Renters pay more than first time buyers in almost every corner of the United Kingdom – though new data shows the gap has narrowed greatly in the era of rising interest rates.

The cost of a mortgage on a first home is typically around £42 per month cheaper than renting, but the difference has reduced and in some parts of the UK renting may be the less expensive option, analysis suggests.

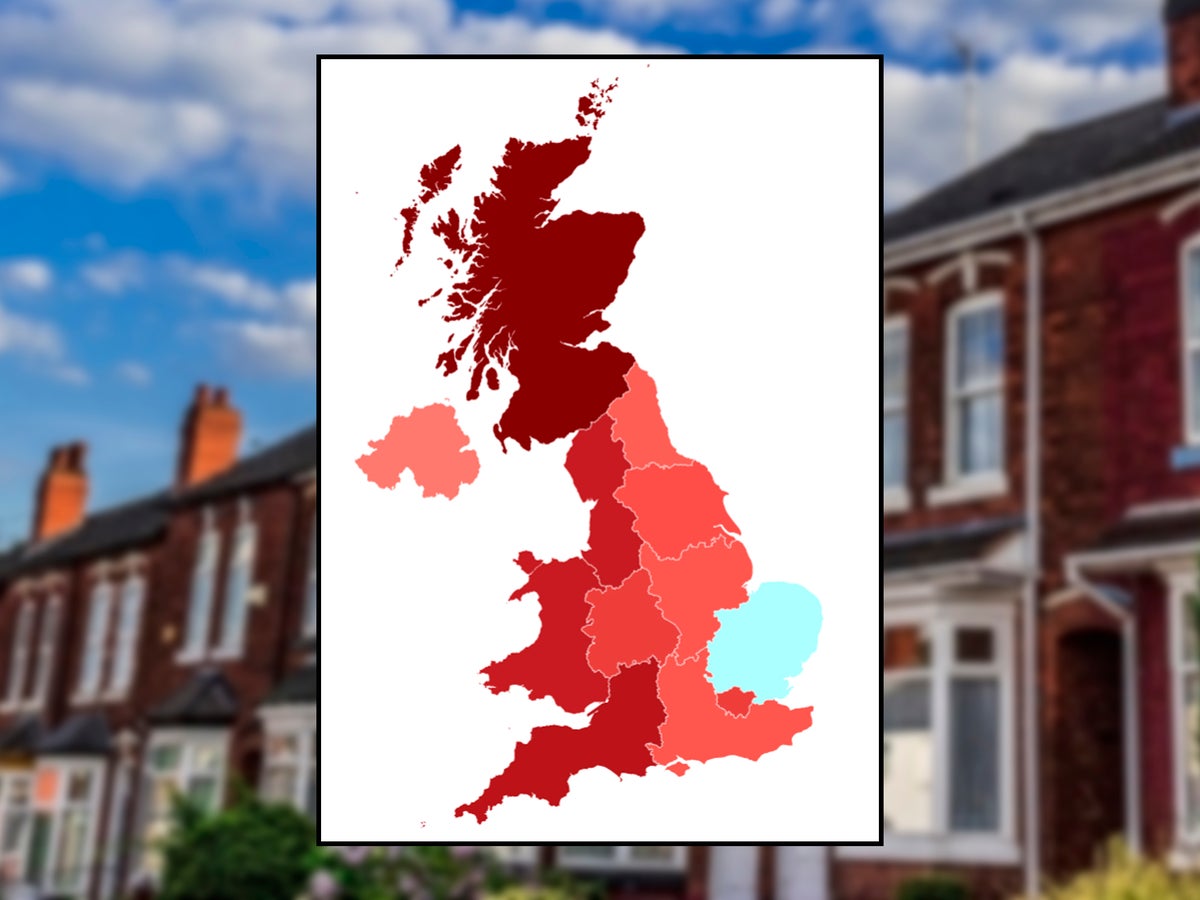

Differences varied across the country, with Scottish renters getting the worst deal, while homeowners in the East of England have reason to be jealous of their northern counterparts.

On the whole, first-time buyers could typically pay around £971 per month for a three-bedroom home, while renters would potentially be forking out around £1,013, according to calculations by Halifax.

The difference works out at around £500 per year, down from a peak reached in 2016, when owners saved £1,567 annually.

Just 2 years ago in 2021, buying a home was found to be around £1,300 per year cheaper than renting, according to Halifax.

Towards the end 2021, the Bank of England set on its ongoing path of rising interest rates after the historic 0.1 per cent low of the pandemic era. The Covid drop followed more than a decade of extremely low rates after the 2008 financial crash.

Halifax based its calculations in mortgage payments, household maintenance, repairs, minor alterations and insurance costs for home-owners. The bank used its own house price data, mortgage figures from UK Finance, as well as data from the Bank of England and the Office for National Statistics.

The UK’s biggest gap between owners and renters, in percentage terms, was in Scotland, Halifax said. Those renting in Scotland faced paying an average £918 per month, compared with £727 for home-owners – a saving of 21 per cent for those on the property ladder.

In cash terms, those who had managed to get on the property ladder in London were nearly £3,000 a year better off than renters, according to the research.

The East of England was found to be the only region where it was typically more expensive to buy a first home than rent one.

Kim Kinnaird, mortgages director, Halifax, said: “While a predicted fall in house prices this year will be welcome news for those looking to buy their first home, it doesn’t change the fact that getting on the property ladder remains expensive – a problem that is compounded when rents are high, impacting the ability to save.”

List belows average monthly rent, followed by average monthly mortgage payments and the difference in price:

- Scotland, £727, £918, 21%

- South West, £1,029, £1,237, 17%

- North West, £778, £922, 16%

- Wales, £735, £872, 16%

- London, £1,828, £2,074, 12%

- West Midlands, £839, £951, 12%

- Yorkshire and the Humber, £720, £802, 10%

- South East, £1,345, £1,474, 9%

- East Midlands, £843, £931, 9%

- North East, £628, £685, 8%

- Northern Ireland, £596, £620, 4%

- East of England, £1,212, £1,122, minus 8%

- UK, £971, £1,013, 4%