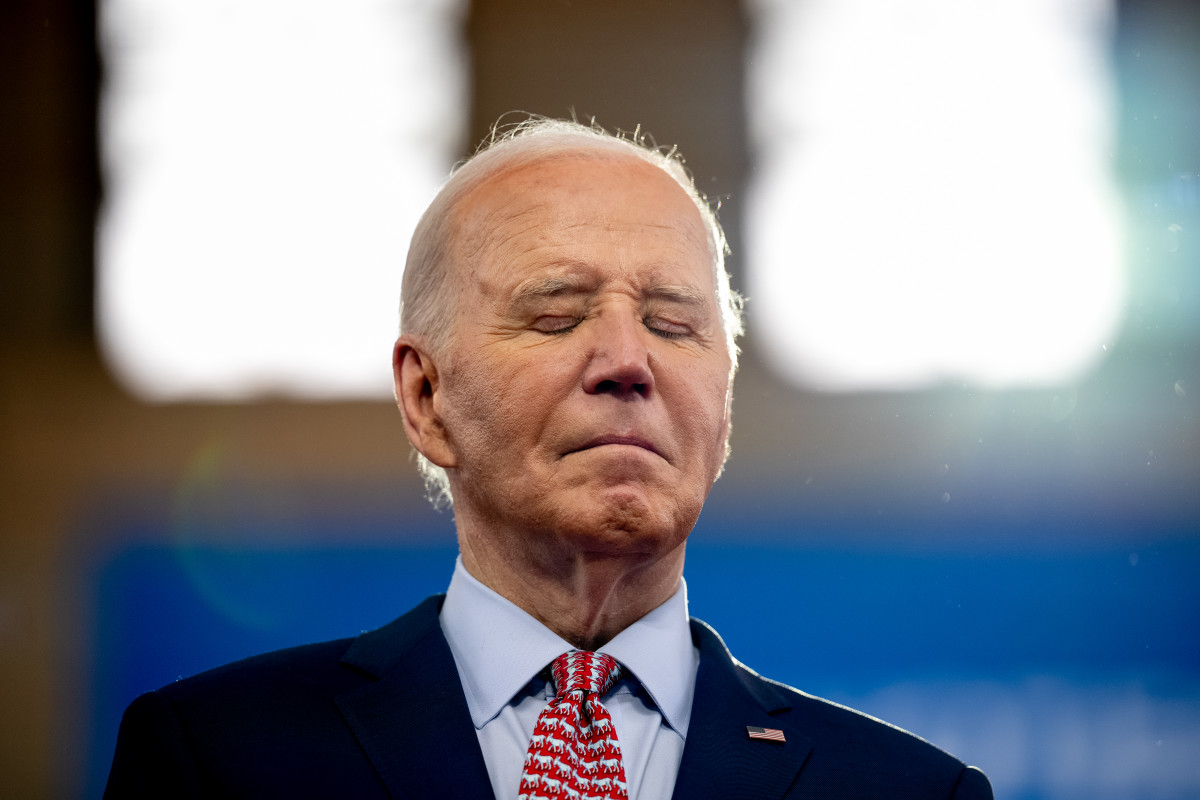

President Joe Biden has dropped out of this year's presidential election race, the White House said Sunday, and endorsed Vice President Kamala Harris to represent the Democratic party against Republican frontrunner Donald Trump.

"It has been the greatest honor of my life to serve as your President," Biden said in a message from his verified account on the X social media platform.

"And while it has been my intention to seek reelection, I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as President for the remainder of my term."

Biden, 81, has seen his campaign for reelection falter significantly over the past four weeks, with calls for him to step aside accelerating quickly after his disastrous performance in last month's debate against former President Trump.

Trump, 78, who was already leading in national polls, and holding modest gains in key swing states, saw his approval ratings and support surge last week following a failed assassination attempt during a campaign rally in Butler, Pennsylvania.

Biden, who had insisted he would stay in the race and beat his Republican rival, contracted Covid for a third time last week, as well, forcing his isolation at his beach home in Rehoboth, Delaware.

Senior figures in the party lined-up to endorse Harris for President, including former President Bill Clinton and his wife, former Secretary of State Hilary Clinton, who lost the 2016 election to Trump by the narrowed of margins.

Statement from President Clinton and Secretary Clinton pic.twitter.com/R7tYMFWbsu

— Bill Clinton (@BillClinton) July 21, 2024

“Harris will have a real chance to sell herself to the American public in the second presidential debate, currently scheduled for September 10, although the Trump campaign could withdraw, not wanting to go toe-to-toe with the ex-attorney,” said analysts at Capital Economics.

Republican House Speaker Mike Johnson, meanwhile, has called for Biden to immediately vacate the office of President, saying in a statement that "if he is not fit to run for President, he is not fit to serve as President".

Related: Stock sentiment resets after tech pullback

Biden's decision, says Gina Bolvin of Bolvin Wealth Management Group in Boston, could trigger "a whole new level of political uncertainty".

"This may be the catalyst for market volatility that is overdue," Bolvin said.

The CBOE Group's VIX index, the market's benchmark volatility gauge, was last marked 3.7% higher at $16.52 following news of Biden's withdraw, near to the highest levels in six months.

At $16.52, the VIX suggests traders expect the S&P 500 to have a daily swing of around 1.03%, or around 57 points, over the next 30 days.

"Some will interpret this as implying greater uncertainty on what can be said about policies after the November elections (though they differ on why}," said Mohamed El-Erian, chief economic adviser at Allianz SE and president of Queens' College, Cambridge.

"Some will see markets as having already priced in the news given the extent to which pressure had been building in the last couple of weeks and yet others will view this as constituting a short-term distraction for markets at best," he added.

"All this is to say that there is genuine uncertainty on how markets will – AND should – react to the news," El-Erian said.

Related: Stocks face summer slump as tech rally fades, political risks rise

U.S. stocks closed firmly lower Friday, extending Wall Street's recent selloff to a third consecutive session, amid rising geopolitical risks and the fallout from last week's global IT disruptions.

The S&P 500, which ended its worst week since March, fell 39.5 points, or 0.71%, while the Nasdaq ended 144 points lower, or 0.81%, to extend its five-day decline past 4%.

More Economic Analysis:

- June jobs report bolsters bets on an autumn Fed interest rate cut

- Biden debate flop boosts Trump, but economy may be tougher opponent

- First-half market gains come with a dash of investor unease

The Dow, meanwhile, fell another 377 points but managed to hold onto a weekly gain of 0.37% thanks in part to big shifts away from tech stocks to industrial and domestic focused companies prior to the mid-week slump.

Early indications from futures market trading suggest the S&P 500 will open 20 points higher Monday, with the Nasdaq gaining around 120 points. The Dow, meanwhile, is called 70 points to the upside.

This chart takes on a whole new meaning now.

— Ryan Detrick, CMT (@RyanDetrick) July 21, 2024

Stocks do well the second half of the year when a President is up for re-election.

Not so much if not. https://t.co/WwoY5frmbf pic.twitter.com/4kusuWtLZD

Markets will face a series of major tests this week, with earnings from Tesla (TSLA) , Google parent Alphabet (GOOGL) and Amazon (AMZN) as well a GDP and inflation data.

Biden's departure, meanwhile, will add another layer of complexity onto a market that now has to grapple with the prospect of Federal Reserve rate cuts, slowing economic growth and weakening corporate earnings.

Tech stocks are also on the ropes, hammered by reports of potential tariffs on China-bound goods and the ongoing rotation into domestic-focused companies that could benefit from Trump's promise of an 'America First' trade policy.

“Markets will be unlikely to reverse the recent rotation for now given the signal for rate cuts is unchanged and it is still Trump’s election to lose," said Lindsay James, investment strategist at Quilter Investors.

"However, this news brings uncertainty and potential instability which investors crave less than anything," James added. "This news does make a Trump sweep somewhat less of a foregone conclusion and as such we should expect some volatility over the next four months."

Related: Veteran fund manager sees world of pain coming for stocks