Investors with a lot of money to spend have taken a bullish stance on Carvana (NYSE:CVNA).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CVNA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 39 uncommon options trades for Carvana.

This isn't normal.

The overall sentiment of these big-money traders is split between 46% bullish and 41%, bearish.

Out of all of the special options we uncovered, 16 are puts, for a total amount of $1,271,005, and 23 are calls, for a total amount of $2,975,276.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $85.0 to $300.0 for Carvana over the last 3 months.

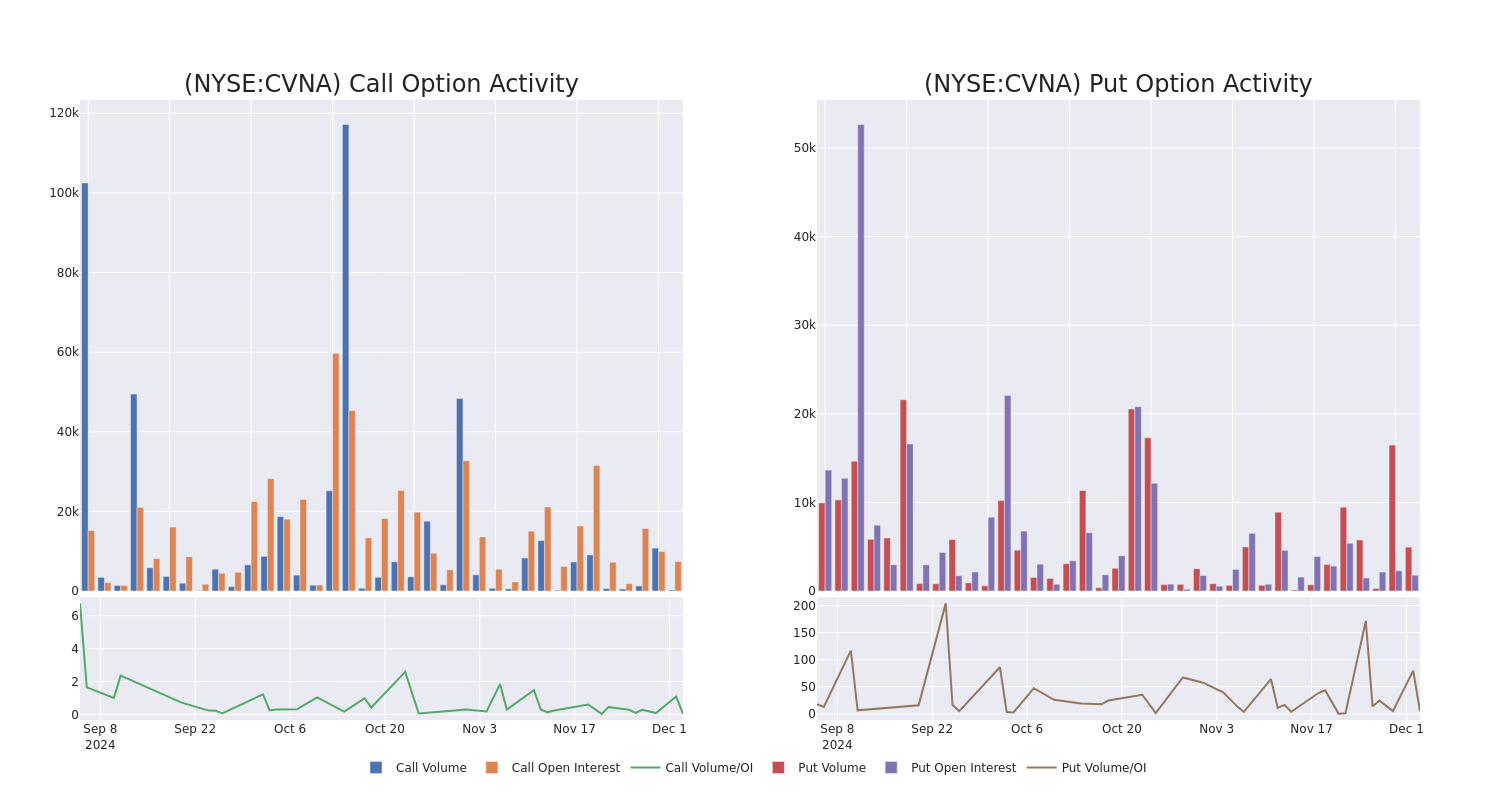

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Carvana options trades today is 399.52 with a total volume of 5,163.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carvana's big money trades within a strike price range of $85.0 to $300.0 over the last 30 days.

Carvana Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | TRADE | BEARISH | 01/17/25 | $171.15 | $168.65 | $169.6 | $85.00 | $848.0K | 1.4K | 50 |

| CVNA | CALL | SWEEP | BULLISH | 01/15/27 | $177.2 | $173.05 | $177.15 | $100.00 | $389.8K | 24 | 22 |

| CVNA | PUT | SWEEP | BEARISH | 02/21/25 | $23.95 | $23.2 | $23.95 | $250.00 | $289.7K | 1.0K | 221 |

| CVNA | CALL | SWEEP | BULLISH | 01/16/26 | $169.9 | $167.1 | $169.9 | $95.00 | $271.7K | 171 | 16 |

| CVNA | CALL | SWEEP | BULLISH | 01/15/27 | $142.05 | $138.05 | $142.05 | $160.00 | $240.8K | 8 | 17 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Following our analysis of the options activities associated with Carvana, we pivot to a closer look at the company's own performance.

Current Position of Carvana

- With a volume of 821,726, the price of CVNA is down -0.76% at $253.0.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 79 days.

Expert Opinions on Carvana

2 market experts have recently issued ratings for this stock, with a consensus target price of $252.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Morgan Stanley has elevated its stance to Equal-Weight, setting a new price target at $260. * Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Carvana with a target price of $245.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Carvana, Benzinga Pro gives you real-time options trades alerts.