The late and notorious Wall Street swindler Bernie Madoff was the architect of the largest Ponzi scheme in history (to the tune of some $64 billion) and ruined thousands of lives before he was finally brought to justice. Madoff made for such a hiss-worthy villain in such an incredible, Shakespearean story that two Academy Award winners jumped at the opportunity to play him: Richard Dreyfuss in the 2016 miniseries “Madoff” and Robert De Niro in the 2017 film “The Wizard of Lies.”

Now you can add the name of one Joseph Scotto to the list, as he portrays Madoff in the four-part Netflix documentary series “Madoff: The Monster of Wall Street” — though Scotto, who with the help of hair and makeup bears an uncanny resemblance to Madoff, doesn’t have any lines. In this detail-oriented, number-crunching, thoroughly researched work from the acclaimed and prolific documentarian Joe Berlinger (“Conversations with a Killer: The Ted Bundy Tapes,” “Jeffrey Epstein: Filthy Rich,” “Murder Among the Mormons”), Scotto is seen in numerous re-creations, either as an enigmatic mystery man with a chilling smile who says nothing, or a shadowy figure moving through Wall Street, alternately charming and bullying his employees, including his brother Peter and his sons Andrew and Mark.

It’s an effective technique that supplies some much-needed color to proceedings that can get a little dry, though for the most part Berlinger makes great use of interviews with the expected roster of investigative journalists, former associates, financial experts, et al., to walk us through the Madoff’s Ponzi playbook and explain how he was able to get away with so many crimes for so long. (The soundtrack, courtesy of Serj Tankian of System of a Down, is invaluable, adding a cinematic vibe.)

Berlinger and his editing team deftly weave in observations and recollections from authors of books about Madoff, former employees of Madoff’s firm and whistleblowers, along with audio of Madoff, e.g., a 2017 deposition in which he says, “One of my problems was, I always wanted to please everybody.” Others render more harsh judgment, with one observer calling Madoff “a financial sociopath, a serial financial killer,” and another noting that when faced with honorable failure or success via a mountain of lies, Madoff chose the lie every time.

In the premiere episode, we get the requisite back story, telling us how Madoff grew up in Queens as the son of Jewish immigrants and was influenced by seeing his father try and fail at several businesses. In the 1960s, the young and exceedingly ambitious Madoff went to work at his father-in-law’s accounting firm, operating a small investment biz specializing in “pink sheets,” aka over-the-counter stocks outside of the New York Stock Exchange. It was high-risk, high-return stuff, with Madoff managing people’s money and taking out loans from his father-in-law to cover up his losses. By the late 1960s and early 1970s, Madoff was operating a legit brokerage firm but was also engaged in a “shadow business” in which he was pooling clients’ resources without telling them and essentially operating an unregulated mutual fund.

Throughout the 1980s, even during the crash of Oct. 19, 1987, and its aftermath, Madoff saw his reputation soar as a golden boy who could do no wrong and seemed to have an almost supernatural ability to avoid setbacks, reap profits for his clients and stay one step ahead of the markets. It seemed too good to be true because it WAS too good to be true. With the help of his loyal chief lieutenant Frank DiPascali, a rough-edged but whip-smart character who looked like he could have been cast in “The Sopranos,” Madoff obtained huge loans from major players when investors came calling in order to keep the ruse going — all the while never engaging in a single actual trade.

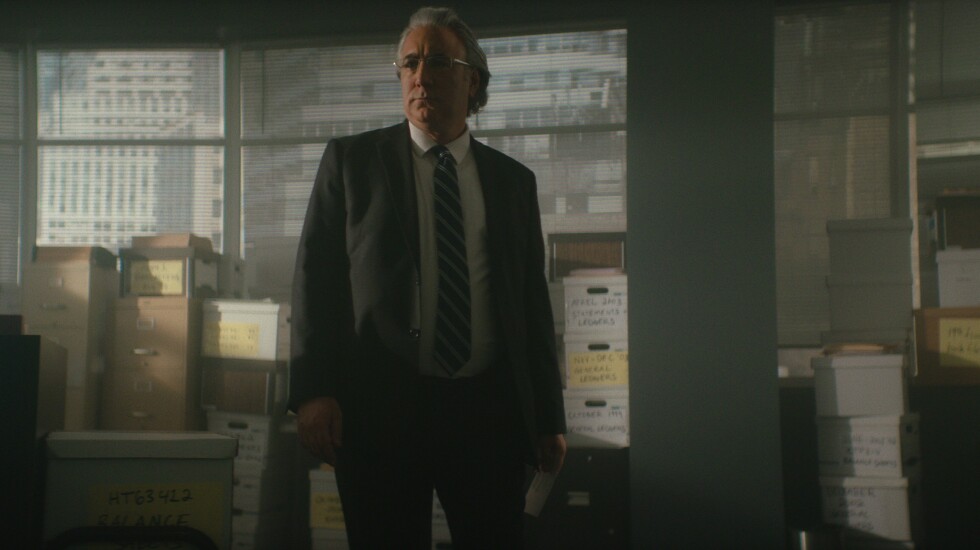

Madoff’s legitimate and successful firm had opulent, high-tech offices on the 19th floor of the Lipstick Building in Midtown Manhattan — but only a few select employees had access to the 17th floor offices, which were dark looked to be stuck in a time warp, with dot matrix printers, boxes of files stacked to the ceiling and 20-year-old computers. That’s where DiPascali and a small team of longtime Madoff employees ran the Ponzi scheme, robbing Peter to pay Paul, then robbing Paul to pay Peter.

Madoff and his team kept up the ruse via the use of stagecraft such as concocting fake documents and aging them, creating software to document non-existent trades and taking out huge loans to cover his tracks. For years, beginning in the late 1990s, forensic accounting and financial fraud expert Harry Markopolos hounded the SEC, providing detailed evidence that Madoff almost surely was running a Ponzi scheme, but it wasn’t until 2008, when Madoff was faced with $7 billion in redemptions and didn’t have anywhere near that kind of cash, that Madoff confessed the scheme to his sons, who were legally bound to turn in their father or face serious charges as accomplices.

The final episode details Madoff’s arrest and imprisonment, but the series is arguably at its most compelling when we hear from some of his victims, many of whom lost everything they had because their grandparents, and then their parents, had trusted Bernie Madoff. We never get the full answer of what motivated Madoff, but we get a sense it was a combination of an obsessive need to prove himself, an almost pathological desire to be admired and loved, and an utter lack of empathy for his fellow man and woman.