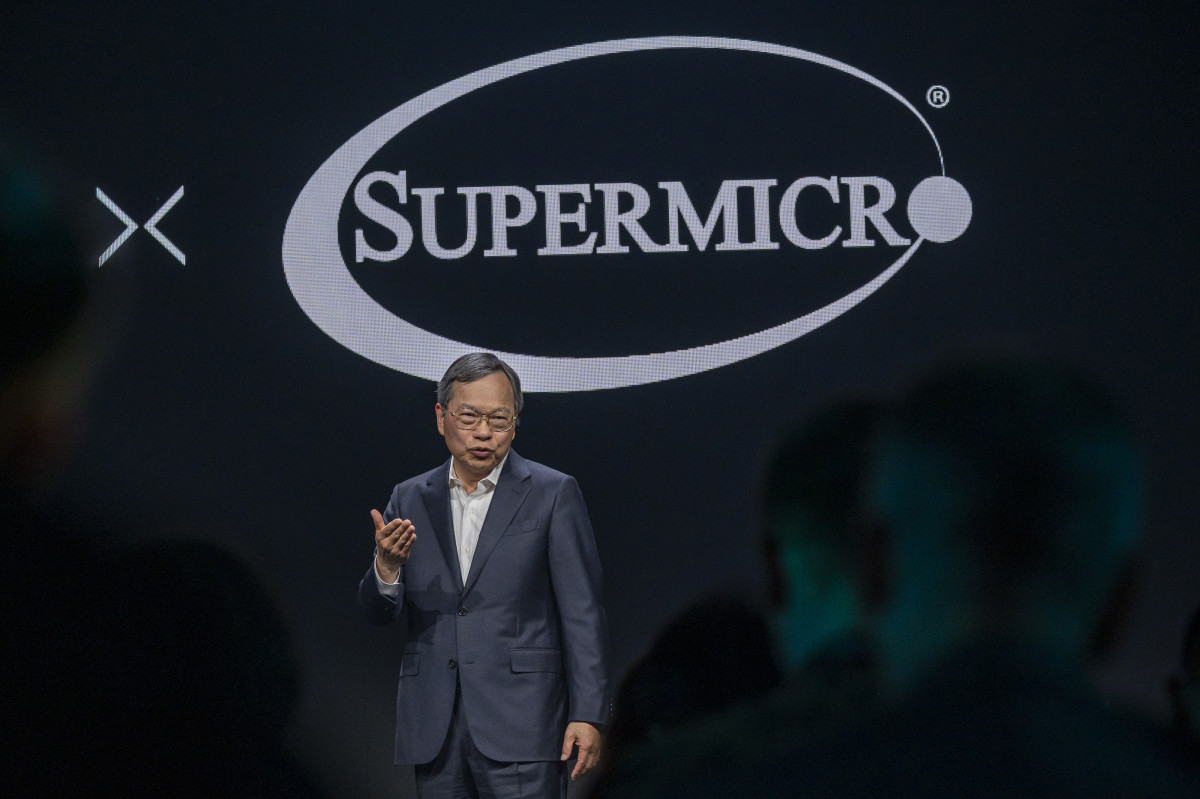

It was an important day for Charles Liang.

The CEO of Super Micro Computer (SMCI) appeared on CNBC's "Mad Money" on July 15 following news that the company, which specializes in high-end servers, would be joining the Nasdaq 100 in a week's time.

Related: Short-seller blasts Super Micro stock in latest report

"It's a great honor," he told Jim Cramer, the show's host. "We’re really excited to be one of the Nasdaq 100 companies."

"I think it's important for people to understand the growth you have is so great that you sometimes have to outstrip necessarily your profits in order to keep growing," Cramer said, "something that I totally support because most companies don't have growth like you."

The growth was indeed impressive. Super Micro shares more than tripled (up 264%) in the first quarter alone and are nearly 76% higher than they were a year ago.

But then things started to unravel for the San Jose, Calif., company.

The company’s fourth-quarter report earlier this month revealed some weakness in Super Micro’s profit story. Profit margins were squeezed due to supply-chain constraints linked to its liquid cooling technology and to increasing competition from rivals such as Dell Technologies (DELL) and HP Enterprise (HPE) .

Related: Apple stock forecasted as top AI pick before crucial rollout

Then short-seller Hindenburg Research released a scathing report on Super Micro, claiming that it had found "glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues."

Analyst slashes Super Micro price target

One day after the Hindenburg report was released, Super Micro said that it would not file its annual report on SEC Form 10-K for the fiscal year ended June 30 on time and expected to file a late filing notification.

"SMCI is unable to file its Annual Report within the prescribed time period without unreasonable effort or expense," the company said in an Aug. 28 statement. "Additional time is needed for SMCI's management to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting as of June 30, 2024."

Related: Analysts overhaul Super Micro stock price targets after Q4 earnings

Super Micro did not immediately respond to a request for comment.

"When something like this happens, a lot of institutional owners cannot own it," said TheStreet Pro's Doug Kass. "Then, after reading the short report on it from Hindenburg Research, a lot of institutional owners shouldn’t want to own it. The company is not nearly as sexy as it sounds."

Super Micro shares were up 1.2% to $448.21 at last check.

Kass said, "it is a commodity, white-box server manufacturer still trading at a massive valuation."

"But digging into it, and granted I might not have this exactly right, if you add up all the ETFs alone, it looks like 80% of the stock is owned by retail," he said. "Then there are all the options and other stuff on top of it, which is retail. This is why the stock is not down more, and still trades where it does, in my view."

"Retail just doesn’t care, doesn’t understand these things, buys the current hype and not the future cash flow, the whole deal," Kass added. "Passive index funds just hold."

And then Wells Fargo slashed its price target on Super Micro to $375 from $650, while keeping an equal weight rating on the shares.

That's a brutal blow, and cuts to stock price targets of that size aren't common.

The investment firm said the stock was under significant pressure following the announcement of the 10-K filing delay.

Wells Fargo noted the Hindenburg Research report. Given the uncertainty and concern about revenue recognition and Super Micro's history, the firm cut its price target on the stock.

Related: Veteran fund manager sees world of pain coming for stocks