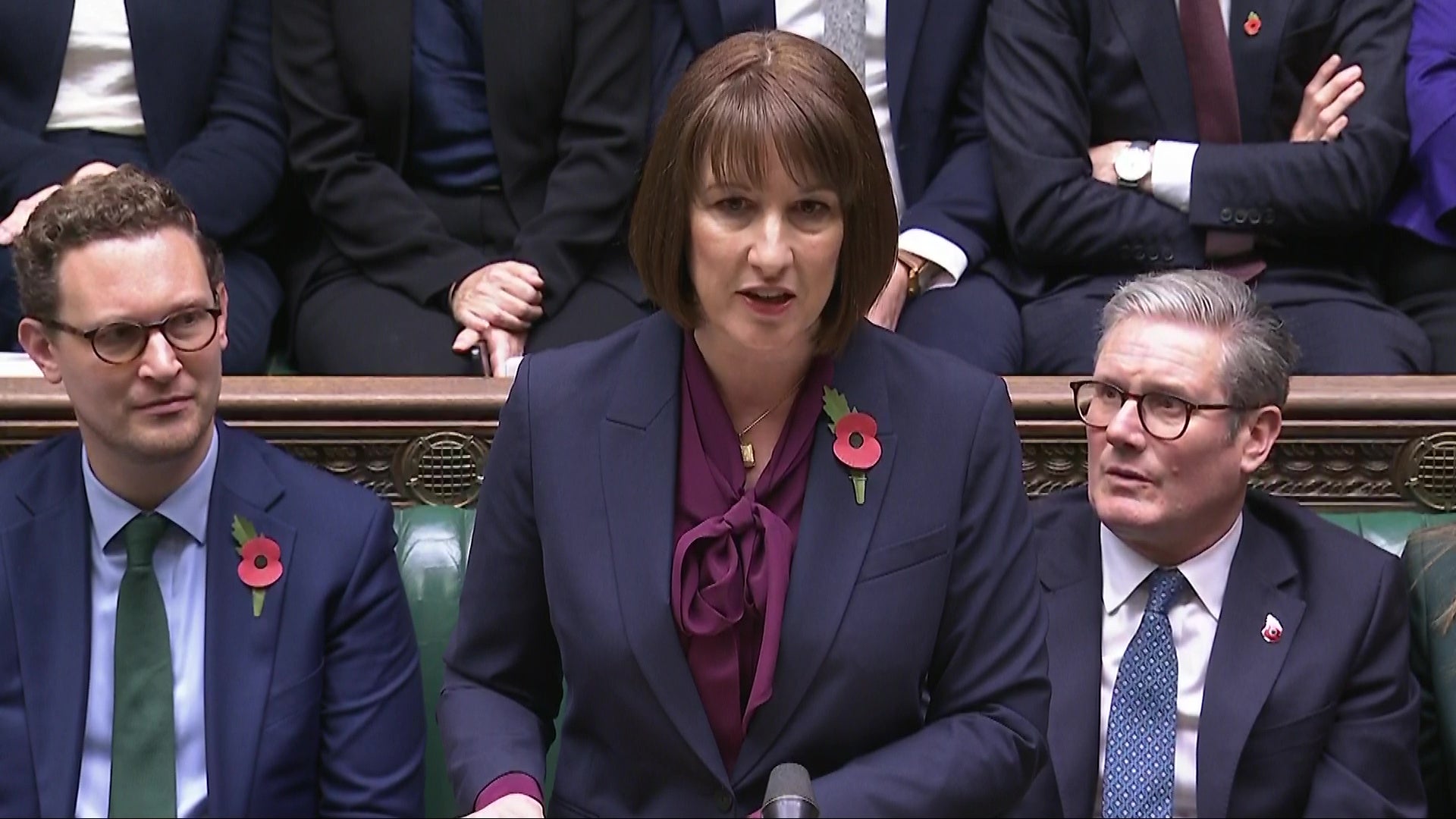

Tax increases in the Budget are likely to hit workers in the pocket with lower pay rises, Rachel Reeves has admitted.

The Chancellor acknowledged her decision to raise national insurance contributions (NIC) for employers could affect wage growth for private sector workers, or companies will have to absorb costs.

Economics experts branded the increase a “tax on working people” which will “definitely” show up in their wages.

Ms Reeves also said she did not want to repeat the £40 billion tax rises she implemented in her first Budget “ever again”.

Choices made by the Chancellor will see the overall tax burden reach a record 38.3% of gross domestic product (GDP) in 2027-28, the highest since 1948.

Despite Labour’s promises to protect “working people”, a £25.7 billion increase in national insurance contributions paid by employers is likely to reduce wages and lead to job losses, something Ms Reeves herself admitted.

Asked about the consequences of the move, the Chancellor told BBC Breakfast: “I said that it will have consequences.

“It will mean that businesses will have to absorb some of this through profits and it is likely to mean that wage increases might be slightly less than they otherwise would have been.”

The Office for Budget Responsibility (OBR) forecasts that by 2026-27, some 76% of the total cost of the NICs increase is passed on through lower real wages – a combination of a squeeze on pay rises and increased prices.

The measure could also lead to the equivalent of around 50,000 average-hour jobs being lost, the watchdog said.

Ms Reeves later suggested the tax rise was not an easy choice, telling BBC Radio 4’s Today programme: “Look, what alternative was there? We had a £22 billion black hole in the public finances.”

The Chancellor insisted ministers had “protected the smallest businesses” from the tax rise, and had stood firm on Labour’s promise not to raise the key taxes on “working people” – national insurance, income tax and VAT.

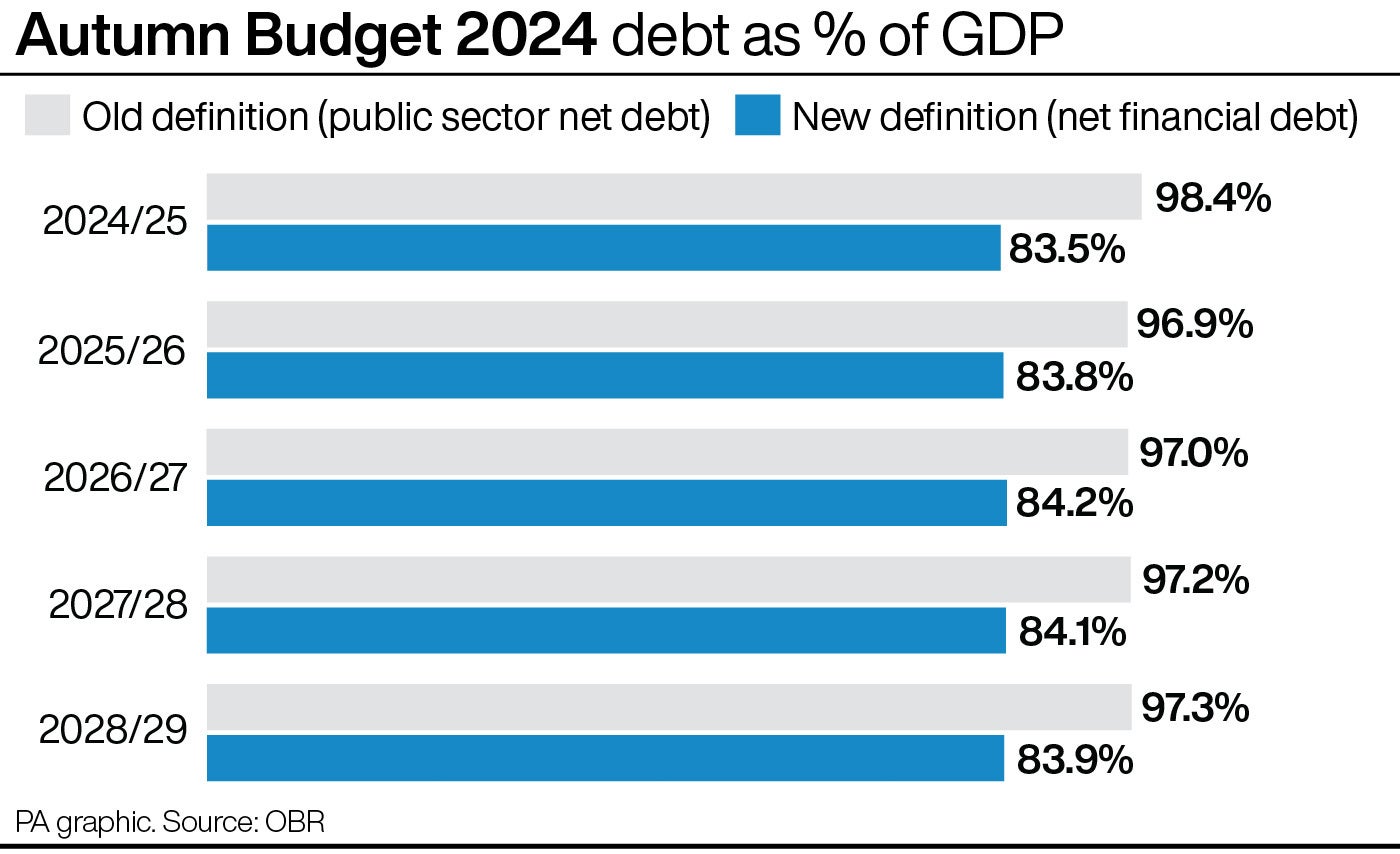

Ms Reeves plans to pour more public cash into schools, hospitals, transport and housing – and will change the way government debt is measured to allow her greater borrowing flexibility.

“This Budget was to wipe the slate clean after the mismanagement and the cover-up of the previous government,” Ms Reeves told Times Radio.

She added: “I had to make big choices. I don’t want to repeat a Budget like this ever again, but it was necessary to get our public finances and our public services on a stable trajectory.”

The Chancellor was also unable to say whether her pledge at the Budget to raise income tax thresholds after 2028 was guaranteed.

“I’m not going to be able to write future budgets,” she said.

Shadow chancellor Jeremy Hunt meanwhile said his counterpart had angered many people, who felt she had not lived up to the spirit of Labour’s manifesto promises not to increase taxes for working people.

“Many people thought this was a new Labour prospectus, not a traditional tax-and-spend prospectus, and they have woken up to a Chancellor who has given us the biggest tax-raising Budget in history,” Mr Hunt told BBC Breakfast.

He later told Sky News: “However much Labour tries to say that their tax rises won’t hurt ordinary families, the OBR and the Institute for Fiscal Studies say it’s going to mean lower pay, lower living standards, higher inflation, higher mortgages – so it is a very sad day for ordinary families.”

James Smith, research director at the Resolution Foundation economic think tank, said the employers’ national insurance tax increase “will definitely show up in wages”.

He added: “This is definitely a tax on working people, let’s be very clear about that.

“Even if it doesn’t show up in pay packets from day one, it will eventually feed through to lower wages.”

The think tank said the impact of the rise in NICs will contribute to living standards remaining largely stagnant over the next few years.

But the wider pay outlook is dire.

— Resolution Foundation (@resfoundation) October 31, 2024

Higher inflation / weaker growth from increased taxes on employment + challenging outlook = real pay stagnating again in the middle of this Parliament.

By 2028 real wages are expected to have grown by just £13 a week over the past two decades. pic.twitter.com/VJd9sFvwa6

The Resolution Foundation’s analysis said: “The immediate outlook for real pay is far from rosy and, after this Budget, has worsened.”

There is now forecast to be a two-year shrinkage of 0.3% and four-year growth of just 0.4%.

Overall household incomes are forecast to grow on average 0.5% a year over the parliament, just above the record-breaking low of 0.3% from 2019-24.

“The contrast between this bleak outlook and life under the 1997-2010 Labour governments – during which incomes rose by an average of 1.9% – is stark,” the foundation said.

The OBR has predicted the Government’s spending measures will provide a temporary boost to GDP.

But the watchdog forecast downgrades in subsequent years, and said the Budget measures will add to pressure on inflation and interest rates.

Our October 2024 real GDP growth forecast #AutumnBudget pic.twitter.com/sqChR2uDuK

— Office for Budget Responsibility (@OBR_UK) October 31, 2024

Paul Johnson, director of the influential economics think tank the Institute for Fiscal Studies (IFS), warned Ms Reeves may have to come back for “another round of tax rises in a couple of years’ time – unless she gets lucky on growth”.

Meanwhile, the International Monetary Fund (IMF) endorsed the investment and spending on public services in the Chancellor’s Budget, as well as sustainable tax rises.

In an unusual move, the Washington-based watchdog said: “We support the envisaged reduction in the deficit over the medium term, including by sustainably raising revenue.”