The ASX 200 shed 1.4pc in value today, after a plunge for giant Swiss bank Credit Suisse triggered a rout on European stock markets and losses on Wall Street overnight.

It came as Latitude Financial confirmed the personal information of more than 300,000 customers had been compromised in a cyber attack, and IPH Ltd said it had also suffered a databreach, while the unemployment rate fell in February to 3.5 per cent, making the RBA's April interest rate decision more certain.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Signing off

By Gareth Hutchens

But that's it for today. Thanks for having me.

Good luck to the latest victims of the personal data breaches.

Victim of multiple data breaches

By Gareth Hutchens

Before we wrap things up, my colleague Emilia Terzon says after the news of Latitude's data breach broke, she's since spoken to someone who's now had their personal information exposed in three separate incidents.

They won't be the only one.

Biggest movers

By Gareth Hutchens

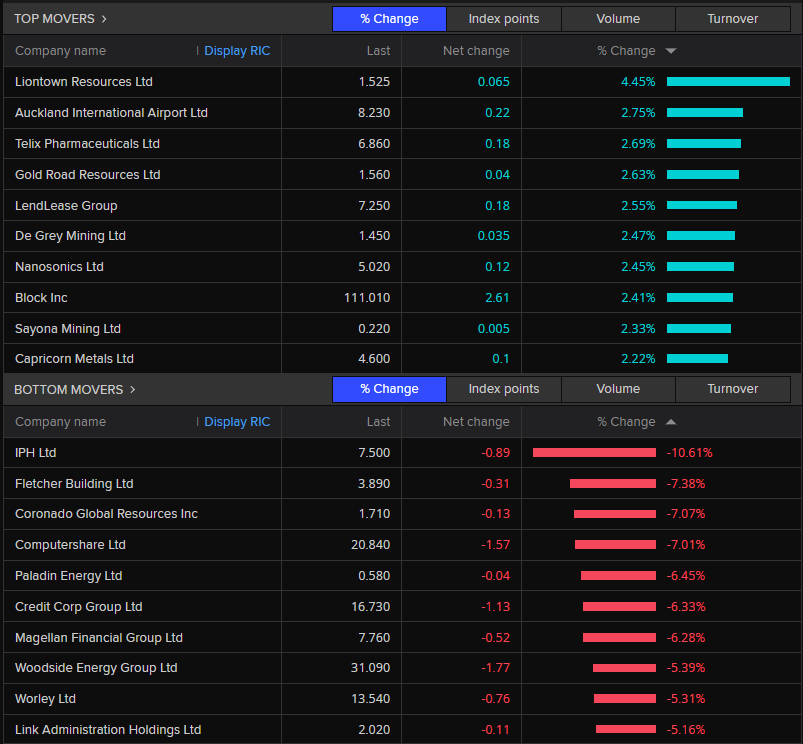

These were the best and worst performers today.

IPH Ltd was the worst performer, after it told the ASX about its databreach. At one point it was down 14% but it managed to claw back some of those loses to finish 10.6% lower.

Liontown Resources (lithium stock) made the biggest relative gain, but since its share price is only $1.52 it's not that impactful.

Sharemarket closes down 1.46%

By Gareth Hutchens

The ASX 200 index shed 1.46% in value today, to close on 6,965.5 points.

As Commsec pointed out earlier, this is the first time this year that the index has closed below 7,000 points.

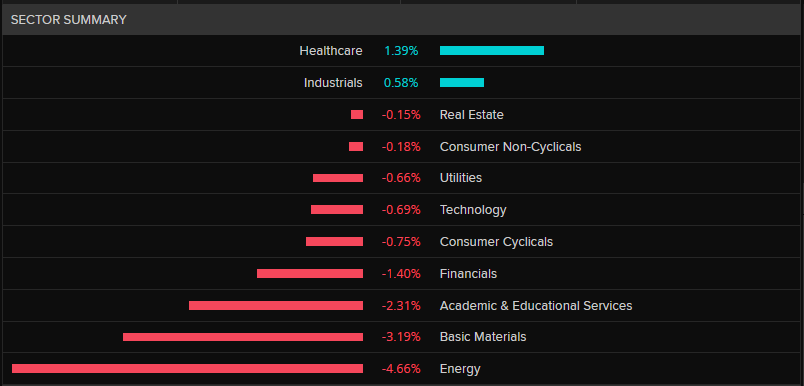

The only sectors to make gains today were healthcare and industrials.

Snapshot of regional markets

By Gareth Hutchens

Trading on the ASX has closed for the day, with heavy losses across the board.

But as we wait for trade to settle, here's how other markets in the region are travelling, as of 4.05pm AEDT:

- Hang Seng: -1.5%, to 19,245.6 points

- Nikkei: -0.96%, to 26,970 points

IPH LTD another company to suffer data breach, shares tumble 14%

By Gareth Hutchens

The share price of IPH Ltd has fallen 13.95%, losing $1.17 a share to be worth $7.20.

IPH is an intellectual property services provider.

The company had put in a trading halt request on Tuesday after it detected unauthorised access to a portion of its IT environment.

And it issued this statement to the ASX earlier:

"As soon as the incident was detected IPH commenced working to secure its IT environment and is working with leading external security and forensic IT advisors to respond and conduct a forensic investigation.

"We have also notified the Australian Cyber Security Centre of the incident.

"Based on preliminary analysis, it appears the incident is primarily limited to the document management systems (DMS) of the IPH head office and two IPH member firms in Australia, Spruson & Ferguson (Australia) and Griffith Hack, and the practice management systems (PMS) of these two member firms.

"The information contained in the DMSs includes documents relating to the administration of these entities and, in the case of the two IPH member firms, client documents and correspondence.

"The PMSs contain IP case management information (such as filing timelines) relating to the practice of the two IPH member firms.

"The investigation underway is focused on determining whether the information stored in these systems has been accessed by the unauthorised third-party.

"We have enacted our business continuity plan (BCP) and, while the functionality of some systems has been affected, we have transitioned to alternative processes which are working adequately to enable the relevant firms to continue to conduct operations, albeit with some disruption.

"We apologise to our clients and the community for any concern that this incident may cause.

"We will continue to keep our clients, shareholders and key stakeholders updated as we respond to this event and our investigation continues and further facts are established."

That statement led to the share price rout we're now seeing.

Bank bail-outs, and financial systems under pressure

By Gareth Hutchens

My colleague David Taylor has written about the implications of the Credit Suisse bail-out, as governments rush to reassure their citizens that everything is fine..

Does the Productivity Commission need reform?

By Gareth Hutchens

Dr Chalmers has also raised the question of the Productivity Commission's remit.

Does the organisation need reform?

"The PC has played an important role in economic reform over a long period of time," he said.

"But its structure and remit have not changed for twenty-five years – and our productivity challenge has evolved.

"To elevate the economic reform discussion, we need to ensure we’ve got a PC suited to the times.

"This could mean a more strategic focus on how we maximise opportunities in areas of economic transformation, including the shift to net zero.

"It could mean building a better understanding of how we measure productivity and the magnitude of the challenge.

"What it must mean, is the evolution of a more meaningful, expanded research agenda and a stronger reform blueprint.

"This is something I’m giving further thought to, and will have more to say about, later in the year."

Chalmers: the Albanese government won't accept all of the PC's recommendations

By Gareth Hutchens

Treasurer Chalmers is also letting people know that he won't be implementing all of the Productivity Commission's recommendations.

He said the general themes of its recommendations accord pretty well with what he's been talking about over the last nine months, but "no government is expected to pick up and run with every recommendation of the PC."

"A major point I want to convey to you today is that there are more ways than one to satisfy our objectives when it comes to productivity," he said.

"Multiple pathways, and not all of them in the report I release tomorrow will be consistent with the government’s priorities or values.

"We don’t believe productivity gains come from scorched earth industrial relations, for example, or from abolishing clean energy programs.

"Instead, we’ll get productivity gains from investing in our people and their abilities, from fixing our energy markets, from making it easier to adapt and adopt technology so it works for us, not against us.

"And by creating the stability and certainty necessary for capital to flow towards areas where we have advantages and opportunities to underpin a more modern industrial base.

"We want to maximise opportunities in energy, not just minimise costs. We want more cooperative workplaces, not more insecurity and conflict.

"But I hope these points of difference don’t dominate the coverage, especially when there is so much common ground to be recognised and progress to be made," he said.

He said the government is working on more than two-thirds of the 29 reform directives outlined in the report.

Productivity trends in Australia's economy

By Gareth Hutchens

Dr Chalmers says the Productivity Commission has identified five key trends for Australia's economy.

- 1.The large and growing services sector.

- 2.The costs of climate change.

- 3.The need for a more skilled and adaptable workforce.

- 4.Our use of data and digital technology.

- 5.Economic dynamism in a changed world of geopolitical tension and uncertainty which is putting up barriers.

He says according to the PC, the non-market services sector - including the care economy (childcare, aged care etc) - has averaged zero productivity growth since 2000.

And since that sector of the economy will keep getting bigger and bigger in coming decades, it will drag on productivity.

He says that will happen at the same time as Australia transitions towards net zero, which will require billions of dollars of investment by 2050.

That will help us avoid some of the worst impacts of climate change and help create new sources of growth that will lift our productivity performance over time, he says.

But this will require major investment in a highly-skilled workforce.

"We'll require better education and training systems that can supply the skills and labour we need," he said.

"And which can enable the digital revolution to happen in a way that enhances rather than just replaces work – helping to diffuse ideas and digital technology across more of our economy.

"All this, in the context of significant geopolitical uncertainty that will present its own headwinds if not handled correctly ... with serious fiscal constraints.

"And with an economy that has become less dynamic over recent decades," he said.

Treasurer Jim Chalmers on Australia's productivity challenge

By Gareth Hutchens

Treasurer Chalmers is delivering a speech in Brisbane, as we speak.

It's on Australia's productivity challenge.

He said tomorrow he'll release the Productivity Commission’s five-yearly review of Australia’s productivity performance.

It's almost a thousand pages long, with nine volumes, and there are 71 recommendations.

"I received it last month and I’ve been getting my head around it and briefing my Ministerial colleagues on it since," he said.

He says there are five facts from the report that put Australia's woeful productivity performance from the last decade into perspective:

- Our productivity growth in the past decade has been the slowest in 60 years, averaging just 1.1 per cent a year – worse than the decade before and barely half the rate achieved during the 1990s.

- Between 1970 and 2020, Australia slipped ten places in productivity rankings, falling from 6th to 16th in the OECD.

- This means our productivity is now 22 per cent lower than the US.

- If we’d kept up with the 60-year average for productivity growth, national income would have been around $4,600 higher in 2020.

- If we stay stuck on the current course, the PC projects future incomes will be 40 per cent lower and the working week 5 per cent longer.

Switzerland central bank pledges to back Credit Swisse

By Gareth Hutchens

Reuters is reporting that Switzerland's central bank has pledged to fund Credit Suisse with liquidity "if necessary."

It says it's the first for a global bank since the financial crisis more than a decade ago.

Reuters: In a joint statement with supervisor FINMA, they announced the radical step, but insisted that Credit Suisse was sound and "meets the capital and liquidity requirements imposed on systemically important banks".

The move to support the bank, with the pledge of central bank money, is designed to stem a crisis of confidence in Switzerland's second-biggest lender.

It says Credit Suisse's problems have raised serious doubts about whether central banks will be able to sustain their fight against inflation with aggressive interest rate hikes.

A sliding index

By Gareth Hutchens

It may not close lower than 7,000, but we'll see.

Price of Australian gold hits all-time record

By Kate Ainsworth

Let's divert away from jobs and Credit Suisse for a minute to check out the commodities, with the Australian dollar gold price hitting an all-time high overnight.

That's according to the Melbourne-based gold mining consultants Surbition Associates.

The price hit $2,874 per ounce overnight, which is just above the previous high of $2,868 an ounce back on August 6, 2020.

Surbiton Associates says that price is the combination of a high US dollar gold price and a lower Australian dollar exchange rate versus the US dollar.

"US dollar gold prices have surged in the last few days due to the failure of three US banks, including Silicon Valley Bank, the 16th largest bank in the US," Dr Sandra Close, a director of Surbiton Associates said.

"Yesterday's public disclosure of Credit Suisse's problems has now further destabilised the market."

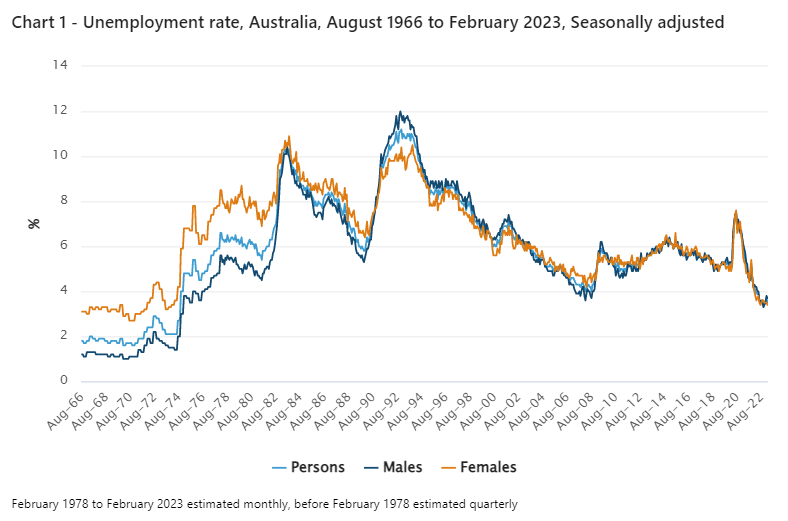

Unemployment in the full employment era

By Gareth Hutchens

When talking about the labour market, the word "tight" is relative.

Earlier, I mentioned how today's labour market is exceptionally tight for the neoliberal era (which is the era after we abandoned full employment in the 1970s), but it's still not as tight as it was in the post-war period.

In that Keynesian full employment era, the unemployment rate averaged below 2% for roughly 30 years.

You can see a glimpse of what that means in this graph on the ABS website, which handily includes data back to 1966.

Note how the unemployment rate was sitting below 2% until 1971 (the light blue line).

There's been far more "slack" in the labour market over the last 40 years, but the current level of slack is the tightest it's been in the modern era.

Watch: What's behind Credit Suisse's plummeting share price?

By Kate Ainsworth

RMIT finance professor Dr Angel Zhong spoke to Joe O'Brien on the ABC News Channel earlier today to explain what happened with Credit Suisse overnight.

She says there's been three major contributing factors to the large fall in its share price, including the retreat of one of its major investors, the poor fundamentals of Credit Suisse, and the ongoing jitters that are affecting the financial markets in the wake of the SVB collapse.

You can catch up on the full chat below:

"Red hot" jobs number means more rate rises to come

By Gareth Hutchens

My colleagues Michael Janda and Rachel Pupazzoni are covering the new employment data.

They'll be adding to this story through the afternoon.

But they say Marcel Thieliant from Capital Economics reckons this "red hot" jobs number should pretty much guarantee another rate rise from the RBA next month.

A rebuttal to the rebuttal

By Gareth Hutchens

Every time I see the word "chartist" I think of the Chartist movement in the 1830s in the UK (a mass working-class movement to reform voting and parliament, which was repeatedly violently crushed by authorities).

I have to remind myself that, in trading circles, "chartists" refer to people who use technical analysis to evaluate stock prices.

There are different schools of thought in the trading community, just like there are different schools of thought in economics.

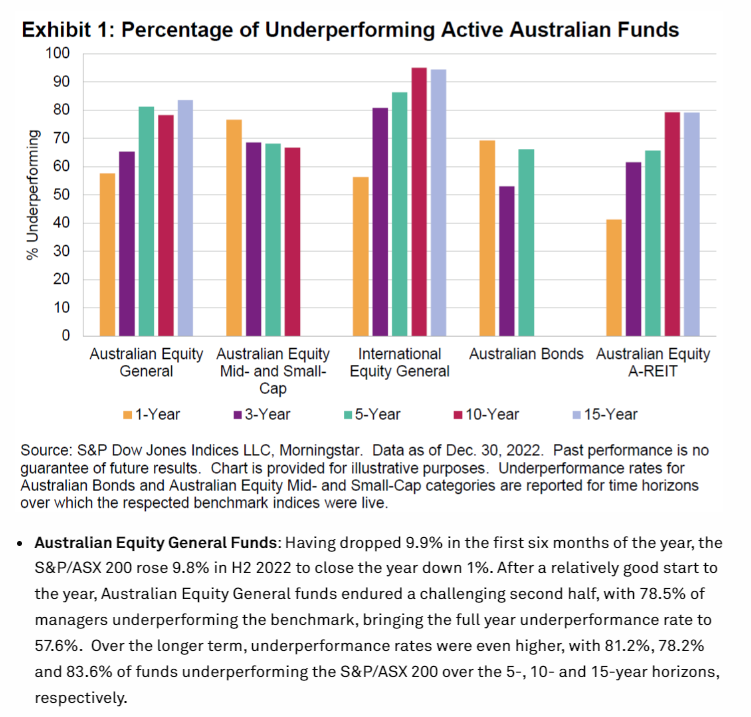

I posted a tweet from a chartist earlier, who was responding to an earlier observation I made about the poor performance of the ASX200 over the last 16 years.

And here's a rebuttal (to the chartist's rebuttal) from Stephen Moriarty, who says any analysis of stock market performance has to include inflation, fees, taxes and volatility etc.

Am I wading into dangerous territory?

That graph comes from the latest SPIVA report.

Market snapshot at 12pm AEDT

By Kate Ainsworth

- ASX 200: -1.5% at 6,965 points

- All Ords : -1.5% at 7,151 points

- Australian dollar: +0.2% at 66.33 US cents

- Nikkei 225: -0.9% at 26,956

-

Brent crude: +1.1% to $US74.52 / barrel

- Spot gold: -0.3% at $US1,913.10 / ounce

- Iron ore: -1.2% to $US130.20 / tonne

Qantas extends COVID travel credits for the last time

By Rhiana Whitson

Qantas and Jetstar customers have been given until December next year to travel using COVID travel credits but must book flights by the end of 2023.

The airline's COVID travel credits were due to expire by the end of this year. Instead, customers have been told they must book flights by the end of this year and travel by December 19 2024.

The company is still holding onto about $800 million worth of unused travel credits.

Flights cancelled by the airline up until the end of September 2021 can get a cash refund instead, the airline says.

The airline’s come under fire from consumer groups and the ACCC for its handling of travel credits.

“We literally had millions of bookings that were cancelled during several waves of lockdowns and border closures,” Qantas Group Chief Customer Officer Markus Svensson said.

“No airline had systems that were designed to manage that in a seamless way and we realise there’s been frustration for some customers as a result,” said Mr Svensson.

“Now that we’re flying again, a huge amount of effort has gone into making it easier to use your credit, from putting 250 specialists into our call centres to building dedicated websites.”

The airline says it won’t be extending the travel expiry date for COVID travel credits again.