The Australian share market has ended its day higher, for the third day in a row, despite investors' ongoing worries about the stability of the US banking sector.

Meanwhile, the ABS's latest monthly inflation data shows cost-of-living pressures have eased for a second consecutive month, which is strengthening the case for the Reserve Bank to keep interest rates on hold next week.

See how the trading day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:15pm AEDT

By David Chau

- All Ordinaries: +0.2% at 7,236 points

- ASX 200: +0.2% at 7,050

- Australian dollar: -0.2% to 66.95 US cents

-

Brent crude: +0.3% to $US78.85 / barrel

- Spot gold: -0.4% at $US1,965.81 / ounce

- Iron ore: +1.9% to $US122.85 / tonne

- Bitcoin: +1% at $US27,583

- Hang Seng: +1.9% at 20,163 points

- Shanghai Composite: flat at 3,244

- Nikkei: +0.8% at 27,727

That's all folks

By David Chau

Logging out now at the end of another busy day in finance and business news.

My colleauge Rhiana Whitson will be joining you bright and early tomorrow for the latest developments in US and European markets.

ASX posts slight gain on weaker-than-expected inflation result

By David Chau

Australian shares have finished trading with very slight gains after the latest ABS data suggested domestic inflation may have peaked.

The ASX 200 closed 0.2% higher at 7,050 points.

By 4:30pm AEDT, the Australian dollar was trading at 66.9 US cents, after a 0.3% fall.

Energy and materials were the best performing sectors, thanks to a sharp rise in the stocks of Deterra Royalties, Silver Lake Resources, Fortescue Metals, Allkem and Woodside Energy.

Many of the stocks which suffered the heaviest falls were lithium companies like Core Lithium, coal miners Whitehaven Coal and New Hope Corporation, and regional lender Bendigo and Adelaide Bank.

ANZ predicts RBA will raise rates by 0.25 percentage points in April and May

By Kate Ainsworth

Earlier we heard from Diana Mousina, a senior economist at AMP, who said it was likely the RBA wouldn't hike the cash rate at its next meeting, but not everyone is on board with that.

Take ANZ, which still expecting the RBA will hike rates by 0.25 percentage points next month and in May, which would take the cash rate to 3.85% and 4.1% respectively.

Senior economist with ANZ Research, Catherine Birch, says despite inflation slowing, there is some economic data that points to another hike.

"We saw a strong labour market report, we saw a strong business survey from NAB, retail sales data was a little softer than we expected, but this monthly CPI coming in quite seasonally strong.

"We expect another 25 basis point hike in the cash rate in the April and the May meetings, which would take the cash rate to a terminal rate of 4.1%.

"We think that actually the RBA is going to need to hold at that restrictive level for quite some time, because there is such a gap between demand and supply at the moment in the Australian economy.

"That suggests that it's going to take quite some time for inflation to come down back to target."

ANZ says inflation peak has passed, but it remains 'far too high'

By Kate Ainsworth

Catherine Birch, senior economist with ANZ Research, says today's inflation figures shows Australia has "passed the peak" but is still too high.

"The 6.8% inflation that we saw today was in line with our expectations, it does confirm that we've passed the peak in annual inflation, with 6.8% today coming down significantly from that 8.4% peak that we saw in December.

"But if we look at what happened in February, specifically, on a seasonally adjusted basis prices actually rose 0.6%, which is quite strong.

"And actually, if you annualise that, we're still looking at inflation of around 7% or a bit higher, which is still far too high."

Meriton falls victim to data hack

By David Chau

One of Australia's biggest property giants has been hit by cybercriminals who may have made off with highly sensitive personal data including birth certificates and bank details, as well as information about salaries and disciplinary proceedings.

Guests and staff members employed by Meriton were affected by the data breach when hackers struck the luxury developer on January 14.

The incident compelled the company to warn approximately 1,889 people to take steps to protect themselves.

Meriton staff members were the most intimately stung by the hack, with the company warning them that cybercriminals may have accessed details of their bank accounts, tax file numbers and employment information,which includes particulars about salaries, disciplinary history and performance appraisals.

The company also said staff health information may have been accessed.

Our national technology reporter Danny Tran has more details:

Housing, food and transport most significant inflation contributors

By Kate Ainsworth

Let's take a deeper dive into what's actually behind February's inflation figure.

The ABS says the most significant contributors to the increase in prices included:

- Housing (up 9.9%)

- Food and non-alcoholic beverages (up 8%)

- Recreation and culture (up 6.4%)

- Transport (up 5.6%)

That said — the level of those increases are lower than they were in January.

On the housing front, the cost of building a new house is at its lowest level since last February, while rents increased by 4.8% over the past year — although they haven't increased from last month's reading.

Meanwhile electricity was up slightly to 17.2% over the past year, a mild increase on the 16.8% figure seen last month.

As for increases to food prices, the ABS's head of price statistics Michelle Marquandt said dining out was the main driver.

"Meals out and takeaway food (+7.3%) was the main contributor to the annual increase, followed by food products not elsewhere classified (+11.8%), bread and cereal products (+12.5%), and dairy and related products (+14.3%)," she said.

One interesting thing is there's been a sharp fall when it comes to travel and accommodation, which comes under the "recreation" category.

That's dropped from 17.8% in January to 14.9% in February — half of what it was back in December 2022 when it was sitting at 29.3%.

The cause? The summer holidays coming to an end (and don't we miss them already).

Pilbara Minerals approves $560m lithium expansion in WA

By David Chau

Lithium miner Pilbara Minerals has approved a capital investment to increase production capacity at its flagship Pilgangoora lithium project in Western Australia.

The company said the investment in the Pilgan plant will help increase spodumene concentrate production by 47% (to 1 million dry metric tonnes per annum).

Pilbara expects full production and ramp-up at the project by the end of the September quarter of 2025, with an estimated capital expenditure of $560 million.

"This further increase in production capacity will cement Pilbara Minerals' position as a globally significant supplier of lithium materials products delivering into this rapidly growing market," said Pilbara's CEO Dale Henderson.

Shares of the miner jumped 3.8% to $3.99.

The Western Australian miner had last year secured $250 million long-term financing from Australia to support expansion at the Pilgangoora project, which sits on one of the world's largest lithium ore deposits, according to the company's website.

Economist says current cash rate not 'sustainable', cuts likely by end of the year

By Kate Ainsworth

Business reporter Alicia Barry has just asked senior economist Diana Mousina from AMP whether Australia will see higher interest rates for longer, on the back of other economic data, like the unemployment rate.

But Ms Mousina said she believes the current cash rate can't be sustained for the rest of the year.

"It depends on whether you think Australia can maintain its level of interest rates, so is the current level of 3.6% sustainable for households? We think the answer is no," she said.

"We don't think that the average household with a mortgage of $600,000 can continue to pay the levels, the monthly repayments at a 3.6% cash rate, we think that the more neutral level of the cash rate that won't put too much downside or upside pressure on the economy is between 2.5 to 3%.

"So ultimately we see the RBA actually cutting the cash rate at the end of this year by 25 basis points and early next year as well so taking the cash rate back to around 3.1% or so

"We just don't think the current level of the cash rate is sustainable for Australia at this current point in the cycle."

Watch: What falling inflation means for interest rates

By Kate Ainsworth

AMP senior economist Diana Mousina has canvassed some pretty big and important topics on the ABC's News Channel just now — including a deeper dive into what inflation looks like in Australia currently, and what it means for the Reserve Bank's cash rate decision next week.

Spoiler: Based on current data, she's of the belief we could be seeing interest rates being cut by the RBA by the end of the year.

You can watch her full chat with business reporter Alicia Barry below:

No further rate hikes likely as inflation eases, economist says

By Kate Ainsworth

AMP senior economist Diana Mousina has just told the ABC News Channel it is likely the RBA will pause interest rate hikes next week in light of today's inflation data.

"I think that the RBA is most likely to pause at next week's meeting however, there is still a chance of a rate hike," she said.

"Markets are already pricing it at a 3% chance of a rate hike which I think is too low.

"But ultimately we see the central bank remaining on hold and we do not think there will be any more rate hikes in this current cycle."

Market snapshot at 1:30pm AEDT

By David Chau

The Australian dollar fell slightly after the ABS revealed that consumer inflation fell to 6.8% in February (which was lower than market expectations).

The local share market has recovered, after starting its day in negative territory.

- All Ordinaries: +0.1% at 7,229 points

- ASX 200: +0.1% at 7,042

- Australian dollar: -0.2% to 66.95 US cents

-

Brent crude: +0.5% to $US79 / barrel

- Spot gold: -0.3% at $US1,968.67 / ounce

- Iron ore: +1.9% to $US122.85 / tonne

- Bitcoin: +0.2% at $US27,372

- Hang Seng: +2.2% at 20,215 points

- Shanghai Composite: -0.5% at 3,230

- Nikkei: +0.4% at 27,633

Inflation falls for the second month in a row

By Kate Ainsworth

The latest inflation figures have just been released by the Australian Bureau of Statistics, showing that inflation has dropped to 6.8% in February.

It's the second month in a row that the monthly Consumer Price Index, which is the official measure for inflation, has fallen, which eases pressure on the Reserve Bank to hike interest rates at its meeting next week.

The CPI shows annual inflation was 6.8% over the year to February, down from 7.4% in January and 8.4% in December last year.

Bank of England says it's on alert after banking sector turmoil

By David Chau

It was not just banking regulators in the United States that are being grilled by politicans, and trying to reassure markets about the stability of the financial sector.

A similar thing happened in Britan overnight.

Here's what happened, courtesy of Reuters:

Bank of England officials said it was on alert amid global turmoil in the banking sector but added that the UK was not experiencing stress linked to the demise of Silicon Valley Bank and Credit Suisse.

"We are in a period of very heightened, frankly, tension and alertness," BoE Governor Andrew Bailey told parliament's Treasury Committee in a question-and-answer session about the upheaval triggered by the recent banking failures.

"I don't think that any, and we've said this, that any of these features cause stress in the UK banking system," he said.

Mr Bailey said the recent swings in the share prices of some banks showed investors were testing the sector.

"I think there are moves in markets to, if you like, test out firms," he said.

The failure of SVB had been one of the swiftest he had ever seen, he added.

"The fastest passage from sort of health to death, really, since Barings actually."

He was referring to the failure of British investment bank Barings Plc in 1995.

The heightened concerns about the safety of banks globally have raised questions about how far authorities should go to shore up the sector if needed, particularly regional lenders in the United States.

US Treasury Secretary Janet Yellen told lawmakers last week that regulators and the Treasury were prepared to make comprehensive deposit guarantees at other banks, as they did at failed Silicon Valley Bank and Signature Bank.

Banking stocks drag ASX lower

By David Chau

The Australian share market has fallen slightly in morning trade, weighed down by losses in the healthcare and technology sectors.

The ASX 200 was down 0.3% to 7,014 points, by 10:30am AEDT.

Gold mining stocks were among the best performers, including Silver Lake Resources, Evolution Mining and Perseus Mining:

On the flip side, retail conglomerate Premier Investments, along with financial stocks like Bendigo and Adelaide Bank, Challenger, Bank of Queensland and NAB posted heavy losses.

Those banking stocks were among the biggest drags on the market as worries about US and European financial stability continued to weigh on investors:

Market snapshot at 10:25am AEDT

By David Chau

- All Ordinaries: -0.2% to 7,203 points

- ASX 200: -0.3% to 7,016

- Australian dollar: -0.1% to 67 US cents

- Dow Jones: -0.1% to 32,394 points

- S&P 500: -0.2% to 3,971

- Nasdaq: -0.5% to 11,716

- FTSE: +0.2% to 7,484 points

- EuroStoxx 600: -0.1% to 444 points

- Brent crude: +0.8% to $US78.71 / barrel

- Spot gold: flat at $US1,972.84 / ounce

- Iron ore: +1.9% to $US122.85 / tonne

- Bitcoin: +1% to $US27,297

ASIC investigating ASX for suspected breaches of law regarding CHESS replacement program

By David Chau

The corporate regulator is investigating whether ASX Ltd (the operator of the Australian stock exchange) has broken the law, in regards to ther termination of its blockchain-inspired CHESS replacement program.

CHESS stands for "Clearing House Electronic Subregister System".

In particular, the Australian Securities and Investments Commission (ASIC) is looking into whether ASX, its directors and officers have breached their obligations under the Corporations Act and ASIC Act between 28 October 2020 and 28 March 2022.

In November, ASX said it will write off up to $255 million in pre-tax costs to dump the CHESS replacement project, following significant problems with its rollout.

The project had been delayed five times and began seven years ago.

ASIC's probe relates to ASX's oversight of the program, and the statements and disclosures made by (or on behalf of) ASX on the status of the program.

ASX has responded by saying it "takes its obligations very seriously and will cooperate fully with ASIC".

For more background on ASX's decision to abandon its CHESS replacement program, this article (fron November) is a great place to start:

Does the Government's new climate policy mean it's the end of the road for coal and gas projects?

By David Chau

Concerns that the landmark climate policy to reduce emissions will deter energy investment, increase power prices and put a stop to future coal and gas projects are highly unlikely, industry experts say.

On Monday, the federal government announced it had negotiated a deal with the Greens on its safeguard mechanism, a key scheme to reduce Australia's carbon emissions by a legislated target of 43 per cent by 2030.

The Australian Petroleum Production and Exploration Association (APPEA) said it was concerned that the mechanism would deter future investment in the energy industry.

But energy analyst with the Grattan Institute, Tony Wood, said the change to the mechanism does not deter planned — or future — investment.

"Projects that actually have lower CO2 will be favoured over projects that have higher CO2, projects with high CO2 will have to offset their emissions," he said.

"That's a good thing, but it's not going to suddenly destroy a whole lot of gas projects."

For more detail, I highly recommend this article by my colleagues Kate Ainsworth and Rhiana Whitson:

FTX's Sam Bankman-Fried charged with bribing Chinese officials

By David Chau

FTX founder Sam Bankman-Fried has been charged with directing $US40 million ($59.6 million) in bribes to one or more Chinese officials to unfreeze assets relating to his cryptocurrency business in an indictment that was unsealed on Tuesday.

The charge of conspiracy to violate the anti-bribery provisions of the United States' Foreign Corrupt Practices Act raises to 13 the number of charges Bankman-Fried faces after he was arrested in the Bahamas in December and brought to the United States soon afterward.

FTX filed for bankruptcy on November 11 2022, when it ran out of money after the cryptocurrency equivalent of a bank run.

Bankman-Fried has remained free on a $US250 million ($374 million) personal recognisance bond that lets him stay with his parents in Palo Alto, California.

He has also pleaded not guilty to charges that he cheated investors out of billions of dollars before his business collapsed.

You can read more about this development here:

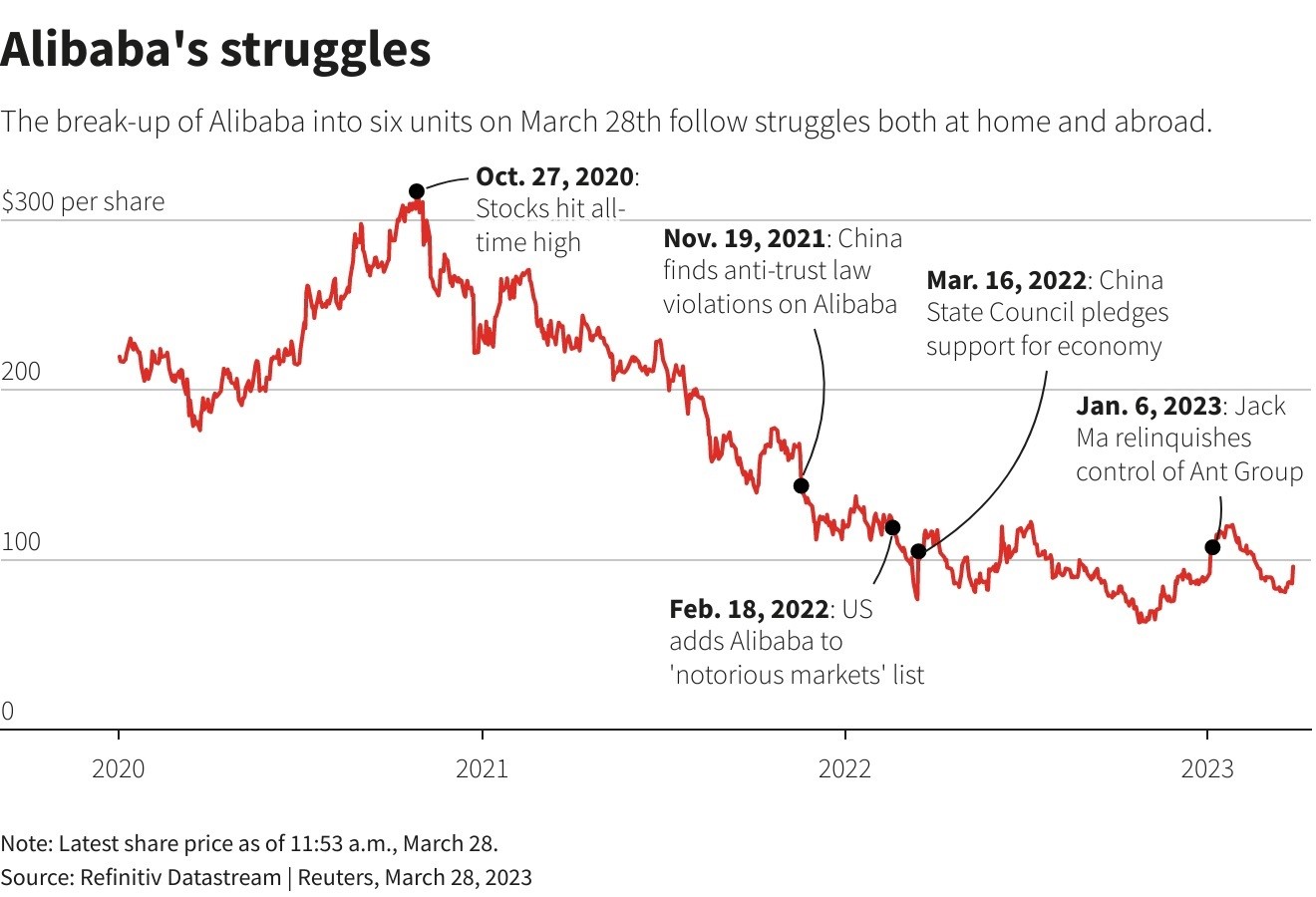

Alibaba to splits its empire as billionaire Jack Ma returns to China

By David Chau

The US-listed shares of Alibaba Group jumped 14.3% on Tuesday (local time) after the company announced plans to split its business into six divisions, covering online shopping, media and the cloud.

But that was after the Chinese e-commerce giant suffered a 70% plunge in its share price in the past couple of years.

Alibaba said the biggest restructuring in its 24-year history would see it split into six units - Cloud Intelligence Group, Taobao Tmall Commerce Group, Local Services Group, Cainiao Smart Logistics Group, Global Digital Commerce Group and Digital Media and Entertainment Group.

The revamp comes a day after Alibaba's billionaire founder Jack Ma returned home from a year-long stay abroad.

It's a move that coincided with Beijing's effort to spur growth in the private sector - following a two-year crackdown on the technology sector.

Analysts said the breakup could ease scrutiny over the tech giant whose sprawling business has been a target of regulators for years.

Each of the six businesses will have a CEO as well as a board of directors and will retain the flexibility to raise outside capital and seek an initial public offering.

The exception would be Taobao Tmall Commerce Group that handles China commerce businesses and will remain a wholly owned unit of Alibaba Group.

'Less hostility' towards tech giants

Investors said the split signals the clearing of regulatory worries and allays concerns that Alibaba had lost the potential to grow.

The decision could also be partly a fallout of the US scrutiny of Chinese tech firms that raised national security concerns over TikTok and its parent ByteDance, said Tara Hariharan, the head of global macro research at NWI Management.

"By paving the way for Alibaba's various new units to list, the Chinese government may be signalling less hostility towards its tech giants as a placatory message to US and international investors," she added.

The restructuring is among the biggest corporate moves by a major Chinese tech company in recent years, as the industry cowered under tighter regulatory oversight, causing deals to dry up and dampening risk appetite among businesses.

Lately, authorities have been softening their tone towards the private sector as leaders try to shore up an economy battered by three years of strict COVID-19 curbs.

Companies, however, have been hesitant, privately pointing to a lack of new supportive policies and the new regulatory framework.

Alibaba's shares had received a boost on Monday after its founder Jack Ma returned to China as his overseas stay was viewed by the industry as a reflection of the sober mood of its private businesses.

ABC/Reuters