Australia's stock market made small gains in its final day of trading for 2022, but it lost more than 5 per cent over the year.

There'll be no trading on Monday next week, due to the New Year's Day public holiday. Trading will pick up again on Tuesday 3 January.

Disclaimer: this blog is not intended as investment advice.

Live updates

Trading closed for 2022

By Gareth Hutchens

That's it.

Trading is done for the year. The ASX200 index has ended 2022 on 7,038.7 points, down more than 5 per cent.

The Australian dollar is currently buying 67.76 US cents. It's down 6.7 per cent since this time last year, when it was buying 72.65 US cents.

The Australian Stock Exchange will open again on Tuesday 3, 2023.

Thanks for having me today.

Australian sharemarket loses more than 5 per cent in 2022

By Gareth Hutchens

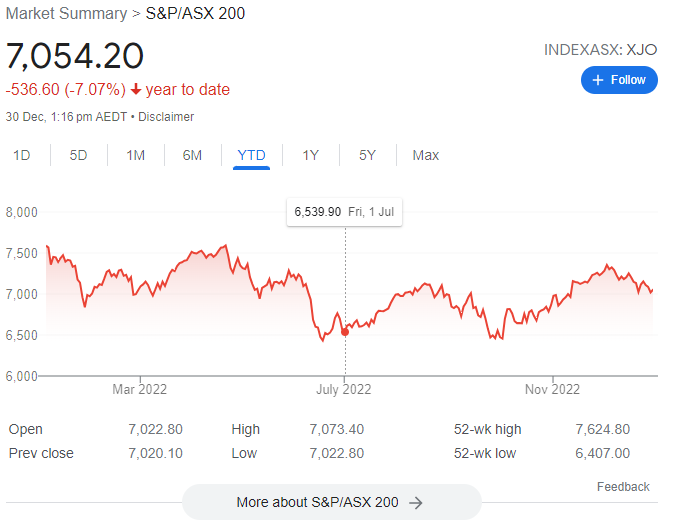

Despite making gains in the last trading day of the year, the ASX200 lost more than 5 per cent this year.

There are different ways of measuring it.

If you take what happened from the first trading day of this year (January 4, 2022) to the last (30 December, 2022), the index fell from 7,589.8 points to 7,038.7 points: - 7.26 per cent.

If you take what happened from the last trading day of last year (31 December, 2021) to the last trading day of this year (30 December, 2022), the index fell from 7,444.6 points to 7,038.7 points: -5.45 per cent.

And according to the ASX website, the index has shed 6.32 per cent over the last 52 weeks.

But anyway you cut it, it hasn't been a good year.

Other Asian indices

By Gareth Hutchens

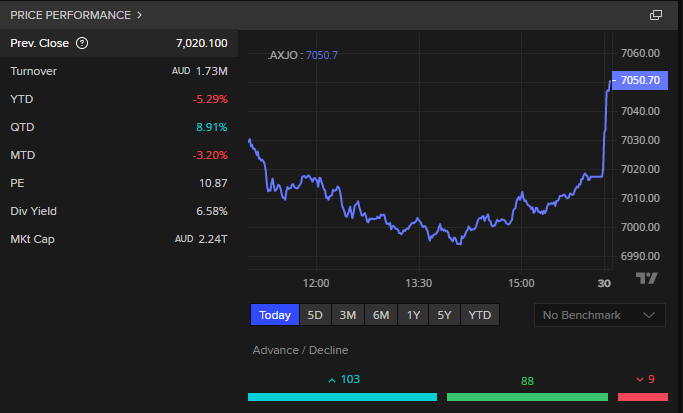

The ASX200 has closed for the day, up 0.26 per cent.

Here's how other markets in the region are tracking, as of 4.35pm AEDT:

- Japan's Nikkei225: +0.20 per cent, to 26,144 points

- Hong Kong's Hang Seng: +0.73 per cent, to 19,886 points

ASX200 closes slightly higher for the day

By Gareth Hutchens

Australia's sharemarket has limped home, ending just 18.6 points higher than yesterday.

Yesterday closed on 7,020.1 points, and the index looks like it's settled on 7,038.7 points today, up 0.26 per cent.

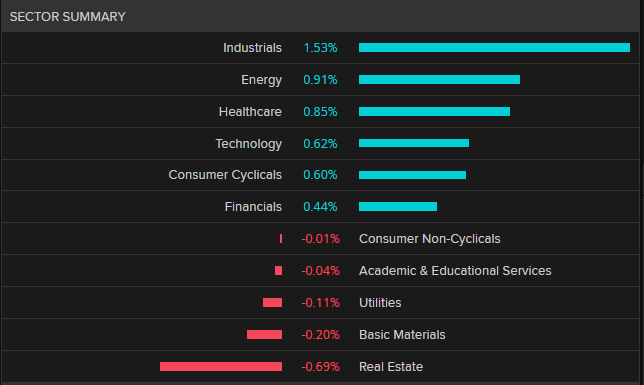

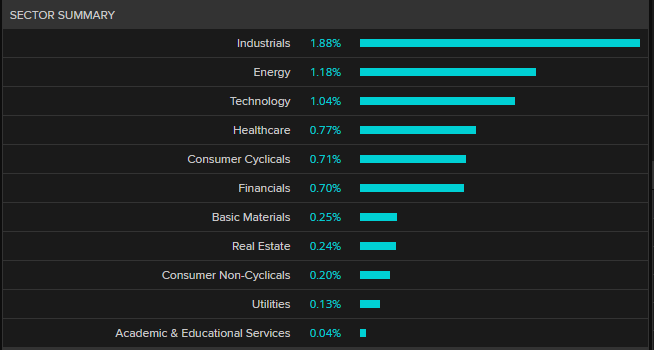

The gains were led by industrials, energy and healthcare stocks, while real estate and basic metals weighed on the index.

Last 10 minutes of trading

By Gareth Hutchens

We've entered the final 10 minutes of trading for the ASX200 today

NAB and ING apologise for wage payments delay

By Gareth Hutchens

Thousands of ING Bank customers should now have received their missing wage payments from employers after a glitch with the bank's payment chain.

ING Australia has apologised for the inconvenience to customers who did not receive their regular salaries over the Christmas period.

It blamed a "glitch in the payment chain" preventing some payments being sent from other institutions.

More on Keynes

By Gareth Hutchens

Back to that book about Keynes' approach to investing.

He became so confident in his ability to make profitable trades that he was almost forced to take physical delivery of an enormous amount of wheat from South America.

But he had nowhere to store the wheat, so he hatched a preposterous plan to store it in a medieval chapel in King's College before coming up with a better work-around.

As the book tells:

"Owing to one of his more flamboyant commodity trades, Keynes was about to be encumbered with the equivalent of a month's supply of wheat for the whole of the United Kingdom. Rather than pay the difference between the spot price of wheat and the contract price - the conventional method for settling a futures contract - Keynes elected to back his judgement and take physical delivery of the grain, confident that the market would eventually rise beyond his contracted price.

"In a rare victory for aesthetics over commerce, Keynes' impertinent scheme to convert King's College chapel into a granary was averted - apparently the building was simply not big enough to store the consignment. Instead, Keynes stalled by objecting to the quality of the cargo, complaining that the wheat contained more than the permitted number of weevils per cubic foot. By the time to grain was cleaned, the market price had risen such that the wily economist eventually made money on the contract."

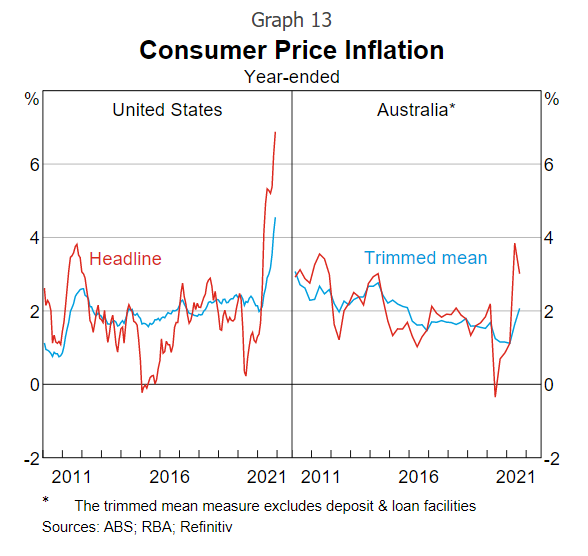

How the RBA was feeling a year ago

By Gareth Hutchens

At this time of year it's easy to get reflective.

And a year ago (16 December 2021), Reserve Bank governor Philip Lowe gave a speech in Wagga Wagga in which he talked about the year ahead.

He noted that inflation had picked up in the US recently (in 2021), where it was running at 6.8 per cent, with underlying inflation above 4 per cent.

He said inflation in Australia was only around 3 per cent at that stage, and in underlying terms it had only just crossed above 2 per cent for the first time in six years.

He produced the graph below.

But fast forward to today and where do things stand?

Australia's headline inflation is now running at 7.3 per cent, with underlying inflation at 6.1 per cent.

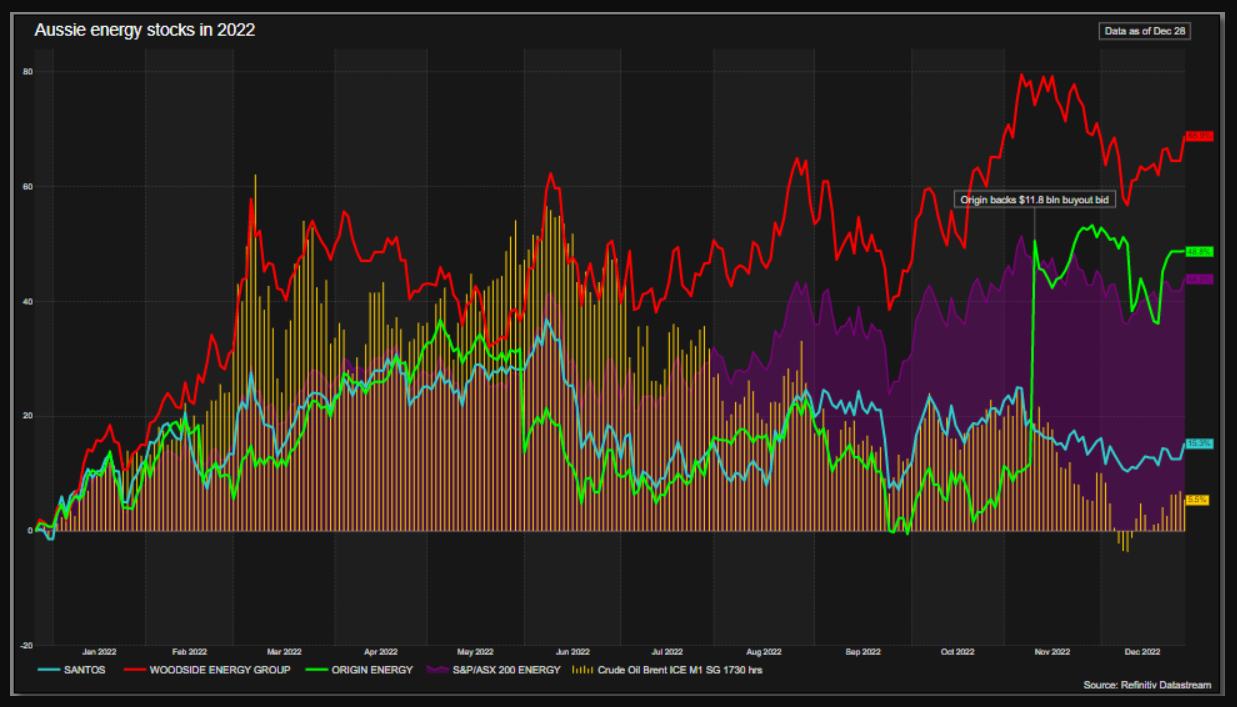

Some shareholders benefited from inflation. Energy stocks soared in 2022.

By Gareth Hutchens

Reuters has put together an important little graph just now.

It shows how Australian energy stocks are on track to end 2022 nearly 40 per cent higher.

Compare that to the broader ASX200 index which looks like it could be down by around 5.2 per cent for the year.

- Woodside Energy's share price jumped more than 60 per cent. It's on track for its best year since 2005.

- Origin Energy's share price rose nearly 50 per cent

- Santos's share price rose by more than 10 per cent

The graphic below shows the gains of all three. Woodside is the red line, Origin is the green line, and Santos is the blue line.

The purple line is the ASX200 energy sector.

The yellow columns show oil prices peaking in June and then declining steadily until year-end.

Market update

By Gareth Hutchens

Here's how things stand at 1.45pm AEDT

- Australia's ASX200: +0.53 per cent, to 7,057.2 points

- Japan's Nikkei225: +0.27 per cent, to 26,164.6 points

- Hong Kong's Hang Seng: +0.51 per cent, to 19,842.12 points

Kirby Rappell from SuperRatings

By Gareth Hutchens

My colleague Sue Lannin spoke to Kirby Rappell from SuperRatings about the hit to super balances this year.

He says it was a year of two halves for Australia's sharemarket in 2022, and we may have to get used to more volatility next year.

Billions wiped from superannuation balances, first loss for balanced funds since 2011

By Gareth Hutchens

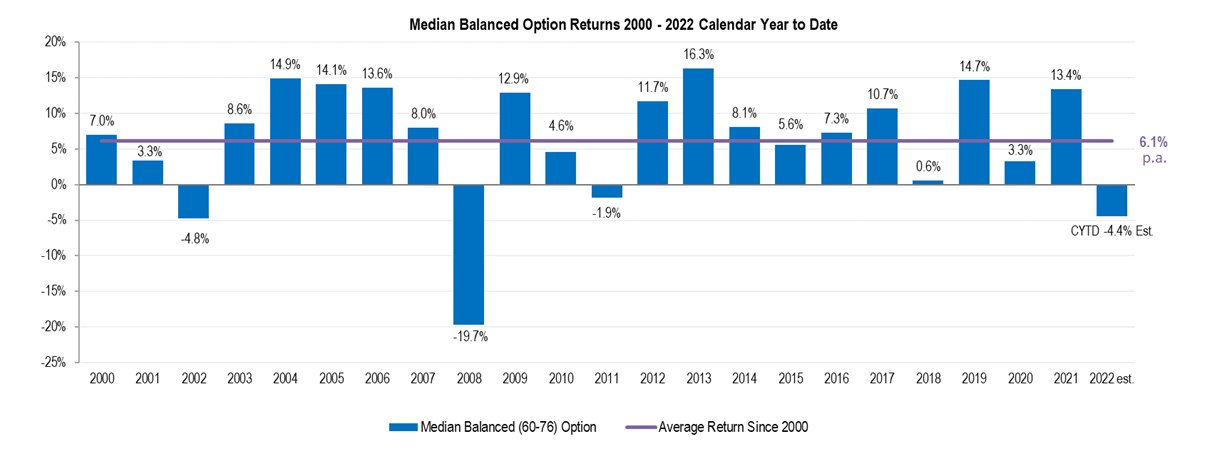

With a few hours left in trading for the year, the ASX200 index will be finishing with significant losses.

And it's not the only market.

US stock exchanges have been decimated this year, suffering their worst year since the global financial crisis.

You can see it in our superannuation balances.

The superannuation research house SuperRatings says the median return for super accounts that choose to invest with "balanced" options (with 60-76% growth assets) is estimated to be -4.4 per cent for calendar year 2022.

It says super balances actually saw a median positive overall return for the second half of the calendar year of 3.2 per cent (July to December), but it wasn't enough to offset the median -7.4 per cent fall for the first half of the calendar year (January to June).

You can see what they're talking about in this graph.

The ASX200 index fell heavily in the first six months of this year, and then it spent the next six months trying to recover.

Overall, with Australia's sharemarket ending lower for 2022, and with overseas stock exchange faring even worse, it's done a lot of damage to our superannuation savings.

The last negative median calendar year return for a balanced option super fund was recorded in 2011.

Japan insurers to continue offering war coverage for LNG shippers in Russian water

By Gareth Hutchens

This story is interesting.

Reuters reported overnight that Japanese insurers are expected to continue providing marine war insurance which covers the sinking and requisition of ships due to war in Russian waters after Jan. 1.

"Japan's Tokio Marine & Nichido Fire Insurance, Sompo Japan Insurance and Mitsui Sumitomo Insurance told shipowners last Friday that from Jan. 1 they would stop offering insurance coverage for ship damage caused by war in Russian waters, because reinsurers were withdrawing coverage.

"But on Tuesday, a senior official at the industry ministry said the Japanese government had asked insurers to take on additional risks to continue providing war insurance for liquefied natural gas (LNG) shippers in Russian waters. This was to ensure Japan will continue to import the vital fuel from the Sakhalin-2 gas and oil project in Russia's Far East.

"The insurance companies negotiated with reinsurers to replace part of the coverage and they are now expected to be able to continue offering war insurance for LNG carriers, the Nikkei said.

"After renegotiating with U.K. reinsurers, a total of 30 billion yen ($224 million) are expected to be secured, with domestic insurers covering about 8 billion yen and overseas reinsurers taking on about 22 billion yen.

"But the underwriting capacity will be less than half of the previous 67 billion yen, according to the Nikkei.

"Therefore, the number of ships that can be compensated at one time is likely to be about half of what it used to be, which means shipping companies may need to review their operations, the Nikkei said."

The UK recession and the cost-of-living crisis

By Gareth Hutchens

How will share markets deal with recessions in major economies next year?

This piece illustrates what's already happening on the ground in some parts of the UK.

"Why is Britain set to be the first country into recession and the last country out?" Labour leader Keir Starmer asked in parliament last month.

Japan trading slightly higher today

By Gareth Hutchens

Japan's Nikkei225 index has picked up the positive momentum from Wall Street overnight and Australia's stock market today.

It's currently trading 0.32 per cent higher than yesterday's close.

It closed yesterday on 26,093.67 points, and it's currently sitting at 26,176 points.

Are you a day trader or a set-and-forget investor?

By Gareth Hutchens

I stumbled across a book recently.

It's about the famous British economist John Maynard Keynes, and the trading strategies he devised through trial and error.

When he first started buying shares he figured he'd be able to beat the market. But he got badly burnt.

So he re-thought his strategy and ended up devising a set of principles that set him on the path to becoming a "value investor" - he started trying to pick stocks that appeared really undervalued, with great earnings potential.

Warren Buffett has spoken quite a lot about Keynes' approach.

Anyway, how's this excerpt from the book:

"Keynes' switch from speculator to value investor delivered a radical change in his fortunes. In contrast to the grim days of the early 1930s - where, "although not quite destitute," he had been obliged to put two of his best-loved paintings, a Matisse and a Seurat, up for sale - Keynes had again become "horribly prosperous" by the time The General Theory was published. In the years between the Wall Street Crash and the end of 1936, Keynes multiplied his wealth more than sixtyfold, parlaying net assets of just under £8,000 at the end of 1929 to more than £500,000 only six years later."

Not bad at all.

It's a great little read.

Sector summary

By Gareth Hutchens

As of 11.10am AEDT, all sectors have gained a little bit of value today.

Industrials, energy, and technology stocks have led the way.

Stockmarket in positive territory

By Gareth Hutchens

After an hour of trading, the ASX200 is up 0.55 per cent on yesterday's close.

The index has gained 38.2 points, to be sitting at 7,058.3 points.

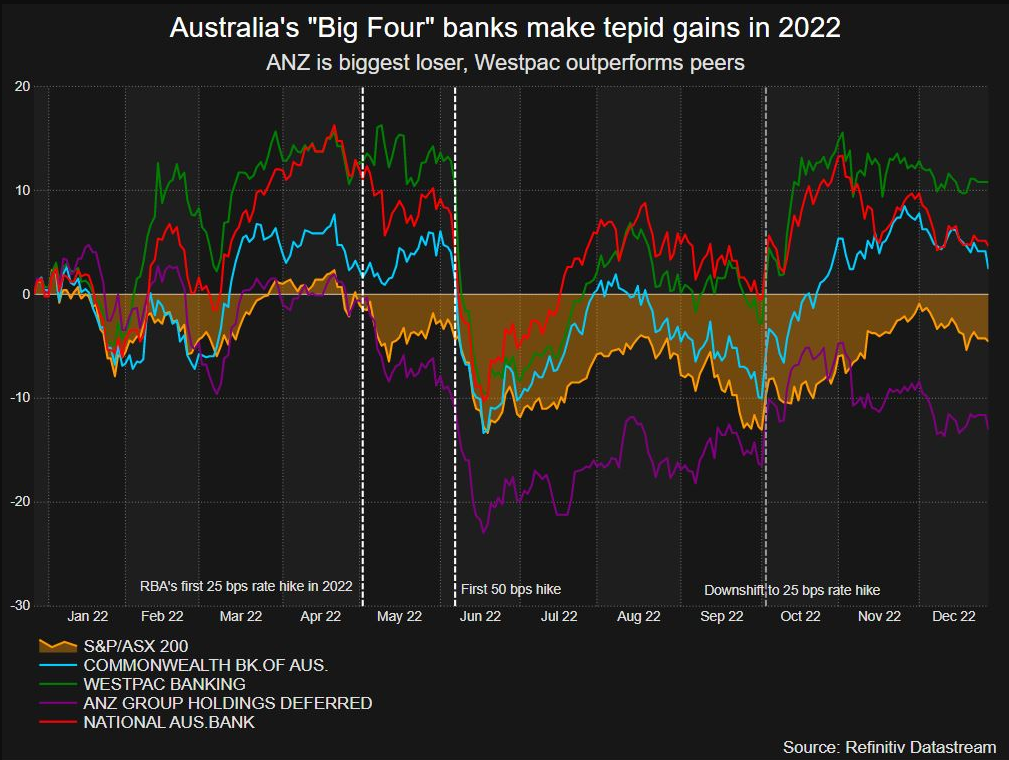

How have the Big Four banks performed this year?

By Gareth Hutchens

This graph is great.

I've taken it from a Reuters analysis of the share price of the major banks this year.

It shows their performance relative to the ASX200 index itself (the yellow line).

Westpac is performed best, followed by NAB and the Commonwealth Bank.

ANZ is the only bank to underperform the index. It's lost around 13 per cent year-to-date. It has more exposure to New Zealand than the other banks, and New Zealand is expected to be hit by recession early next year.

Trading jumps higher on opening bell

By Gareth Hutchens

As expected, the ASX200 jumped higher as soon as trading began this morning.

You can see that on the right-hand side of the graph.

The index closed yesterday on 7,020 points, and it's already around 0.5 per cent higher.