Bank stocks boost the ASX to a solid gain, while Westpac waives the mortgage serviceability buffer for some select borrowers who want to refinance their mortgage.

Find out how things go on our specialist business and economics blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:45pm AEST

By Michael Janda

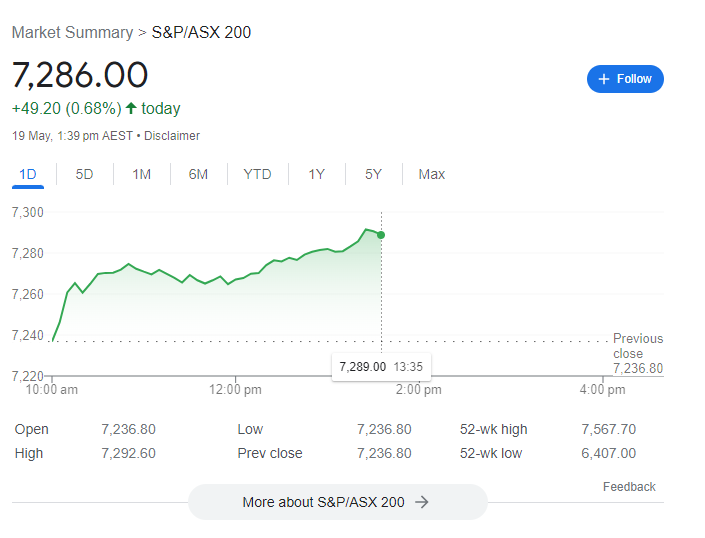

- ASX 200: +0.6% to 7,280 points

- All Ords: +0.6% to 7,472 points

- AUD: +0.4% to 66.44 US cents

- On Wall Street: Dow +0.3%, S&P 500 +0.9%, Nasdaq +1.5%

- In Europe: FTSE 100 +0.3%, DAX +1.3%

- Spot gold: +0.4% to $US1,966/ounce

- Brent crude: +0.9% at $US76.57/barrel

- Iron ore: $US107.00/tonne

- Bitcoin: +0.7% to $US26,911

That's your lot for the week

By Michael Janda

I'll be in the blogging chair on Monday from about 8:30am AEST.

Until then, get out in the garden (or whatever you do with your weekends).

Banks lead ASX higher at the close

By Michael Janda

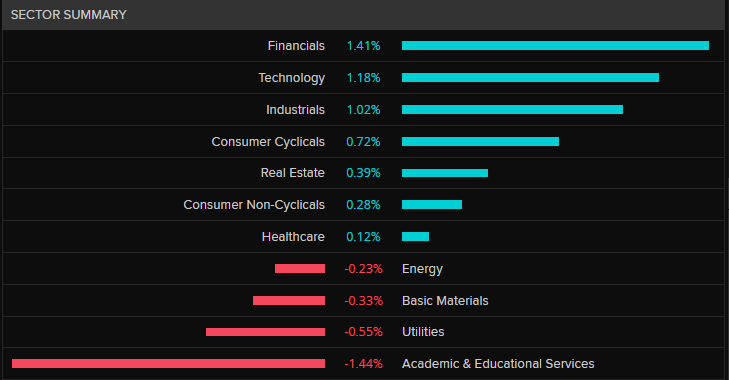

Very strong gains in the banking sector have led the ASX to a positive close on Friday.

The ASX 200 closed 0.6% higher at 7,280 points and the All Ords was up 0.6% to 7,472.

Financials gained 1.5% as a sector, with CBA's 1.8% rise to $99.80 leading the big four, while Westpac's 1.3% rise brought up the rear.

Smaller banks and Macquarie also gained.

In a 'risk on, we're all going to be fine and interest rates aren't going to keep rising much more' kind of trading day, tech stocks, industrials and consumer cyclicals rounded out the top performers.

The drags were more boring utilitarian stocks, like utilities and the mining sector, although they didn't fall a lot (except the coal miners, which dominated the biggest fall list below).

The biggest winners on the ASX 200:

- BrainChip: +9.3% to $0.47

- AUB Group: +5.9% to $27.38

- Xero: +5.4% to $108.00

- Syrah Resources: +4.8% to $0.98

- Insurance Australia Group: +4.6% to $5.19

The biggest losers among the top firms:

- Nufarm: -4.6% to $5.77

- Whitehaven Coal: -4.3% to $6.86

- West African Resources: -3.8% to $0.895

- New Hope: -3% to $5.11

- Coronado Global Resources: -2% to 1.455

Westpac slashes servicibility to steal mortgage prisoners

By Emilia Terzon

Business reporter Emilia Terzon here with some interesting late Friday afternoon news about the mortgage market.

Westpac has told brokers that it's going to let some borrowers refinance over to the big four bank, even if they fail standard stress tests on their new loans.

Typically, banks will assess a borrower's finances to make sure they could still afford to pay it if interest rates rose, typically by 3 per cent in line with APRA guidelines.

Westpac has told its brokers that now:

If a customer is unable to meet serviceability under the standard assessment criteria, a modified Serviceability Assessment Rate (SAR) may be applied as a credit exception to new and existing consumer mortgage commitments.

Streamline Refinance is only available to customers who meet eligibility criteria and have a proven track record of servicing their existing loan commitments. The standard floor rate will continue to apply.

There is a lot of provisos, however.

People can't refinance to Westpac, and its subsidaries St George, Bank of Melbourne and BankSA, under this dropped serviceability if their repayments will be higher than their old loan.

They also need a credit score over 650, and no arrears or hardship in the last 12 months.

This get out of jail free card also can't be given to people on a guarantor loan or those with lenders mortgage insurance, which would be cutting out a whole lot of first home buyers.

Homeloan comparison website RateCity is supporting the deal.

"The current buffer of 3 percentage points helps ensure new borrowers don’t take out excessive debts compared to their incomes," it says in a statement.

"However, the test is locking some existing borrowers into mortgage prison."

RateCity cited data that showed just 3.1 per cent of new loans taken out in December quarter didn't meet serviceability guidelines set by APRA.

APRA boosted the serviceability guideline buffer in 2021.

"RateCity.com.au believes Australia’s banking regulator, APRA, should consider officially lowering the serviceability buffer for refinancers," the website added.

It is an interesting tactic from a bank, in a time when we know that the number of new home loans being taken out is lower than it was during the pandemic boom.

The deal also only applies if you're an external customer, but not if you're a current Westpac customer looking to internally refinance within the bank's subsidiaries.

What do you think? Is this good policy from the bank, the regulators and the market? Send us a comment here.

Perth-based shipbuilder Austal wins potential $4.8 billion US defence contract

By Michael Janda

Austal USA, the company's North American subsidiary, has won an initial $US114 million ($172 million) contract for detail design of the new Auxiliary General Ocean Surveillance Ship T-AGOS 25 Class for the US Navy.

The contract includes options for the detail design and construction of up to seven of the ships which, if the US Navy exercises them, would bring the total value of the contract to $US3.195 billion ($4.8 billion).

The ships are primarily used for anti-submarine warfare, using towed array sonar.

The ASX-listed company originally specialised in aluminium hulled vessels, such as littoral combat and fast transport ships for the US Navy, but has since expanded into more conventional steel hulls.

"The T-AGOS contract is a clear acknowledgment of Austal's capabilities in steel naval shipbuilding, that includes the Navy's Towing, Salvage and Rescue (T-ATS) ships, an Auxiliary Floating Drydock Medium (AFDM), and the US Coast Guards' Offshore Patrol Cutters," said the company's CEO Paddy Gregg.

"These four steel naval shipbuilding projects, and our continuing successful delivery of the Independence-variant Littoral Combat Ship and Spearhead-class Expeditionary Fast Transport programs, are positioning Austal USA exceptionally well to meet the growing demands of the US Navy and Coast Guard."

If successful, the company will build the ships at its facility in Mobile, Alabama.

The company's shares were up 25.4% to $2.00 near the end of trade today.

Qantas announces new flight training centre in Sydney

By Gareth Hutchens

Another Qantas announcement...

The airline says construction has started on a new flight training centre in St Peters in Sydney, near the airport, which will train up to 4,500 Qantas and Jetstar pilots and cabin crew every year from early 2024.

It says the facility will have eight full motion simulators, including for the Airbus A350 which will operate non-stop flights from Sydney to London and New York from late 2025.

Senior Qantas and Jetstar training captains will train pilots from the two airlines while global training provider CAE will maintain all simulators and training equipment, and manage the centre’s day-to-day operations as part of a long-term agreement.

Qantas and Jetstar pilots typically do four simulator sessions per year to remain current in their formal qualifications and up to 15 sessions when training for a new aircraft type.

These are the full-motion simulators and fixed flight training devices (FTD) to be located at the new Sydney Flight Training Centre:

- A380

- A350

- A330

- A320

- B787

- B738

- A380 FTD

- A330 FTD

- B787 FTD

Qantas relocated its simulators from Sydney to Melbourne and Brisbane in 2021 to make way for the NSW Government’s Sydney Gateway road project. Sydney-based pilots currently travelling interstate will be able to do training in their home state when the new facility opens in early 2024.

Qantas Group CEO Alan Joyce, who was onsite this morning to mark the official start of construction, said the national carrier was looking forward to bringing the critical flight training function back to Sydney.

“Qantas provides training for thousands of pilots and cabin crew each year and this purpose-built facility will ensure our high training standards continue as we introduce the next generation of aircraft, grow our network and create new high skilled jobs,” he said.

“We’ll receive an average of one new aircraft every three weeks for the next three years across the Qantas Group, and more simulator capacity to train new and current pilots is critical.

“We’d like to thank the NSW Government and the LOGOS Group for its support for this world-class facility, which will generate broader economic benefits for the state.”

Trouble continues for ASX-listed company

By Gareth Hutchens

This is an interesting story.

Reignited plans to build one of the world's largest prawn farms on a remote Northern Territory cattle station has been disrupted by a federal court case.

A payment dispute between Seafarms, the embattled parent company of the ambitious $2 billion prawn farming project Project Sea Dragon, and Canstruct, the contractor that managed works on the prawn grow-out facility has become the latest stumbling block for the ASX-listed company.

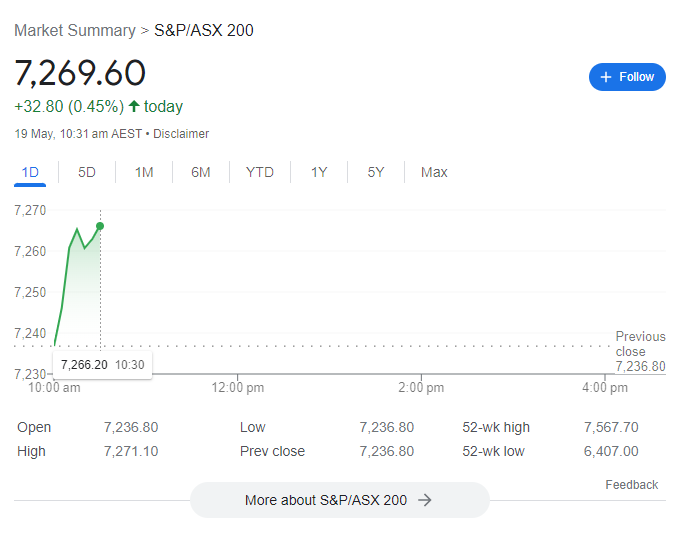

Australia's stockmarket inches higher

By Gareth Hutchens

The ASX200 has consolidated thing morning's gains, and it looks like it could be on track to finish the week slightly higher.

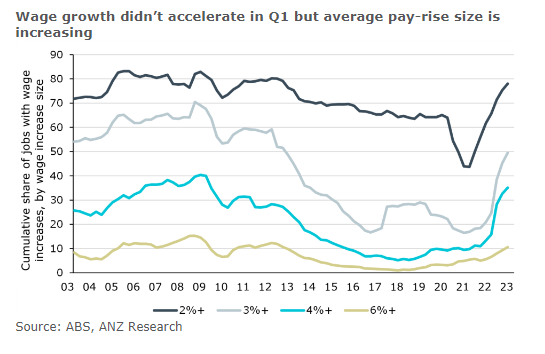

Devil in the detail (for wages and inflation)

By Gareth Hutchens

ANZ's economics team has circulated a note this afternoon that looks back at the recent string of data we've had.

They say at the headline level the data this week (wages, unemployment) would appear to be consistent with the Reserve Bank keep rates steady next month.

But beneath the headlines, there are elements that suggest the RBA may want to lift rates higher.

The headlines:

- The unemployment rate rose to 3.7% in April (from 3.5%) with the increase broadly in line with the RBA’s forecasts in the May Statement on Monetary Policy.

- The WagePrice Index rose 0.8% in the March quarter, with no acceleration from the December quarter. While revisions did see annual wages growth at 3.7%, the fastest pace since 2012, hitting the RBA’s 3.8% forecast for the June quarter 2023 would require a step upfrom where wages growth has been over the past two quarters.

But the devil is in the detail, they say.

"This is especially so given the number of mentions of productivity in the Minutes of the RBA’s May board meeting(also released this week). For example: “Members observed that the forecast for inflation to return to the top of the target band by mid-2025 was predicated on productivity growth returning to around the modest pace recorded prior to the pandemic.

So how is productivity shaping up?

"A (very) small increase in productivity would seem possible in the March quarter but, given the strength in hours worked in April, it is difficult not to foresee a fall in productivity in the June quarter," they say.

"That would keep yearly productivity growth negative and a long way from the pre-pandemic trend.

"As a result, unit labour costs would continue to be elevated, increasing the risk of a slower return to the inflation target.

"Accordingly, we still see the RBA tightening to 4.1% in August, with risks skewed toward more and earlier action."

And this is their chart of the week:

Major markets in the region

By Gareth Hutchens

Here's how major stock markets in the region are performing today, as of 12.50pm AEDT:

- ASX200: +0.60%, to 7,281.3 points

- Nikkei 225: +1.04%, to 30892.47 points

- Hang Seng: -1.34%, to 19,464 points

Sector summary after midday

By Gareth Hutchens

After two hours of trading today, financial, technology and industrials stocks have made the most gains.

Anger at Qantas decision to outsource some flights

By Gareth Hutchens

The Australian and International Pilots Association (AIPA) says it's bitterly disappointed by Qantas' decision to use some Finnair aircraft (and crew) to expand its international flights.

It follows Qantas' announcement this morning that it will start boosting its international flights capacity from late October.

Qantas has made an arrangement with Finnair (Finland's flag carrier and largest airline) which will see Finnair aircraft (with Finnair crew and pilots) taking Qantas passengers from Sydney to Singapore, and Sydney to Bangkok, for two and a half years.

AIPA president, Captain Tony Lucas, said the decision to outsource Australian jobs was an "appalling decision."

Here is his statement:

“Qantas’ decision to wet lease two Finnair aircraft is shocking, bitterly disappointing and could have been avoided with more effective management decisions,” he said.

“It beggars belief that Qantas is outsourcing the Spirit of Australia while simultaneously converting two of our own A330 passenger aircraft into freighters.

“The decision to wet lease illustrates the failures of the fleet planning processes of the last five years and certainly recent decisions made during the pandemic recovery.

“Not only is it disappointing for our hardworking and dedicated pilots but it is also disappointing for loyal Qantas passengers.

“Using the words of Qantas, stepping onto one of its aircraft is supposed to “feel like home”. Sadly this won’t be the case for passengers on these flights.

“Getting another carrier to operate our routes is also significantly more expensive than operating the services within Qantas.

“This is a sad day for our great airline.”

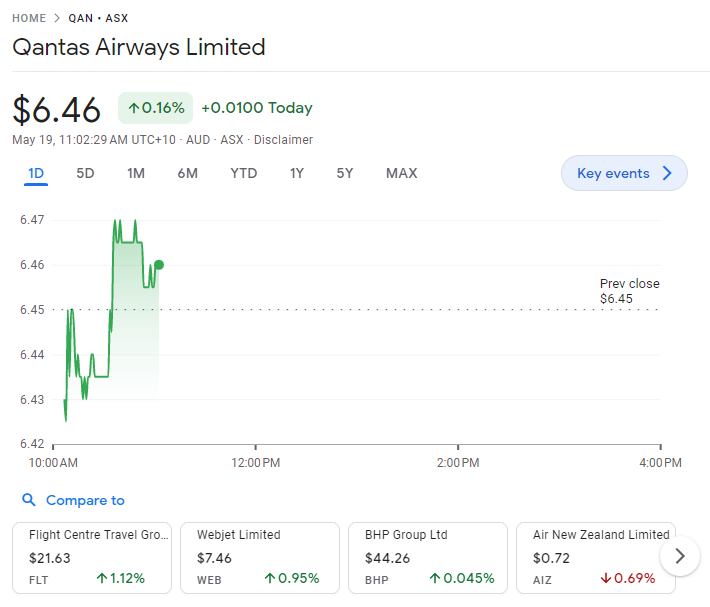

Qantas shares up a little

By Gareth Hutchens

Qantas shares have reacted positively to the news, but not in an exuberant way.

If you look underneath this graphic, you'll see Flight Centre and Webjet have also made small gains this morning.

Qantas boosting the number of its international flights (with help from Finnair pilots)

By Gareth Hutchens

Qantas says it will adding extra flights to its international schedule, with more flights, more aircraft and new routes later this year.

It says the network changes will see its international capacity grow to around 100% of pre-COVID levels by March 2024 (up from 44% a year ago, and 84% today).

Here are some of the changes coming:

- More flights to key destinations including Tokyo, Los Angeles and New York

- Frequency between Australia and Japan to double with four daily flights to Tokyo

- Two new international routes to launch from Brisbane

- Two Airbus A330s to be leased from Finnair to meet demand

It says an extra 300 workers (pilots and cabin crew) will be needed by the end of the year to support the extra flying.

However, some of the extra flying will be achieved by an arrangement with Finnair (Finland's flag carrier and largest airline) to operate two Airbus A330 aircraft on two Qantas routes.

Outgoing Qantas CEO Alan Joyce says the rebound in demand for international travel since borders reopened has been "incredibly strong."

“While airlines globally are working to restore capacity to meet demand, there is still a mismatch between supply and demand for international flying," he said.

"But with more of our aircraft back in the air, new 787s joining our fleet and our contract with Finnair, we’ve got more seats for our customers and more opportunity for Qantas crew as we increase our own flying.

“We know our customers are looking for great value and this additional capacity will also put downward pressure on fares."

ASX makes early gains

By Gareth Hutchens

The ASX has risen by 0.45% in the first half-hour of trading this morning.

$24M whack for AMP, who charged dead clients for life insurance and advice

By Daniel Ziffer

AMP knew more than 2,000 of its customers were dead.

It kept charging them life insurance premiums and fees for 'advice'.

Today in Federal Court, it got 24 million reasons to not do that again

Wait, what?

The financial services giant knowingly deducted fees from the accounts of clients after it had been notified of their deaths.

It is obvious but I'll make it clear - you can't give advice to dead people and you shouldn't be charging them life insurance premiums either.

Today, Federal Court Justice Hespe whacked the company with two large "pecuniary penalties", fines intended as a punishment.

AMP Life has to pay $18 million, AMP Financial Planning has to pay $6 million.

How long?

The court action began in May 2021 when ASIC took civil penalty proceedings alleging "unconscionable conduct".

Not only did the company deduct life insurance premiums and financial advice fees from customers after it had been notified of their deaths, ASIC alleged AMP:

"..contravened their overarching obligations as Australian financial services licensees to act efficiently, honestly and fairly"

In a media release at the time, ASIC added:

"ASIC further alleges that the AMP companies’ conduct demonstrated a system of conduct or pattern of behaviour that was, in all the circumstances, unconscionable."

But wait, there's more

If you're an AMP customer, you'll be hearing about this for some time.

Part of the brief judgement announced today is that AMP must publish "at it's own expense" a written notice about the judgement. (These are typically put in newspapers).

For the next 90 days a notice "in no less than 10-point font" must be on the front page of the AMP website (www.amp.com.au).

If you're an AMP customer and you log-in to the site or any of it's platforms, that notice must stay as one of the first things you see for the next year.

Shares in AMP closed at $1.08 last night.

The value of an AMP share has slumped 73% in the past five years after the firm was smashed in the Banking Royal Commission for... well, stuff like this.

AMP charged the dead for life insurance - now it's got a $24M fine

By Daniel Ziffer

Beleagured financial services giant AMP has been hit with a $24 million fine for charging life insurance premiums to customers it knew to be dead.

Fines of $18M for AMP Life Insurance and $6M for AMP Financial Planning must be paid after regulator ASIC was successful in an action in Federal Court in front of Justice Hespe.

More to come...

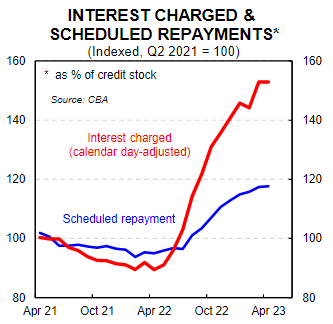

CBA data shows full extent of interest rate lag

By Michael Janda

Some deeply concerning data from CBA should give the Reserve Bank even more pause for thought ahead of its June meeting, following weak jobs data and contained wages growth.

Look at this graph:

What it's showing you is that, even before this month's 0.25 percentage point rate rise, the interest charged on CBA customers' home loans had risen more than 50%.

It also also showing you that their scheduled repayments — the money actually coming out of their account each month — had risen less than 20 per cent up to April.

The scary thing? Over the next few months that blue line has to move much closer to the red line.

This shows most mortgage customers are yet to feel anywhere near the full impact of the rate rises that have already happened.

Why? Because there is roughly a three month lag between when an RBA rate rise happens and when the higher minimum repayment amount is passed through to the customer.

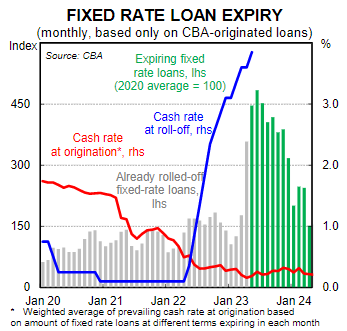

And this is even before the full impact of the fixed rate mortgage cliff hits.

CBA's internal data shows last month was the first big step up in fixed loans rolling off onto variable rates.

All of these customers are facing interest rates that have more than doubled, in many cases tripled, since they took out their fixed loans.

And CBA economist Stephen Wu says those customers will also have a lag between when their fixed loan expires until their scheduled repayments rise.

"At CBA there is generally a lag of around a few months between when a fixed term loan expires and when the required mortgage repayment steps up," he explained.

It's a reality check as to why the RBA needs to be very careful in raising rates further until it sees the effect of the hikes it's already implemented.

Yesterday's jobs data is being interpreted by many economists as a likely turning point in the labour market, where unemployment turns higher.

The many layers of the rental crisis

By Gareth Hutchens

International students coming to Australia are shocked at the lack of rental housing, and many are feeling misled about what life in Australia was going to be.

They understand they're being blamed in some quarters for the rental crisis, but they're also victims.

Notes on US markets - why so positive?

By Gareth Hutchens

The morning notes from NAB's markets team have emphasised the psychological importance of the US debt ceiling negotiations on market sentiment overnight.

They say House Speaker Kevin McCarthy said the House could vote on a deal as soon as next week.

They say one of McCarthy's allies, Patrick McHenry, has warned that a deal is "not close to being done," but that hasn't dampened peoples' optimism that a deal will be done.

As the kids say, let's just manifest it. Think positive thoughts and positive things will happen.

It saw the S&P500 rise 0.9% to close at its highest level since 25 August, and the Nasdaq also outperformed, closing at its highest level in more than a year.