ExxonMobil and Chevron reported lower but still strong profits Friday as they push ahead with hefty shareholder payouts and major acquisitions.

The two biggest US oil companies, which have similar profiles and strategies, both saw fourth-quarter profits dip amid lower commodity prices, especially for natural gas.

But both companies still scored mammoth full-year earnings: $36 billion at ExxonMobil and $21.4 billion at Chevron.

Those are below the record profits of 2022, which benefited from a spike in crude prices following Russia's invasion of Ukraine, but robust enough to enable significant increases in dividends and share buybacks.

"In 2023, we returned more cash to shareholders and produced more oil and natural gas than any year in the company's history," said Chevron Chief Executive Mike Wirth of an 18 percent jump in payouts to $26 billion.

ExxonMobil, which has added some low-carbon ventures to its oil and natural gas-dominated profile, reported fourth-quarter profits of $7.6 billion, down 40 percent from the year-ago period.

Revenues declined 11.6 percent to $84.3 billion.

The oil giant scored production increases in Guyana and the Permian Basin in the United States, two of its targeted prospects that have offset the effect of other divestitures.

Besides somewhat weaker commodity prices, the 2023 period was also negatively affected by a $2.0 billion impairment related to an idled offshore California upstream project that the company has been unable to restart due to "continuing challenges in the state regulatory environment," it said.

ExxonMobil shares have recovered their mojo after a difficult period a few years ago when Wall Street questioned aggressive investments that saw the company build debt. In August 2020, ExxonMobil was removed from the prestigious Dow index.

But as ExxonMobil has advanced Guyana and the Permian against a more favorable commodity price environment, profits have soared.

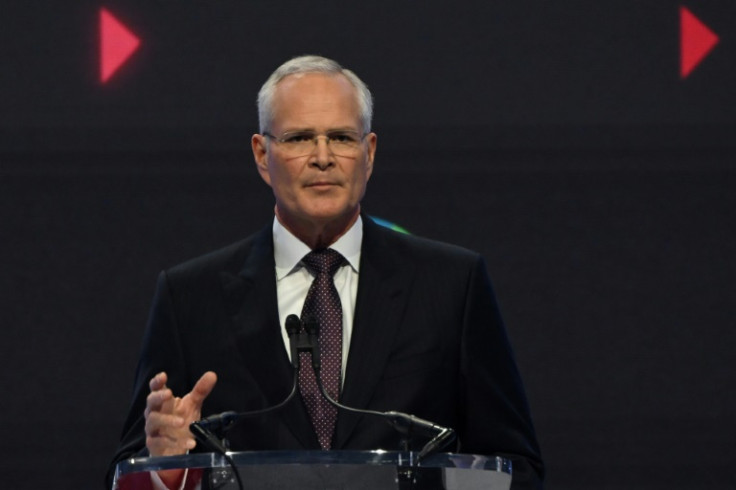

Chief Executive Darren Woods described the company as well positioned.

"Our consistent strategy and execution excellence across the business delivered industry-leading earnings and enabled us to return more cash to shareholders than our peers in 2023," Woods said in a statement.

In 2023, ExxonMobil returned $32.4 billion to shareholders in dividends and share repurchases, up almost nine percent from the year-ago level.

ExxonMobil said it expects its takeover of shale producer Pioneer Natural Resources for about $60 billion to close in the second quarter.

US antitrust officials have sought more info on the deal, but ExxonMobil has expressed confidence it will close.

At Chevron, which is smaller than ExxonMobil, fourth-quarter profits of $2.3 billion were down 65 percent from the year-ago period, while revenues fell 16 percent to $47.2 billion.

Chevron also pointed to growth in the Permian Basin and described its $53 billion acquisition of Hess as on track. The deal was announced less than two weeks after the ExxonMobil-Pioneer deal.

Chevron's results were dented by a $1.8 billion impairment on California assets in which "continuing regulatory challenges" will reduce investment.

Chevron also booked $1.9 billion in decommissioning costs from previously sold assets in the Gulf of Mexico.

Shares of ExxonMobil rose 0.6 percent after midday, while Chevron gained 2.5 percent.