It makes sense that this year's elevated home prices and surge in mortgage rates would create an increase in renters at the expense of homeowners.

But the trend was already getting started in the past decade. RentCafe, an apartment-search website, found that among 1,553 zip codes it analyzed in 50 major cities, 101 switched to renter majority from homeowner majority between 2011-2020.

That put the number of renter-majority Zip codes at 632, or 41% of total Zip codes.

The number of renters rose 12% between 2011 and 2020, compared to a 4% increase in homeowners, according to the Census Department.

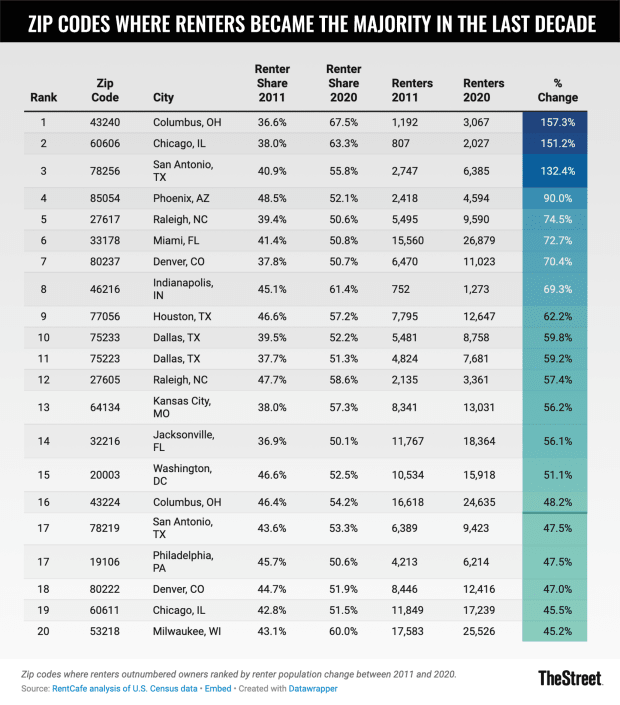

Here are the Zip codes that saw the biggest percentage increases in renters during 2011-2020.

TheStreet

The Strength of Columbus, Chicago Zips

As for 43240 in Columbus, it’s a densely populated area containing the Polaris neighborhood, which includes many renters with a median age of 31, RentCafe said. Residents have per-capita income of $43,000, 25% higher than the Columbus metropolitan area.

Looking at Chicago’s 60606, it holds the West Loop neighborhood. “A thriving community that flaunts a 63% renter population, its residents are mostly Millennials [birth years 1981-96] and Gen Zers [birth years 1997-2012] with high academic achievements,” RentCafe said.

As for 2022, if you’re a prospective home buyer now, you too might want to stay on the sidelines until mortgage rates retreat and home prices fall to reasonable levels.

The 30-year, fixed-rate mortgage averaged a 20-year high of 6.92% in the week ended Oct. 13. And the median existing-home-sale price totaled $389,500 in August, up 7.7% from a year earlier, though it was down 3.5% from July.

Of course, it may take a year or more for mortgage rates and home prices to return to reasonable levels. So as a prospective buyer, you either have to be patient or pay up.

Benefits for Renters and Investors

If you decide to rent, you may benefit from a recent decline in prices. The median asking rent in the top 50 cities dipped 0.7%, or $12, to $1,759 in September from August, according to Realtor.com. That follows a 0.6% decline in August, the first dip since last November.

To be sure, rents still rose 7.8% in the 12 months through September. But that was the lowest rate in 16 months.

If you’re someone who likes to invest in rental properties, apartment real estate investment trusts have hit the skids this year amid soaring interest rates.

So current REIT-price levels may turn out to be bargains. The Nareit Apartment REIT index lost 30% year to date through Oct. 13.

Among the apartment REITs that experts rate highly are AvalonBay Communities (AVB), Equity Residential (EQR), Camden Property Trust (CPT) and Mid-America Apartment Communities (MAA).

But be careful: These REITs may fall further as the Federal Reserve keeps raising interest rates. You might want to start with small positions.

The author of this story owns shares of AvalonBay Communities and Mid-America Apartment Communities.