The Australian share market has ended its day practically flat, but is hovering near a six-week high, despite a lacklustre session on Wall Street overnight.

Shares of Star Entertainment plunged after the casino operator issued a profit downgrade and announced major job cuts, while Woodside Energy CEO Meg O'Neill used an address at the National Press Club to blast "extremists" for slowing down gas projects.

See how the trading day unfolded in our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:15pm AEST

By David Chau

Cautious day for Australian stocks

By David Chau

The ASX 200 ended its day with very little change (flat, in other words). However, it still remains close to a six-week high.

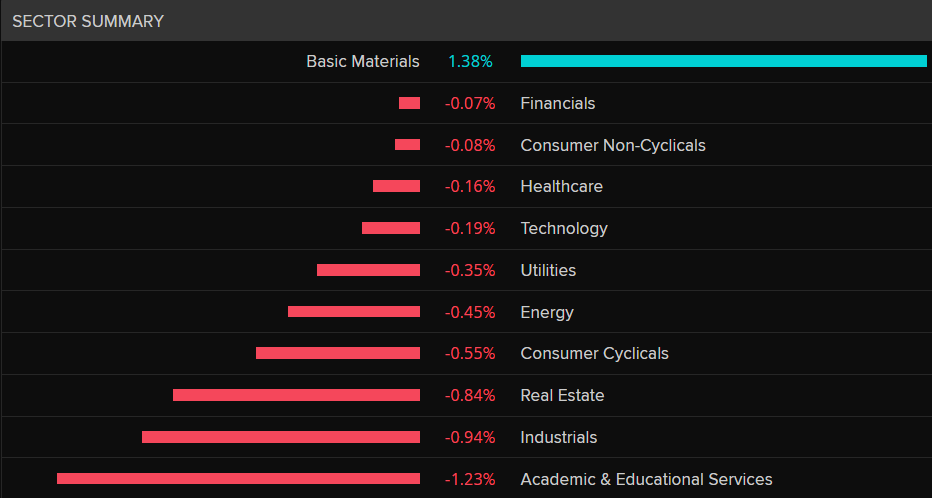

Almost every sector was in the red, except for materials (+1%) — which kept the market afloat.

Essentially, mining stocks posted such strong gains that it offset losses in practically all the other sectors.

Today's best performing stocks include Telix Pharmaceuticals (+5.4%), IGO (+4%), Gold Road Resources (+3.9%) and De Grey Mining (+3.5%).

AMP shares jumped 3.7% after the company said the "net cash outflows" (for its wealth management business) had fallen.

In other words, clients are still pulling their money out of AMP, but at a slower rate compared to previous quarters.

Mining stocks were the top gainers on the market after iron ore prices jumped to one-week highs.

BHP, Rio Tinto and Fortescue Metals rose between 0.2% and 1.5%.

BHP and Rio are scheduled to report their quarterly production figures later this week.

On the flip side, the worst performing stocks were Lake Resources (-8.1%), Domain (-4.4%), Kelsian Group (-3.8%) and Karoon Energy (-3.6%).

Star Entertainment shares plunged 7.4% after the casino operator warned its "current earnings performance is at unprecedented low levels", and that it would sack 500 full-time employees.

Bounce in global growth won't last, NAB warns

By David Chau

NAB has published a somewhat gloomy research report, warning that the bounce in global GDP during the March quarter (driven by China's economic recovery) won't last.

The bank also said we should expect some fallout from last month's "banking stress".

By that, it was referring to the collapse of two US banks (Silicon Valley Bank and Signature Bank), along with a crisis-of-confidence leading to the forced takeover of Credit Suisse (by UBS).

Inflation likely to remain sticky

The bank said consequence is that "lending standards" are likely to "tighten further", contributing to expectations that central banks (like the US Federal Reserve and others) may not need to lift interest rates as much from now on.

"While some further rate hikes are expected – in particular, by the ECB and the Fed – the peak of the global tightening cycle is in sight," NAB senior economists Gerard Burg and Tony Kelly wrote in their report.

"Whether this ends up being the case, and how long rates are kept at elevated levels, will depend on the path for inflation."

They argue that inflation has already peaked, and is expected to drift lower as supply chain problems resolve.

However, the decision by OPEC+ producers (like Russia and Saudi Arabai) to reduce their production and "put a floor under oil prices" means inflation will still remain at quite a high level for some time.

China's momentum unliekly to be maintained

They also noted that China's economy grew by a stronger-than-expected 2.2% between the December and March quarters.

"However, China will not be able to sustain growth at its Q1 pace, and with the impact of tighter policy settings (including fiscal) still working its way through, global growth over the rest of 2023 is likely to be more subdued.

"We continue to anticipate that annual average global growth will step down in 2023 and 2024 – to around 2.7%.

"Excluding the downturns associated with the global financial crisis and COVID-19 impacted 2020, these would be the slowest rates of growth since 2001."

On the plus side, they say a "modest recovery" looks likely in 2025.

What to expect from Treasurer Jim Chalmers ahead of the budget

By David Chau

The federal budget is less than three weeks away.

Treasurer Jim Chalmers still has a lot to do between now and then, including releasing a number of important reports.

He wants his budget to provide cost-of-living relief for households, and to support employment and wages for workers, in line with voters' wishes from the election.

But he has recently returned from Washington DC, where he was warned by the International Monetary Fund of the coming slow-down in the global economy.

Here's what's happening as we countdown to the budget on 9 May:

- Economic Inclusion Advisory Committee (just released)

- Women's Economic Equality Taskforce (just released)

- Reserve Bank review (out very soon)

- Treasurer's Investor Roundtable (Friday)

- Petroleum Resource Rent Tax report (in government hands)

For more on this, here's the story by business reporter Gareth Hutchens:

Is Meg O'Neill worried about Woodside's next AGM?

By Kate Ainsworth

The Woodside boss was just asked about this, after 49% of shareholders last year voted against the company's climate report.

Here's how she responded:

"Our AGM is an opportunity for us to engage actively with our shareholders and we look forward to that conversation," she said.

"I'm sure there will be people asking questions that challenge the thesis of what we do and we look forward to having those discussions.

"I'm really proud of what we do. I hope our employees are proud of what they do. Because we're providing energy that literally keeps the lights on. It keeps homes warm. "

More gas supply would drive down energy prices, Woodside boss says

By Kate Ainsworth

Meg O'Neill has just been asked about east coast gas market intervention and the impact that would have on the future supply of gas.

"What we're concerned about with some of the market intervention that's been tabled is that it takes some of the upside away from the producers, creating uncertainty and the customers potentially will have leverage to challenge the price we're selling the product," she said.

"It's the only commodity in Australia that's subject to this sort of regulation."

She says continued investment in gas projects — like the project in Narrabri, in north-west New South Wales — could provide energy to the state now if the right framework was in place.

"So I would again advocate that the best solution to the challenges we're facing actually is supporting more gas supply," she said.

"More supply will keep prices down for customers, more supply will keep that gas reliable for the businesses that count on it, and more supply will be part of Australia's decarbonisation pathway."

Food security at risk if gas projects slowed down: Woodside CEO contends

By Daniel Ziffer

Woodside Energy CEO Meg O'Neill has accused environmentalists of pushing us towards food insecurity by failing to understand the role of gas in agriculture.

In provocative remarks at the National Press Club, the CEO of the gas giant said opponents were misguided and pointed out that even 'clean transport' users - of bicycles and electric vehicles - still required the gas industry.

"In addition to energy supply our gas industry provides feedstock for manufacturing of products that are central to our lives. It might be stating the obvious, but if you drove here today, there's a high chance you used a car that uses petrol or diesel.

But even if you came here in an electric vehicle or rode a bicycle, it is highly likely those vehicles contain plastics that are (made with) oil and gas. Same with the packaging that kept your Weetbix fresh. Our lunch would have been produced using fertilisers that rely on gas.

(It's) not only energy security that's at stake, but also food security. Now these might seem like fairly obvious observations but when you consider the vocal minority that is trying to shut our industry down. It really does beg the question of whether these people understand the consequences of what they're asking for".

Woodside CEO blasts 'extremists' with 'deep pockets' for stopping gas projects

By Daniel Ziffer

Hi team, jumping in with an update from Woodside Energy CEO Meg O'Neill, who is talking to the National Press Club.

She's blasted "extremism" for slowing down gas projects.

While not naming anyone specifically, The Greens want no new fossil fuel projects to prevent the worst impacts of climate change.

Other groups have launched legal cases to stop projects, and to pressure banks and superannuation funds to get out of supporting Woodside and similar companies.

The development of the Australian gas industry was only possible with support of international investors and customers with an interest in securing their own energy supply.

Those same customers and partners are now feeling that interest more keenly than ever after the energy shock of the past year.

But they are questioning whether Australia wants their investment.

A vocal minority wants to shut down the industry and the jobs and livelihoods that go with it. They have deep pockets and are using both protest action and the courts to create uncertainty and destabilise regulatory processes to frustrate both existing and new projects.

I certainly respect every Australians right to express their opinion and we absolutely share the commitment to decarbonisation, but extremism is not the answer.

Australia 'should be an energy superpower for a decarbonising world'

By Kate Ainsworth

Ms O'Neill is nearing the end of her speech, but says Australia is best placed to "succeed in the energy transition".

"We have plenty of natural resources, gas, sun, wind, critical minerals," she said.

"We have a talented, educated, highly skilled workforce.

"We're strategically located near customers in Asia.

"We should be an energy superpower for a decarbonising world. And if we capture our global potential, we'll also deliver solutions here at home."

Gas 'flexible source of energy' that 'smooths the transition renewables'

By Kate Ainsworth

Ms O'Neill says gas is needed to help Australia move towards renewables, and could become a world leader — but it needs investment first.

"When used to generate electricity, natural gas emits around half the life cycle emissions of coal. Gas is a flexible source of energy and provides a stable baseload," she said.

"As the Prime Minister has said, it smooths the transition to renewables.

"Gas is also an important input for processing critical minerals for batteries, solar power and wind farms. In the years ahead, Australia can lead the world in the adoption of renewable energy.

"But this will only be possible with reliable firming power sources.

"If we don’t support investment in new gas supply and infrastructure in Australia, then we are not only limiting the availability of gas as an energy supply, but also potentially compromising the scale and pace of our renewable ambition."

Woodside committed to decarbonisation process in Australia

By Kate Ainsworth

Ms O'Neill's speech has focused largely on gas and ensuring Australia has a reliable energy supply as it transitions to decarbonisation and renewables.

She's using her speech to outline three goals that are "interrelated" to the challenge of Australia using its natural gas resource:

- 1.To provide affordable and reliable energy for Australians

- 2.To maintain strategic partnerships and energy security in our region; and

- 3.to progress global decarbonisation

Woodside supports the Yes campaign for the Voice

By Kate Ainsworth

Meg O'Neill has begun her address acknowledging traditional owners, before mentioning that Woodside supports the Yes campaign for the Indigenous Voice to Parliament.

"In my view, this would be an important step forward in reconciliation. A genuine opportunity to bring Australians together," she said.

ANZ predicts there won't be any interest rate cuts in 2023

By David Chau

Share market investors have been feel very optimistic lately, partly on hope that inflation has peaked and central banks will start cutting interest rates soon.

For instance, the ASX 200 has risen by 6.1% since the year began.

European stocks are doing even better, with the Stoxx 600 index gaining more than 9% since January 1.

But even more impressive is Wall Street's tech index, the Nasdaq Composite, which has surged by around 17% in four months!

However, ANZ doesn't think a rate cut will happen this year.

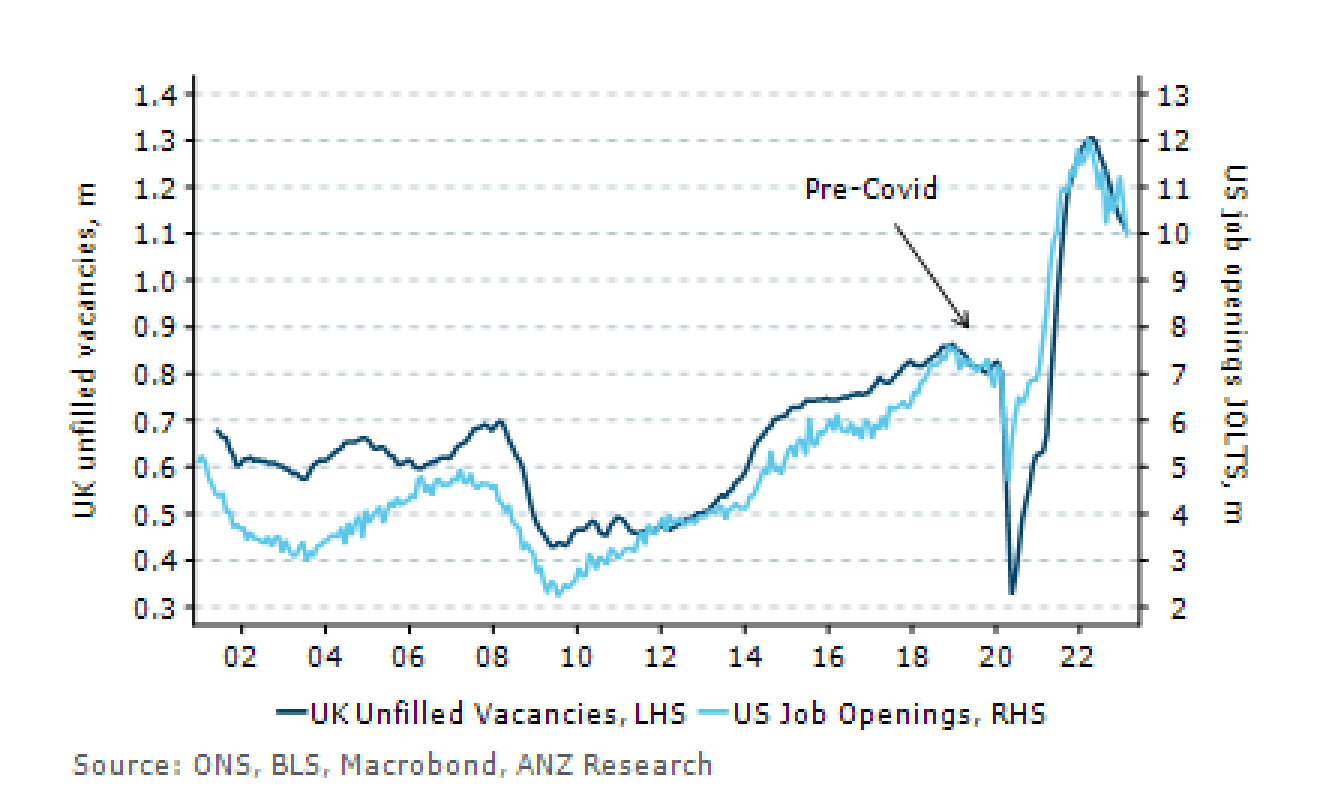

"There are some encouraging signs that headline inflation has peaked and that labour demand is starting to weaken," ANZ economist Brian Martin wrote in a note to clients.

"However, our assessment is that central banks will need to undertake further tightening to bring inflation to target.

Rates to remain higher for longer

He believes US and European central banks will keep rates "at peak levels for an extended period in order to squeeze aggregate demand and weaken cyclical inflation pressures, which are currently multiples of target inflation".

"It is too early to declare victory over inflation," Mr Martin added.

"Whilst we are sensitive to the potential for adverse surprise shocks, we are at odds with the markets view that the Federal Reserve and potentially the European Central Bank and the Bank of England will be cutting interest rates in the second half of this year. "

Woodside Energy CEO Meg O'Neill is about to address the National Press Club

By Kate Ainsworth

With soaring global prices and new climate policies shaking up the gas industry, there's no shortage of topics Woodside boss Meg O'Neill can discuss in her National Press Club address.

You can tune in below:

Market snapshot at 12pm AEST

By David Chau

Fortra finalises investigation into GoAnywhere cyber attack

By Kate Ainsworth

The company behind GoAnywhere, which was breached in a cyber attack earlier this year and stole sensitive data from dozens of major companies, has finalised its investigation and detailed how the hack occurred.

GoAnywhere is a managed file transfer system owned by US cybersecurity firm Fortra, and allows major companies to share sensitive information via the internet.

Fortra says it first discovered unusual activity in its systems between January 28 and January 30, after an "unauthorised party" gained able to gain access to GoAnywhere through a previously unknown vulnerability in the software.

That allowed them to access certain GoAnywhere customer systems, and create unauthorised user accounts in some of its customer environments, which allowed some customers to have their files downloaded.

Fortra's investigation says there's evidence of the unauthorised activity within GoAnywhere dating back to January 18.

In its investigation, Fortra found that customers who were running "an admin portal exposed to the internet" were at increased risk of being affected by the attack, but said that only affected a "small minority of customers".

The company has since issued a patch to reduce the risk, and says it is reviewing its operation practices and security programs.

The GoAnywhere hack impacted a number of companies and government agencies globally, including Rio Tinto, Crown Resorts, and the Tasmanian Government.

You can read Fortra's full summary of their GoAnywhere investigation below:

EV strategy released by Labor with key focus on improving supply and affordability

By David Chau

The federal government has released its first electric vehicle strategy and outlined how it plans to remove barriers to buying EVs.

The three focus areas for the government are the supply of EVs, the systems and infrastructure needed to support uptake, and demand from drivers for them.

According to the strategy, there are six expected outcomes:

- a greater choice of EVs

- a reduction in transport emissions

- increasing ease of charging EVs nationally

- an increase in local manufacturing and recycling of materials

- making EVs more affordable

- making it cheaper for people to run their vehicles

As expected the other key pillar of the strategy is the plan to introduce a fuel efficiency standard, which requires car makers to meet certain emissions limits for their entire fleet or else face penalties.

The idea of the standard is that it then encourages car makers to sell EVs or more fuel-efficient vehicles to remain under the limit.

For more on this, here's the story by political reporter Georgia Hitch:

AMP shares jump on signs of business improvement

By David Chau

AMP's share price has jumped 3% in morning trade, as there has been some improvement to its financials.

Its flagship wealth management business saw "net cash outflows" of about $606 million for the March quarter (compared with $873 million of outflows a year ago).

In other words, clients are not pulling out as much of their money from AMP, compared to last year.

Assets under management for that business unit stood at $126.2 billion at the end of the quarter (around a $2 billion improvement from the previous three months).

The company attributed that to "positive investment markets".

Recovery from banking royal commission

"While economic conditions have become more difficult for some borrowers, AMP Bank's credit quality remains strong," the company said.

The loan book of AMP Bank grew over the first quarter compared with the previous three months, while lending margins were largely in line with what they were a year earlier.

The company also said momentum in loan applications was improving, despite higher interest rates in the country.

AMP is also trying to regain public trust after its involvement in a series of scandals over the past few years, which were highlighted in the 2018 banking royal commission.

The misconduct ranges from charging fees for no service to executive misconduct, which led to a large-scale withdrawal of client funds.

Mining offets losses in every other ASX sector

By David Chau

Here are today's best and worst performing stocks on the ASX 200.

While Telix Pharmaceuticals is posting the largest gains, the top-performer list is dominated by mining and metal companies like Gold Road Resources, Capricorn Metals, Sayona Mining and Mineral Resources.

At the other end of the spectrum, six out of every 10 stocks are trading lower (so that's most of them).

The list of underperformers includes Star Entertaiment, Imugene, Lake Resources, Hub24 and Atlas Arteria.

Materials sector keeping the ASX afloat

By David Chau

In the first hour of trade, the ASX 200 has risen by just 0.1% to 7,367 points.

That's despite nearly sector posting losses, with industrials and real estate among the worst performers.

However, one sector is keeping the local share market (barely) in positive territory — materials.

The materials sector is dominated by BHP, Rio Tinto and Fortescue Metals, which have risen by around 2 per cent each.

ABC/Reuters