Sazerac is one of the world’s leading beverage companies. It has operations across the United States, as well as the United Kingdom, Ireland, India, Canada, France and Australia.

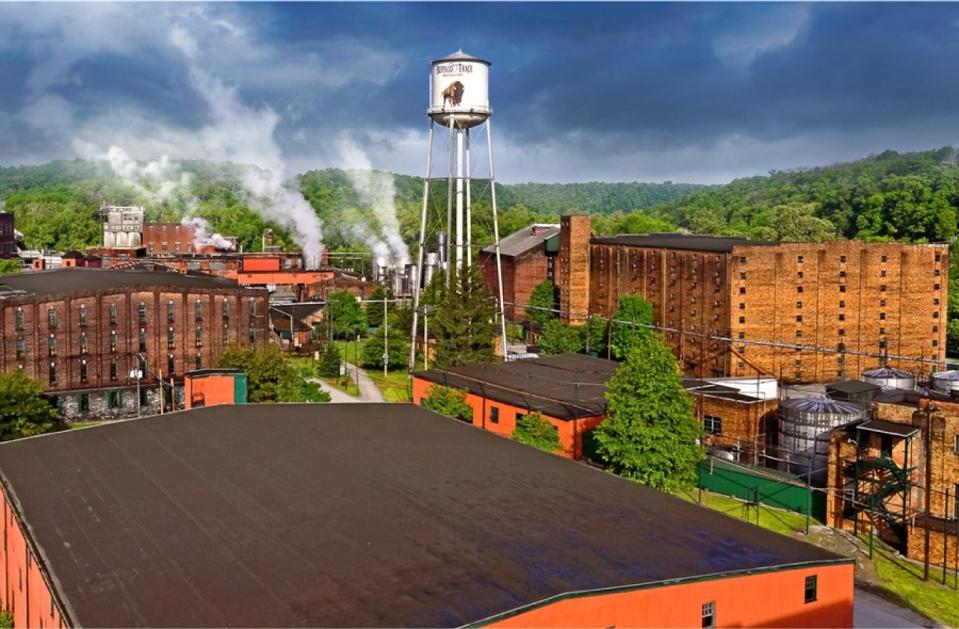

With over 450 different spirit brands in its portfolio, it has been one of the fastest growing spirit companies in America. It’s home to such iconic brands as Buffalo Trace, Eagle Rare, E.H. Taylor, and George T Stagg. Some of its brands, both owned or distributed, like W. L. Weller, Blanton’s and of course, Pappy Van Winkle, have become highly coveted by collectors and routinely sell for far above their list prices.

Recently, I sat down with Mark Brown, the President and CEO of Sazerac Company, to talk about the future of Sazerac and its spirits business.

Brown started in the beverage alcohol business in 1971, working in his family’s pub business in the U.K. In 1976, he joined British cider-maker H.P. Bulmer as a salesperson and, by 1978, was Sales Trainer. He came to the United States in 1980, operating as the US Field Sales Manager for Bulmer.

From 1981 to 1992, he served as Director of New Products, National Sales Manager and, eventually, Vice President of Sales and Marketing with Sazerac.

Brown left Sazerac and joined Brown-Forman (no relation) as Senior Vice President and COO of the Select Brands Group for two years. He then spent the next three years as President of the Advancing Markets Group, before returning to Sazerac in June 1997, in his current role.

JM: Sazerac has been steadily expanding around the world, with acquisitions from London to Goa. What’s the rationale behind these acquisitions? Are you looking to strengthen your road to market in overseas territories or is there another objective?

MB: We have been expanding but it is simply part of our long-stated goal to become a leading global spirits company.

JM: Several years ago, Sazerac acquired The Last Drop Distillers, a bottler of rare spirits. This is a small company. Its revenues would hardly register in Sazerac’s sales total. What does a company like The Last Drop bring to Sazerac?

MB: Last Drop is a unique concept and a beautiful luxury brand. Given our presence in so many spirit categories and our stocks of very old spirits we feel that the brand is a perfect fit for our portfolio.

JM: Sazerac has more than 450 brands, but the overwhelming majority of those brands are brown spirits and most of those are American whiskey brands. You already cover the major white spirits categories. Are you looking to add more white spirits to your portfolio? Any particular categories that look attractive?

MB: We are very pleased with the diversity of our present portfolio, which has been nicely rounded out in brandy with the recent addition of Paul Masson. We continue to be open minded and interested in further additions to the portfolio via new business development or acquisitions.

JM: It’s been suggested that there may be a broad multi-generational cycle in the spirits industry that drives the rotation in demand between brown and white spirits as successive generations look to drink something different than what their parents and grandparents drank. Do you think this is true? How would Sazerac deal with a shift in consumer demand from brown spirits to white ones?

MB: It is true that spirit categories are cyclical to some degree or other, recent examples being gin in the U.K. and bourbon in the United States. We do not believe that it is necessarily generational, the collapse and resurgence of bourbon in United States had more to do with being in step with consumer needs.

It is clear, with the benefit of hindsight, that bourbon lost touch with its consumer audience during the 70s. With that said, individual brands can still prosper in a declining category. Both Jack Daniels and Jim Beam enjoyed growth all through the 70s.

JM: Millennials appear to be looking for new and innovative flavors in their whiskey. Flavored whiskeys have been the fastest growing segment of the American whiskey market, up six-fold over the last decade. Sazerac has several flavored whiskeys, including Fireball, the category leader. Any plans to expand your offerings in this category? What are your expectations for the growth of the flavored whiskey category? Has it peaked or is there still substantial growth ahead?

MB: It has been very exciting to see consumer demand evolve over the past 40 years in so many different areas of beverage alcohol. We believe that we are in a long-term growth period for flavors and consumer demand across all demographics for flavor is strong.

Concurrently, flavor technology has allowed us to meet this demand delivering exciting and interesting products. Much of what you see today would not have been technically possible 40 years ago. We plan to continue to innovate in this area delivering new and exciting products.

JM: The expansion of craft distillers has brought a wave of innovation to the spirits industry. What do you think craft distillers can teach the larger spirits companies?

MB: The last decade provides a great deal of comfort that we have a vibrant and competitive industry in which entrepreneurs can be very successful, Tito’s being a great example. A vibrant and competitive industry promotes a great deal of innovation and allows all industry members to learn from each other, this is exactly what we have seen in the past decade.

JM: Several of the bigger spirits companies, Diageo, Pernod Ricard, have started internal venture capital funds to invest in promising startups among craft distillers. Is Sazerac doing anything similar? If not, any plans to start doing so?

MB: Yes, we started back in 2002 investing in promising developmental projects and have six underwing today. We have been very pleased with the results to date. It is very rewarding to see entrepreneurship be successful and rewarded.

JM: Thank you.