For Mathieu Nouzareth, U.S. chief executive of the Sandbox, the past few weeks have been somewhat curious .

The Sandbox is developing a metaverse alternative to the one Meta Platforms is building, And Nouzareth is hearing everywhere that the metaverse is in trouble.

Yet he is hiring and continues to invest and grow his business.

His problem is that for Main Street, the metaverse is Mark Zuckerberg and his Meta/Facebook (META) social-media empire. Zuckerberg in October 2021 gave Facebook a new name, Meta, explaining that the metaverse was the next big thing.

A year later, Meta has lost $16 billion to this vision of an immersive 3D world in which we will interact via avatars, enabled by hardware like virtual-reality headsets and goggles.

Critics say that Horizon Worlds, Meta's metaverse, looks more like cartoons from a decade ago than a major technological innovation.

"I think he is probably impacting the whole metaverse industry even though we don't have a lot in common with their vision and what they're doing, not the same platform, not the same vision and values," Nouzareth says of Zuckerberg and Meta.

From Snow Crash to Meta

The metaverse is a digitized world. Avatars represent users, who can live many different experiences. They can play games, go to concerts and the beach, buy digital fashion goods, socialize, interact with others, and more.

The term "metaverse" was coined by Neal Stephenson in his book "Snow Crash," published in 1992. It's a virtual space that is the next stage in the evolution of the internet and is based on blockchain technology.

The theory is that the metaverse should be open and free from control of a centralized entity. This theory says further that Big Tech -- Meta Platforms, Alphabet (GOOGL), Apple (AAPL) and other major companies -- has taken over Stephenson's vision, wanting to keep control of information flows. This is why the metaverse is described as Web3, since Web2, the current internet, is dominated by Big Tech.

"The big difference" between Web2 and Web3 is that in the latter, "the digital ownership and everything you do as a user as a player or as a creator really belongs to you. We don't have a say in it," Nouzareth explains.

"So if you play inside the Sandbox, let's say you buy a digital handbag or you buy sneakers. This will belong to you forever, and you're free to do whatever you want with it. You can use them in other metaverses."

Goggles -- and Big Fees

Another of the big differences is the commissions to be charged creators. Meta's Horizon Worlds takes an overall cut of as much as 47.5% on the sale of digital assets.

"Our commission rate is only 5%," says Nouzareth. "We want to focus on fostering and really bring the best creators on the platform. So you'll have lots of different experiences. The digital worship is yours. You meet friends. And if you're a creator, you can make a living out of it."

In the metaverse of the Sandbox -- and in that of its key competitor, Decentraland, -- users do not need goggles or a virtual reality headset as they do in Meta's metaverse.

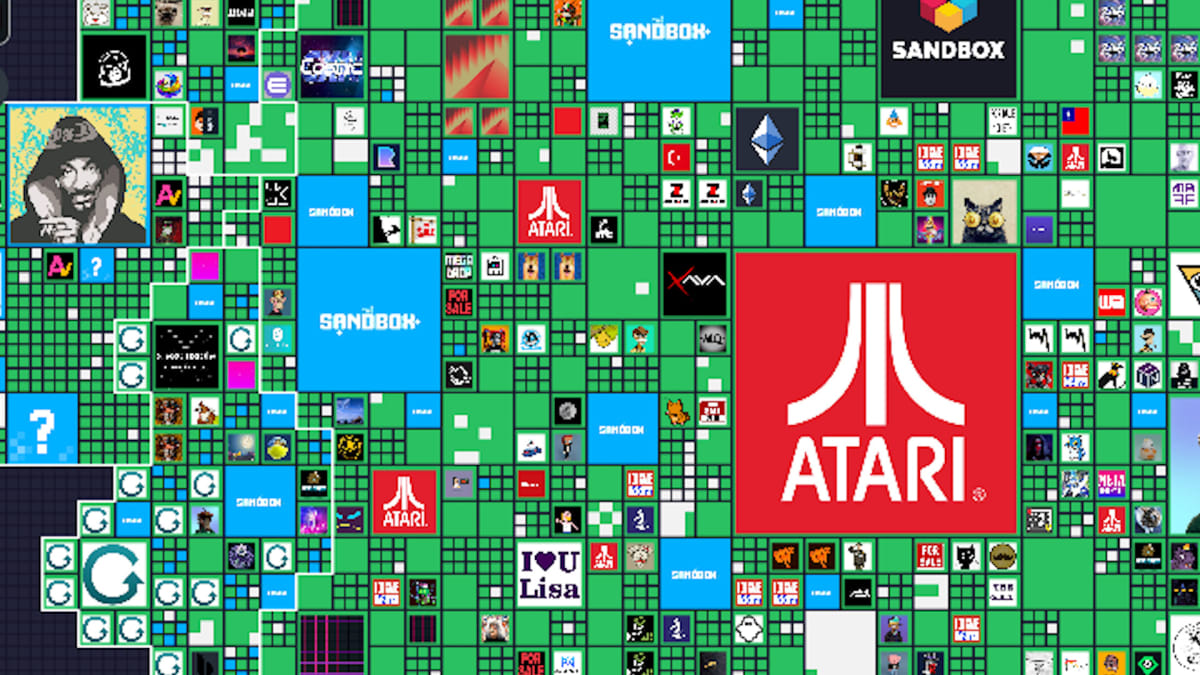

The Sandbox, owned by software and venture firm Animoca Brands, is a platform built on the ethereum blockchain that enables users to buy, sell, trade and own digital assets in a virtual world. They buy and sell assets -- plots of land, cars, art -- in the form of nonfungible tokens.

To buy things on the platform, players purchase and use Sand, the digital currency underlying the Sandbox platform.

Financial-services giants HSBC and JPMorgan Chase, the sports-equipment manufacturer Adidas, the luxury apparel-and-accessories brand Gucci and the consulting firm PWC are among Sandbox's user-partners.

Brands are looking to the metaverse for marketing opportunities.

$1B Valuation; Sandbox Still Might Raise Funds

The Sandbox is currently valued above $1 billion but it doesn't rule out raising more capital in coming months. The company raised $93 million last November.

Co-founded by Sebastien Borget and Arthur Madrid, the Sandbox continues to build out its metaverse, which is pixelated.

The platform, in the form of a pixelated game, is in its alpha stage, giving developers and users access so both can build and implement the game on the ground. The development continues through what the company calls seasons, offering developers and users rewards for hitting development milestones.

Season 3 has been available since August; it's open to all users for free. The results have been positive despite the ambient gloom in the crypto space.

Atari, the legendary gaming company, recently launched Atari Sunnyvale, a massive social and gaming experience, in the Sandbox. Some 17 of its games are available there.

"We can build out an ecosystem that's Atari, bringing all our partners" and providing "benefits, access and experiences, whether that's games or entry to other metaverses that we partner with," says Tyler Drewitz, director of Atari X. '"So everyone can benefit if you're a part of any part of the Atari ecosystem."

Still, amid the optimism of the Sandbox and its user-partners, the hype around the metaverse has sharply declined. The native tokens of the metaverse platforms have in turn lost a good portion of their value, along with the rest of the crypto market.

Sand, the token of the Sandbox, is down 91% from its Nov. 25 all-time high, according to CoinGecko. Its market value is currently at $1.2 billion.