Rents across the UK have reached record highs as the shortage of rental properties continues, new data has found.

According to property website Rightmove, average asking rents outside London have reached £1,190 per calendar month, a figure which has risen for thirteen consecutive quarters. Meanwhile, average asking rents in the capital have surpassed £2,500 for the first time, reaching a record-breaking £2,501 per calendar month.

Rightmove identified High Wycombe in Buckinghamshire as having the largest annual change with a whopping 22.4% increase. Here, the average monthly rent is now £1,311, compared to £1,071 one year prior.

In Scotland, rents in the first quarter of 2023 – the period between 1 January and 31 March – rested at £957 pcm, marking an annual change of 12.3%. The North East, North West and Yorkshire and the Humber reported averages of £803, £1,025 and £940 pcm respectively, with year-over-year changes of 9.7%, 9.3% and 10.8%.

Wales experienced a slightly larger annual change of 11.9%, with average rents reaching £987 pcm. In the West Midlands, this figure was £1,052 pcm, an increase of 9.2%.

However, the pace of asking rent growth is slowing nationally, and has now eased for three quarters in a row. In London specifically, there are signs that the speed of rent increases is slowing down as this quarter’s rise marks the smallest in two years, at 0.9%.

Rightmove’s Director of Property Science Tim Bannister said: “We have seen some early signs of improvement on squeezed supply levels this year, though with no significant influx of new properties becoming available to rent currently on the horizon, the mismatch is set to continue for some time.

“Many agents are having to manage a very high volume of tenant enquiries for every property that they let in the current market. Properties in popular areas within an affordable asking rent range of that local area are likely to be snapped up almost immediately, and on average homes are finding a tenant much more quickly than this time in 2019.

“Although there are some early signs that the gap between supply and demand is starting to narrow a little, it will still feel very competitive for tenants trying to secure a home.”

As a result, many tenants are choosing to stay in their current homes for fear of rent increases. “The rental market remains very busy, with multiple applicants competing over a shortage of property to let”, Craig Webster, Managing Director of Tiger Sales & Lettings in Blackpool, said. “We’re seeing more tenants staying put in their current home, which is having a knock-on effect for the rest of the market and contributing to the shortage.”

“We are also seeing some of our landlords decide to sell up for a variety of reasons – more legislation to navigate, higher mortgage costs, or because they can now get a good price for their home”, Mr Webster added.

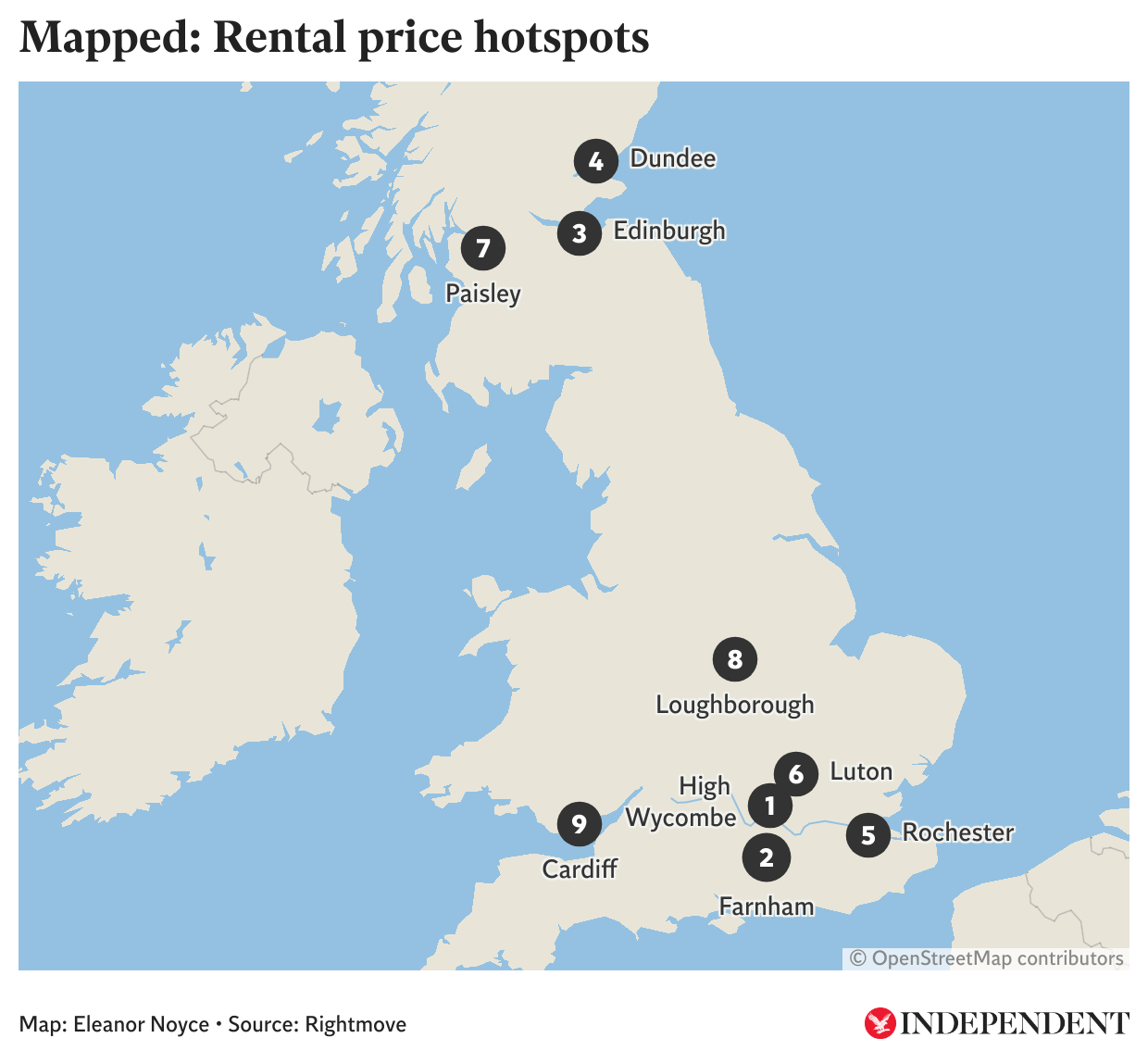

Rental price hotspots:

1. High Wycombe, Buckinghamshire: +22.4% annual change

2. Farnham, Surrey: +21.9%

3. Edinburgh: +20%

4. Dundee: +18.8%

5. Rochester, Kent: +18.7%

6. Luton, Bedfordshire: +17.4%

7. Paisley, Renfrewshire: +17.3%

8. Loughborough, Leicestershire: +17.1%

9. Cardiff: +16.6%

10. Slough, Berkshire: +16.5%

Average rental price by area:

Scotland - £957pcm

North East - £803

Yorkshire & Humber - £940

North West - £1,025

East Midlands - £1,048

West Midlands - £1,052

East of England - £1,446

Wales - £987

London - £2,501

South West - £1,293

South East - £1,676.