High-rolling investors have positioned themselves bullish on PepsiCo (NASDAQ:PEP), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PEP often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for PepsiCo. This is not a typical pattern.

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $38,850, and 7 calls, totaling $446,181.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $165.0 for PepsiCo over the last 3 months.

Analyzing Volume & Open Interest

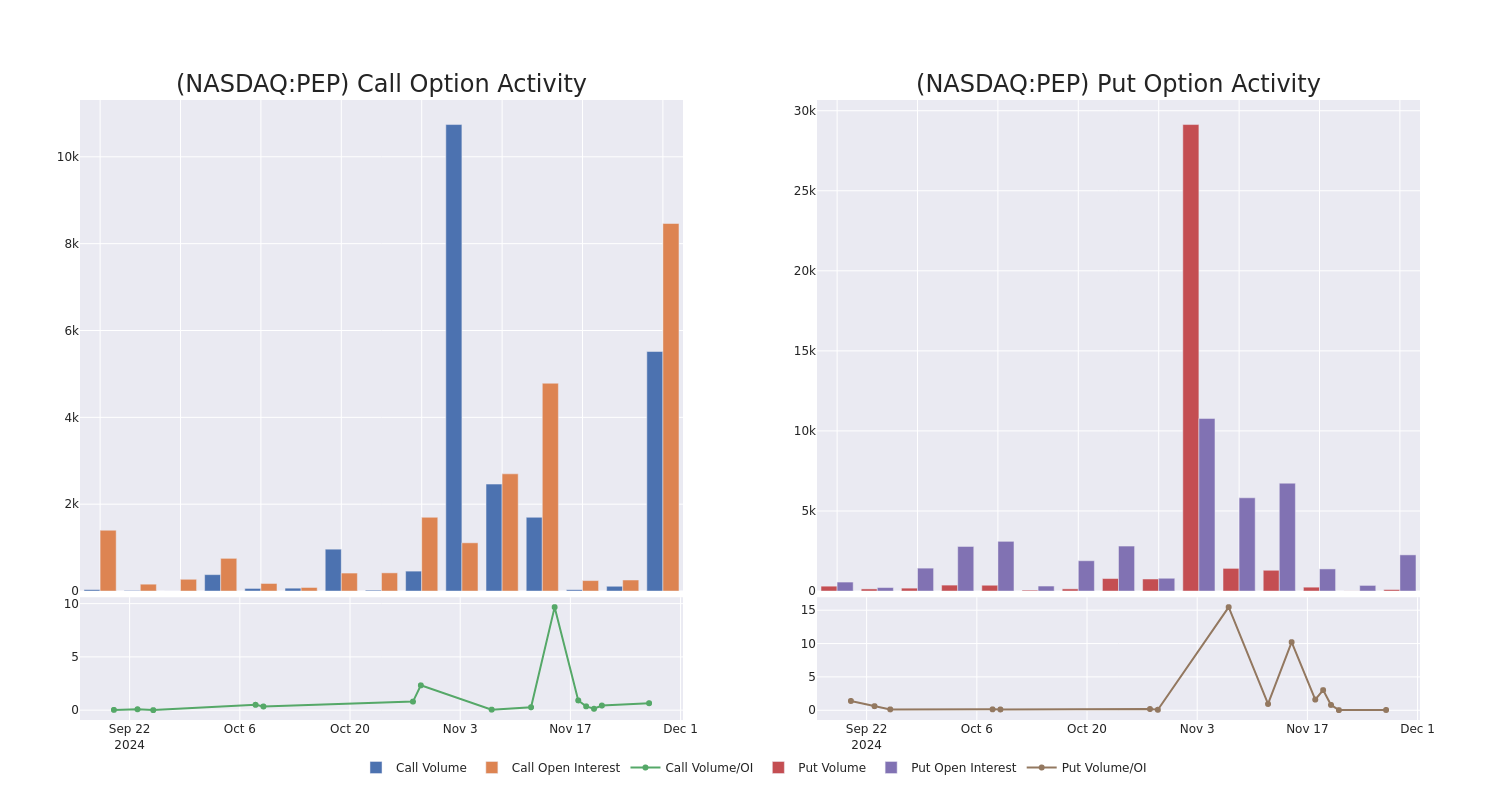

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PepsiCo's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PepsiCo's significant trades, within a strike price range of $150.0 to $165.0, over the past month.

PepsiCo Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PEP | CALL | SWEEP | BULLISH | 12/20/24 | $2.15 | $2.1 | $2.15 | $165.00 | $146.6K | 5.0K | 1.7K |

| PEP | CALL | SWEEP | BEARISH | 01/15/27 | $27.3 | $26.4 | $26.4 | $150.00 | $71.2K | 21 | 27 |

| PEP | CALL | SWEEP | BULLISH | 12/20/24 | $1.5 | $1.49 | $1.5 | $165.00 | $60.3K | 5.0K | 477 |

| PEP | CALL | SWEEP | BEARISH | 12/20/24 | $2.2 | $2.15 | $2.15 | $165.00 | $59.7K | 5.0K | 1.9K |

| PEP | CALL | SWEEP | BEARISH | 12/20/24 | $1.62 | $1.5 | $1.5 | $165.00 | $40.8K | 5.0K | 753 |

About PepsiCo

PepsiCo is a global leader in snacks and beverages, owning well-known household brands including Pepsi, Mountain Dew, Gatorade, Lay's, Cheetos, and Doritos, among others. The company dominates the global savory snacks market and also ranks as the second-largest beverage provider in the world (behind Coca-Cola) with diversified exposure to carbonated soft drinks, or CSD, as well as water, sports, and energy drink offerings. Convenience foods account for approximately 55% of its total revenue, with beverages making up the rest. Pepsi owns the bulk of its manufacturing and distribution capacity in the US and overseas. International markets make up 40% of total sales and one third of operating profits.

After a thorough review of the options trading surrounding PepsiCo, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of PepsiCo

- Trading volume stands at 1,819,910, with PEP's price up by 0.39%, positioned at $162.8.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 72 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PepsiCo with Benzinga Pro for real-time alerts.

.jpg?w=600)