Whales with a lot of money to spend have taken a noticeably bullish stance on MARA Holdings.

Looking at options history for MARA Holdings (NASDAQ:MARA) we detected 29 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 27% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $204,600 and 26, calls, for a total amount of $1,438,842.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.5 to $47.0 for MARA Holdings over the last 3 months.

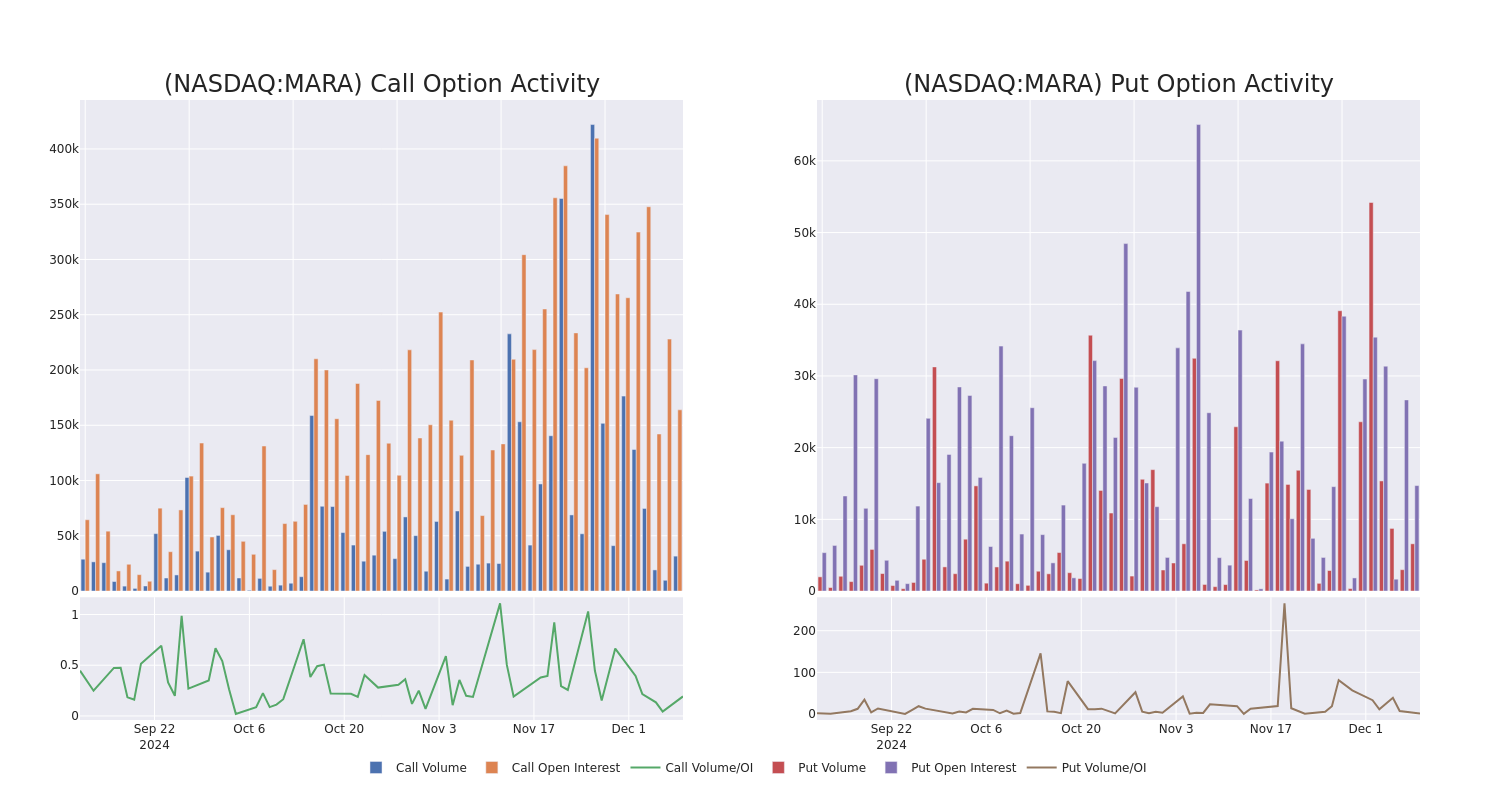

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MARA Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MARA Holdings's substantial trades, within a strike price spectrum from $3.5 to $47.0 over the preceding 30 days.

MARA Holdings Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MARA | CALL | SWEEP | BEARISH | 03/21/25 | $9.65 | $9.6 | $9.6 | $20.00 | $192.0K | 9.3K | 416 |

| MARA | CALL | TRADE | BULLISH | 03/21/25 | $9.8 | $9.75 | $9.8 | $20.00 | $184.2K | 9.3K | 826 |

| MARA | PUT | TRADE | BEARISH | 12/20/24 | $1.26 | $1.25 | $1.26 | $23.00 | $126.0K | 4.6K | 1.4K |

| MARA | CALL | SWEEP | BULLISH | 06/20/25 | $7.75 | $7.6 | $7.75 | $30.00 | $108.5K | 6.9K | 477 |

| MARA | CALL | SWEEP | BULLISH | 01/17/25 | $7.1 | $7.0 | $7.1 | $19.00 | $85.2K | 4.8K | 269 |

About MARA Holdings

MARA Holdings Inc leverages digital asset compute to support the energy transformation. It secures the blockchain ledger and supports the energy transformation by converting clean, stranded, or underutilized energy into economic value.

In light of the recent options history for MARA Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

MARA Holdings's Current Market Status

- With a trading volume of 38,786,598, the price of MARA is down by -7.35%, reaching $24.49.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 79 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MARA Holdings with Benzinga Pro for real-time alerts.