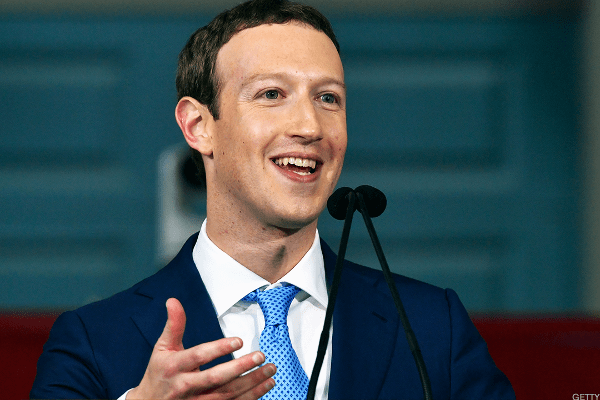

The years go by but are not the same for Mark Zuckerberg.

Last year, the one Elon Musk dubbed "Zuck the Fourteenth" in an apparent nod to the French king Louis the XIV, famous for his hubris and excess, was the villain of Silicon Valley.

Meta Platforms' shareholders were up in arms against him.

They did not understand why the Chief Executive Officer clung to the infamous metaverse, a virtual alternate world in which we would interact via avatars, using tech objects like headsets and goggles. The idea was to build virtual and augmented technology. The concept resonated hugely during the pandemic, as the whole world was on lockdown and people were looking for an escape.

For Zuckerberg, the metaverse was the new technological revolution, a kind of new frontier: In October 2021, Zuckerberg described a utopian future in which people would live immersive digital experiences and renamed Facebook Meta Platforms. The company is the parent of Facebook, Instagram and WhatsApp.

A Nightmare

The problem is that the reality on the ground was different from Zuckerberg’s dream. The metaverse was a sinkhole for Meta and gobbled up billions of investment dollars. The Reality Labs unit, home to the metaverse projects, lost $4.28 billion in the fourth quarter of 2022, bringing its total operating loss for the year to $13.72 billion.

Unhappy to see that Zuckerberg was deaf to their pleas to focus the company on its core business and forget the metaverse, investors began to sell off Meta shares. By the end of October, Meta’s stock had completely sunk. Meta’s shares, which started 2022 at $338.54, had plummeted to $93.16 as of Oct. 31, a drop of 72.5% in just 10 months.

The only thing that had allowed Zuckerberg to remain captain of the sinking ship was the fact that he has a majority of the voting rights, which protects him from being ousted as CEO. While the tech mogul had managed to survive, he had been very weakened by this stock market rout. At the end of May, Sheryl Sandberg, 52, Chief Operating Officer and right-hand person to Zuckerberg, stepped down.

Ms. Sandberg had joined Facebook in October 2008. She was credited with transforming the platform into an online advertising giant. Sandberg was indeed seen as the person who managed to help the firm of Menlo Park, California monetize its audience. She was viewed as a Silicon Valley heavyweight and one of the most powerful women in the business world, after having formed, with Zuckerberg, one of the most prominent duos in the tech world.

Zuckerberg had also seen his personal fortune plummet. His net worth had fallen by $87.3 billion as of Oct. 31, according to the Bloomberg Billionaires Index. The bulk of the fortune of the tech luminary is closely tied to the stock market performance of Meta Platforms. Zuckerberg owns between 13% and 16.8% of Meta.

The Resurgence

A few months later, luck smiled again on Zuckerberg. It all started with his decision to drastically reduce costs and to talk less about the metaverse, which no longer seems to be the group's priority. On Nov. 9, Meta announced 11,000 job cuts. Last month, the company announced the elimination of 10,000 additional jobs, bringing the total to 21,000 jobs eliminated in just five months.

He also stated that Meta (META) was entering an era of efficiency.

This new Zuckerberg appealed to investors who applauded. The Meta Platforms stock had closed at $96.47 on Nov. 8, the day before the announcement of the start of the austerity cure. On Apr. 3, the stock price was $213.07. Five months later, Meta ‘s stock price soared 121%. This year, the rebound is 77%, which translates into more than $240 billion in market value increase in just three months. Meta's market capitalization is currently $552.4 billion.

This stock market revival is also good news for Zuckerberg personally. Not only is his leadership no longer questioned, but his fortune has also gone up. Since the start of the year, he is worth $32.8 billion more, according to the Bloomberg Billionaires Index. He thus weighs $78.4 billion as of Apr. 3.

Zuckerberg is, after Elon Musk of Tesla (TSLA) and Bernard Arnault of LVMH, the billionaire whose net wealth has increased the most this year. He, who had disappeared from the top 20 of the biggest fortunes of the planet, is now 13th in this ranking. He is only $11 billion away from the top 10. At the rate of his rebound, he is more than likely to occupy again one of the top places in the ranking which is dominated by the tech barons.

The billionaire can thus say a big thank you to the cost reduction steps that he took.