Macy’s (M) shares are up about 6% as investors cheer the retail stalwart's quarterly earnings results.

The stock had come down hard from its fourth-quarter highs as it entered 2022, then held up pretty well through the first four months of the year.

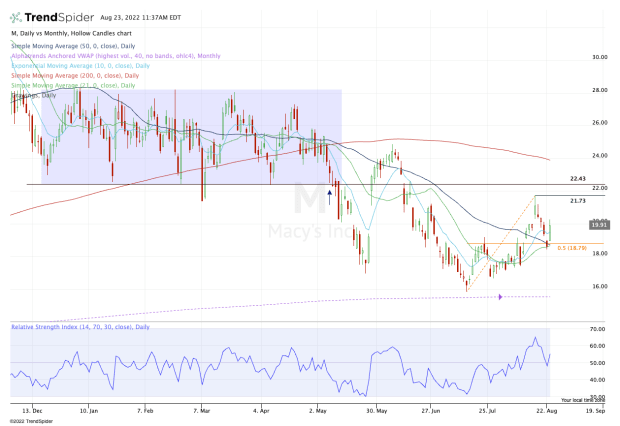

In that span, Macy’s mostly chopped between $22.50 and $27.50, failing to gain traction in either direction. The shares then broke down in May and have had trouble regaining momentum since.

Investors are hoping today’s report can help the stock restore enough momentum to at least get it back in that range.

The company delivered a top- and bottom-line beat but trimmed its full-year earnings and revenue outlook. While the midpoint of its new revenue outlook is still above consensus, Macy’s earnings outlook is not.

Let’s look at the chart to see how Macy’s stock might be able to continue higher — or might not.

Trading Macy’s Stock

Chart courtesy of TrendSpider.com

The stock put together a five-day 24% rally, topping out last week at $21.73. Then last week it strung together a four-day losing streak. The suffered a peak-to-trough decline of more than 15%.

The mixed retail earnings from last week likely didn’t help matters, but all that matters now is how the stock is reacting to Macy's' own report.

With yesterday’s decline, the shares dipped into the 21-day and 50-day moving averages, along with the 38.2% retracement of the current range.

With today’s rally, Macy’s is trying to reclaim $20 and the 10-day moving average, while also trading above these other measures.

If it can get above — and more important, stay above — all the levels mentioned, that opens the door to last week’s high.

If it can clear this level either this week (for a weekly-up rotation) or next month (for a monthly-up rotation), then the $22.50 area is back in play. Regaining that mark puts it back in the $22.50 to $27.50 range until one of these levels fails.

Of course, it’s reasonable to expect that the $22.50 level — which was prior support — will act as resistance, but we’ll find that out later, assuming Macy’s stock can even climb that high.

On the downside, this week’s low at $18.42 is vital. A break of that measure not only creates some downward selling pressure and bearish momentum, but it also puts the stock below the 10-day, 21-day and 50-day moving averages.

At that point, Macy’s stock will not have any bullish momentum and thus makes mapping out the downside somewhat irrelevant.

If the shares dip to the $16 level and monthly VWAP measure, it may be worth reevaluating at that time.