Lucid Group, Inc (NASDAQ:LCID) was trading almost 10% lower at one point on Thursday morning in sympathy with Tesla, Inc (NASDAQ:TSLA), which was down almost 8% following a bearish reaction to its fourth-quarter earnings beat.

On Wednesday, Lucid announced on Twitter it was expanding internationally, and its website shows Lucid expects to open a studio in Toronto, Canada in the first quarter of 2022 and three service centers, in Montreal, Vaughan and Vancouver in the third-quarter.

The expansion is likely to drive revenue for the high-end electric vehicle manufacturer and give Canadians more vehicle choices.

Lucid’s Air Dream Edition R all-wheel drive model currently has the longest range of all electric vehicles on the market, able to drive 520 miles before requiring a recharge. The range comes in well above the 599 km (372 miles), which was the average Deloitte’s 2022 International Automotive Client survey found that Canadians said was needed before they would consider switching over to an EV.

The only other electric that currently has at least a 372-mile range is the Tesla Model S Dual-Motor AWD, which has a range of 405 miles.

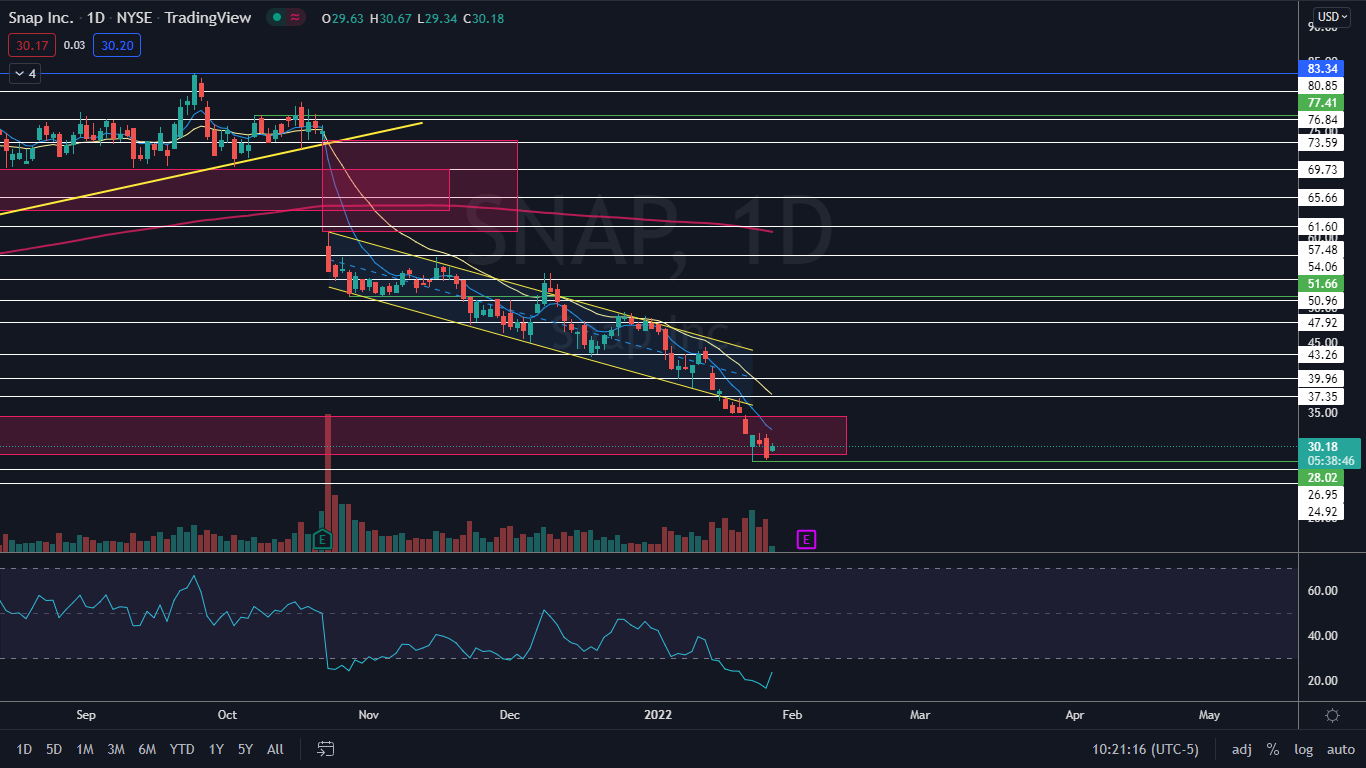

The news of expansion may not do much for Lucid in the short-term, however, and if the stock falls below the 200-day simple moving average (SMA), it could enter into a long-term bearish cycle.

See Also: 10 Electric Vehicles With The Longest Range In 2022

The Lucid Chart: On Thursday, Lucid tested the 200-day SMA as support and bounced up slightly from the level. The 200-day is a bellwether for many traders because it us used to identify overall long-term trends.

If Lucid closes the trading day near its low of day, it will print a bearish Marubozu candlestick on the daily chart, which indicates lower prices may come on Friday. There is also a chance the stock will print an inside bar pattern on Friday in consolidation.

Although an inside bar would lean bearish because Lucid was trading lower before printing the pattern, sideways trading could help the stock to develop support above the 200-day SMA that could save it from falling below the level.

Lucid is trading in a confirmed downtrend with the most recent lower high on Tuesday at $37.55 and the most recent lower low is possibly printing on Thursday. Eventually the stock is likely to bounce up higher to print its next higher low.

The stock is also likely to bounce because its relative strength index has entered into oversold territory at about the 30% mark. When a stock nears or reaches the level, it can be a buy signal for technical traders.

Lucid has resistance above at $35.72 and $41.37 and support below at $30 and $25.24.

Photo courtesy of Lucid.