Australia's stock market finished higher today, despite losses on Wall Street overnight.

The index closed higher for the first week of trading for 2023.

Disclaimer: this blog is not intended as investment advice.

Live updates

Until next week

By Gareth Hutchens

Thanks for having me today, and have a good weekend.

ASX200 closes higher in first week of 2023

By Gareth Hutchens

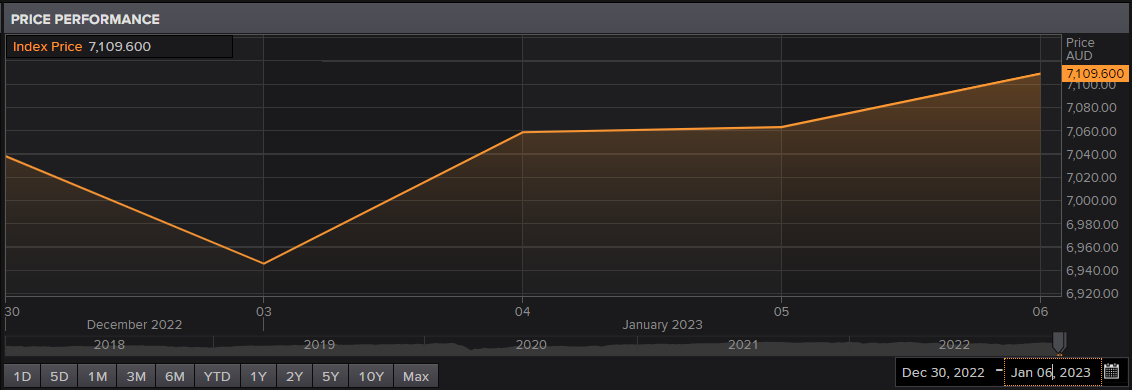

That's it for the first week of trading for 2023.

The ASX200 index closes on 7,109 points, up from 7,038.7 points on the last day of trading in 2022.

Next week we'll start to get more local economic data releases from the Bureau of Statistics including job vacancies, building approvals, retail trade, and monthly inflation.

Asian markets trading higher

By Gareth Hutchens

Australia's stock exchange has closed for the week.

But here's how other indexes in the region are going. As of 4.25pm AEDT:

- Japan's Nikkei 225 index: up 0.63 per cent, to 25,982 points

- Hong Kong's Hang Seng index: up 0.22 per cent, to 21.100 points

Best and worst performers

By Gareth Hutchens

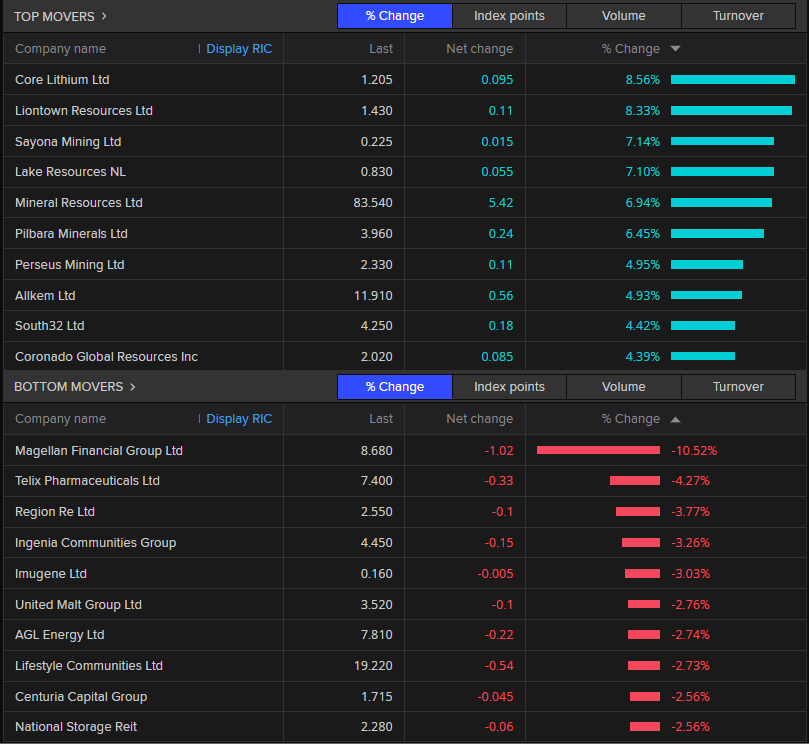

Lithium and mining stocks dominated the top 10 individual gains.

The worst performers were more varied, although Magellan Financial Group stands out for shedding more than 10 per cent in value.

Market closes higher for the day

By Gareth Hutchens

The ASX200 index has closed higher for the day, up 0.65 per cent.

It ended yesterday on 7,063 points and it finishes today on 7,109 points.

The benefits of a tight labour market

By Gareth Hutchens

I looked at that phenomenon in August.

At that stage, the data showed there were 127,900 long-term unemployed people in June last year.

It's continued to fall since then.

Long-term unemployment has declined in Australia in recent years

By Gareth Hutchens

When thinking about Australia's economy, Bjorn Jarvis shared some good stats today.

Mr Jarvis is the head of labour statistics at the Australian Bureau of Statistics.

He posted a few numbers on Twitter earlier to show what's happened to Australia's labour market in the pandemic era:

Officially unemployed (seasonally adjusted):

- March 2020: 713,000 people

- November 2022: 492,000 people

Long-term unemployed (out of work for 1 year or more):

- March 2020: 172,000 people

- November 2022: 106,000 people

Very long-term unemployed (out of work for 2 years or more):

- March 2020: 98,000 people

- November 2022: 71,000 people

He said the "long-term unemployment ratio" has also fallen a few points.

That shows the percentage of unemployed people who are considered long-term unemployed

In March 2020, the ratio was 24.1 per cent, but in November 2022 it was 21.6 per cent.

Magellan suffers worst day in three months

By Gareth Hutchens

Shares in Magellan Financial Group have lost over 10 per cent of their value today.

It's their worst day of trading in three months.

Its share price closed yesterday on $9.70, but it's currently trading at $8.66 a share, having shed over $1.

It's the worst-performing stock on the ASX200 index today.

As detailed earlier, the fund manager told the market this morning that it experienced net outflows of $2.6 billion in December, with the vast majority of those outflows belonging to institutional investors.

Its total funds under management fell from $50.2 billion in November to $45.3 billion in December.

Asian markets

By Gareth Hutchens

Australia's stock market has a couple of hours left to trade today, and the ASX200 index is currently up 0.55 per cent.

Here's how other major markets in the region are tracking:

- Japan's Nikkei 225 index is up 0.6 per cent, to 25,977 points

- Hong Kong's Hang Seng index is down 0.09 per cent, to 21,031 points

Domain Holdings

By Gareth Hutchens

Out of interest, let's have a look at Domain shares.

They've fallen from $4.10 a share in August last year to around $2.73 a share today.

That very roughly tracks the decline in Australian property prices that's occurred since the Reserve Bank began aggressively lifting rates in May last year.

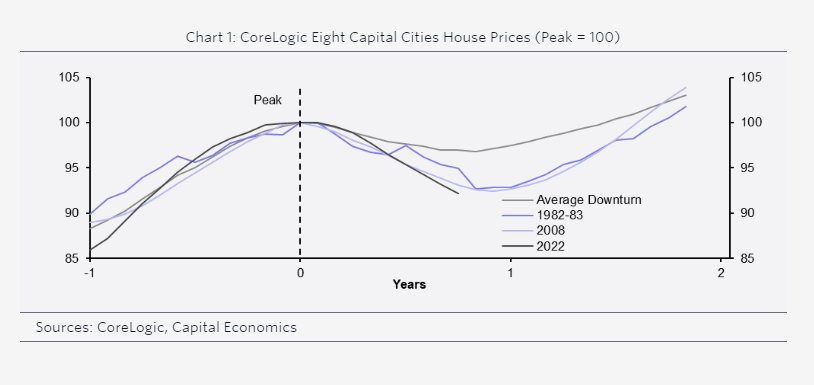

How much further can property prices fall?

Capital Economics produced the below graph earlier this week comparing the current property price declines to previous cycles.

Its researchers said while the 7.9 per cent peak-to-trough fall in the current downturn still falls short of the record 10.4 per cent plunge during the 2017-19 downturn, house prices have never fallen so rapidly in such a short period of time.

Lithium stocks performing well (again)

By Gareth Hutchens

Once again this week, some of the individual stocks that have gained the most in value are lithium stocks.

At 12.43pm AEDT, these are the top 10 performers.

Core Lithium, Lake Resources, Liontown Resources, and Allkem Ltd are in the top six.

Market up at lunch time

By Gareth Hutchens

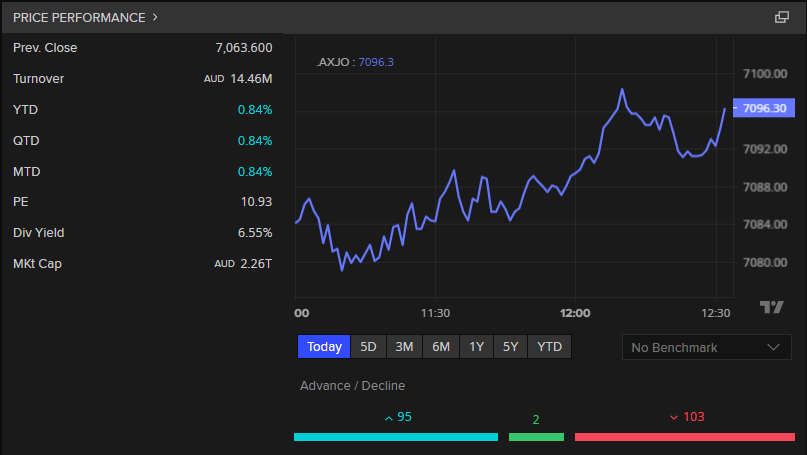

The ASX200 index is currently up around 0.5 per cent, as of 12.30pm AEDT.

You can see in the chart below, that of the 200 stocks on the index 95 of them have gained some value, while two are treading water and 103 have lost value.

But the minority of stocks that have risen in value have still lifted the index higher, because their gains have been large enough.

The sectors with the most gains this morning are basic materials, academic and educational services, and energy.

What should be included in GDP?

By Gareth Hutchens

The record military spending by US president Joe Biden raises an interesting historical point.

In the 1930s and 1940s, when economists like Simon Kuznets and John Maynard Keynes were developing the statistics that eventually led to the creation of "gross domestic product," they argued over the role of government spending in national aggregates.

Keynes believed estimates of national income should represent the sum of investment, private consumption, and government spending.

It was in the early days of the Second World War, and he argued that if government spending was excluded from official measurements of economic activity it wouldn't give a proper picture of any movements in a country's national income.

Kuznets disagreed.

Kuznets said spending on armaments shouldn't be included in national aggregates because it would create perverse incentives for governments.

He said it could encourage governments to increase military spending if it boosted official measures of overall output.

But he lost that argument.

Joe Biden's military spending

By Gareth Hutchens

Military spending boosts GDP, and therefore economic growth.

Samsung reports likely 69% plunge in December-quarter operating profit

By Gareth Hutchens

Samsung Electronics Co Ltd has reported a likely 69 per cent plunge in December-quarter operating profit to an eight-year low, as a global economic downturn saps demand for electronic devices and clouds the memory-chip industry outlook.

RSL Australia president says clubs should act "ethically" and support gaming reform

By Gareth Hutchens

RSL Australia's president has threatened to split from the body that runs RSL clubs over its campaign against cashless gaming cards.

Melick supports gaming reform and says the clubs should act 'ethically' or lose rights to call themselves RSL.

Isobel Roe has the story here:

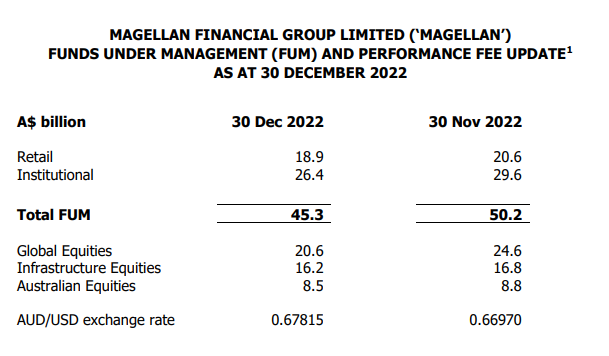

Magellan suffers early losses

By Gareth Hutchens

In the opening session of trading today, Magellan Financial Group is suffering the biggest losses.

At 10.30am AEDT, its share price has lost more than 8 per cent in value.

It comes after the fund manager told the ASX this morning, before trading began, that it experienced net outflows of $2.6 billion in December.

Institutional investors accounted for $2.6 billion of those net outflows and retail investors accounted for $600 million.

Its total funds under management has fell from $50.2 billion in November to $45.3 billion in December: down 9.7 per cent.

Its share price is currently $8.86, down 8.6 per cent.

This is the table it presented to the ASX this morning:

ASX200 opens slightly higher

By Gareth Hutchens

In the first 15 minutes of trade this morning the ASX200 index is slightly up.

It's trading at 7,075 points, up from yesterday's close of 7,063 points.

Update

By Gareth Hutchens

Australian property prices have slowly declined since the middle of last year.

For all of 2022, they declined by over 5 per cent, which was the largest decline since the GFC. But that's only an average figure.

In Tumbarumba in NSW, prices are still 82 per cent higher than they were before the pandemic began.

It's brought some benefits to the community, but big costs too.

Caroline Dwyer-Gray was given notice to vacate her flat of more than eight years early in 2022, after a city buyer purchased the building and decided to turn it into an Airbnb.

Ms Dwyer-Gray had lived in Tumbarumba for almost 20 years but had to move an hour north to Tumut, unable to find any rentals in the area.

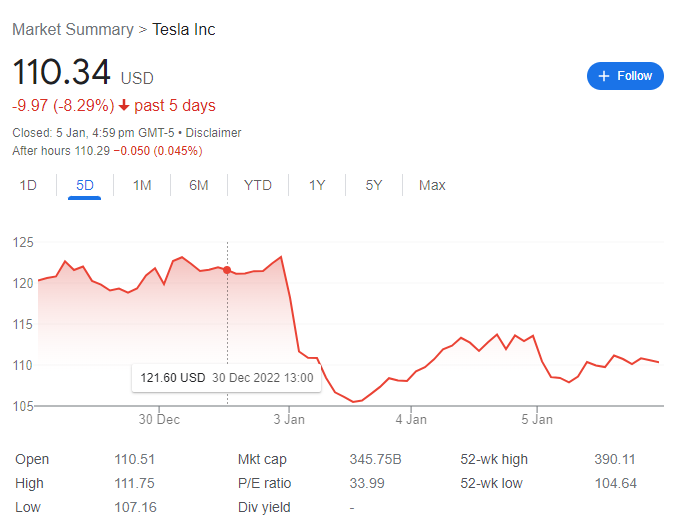

Tesla shares fall again

By Gareth Hutchens

Tesla shares lost another 2.9 per cent overnight after data showed December sales of its China-made electric vehicles fell to a five-month low.

They're now sitting at US$110.34 a share, down from US$308.73 in September.

The Reuters report below explains what's going on.

It partly has to do with China's withdrawal of EV subsidies which is forcing car companies in China to review their pricing and sales strategies.

SHANGHAI, Jan 5 (Reuters) - China’s decision to end a more than decade-long subsidy for electric vehicle purchases has forced automakers, including Tesla, to deepen discounts to maintain sales as demand eases in the world's largest market.

The government originally planned to phase out the support scheme for EV makers and battery suppliers by the end of 2020, but extended it until the end of December in response to the pandemic.

As China grapples with the upheaval of an upsurge in COVID-19 cases and its economy grows at the slowest pace in decades, Tesla, Xpeng and SAIC-GM-Wuling have opted to hold consumer prices flat in January.

The subsidy accounted for around 3% to 6% of the cost of the best-selling electric vehicles in China last year, a Reuters analysis found.

Other EV makers, including Tesla's larger rival BYD and SAIC-Volkswagen, have raised prices for some models but opted to absorb most of the cost of the subsidy, the Reuters tally showed.

The subsidy, paid to the automaker at the point of purchase, began in 2009 and was scaled back over time. It paid out nearly $15 billion to encourage EV purchases through 2021, according to an estimate by China Merchants Bank International.

As some consumers rushed to take advantage of the subsidy while there was time, BYD doubled its retail sales in China in December from a year earlier, while Tesla's retail sales in China fell by 42%.

J.P. Morgan said in a research note on Thursday, it expects "a transitional pain period," with January and February industry-wide sales of EVs and plug-ins in China down between 40% to 60% from year-end levels.

DYNASTIES AND DISCOUNTS

BYD raised prices on its best-selling EVs, named after Chinese dynasties.

Tesla, meanwhile, is defending its market share by selling the basic, rear-wheel drive Model Y for 288,900 yuan ($42,053.63) in China, unchanged from December.

It is also offering another 10,000 yuan in cash incentives and insurance rebates for buyers in January, which means it has effectively cut prices in China by up to 12% since early September, when that model was sold for 316,900 yuan.

Buyers of BYD's best-selling electric cars have to pay 2,000 yuan to 6,000 yuan more in January, depending on the model they choose, compared to those who placed the orders in 2022, posted prices show. That represents a price hike of between 2% and 3%.

China's Association of Automobile Manufacturers said in December it expected sales of EVs and plug-in hybrids to grow by 35% in 2023, accounting for a third of total vehicle sales.

But William Li, chief executive of automaker Nio, said it could take until May for China's EV market to begin to recover.

"It will take time for both the supply chain and consumer demand to recover," Li told reporters last month.