Financial giants have made a conspicuous bullish move on Palo Alto Networks. Our analysis of options history for Palo Alto Networks (NASDAQ:PANW) revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $67,172, and 9 were calls, valued at $398,540.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $420.0 for Palo Alto Networks over the last 3 months.

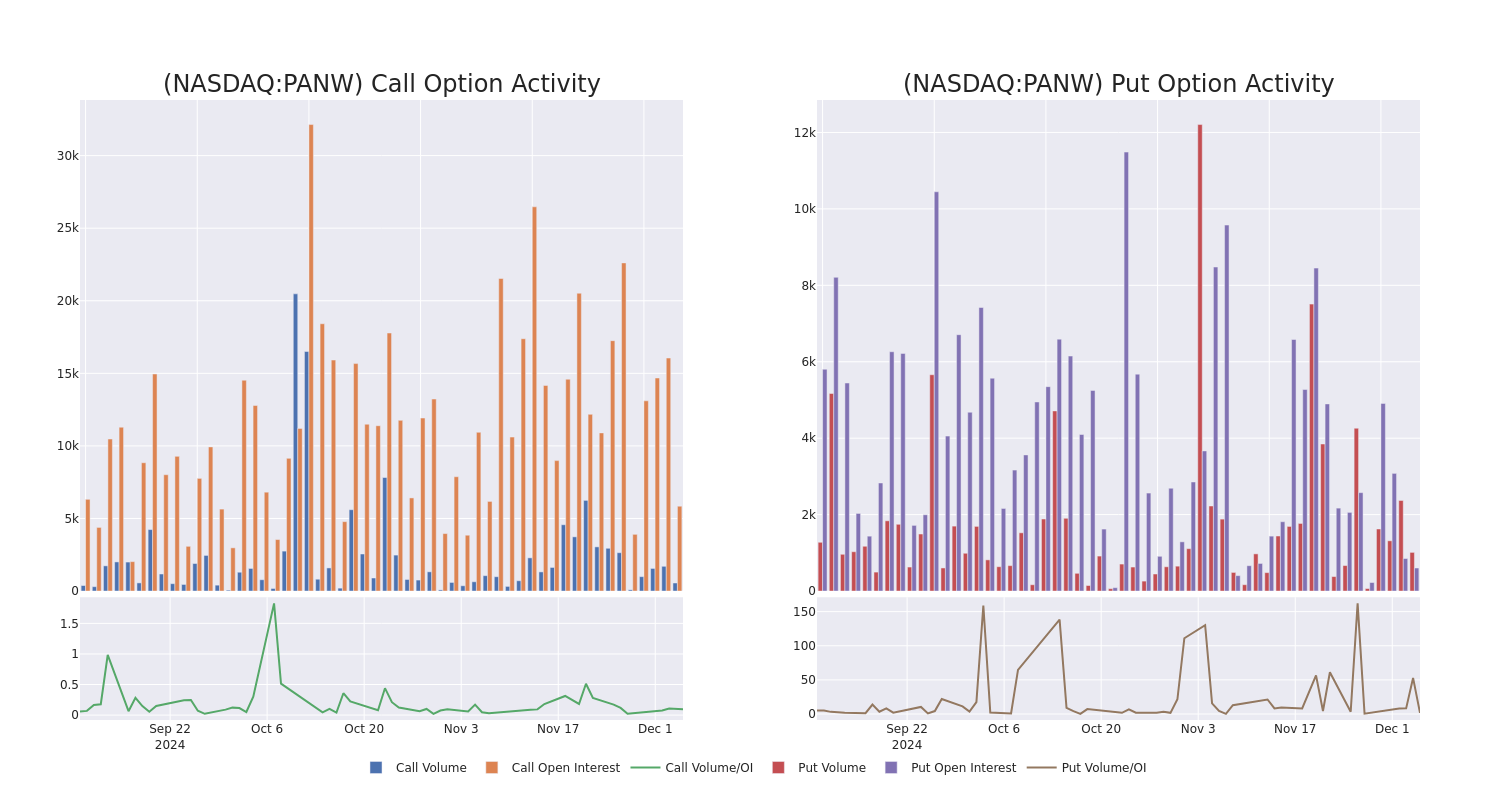

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale trades within a strike price range from $260.0 to $420.0 in the last 30 days.

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | TRADE | BEARISH | 01/17/25 | $19.9 | $18.95 | $19.25 | $400.00 | $105.8K | 3.5K | 135 |

| PANW | CALL | TRADE | BEARISH | 01/17/25 | $19.8 | $18.95 | $19.25 | $400.00 | $59.6K | 3.5K | 188 |

| PANW | CALL | TRADE | BULLISH | 12/18/26 | $95.15 | $91.55 | $94.0 | $420.00 | $47.0K | 56 | 8 |

| PANW | CALL | TRADE | BEARISH | 01/17/25 | $19.85 | $19.25 | $19.25 | $400.00 | $36.5K | 3.5K | 157 |

| PANW | CALL | TRADE | NEUTRAL | 01/17/25 | $26.3 | $22.3 | $24.0 | $390.00 | $36.0K | 1.6K | 17 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Having examined the options trading patterns of Palo Alto Networks, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Palo Alto Networks Standing Right Now?

- With a volume of 271,470, the price of PANW is up 0.57% at $406.87.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 75 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palo Alto Networks with Benzinga Pro for real-time alerts.