It means the company will be shut down, and the liquidators will now convert the company's assets into cash to pay remuneration and pay off its debts.

The creditors meeting is still ongoing — currently they're considering a resolution on the future remuneration of the liquidators for each of the six companies.

Oil prices ... how high could they get?

By David Chau

Investment bank Goldman Sachs has raised its price forecasts for Brent crude futures, following a surprise announcement from OPEC+ that the producer alliance will cut oil output further.

Its price forecast for Brent for December 2023 was increased by $US5 (to $US95 a barrel), according to a note written by Goldman analysts.

Its December 2024 price foreacast was raised by $US3 (to $US100 a barrel).

In comparison, Brent crude is currently fetching around $US84 a barrel (so it could potentially rise another 13% by the end of this year)!

Goldman also lowered its own end-2023 production forecast for OPEC+ (grouping the Organization of the Petroleum Exporting Countries (OPEC) and other producers including Russia) by 1.1 million barrels per day.

"Today's surprise (production) cut is consistent with the new OPEC+ doctrine to act preemptively because they can without significant losses in market share," the bank said.

"The risks around cutting production have become asymmetric given how short positioning has become, and because price increases in response to tightening events can be stronger when the market is short."

Potential oil shortages due to China's demand

CBA's mining and energy analyst Vivek Dhar also predicts a sharp rise in oil prices.

Mr Dhar expects Brent futures will rise to $US90 per barrel by the December quarter as "as oil markets shift into a deficit" in the second-half of this year.

"China's oil demand growth "remains a key driver of oil shortages later this year," he wrote in a note to clients.

"China’s oil demand is likely to remain robust in H1 2023 from pent up demand following the re opening of China’s economy.

"However, it’s unlikely that China’s demand can hold up at current levels through H2 2023 given China’s conservative economic growth target of ‘around 5%’ this year."

Market snapshot at 3:20pm AEST

By David Chau

- ASX 200: +0.5% to 7,215 points

- All Ords: +0.5% to 7,408

- Australian dollar: -0.3% to 66.67 US cents

-

Spot gold: -0.8% at $US1,953/ounce

- Brent crude: +4.8% at $US83.69/barrel

- Iron ore: -0.1% to $US125.20 a tonne

- Bitcoin: -2.3% at $US27,732

- Hang Seng: -0.5% at 20,303 points

- Shanghai Composite: +0.6% at 3,291

- Nikkei: +0.6% at 28,196

Scott's Group was losing an average of $8 million per month

By Kate Ainsworth

That's according to administrators who have been digging into the company's situation, who say Scott's had been recording losses since July 2020.

Here's how the company's financials looked at the end of recent financial years:

- FY21: loss of $36 million

- FY22: loss of $87 million

- FY23 year-to-date: loss of $62 million

The administrators note that Scott's Group failed to generate sufficient earnings (before tax, interest and depreciation) to cover the cost of its fleet from at least the 2021 financial year.

Overall, its continued trading losses meant Scott's needed to be funded by debt, which came from a few different sources, including:

- $26 million in debtor finance provided by ScotPac

- $64 million in secured debt provided by Gordon Brothers

- $8 million in shareholder loans provided by Anchorage

- $62 million from unsecured creditors

A closer look at Scott's cash flow shows that all of its funding was being attributed to losses.

Risks of Russia and the Middle East 'setting oil production policy together'

By David Chau

The surprise decision by OPEC+ to cut its oil production (by more than 1 million barrels per day) may complicate the West's efforts to penalise Russia for invading Ukraine.

According to the Commonwealth Bank's mining and energy analyst Vivek Dhar:

"There are also wider implications to consider from a geopolitical perspective.

"EU sanctions on Russian oil (5 December 2022) and refined products (5 February 2023) will need to see global oil and fuel trade readjust.

"The EU will likely need to import more oil and refined products from the Middle East to compensate for an import ban on seaborne Russian crude oil and refined products.

"The ability of western sanctions to penalise Russia but keep enough oil in the global market is facing risks if Russia and the Middle East are setting oil production policy together.

Saudi Arabia prioritising China, as it ignores US request to boost oil supply

By David Chau

Just when it looked like inflation was going down, OPEC (which includes Russia, Saudi Arabia, Iraq and others) has surprised the world by cutting oil production by more than 1 million barrels per day, starting from May.

Oil prices have already jumped by more than 5% as a result, which will lead to more expensive petrol (and cost-of-living in general).

It's a decision that has annoyed the United States, as it has been lobbying Saudi Arabia (the most powerful member of the OPEC cartel) to boost its oil production.

But it looks like the Saudis aren't too worried, and they're prioritising their trade relationship with China, according to Helima Croft, the head of global commodity strategy at RBC Capital Markets:

"Today’s move, like the October cut, can be read as another clear signal that Saudi Arabia and its OPEC partners will seek to short circuit further macro sell-offs and that [US Federal Reserve chair] Jay Powell is not the only central banker that matters," Ms Croft said.

"This decision will certainly not be welcomed by the White House – which had called the move ill advised – but the bottom line is Washington and Riyadh simply have different price targets for their key policy initiatives.

"Since August, when Washington did not get the OPEC increase it was seeking after President [Joe] Biden’s trip to Jeddah, it has been apparent that Saudi Arabia is prepared to endure increased friction in the bilateral relationship.

"We have made several trips to the Kingdom in recent months and one of the key messages has been that the United States is now seen as just one of several partners, and that the bilateral relationship with China is rising in importance.

"China is already the Kingdom’s most important trading partner and the country’s economic future is seen as residing in the East.

"Beijing has also been described as a less demanding partner than Washington – not making ever-changing oil asks or seeking full alignment with foreign policy aims."

Scott's potentially trading as insolvent since late 2022, administrators say

By Kate Ainsworth

The creditors meeting has just been running through the administrator's report into Scott's Refrigerated Logistics business situation, which has found that Scott's was potentially trading as insolvent since late 2022.

The administrator's report examined the company's cash flows and balance sheets, and found the company was "likely insolvent from the week prior to the administrators being appointed, but "potentially from late 2022".

They specified that Scott's missed payments on February 24, 2023, had special arrangements in place with creditors, and had deferred its landlord rent to late 2022.

The administrators also found there was a deficiency in net assets from May 2022.

What's the Scott's creditors meeting about?

By Kate Ainsworth

Ultimately its for the creditors to decide what should happen with the business.

Creditors will get to vote to decide one of three outcomes.

Either they will choose for:

- 1.The companies be returned to directors

- 2.The companies enter into liquidation

- 3.The companies enter a Deed of Company Arrangement

The administrators have recommended creditors vote to liquidate the company at the meeting today.

Option one is not recommended as Scott's is insolvent, and option three us not available for creditors to consider.

The Star Sydney's CEO resigns ... after eight months

By David Chau

The Star Sydney CEO Scott Wharton has resigned, less than a year after taking up the appointment overseeing the troubled casino and hotel complex.

Mr Wharton will remain in the position until April 28, and will join employee management services corporation Smartgroup in July as CEO and managing director, on a $1 million salary package.

During his time with The Star, Mr Wharton oversaw the company's renewal program, targeting governance and culture.

It comes after a tumultuous period for parent company, The Star Entertainment Group (SEG).

The organisation's Sydney casino reported a $1 billion loss for the first half of this financial year, attributed to regulatory changes and fines that left its business "in a state of significant uncertainty".

SEG came under fire last year after allegations of money laundering, which sparked an investigation by the NSW Independent Casino Commission (NSWICC), and saw Australia's corporate watchdog, ASIC, launch legal action against past and current directors in December.

For more on this, here's the story by Millie Roberts:

Second creditors meeting for Scott's Refrigerated Logistics about to begin

By Kate Ainsworth

Good afternoon — I'm jumping in alongside David to bring some updates from the second meeting of creditors for Scott's Refrigerated Transport after it entered voluntary administration last month.

The logistics company, which had been the sole supplier of refrigerated transport for Coles and Aldi, had struggled to find a buyer before it folded, leaving $500 million of produce in limbo and 1,500 people facing redundancy.

At its first creditors meeting last month, administrators said Scott's reported a loss of $41 million in the current financial year, and liquidation of the company was "very likely to occur".

We'll hear the latest on the situation in the next few minutes and what the next steps are for the business — I'm sitting in on the meeting so will bring you the latest as it happens.

Shipbuilder Austal sinks on former US executives' indictment for fraud

By David Chau

Austal shares have slumped to a four-year low after the United States Department of Justice (DoJ) indicted three of its former US employees on manipulating financial information.

Austal, which builds ships for the US Navy and is working on parts of the Virginia class nuclear-powered submarines, plunged to its lowest level since October 25, 2018.

The DoJ charged three former employees for "allegedly making or causing to be made false and misleading statements about Austal USA's performance and financial condition between 2012 and 2016", the company said.

The US Securities and Exchange Commission (SEC) has also filed civil charges against the three individuals, Austal said.

The SEC and DOJ alleged that the individuals artificially reduced and suppressed an accounting metric, called estimate at completion (EAC), in relation to multiple littoral combat ships that Austal was building for the US Navy.

The company since then has announced a write-back to adjust its revenue and profit, settled an investigation by Australia's securities regulator (ASIC), and conducted its own investigation into the matter, which resulted in the resignation of the president of Austal USA.

By 2:20pm AEST, shares in Austal have fallen 5.2% to $1.64.

Austal's share price has plummetted by 21.4% so far this year - compared with a 2.6% increase in the ASX 200 index.

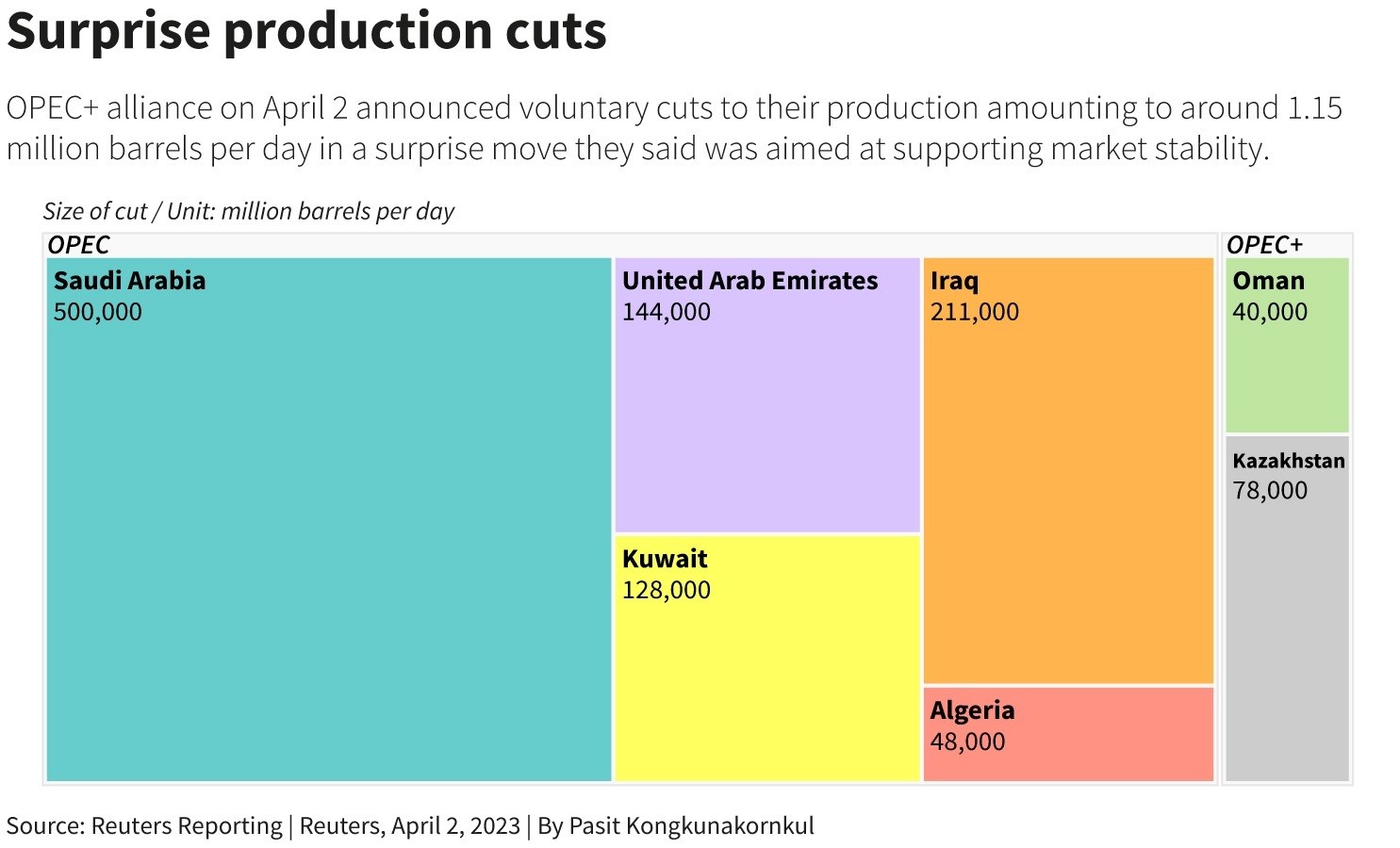

Saudi Arabia cutting oil production by 500,000 barrels per day

By David Chau

Here's what the oil production cuts look like across the OPEC nations.

Most of those cuts will come from the cartel's biggest oil producer Saudi Arabia, followed by Iraq, the United Arab Emirates and Kuwait:

Oil prices rebound from 15-month low as OPEC+ announces surprise cuts

By David Chau

Oil prices surged by as much as 8 per cent, after Saudi Arabia and other OPEC+ oil producers announced they would cut their output by around 1.16 million barrels per day.

It's a potentially ominous sign for global inflation (which had been drifting lower in recent months).

All up, the pledges bring the total volume of cuts by OPEC+ to 3.66 million barrels per day (bpd), according to Reuters calculations.

That works out to be around 3.7% of global demand.

These voluntary cuts start from May and last until the end of the year.

OPEC+ is a group which includes Russia and the OPEC nations (Saudi Arabia, United Arab Emirates, Iraq and others).

By 1:30pm AEST, Brent crude futures were up 5.3% to ($US84.14 a barrel), while US crude climbed 5.5% to $US79.84.

US warns against supply cut

Last month, oil prices fell towards $US70 a barrel, the lowest in 15 months, on concern that a global banking crisis would hit demand.

Back in October, OPEC+ had agreed to an output cut of 2 million bpd from November until the end of the year, a move that angered Washington as tighter supply boosts oil prices.

The US has argued that the world needs lower prices to support economic growth and prevent Russian President Vladimir Putin from earning more revenue to fund the Ukraine war.

The Biden administration said it sees the surprise move announced by the OPEC+ nations as unwise.

"We don't think cuts are advisable at this moment given market uncertainty - and we've made that clear," a spokesperson for the National Security Council said.

Downer EDI sued in class action

By David Chau

Engineering and construction contractor Downer EDI is being sued in a class action lawsuit, filed in the Federal Court.

Downer is accused of breaching its continuous disclosure obligations under the Corporations Act and ASX Listing Rules, by withholding certain information from its shareholders.

The plaintiffs also allege the Downer misled or deceived them by making or "failing to qualify various representations" related to its financial performance, systems and controls.

The company's alleged misleading conduct also relates to a "maintenace contract in its Australian Utilities business".

The case was filed by shareholders of the company, who acquired their shares between April 1, 2020 and February 27, 2023.

Downer said it intends to defend the lawsuit.

Energy and tech boost ASX at midday

By David Chau

The local share market is trading at its highest level since early March, helped by gains in technology and energy stocks.

The ASX 200 climbed 0.7% to 7,230 points, by 12:55pm AEST.

Energy stocks rose 2.8%, as crude oil prices jumped following a surprise announcement by OPEC+ to cut production further in an effort to support market stability.

Sector giants Santos and Woodside jumped by around 3% each.

Tech stocks tracked Wall Street higher, with Xero adding 3.8%.

Gold stocks fell 1.1%, with sector heavyweights Newcrest Mining and Northern Star Resources down 0.9% each.

Among single stocks, Coles gained 0.6% after the country's second-largest grocer acquired two automated milk processing facilities for $105 million.

ABC/Reuters