The Australian share market has finished the trading day lower as the dust starts to settle after yesterday's review of the Reserve Bank, and the ACCC launches a probe into savings rates passed on by banks.

It follows Wall Street finishing its day lower, after shares in Tesla tumbled as Elon Musk vowed to continue cutting prices.

Look back on the day's financial news and insights from our specialist business reporters on our blog.

Disclaimer: This blog is not intended as investment advice.

Key events

Live updates

Here's how the market finished up as of 4:30pm AEST

By Kate Ainsworth

- ASX 200 : -0.4% to 7,330 points

- All Ords: -0.4% to 7,523 points

- Australian dollar: -0.5% to 67.04 US cents

- Dow Jones: -0.3% to 33,786 points

- S&P 500: -0.6% to 4,129 points

- Hang Seng: -1.04% at 20,177 points

- Nikkei: -0.3% at 28,564 points

- Spot gold: -0.5% at $US1,994.13/ounce

- Brent crude: -0.2% at $US80.92/barrel

- Iron ore: -1.9% to $US115.10 a tonne

- Bitcoin: -0.1% at $US28,185

ASX closes lower as materials and financials fail to recover

By Kate Ainsworth

The Australian share market has finished the day lower, down 0.4% to 7,330 points.

The losses stemmed from basic materials and financials, down 1.61% and 0.7% respectively.

Resources companies largely rounded out the top five performers of the day:

- Whitehaven Coal +5.9%

- Boral +5.6%

- Lynas +4.8%

- Pilbara Materials +3.3%

- Seven Group Holdings +2.7%

But resource companies also took a hit at the other end, although the worst performer of the day went to the Bank of Queensland:

- Bank of Queensland -5.0%

- Fortescue Metals -4.2%

- Iluka Resources -3.7%

- Rio Tinto -2.8%

- Sandfire Resources -2.7%

And that brings the trading week — and the blog — to a close. Thanks for joining us throughout the week.

In the meantime you can keep up-to-date with other news on the ABC's website, by subscribing to our mobile alerts, and by watching News Channel or listening to local radio here.

ACMA finds Telstra wrongly cut off more than 5,000 vulnerable customers

By Kate Ainsworth

An investigation by ACMA has found that more than 5,400 Telstra customers were unlawfully suspended or restricted by Telstra without notice between 10 May and 19July 2022.

ACMA found the customers — equivalent to 76 people a day — were disconnected by the telco without notice as required under the Telecommunications Consumer Protection.

The Consumer Action Law Centre says restrictions and suspensions of a service can have the same impact as a disconnection.

"People should not be disconnected from an essential service needed for safety, work, to contact children, to call doctors or other vital services such as your bank or Centrelink. This type of action can have devastating consequences," said Consumer Action's David Hofierka.

Many of the customers were reconnected after Telstra received payment, but it was likely they had sacrificed basic essentials to be able to to do.

Consumer Action's CEO Stephanie Tonkin said it was proof that tougher laws were needed to protect consumers.

"In the midst of the worst cost-of-living crisis in a generation, it’s time the Federal Government took action to introduce mandatory laws to ensure the regulator, the Australian Communications and Media Authority (ACMA) can force telco providers to comply with the law," she said.

"We are calling on Minister Rowland to act now before more customers are cut off from this essential service."

CBA forecasts rents will continue to rise this year despite falling inflation

By Kate Ainsworth

My apologies, I know it's not the news you want for a Friday afternoon — but the Commonwealth Bank says more pain is on the way for renters this year, saying rents are going to keep increasing.

CBA says the vacancy rates are "extremely low" across most of the country, and rental inflation is rising strongly, which has been caused by circumstances related to the pandemic, including:

- reduction in average household size

- a massive and "rapid" increase in demand for rentals

- rising interest rates

- less building activity

- more short-term accommodation

It says all of those combined are impacting the supply of rentals and are creating a "dislocated market".

But even with the pace of headline inflation falling this year, it's unlikely to deliver any respite for renters.

CBA notes that a part reversal in the trend of smaller household might help reduce some of the stress (aka, more of us returning to sharehousing), but the market will remain tight.

Watch: Does the RBA review go far enough?

By Kate Ainsworth

That was just one of the questions The Business host Alicia Barry put to to the CEO of Lateral Economics, Nicholas Gruen last night.

You can hear his thoughts on the RBA review below:

Financial sector falls as ACCC launches probe into bank savings rates

By Kate Ainsworth

The financial sector has continued to dip into the red (right now it's down 0.7%) and that's largely got to do with the ACCC launching a probe into the savings rates offered by banks.

Ahead of its retail deposits inquiry, the ACCC is looking for submissions into from banks, consumers and other stakeholders to share their views on issues on retail deposits that affect retail deposit products (i.e. our savings accounts).

The ACCC says it will be looking at how banks pass on changes to their deposit rates in line with the RBA's cash rates increases, noting that:

"While banks have generally increased variable rate home loans interest rates in line with the cash rate increases, increases to the savings interest rates that banks pay their customers have often been smaller or conditional."

So far the share price for all big four banks have dropped since the announcement — here's how they currently stand:

- Commonwealth Bank: -0.7% at $100.24

- ANZ: -0.5% at $24.34

- NAB: -0.9% at $28.82

- Westpac: -0.9% at $22.37

Confused about what the Reserve Bank review means for you?

By Kate Ainsworth

If you didn't get around to reading the 294-page view, don't worry — I put in the hard yards for you yesterday.

If you want to know what the review means for interest rates, your mortgage, and the future of RBA governor Philip Lowe without the often-confusing economic jargon, you can read it below 👇

ASX continues to trade lower at lunch

By Kate Ainsworth

It's the middle of the trading day but there hasn't been any positive signs for the share market. It's still trading lower, down 0.5% as of 1pm.

The basic materials sector is behind the big losses — it's down 1.5% so far, and the financials sector isn't far behind at -0.7%.

But it isn't all bad news — the energy sector has picked up 0.8% so far, while utilities are up 0.4%.

Given this it's not too surprising who the top movers are:

- Whitehaven Coal +4.7%

- Boral +3.9%

- Lynas Rare Earths +2.9%

- Capricorn Metals +2.9%

- Silver Lake Resources +2.9%

On the other end, the Bank of Queensland is leading the worst performers of the day:

- Bank of Queensland -4.6%

- Iluka Resources -4.4%

- Fortescue Metals -2.8%

- Rio Tinto -2.7%

- Megaport -2.6%

Here's how the market's faring at 1pm AEST

By Kate Ainsworth

- ASX 200 : -0.5% to 7,329 points

- All Ords: -0.4% to 7,522 points

- Australian dollar: -0.2% to 67.24 US cents

- Dow Jones: -0.3% to 33,786 points

- S&P 500: -0.6% to 4,129 points

- Hang Seng: -0.5% at 20,293 points

- Nikkei: -0.1% at 28,638 points

- Spot gold: -0.1% at $US2,002.54/ounce

- Brent crude: -0.1% at $US81.00/barrel

- Iron ore: -1.9% to $US115.10 a tonne

- Bitcoin: +0.1% at $US28,222

Elon Musk is taking his chances with a price war with his Tesla strategy

By Kate Ainsworth

At least, that's the view of Pepperstone's head of research, Chris Weston, who says Musk is rolling the dice with a price war.

That's because Tesla posted its lowest quarterly gross margin in two years overnight, prompting a near-10% drop in its stock price.

Musk wants to drive up demand for his vehicles by cutting their prices, even at the expense of Tesla's profits.

Chris Weston says Tesla's new strategy suggests it will be "the kingpin of volatility for at least the next few weeks".

This has all prompted talk of whether we'll see a "price war", which Musk has pushed back on.

"Interestingly, a handful of equity strategists have made contrasts to Ford's move to assembly lines in 1913, which ultimately saw car prices tumble – in turn, Ford's ability to produce cars far cheaper than its competitors resulted in other car manufacturers going out of business," Mr Weston wrote.

"Tesla's recent moves to cut prices ultimately saw gross margin coming in at 19%, well below the street's consensus expectations and a sharp drop from the 24.3% recorded in Q4.

"Musk has indicated they could even look to lower prices further from here – potentially even to cost price."

But Mr Weston points out that even if Tesla keeps wanting to drive down its prices, it still needs to hit its demand targets.

"The trade-off with cutting prices is that Tesla absolutely needs to hit the streets demand forecasts – if there are increased expectations that they will fail to meet the consensus view of 1.82m vehicle sales for 2023 (2.34m for 2024), then the market will be on notice for further price cuts," he wrote.

"A major negative for the share price, and would clearly entice the short sellers and see analysts cut price targets for the stock.

"Recall, consumers are facing a tougher credit environment as banks' lending standards increase and the rising cost to borrow results in would-be purchases shying away – but like any business, Tesla needs to find that perfect price point within the supply/demand equilibrium.

"Given its position, Tesla does have the ability to undercut other EV players and that suggests an obvious risk of consolidation in the EV space over a longer-term timeframe."

Gas industry pushes back on potential tax reform in federal budget

By Kate Ainsworth

The gas industry says potential tax reform at increasing revenue from the sector shouldn't go ahead because its forecasts suggest it will already pay a substantial amount of tax this year.

Industry forecasts released by the Australian Petroleum Production and Exploration Association (APPEA) — the peak body for the gas industry — says the sector's total gas bill will more than double from $6.5 billion last year to $16.3 billion this year.

The federal government is looking at changing the petroleum resource rent tax (PRRT), which is paid by offshore oil and gas projects, ahead of next month's budget.

The PRRT has been criticised for failing to raise significant revenue despite soaring gas prices.

APPEA's chief executive Sam McCulloch says taxpayers are already seeing benefits from high gas prices abroad.

"The industry is paying a considerable amount of tax, and the higher prices that we're seeing from our export commodities are translating back to government revenues," she said.

BuzzFeed News to close as job cuts continue across tech sector

By Kate Ainsworth

Digital media outlet BuzzFeed News is being shut down as its parent company looks to cut costs across the business.

In a memo sent to staff by CEO Jonah Peretti, the company is shedding around 15% of its entire staff, which will impact the entire news division, with additional job cuts in business, content, tech and administrative teams.

Peretti said he "made the decision to overinvest" in the news division, but didn't recognise early enough that there wasn't enough financial support to sustain its operations.

BuzzFeed employs around 1,200 people, meaning 180 people will lose their jobs in the latest round of redundancies.

HuffPost will be the company's one remaining news brand.

The job cuts at BuzzFeed are the latest in a wave of job cuts in the tech sector, and follow the company's announcement earlier this year that it would be cutting 12% of its workforce, citing worsening economic conditions.

BuzzFeed News also had a presence in Australia, but was closed in 2019.

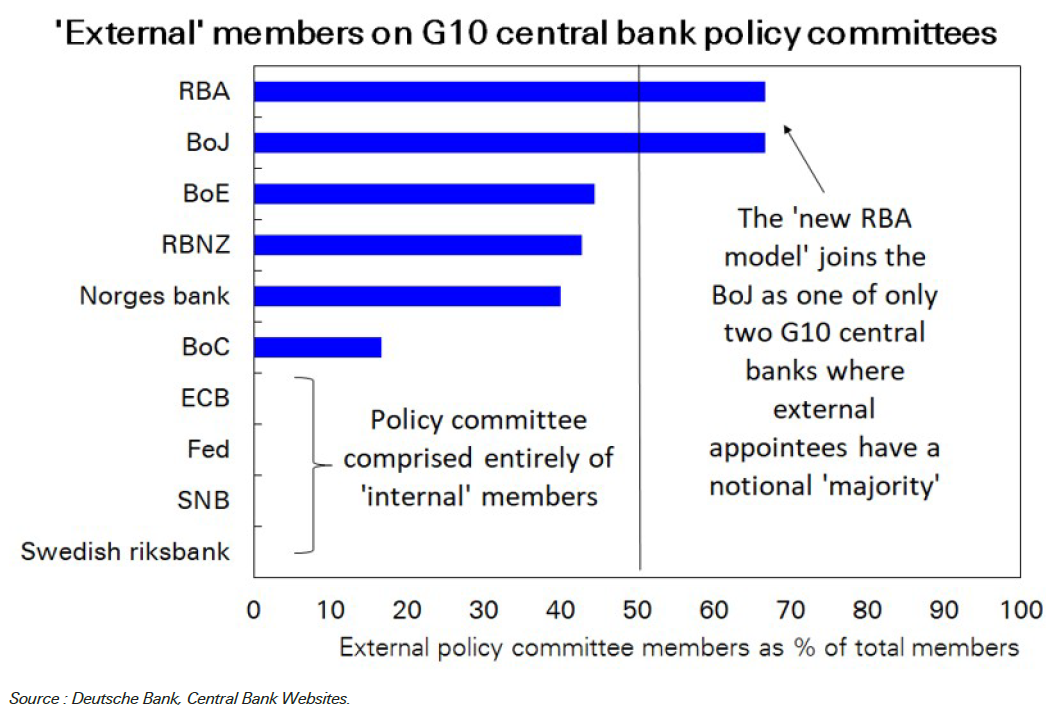

RBA to outsource monetary policy under new structure?

By Michael Janda

An interesting observation from Deutsche Bank economist Phil Odonaghoe about how the Reserve Bank of Australia might compare to its main overseas peers after the changes recommended by the review.

He points out that only the Bank of Japan has a monetary policy committee with a majority of external (i.e. non-central bank staff) members.

"The six 'external' members on the policy committee will have more voting power than the three 'internals'," he notes.

"Technically, an external 'majority' is actually nothing new for the RBA Board. There are already 6 external members, outnumbering the 3 ex-officio members (Governor, Deputy Governor and Treasury Secretary).

"But under the current RBA model, votes on policy decisions do not take place — certainly not formally. Vote-based decisions will, however, be a central feature of the new model. And as the Review states, one reason for moving to the new board model is that the Board "as currently set up can provide only limited challenge to the view of the RBA executive".

"With an external-majority, vote-based model, it is not at all impossible to have a scenario where the group of six external members uniformly disagree with the 'internal' members on a policy decision. And if that happens, the external view would be carried.

"The extent to which this matters in practice remains to be seen. It will depend on who those external members are and how they vote. But a notable distinction nonetheless compared to peer central banks."

Interestingly, the Bank of Canada, where one of the reviewers, Professor Carolyn A. Wilkins, served for six years as senior deputy governor, has a model where the final decision on rates is taken solely by a governing council made up entirely of the BoC's governor and deputy governors (with one external non-executive deputy), considering recommendations from a monetary policy committee that contains external experts.

Watch: Will the RBA review leave you better off?

By Kate Ainsworth

If you somehow managed to miss economics Christmas yesterday (no judgement), fear not: my colleague Stephanie Chalmers put together a very comprehensive wrap of the day's events into a tidy five minute video.

Lachlan Murdoch drops defamation case against Crikey

By Kate Ainsworth

Fox Corporation chief Lachlan Murdoch has filed a notice of discontinuance in his defamation proceedings against the publisher of online news outlet Crikey and several of its editors and executives.

Mr Murdoch sued Private Media in the Federal Court in August over an article published by Crikey, claiming it defamed him in referring to his family as "unindicted co-conspirators" in the US Capitol riots.

Today his lawyers filed a notice to discontinue the case.

In a statement today, Mr Murdoch’s lawyer John Churchill said his client remained confident the court would "ultimately find in his favour" but no longer wished to allow Crikey to use the case to "facilitate a marketing campaign" to boost subscribers.

The decision to discontinue the case comes days after Fox and Dominion Voting Systems settled its high-profile defamation case in the US.

Here's how the market looks at 10:30am AEST

By Kate Ainsworth

- ASX 200 : -0.6% to 7,322 points

- All Ords: -0.5% to 7,516 points

- Australian dollar: -0.1% to 67.35 US cents

- Dow Jones: -0.3% to 33,786 points

- S&P 500: -0.6% to 4,129 points

- Spot gold: -0.1% at $US2,002.18/ounce

- Brent crude: -0.3% at $US80.85/barrel

- Iron ore: -1.9% to $US115.10 a tonne

- Bitcoin: -0.2% at $US28,144

ASX opens lower as materials sector takes a hit

By Kate Ainsworth

As expected, the Australian share market has opened lower this morning, down -0.6% in trade so far.

The losses have stemmed from the materials sector dropping by 1%, while financials have shed 0.2%.

So far the top five movers are:

- Capricorn Metals +2.3%

- Centuria Industrials +2%

- Challenger Ltd +1.5%

- Costa Group +1.2%

- Evolution Mining +0.6%

Meanwhile the bottom five are unsurprisingly reflected of the sectors:

- Bank of Queensland -2.4%

- BHP Group -2.3%

- Alumina Group -2.3%

- Core Lithium -2.3%

- Champion Iron -1.8%

Twitter's blue verification checkmarks are no more

By Kate Ainsworth

If your Twitter feed looks a little different this morning, but you can't put your finger on why, this might be it.

Overnight Twitter began to remove the blue checkmarks next to accounts that don't pay for Twitter Blue, which costs at least $US8 a month.

The blue check helped verify users on the social media platform and distinguish them from imposters, and had originally had around 330,000 verified users.

But since the company was bought by Elon Musk (who yes, is featuring yet again in the blog today) it's decided to remove the verification badge unless they pay that monthly fee, which is part of Musk's plan to boost the platform's revenue.

So far, verified users including Beyonce, Donald Trump and the Pope have all lost their ticks.

If you're thinking this happened before, you're right — they trialled the blue check to people who paid for one, but that quickly spiralled into an inundation of impostor accounts on the platform.

Will this time prove any different? We'll have to sit tight and see.

Watch: Angus Taylor says Coalition hasn't endorsed RBA review's recommendations

By Kate Ainsworth

Speaking on News Breakfast this morning, shadow treasurer Angus Taylor said the Coalition is still going over the recommendations made in the RBA review, and has yet to say whether they will endorse them all completely.

You can watch his interview back below:

What's in the RBA review for borrowers?

By Kate Ainsworth

The bad news is not much, at least not immediately.

Senior business correspondent Peter Ryan spoke to Pradeep Philip, who heads up Deloitte Access Economics, about whether there would be any benefit long-term.

You can listen in below: