After several years of stellar sales growth, demand for alternative meats appears to be plummeting. Big-name brands Beyond Meat and Quorn have been struggling, and some smaller producers have closed down.

Vegetarianism, and even more so veganism, were supposedly gaining in popularity. So have plant-based diets become another fad, destined to fade away like yoyos and bellbottom jeans? Probably not.

A better way of understanding the stall in sales of alternative meats is to think of it not as food but as a new technology. This is helpful because it is widely understood that new technologies don’t diffuse through markets in a simple way.

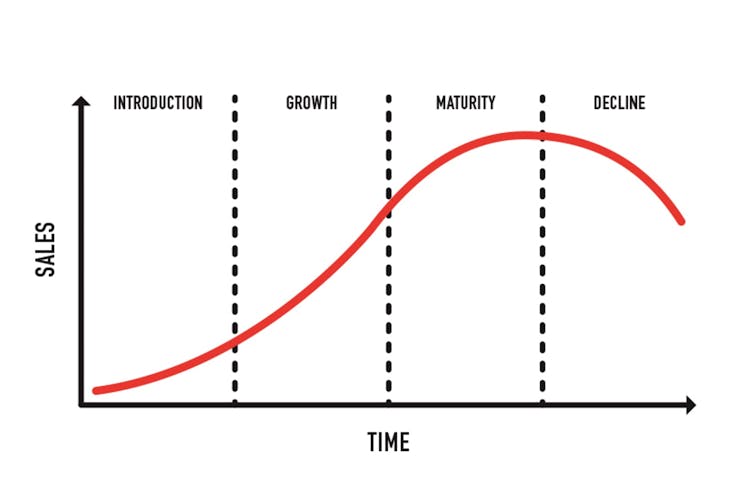

Most new goods follow a conventional product life cycle, where sales grow slowly among the early adopters at first, before increasing more quickly as the product is picked up by later-adopting consumers. But then sales growth begins to slow down again.

What researchers have recognised about new technology products, however, is that instead of following normal product life cycles, sales growth pauses for a while after early adopters have rushed to the shops, and sometimes even declines. It then picks up again as other consumers catch up, and returns to a normal, rapid growth.

This pause or slight decline in sales growth means the product life cycle for new technologies doesn’t follow a graceful “S-curve” as seen above, but has an inelegant hump known as a “saddle”.

Technology adoption life cycle theory provides the explanation for this saddle occurring in some markets, but not in others. This theory recognises that consumer heterogeneity (that is, how different consumers are within a particular market) is much greater in some markets.

The key differences in technology markets can be characterised as being between the early adopters, who are enthusiastic and well informed about the technology, and the rest of the market, who don’t know much about it. This gap in information between market segments causes the normal pattern of diffusion to break down.

Initially, sales accelerate as the new product is launched and is well received by early adopters, who understand what if offers. But then sales stall while the majority of consumers just don’t get it, nor understand the enthusiasm of its admirers.

This classic description of new technology also describes the stilted diffusion of alternative meats – which, for most people, are an entirely new food category.

The right theory leads to the right solution

In the case of new technologies, where there is a gap in understanding between different consumer segments about complex new products, there are some obvious solutions for firms. To attract consumers who are not well-informed early adopters, they can offer them more information, pre-sales demonstrations, after-sales service, money-back guarantees or simpler standards.

But with alternative meats, the gap between early adopters and majority market consumers is not just about different levels of understanding. It is also about different beliefs about what it is right to eat.

Vegetarians and omnivores have different opinions about food. For alternative meat producers wanting to break out of the vegetarian-vegan niche and capture new markets, they must understand the drivers and barriers of non-vegetarian culture.

There are several market surveys that ask consumers about their attitudes to alternative meats. These tell us what ordinary consumers said would make them eat more of them.

Unfortunately, they cannot be taken too literally, because we know that market research for entirely new product categories is unreliable. As Apple co-founder Steve Jobs said: “A lot of times, people don’t know what they want until you show it to them.”

So, where does this leave us? Alternative meats are perhaps best understood as behaving more like new technology, rather than a new food product, because they represent something so completely different in most consumers’ eyes to traditional meat.

This makes it easier to understand that the current slowdown in sales growth is really a consequence of big differences between the consumer segments of this market. What worked for the early adopters of plant-based products is not yet resonating with the majority of consumers.

Fortunately for the brands, there is growing awareness in the industry that the usual marketing methods are in need of a reconfiguration. An innovative example is the UK-based Plant Futures Collective, which is facilitating the development of an industry-wide marketing strategy to promote trust in this product category, and close the consumer information gap. Part of its strategy involves building upon the Meat Free Monday campaign launched by Paul McCartney and his daughters, Mary and Stella.

Those producers wanting to break out of their vegetarian-vegan niche will have to start thinking more about what meat-eaters want than what vegans are looking for. Does the current slowdown in sales spell the end of veganism? Obviously not. But it does mean that continued growth in sales will depend on vegan brands being able to think like omnivores.

Andrew Godley is affiliated with Plant Futures Collective, https://www.plant-futures.com/

Marlana Malerich is an advisor for the Freedom Food Alliance and Rooted Research Collective

This article was originally published on The Conversation. Read the original article.