The ASX 200 lost 0.75 per cent in value on Friday, taking the week's losses to 1.65 per cent.

The giant supermarkets gained ground today, but the big miners, banks, and energy giants all lost value.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

That's it for the week

By Gareth Hutchens

That's it for the live blog today.

We'll be back on Monday.

Next week, the Bureau of Statistics will release its new unemployment stats on Thursday.

Reserve Bank governor Philip Lowe will be appearing before two parliamentary committees, one on Wednesday and one on Friday.

Take care this weekend.

How major Asian markets are tracking at 4.30pm AEDT

By Gareth Hutchens

- ASX200: -0.76%, to 7,433.7 points (close)

- Hang Seng: -2.06%, to 21,178 points

- Nikkei225: +0.2%, to 27,640.6 points

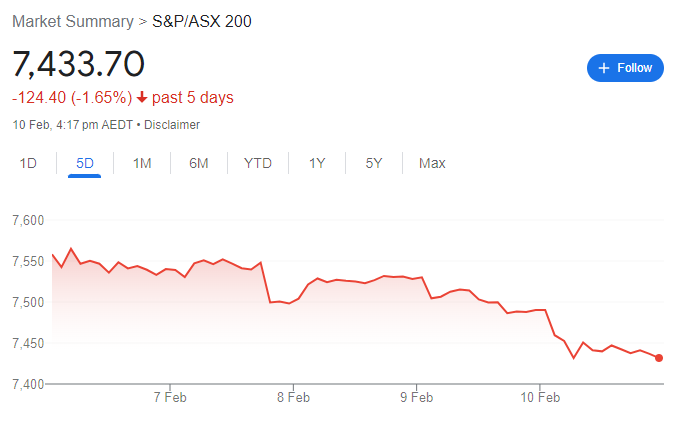

ASX200 over the week

By Gareth Hutchens

It's always good to zoom out slightly.

Here's how the ASX200 index tracked over the week.

It's been a slow grind downwards, shedding 1.65%. It's worst trading week since September.

A question from a reader

By Gareth Hutchens

G’day Gareth, You might recall my question the other day on using GST to curb consumer spending.Interesting to note RBA comments today that interest rises “only curb spending amongst mortgage holders” and that “changes to fiscal policy” (i.e taxes) may be needed. GST hint to the government by RBA ? Phillip

- Phillip

That's a good pick-up Phillip.

I'd like to write something on that topic this weekend.

ASX200 finishes the day down 0.75%

By Gareth Hutchens

With trades looking like they've settled for the day, the ASX200 index will end the session down 0.75%, or 56.6 points, to 7,433.7 points.

For the week, the index lost 1.65% in value.

Trading closes

By Gareth Hutchens

With the clock ticking over 4pm, trading has closed for the week.

A coming decline in GDP growth per person

By Gareth Hutchens

Here's the take from a Rabobank analyst on the RBA's new forecasts.

They say immigration is doing some heavy lifting for the Bank's growth forecasts:

The RBA quarterly Statement on Monetary Policy today also saw the Bank raise its forecasts for core inflation, now 6.25% y-o-y in the year to end-June, up from 5.5%, but then falling back to 4.25% by December (because reasons).

Wages are expected to rise 4% y-o-y by June and peak at 4.25% too, despite a white-hot labour market, despite 1/3 of firms surveyed by the RBA hiking wages by over 5% in Q4 (because reasons).

Those forecasts are based on the RBA overnight cash rate peaking at 3.75% this year then declining to 3% by mid-2025, both of which are open to question at this stage.

Aussie GDP growth is now seen at 1.6% in 2023 and 1.4% in 2024, against population growth of 1.5%, which implies a lot of net immigration, and a slight decline in GDP per capita.

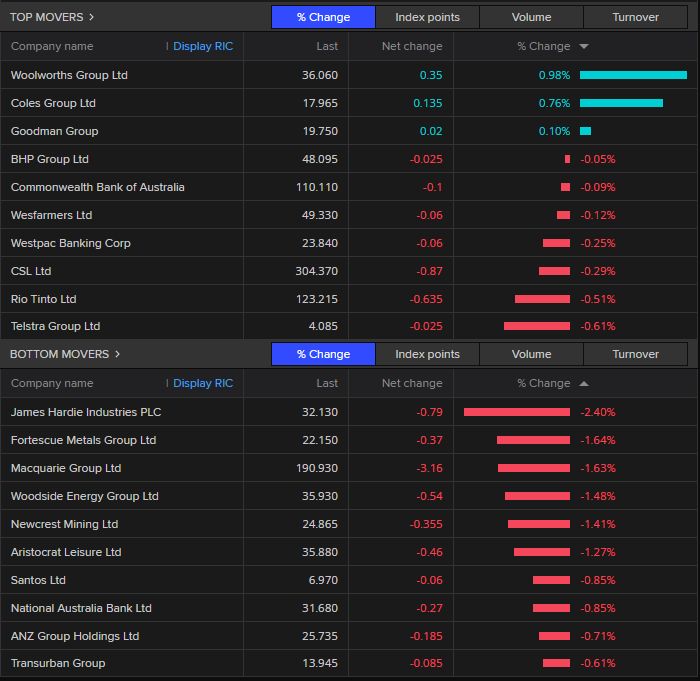

Miners, financials, and energy companies all down

By Gareth Hutchens

Let's take a look at the ASX20.

The ASX20 is an index of the 20 largest companies on Australia's stock exchange.

These companies are household names in Australia (many of them make big political donations to the major parties every year).

Today, only the supermarket giants have seen any gains of note.

The big banks, energy companies, and miners have all posted losses so far.

Adani offloading cheap coal

By Gareth Hutchens

Going back to an earlier post about Adani Group.

According to Reuters, Adani is now offloading coal on the cheap. The report suggests it may be another sign of the pressure the company's under:

Adani Group is offering shipments of coal at a discount, according to people with knowledge of the matter, a sign the embattled conglomerate may be seeking to sell cargoes quickly as its liquidity position comes under increased scrutiny.

The group’s traders are offering to sell several coal shipments from Australia and Indonesia at discounts of about 4% relative to Asia’s price benchmarks, the people said, requesting anonymity to discuss private details. While Adani hasn’t spelled out its motivation for offering discounts and it’s not the only producer doing so, the move suggests the firm is eager to offload the cargoes swiftly, the people said.

An Adani representative declined to immediately comment when reached by phone.

Coal prices have dropped on wavering demand for the fuel, with several suppliers resorting to discounts to find buyers from uncontracted shipments. Asia’s benchmark Newcastle coal futures traded at $231 a ton Thursday and have fallen by about half since touching a record in September.

Adani has coal mines with more than 50 million tonnes of capacity across Indonesia, Australia and India, producing fuel both for sale in global markets and to be used in Adani’s own power stations.

The conglomerate’s cash position entered the spotlight after allegations of fraud by short seller Hindenburg Research sent its shares and bonds tumbling. In a sign that global banks have become more wary of funding Adani’s empire, negotiations over the refinancing of a $500 million bridge loan stalled after the Hindenburg report. That prompted a decision by the group to repay the debt early instead.

Adani has repeatedly denied Hindenburg’s allegations and said the group’s balance sheet is healthy.

Treasurer Jim Chalmers says the RBA's forecasts show the Albanese government's energy plan is working

By Gareth Hutchens

Treasurer Jim Chalmers has jumped on a few lines from the RBA's statement on monetary policy.

The RBA has mentioned the Albanese government's energy plan a few times in its quarterly statement.

Here are the lines:

- Gas prices, which were not affected by government rebates, increased by about 2 per cent in the quarter to be more than 17 per cent higher over the year. Electricity and gas prices are expected to increase further in 2023, largely due to higher wholesale costs recorded over the past year; however, over this year and next, increases in wholesale costs are expected to be dampened by the Australian Government’s Energy Price Relief Plan (page 59).

- Recent announcements from major energy retailers suggest that gas price increases in early 2023 will be larger than expected a few months ago. Later in the forecast period, energy price increases are likely to be smaller than previously assumed, reflecting the expected impact of the Australian Government’s Energy Price Relief Plan (page 70).

- The Australian Government’s Energy Price Relief Plan should limit the extent to which further shocks in global energy prices transmit to domestic retail electricity and gas prices. However, it is possible that the declines in global energy prices and the effects of domestic policy have a smaller impact on domestic energy prices than currently expected, reflecting the complexities of the sector and the costs of and potential for complications in the transition to greater use of renewable energy (page 77).

And this is the reaction from Mr Chalmers:

"The independent Reserve Bank has today confirmed that the Albanese Government’s energy plan is helping moderate inflation in our economy," he said.

"The RBA says our energy plan will do exactly what the economy needs it to do and exactly what Australian households and businesses need it to do: take some of the sting out of high power prices."

ASX on track for worst week in months

By Gareth Hutchens

For the week, it looks like the ASX200 index is currently down around 1.5 per cent, which means it's on track for its worst week since late September.

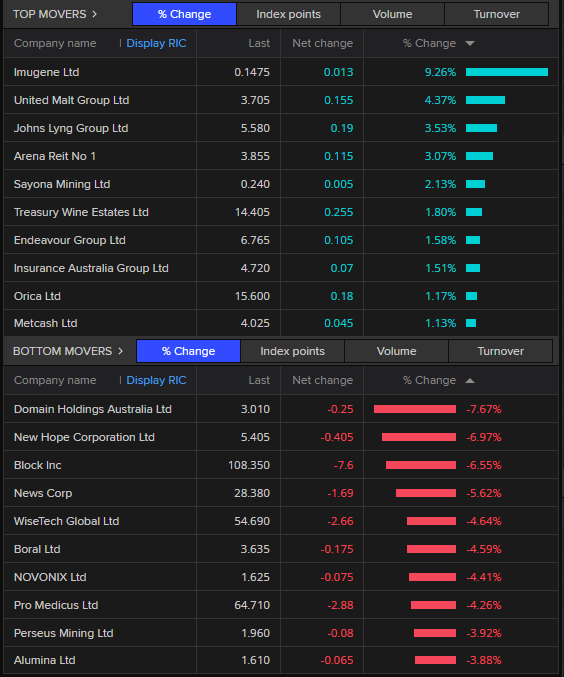

The top and bottom movers

By Gareth Hutchens

As things stand, the biggest individual losers on the ASX include the property group Domain Holdings (-7.6%) and News Corp (-5.6%).

A shock to the system

By Gareth Hutchens

If only monetary policy could do anything about supply shocks.

Why the RBA has become more hawkish

By Gareth Hutchens

David Bassanese, the chief economist at betashares, says the RBA's upward revision to its near-term underlying inflation forecasts helps to explain why the RBA board has come back from the summer break in a hawkish mood.

According to Mr Bassanese:

In the February 2023 Statement on Monetary Policy, the RBA has revised up its estimate of annual [underlying] inflation in June 2023 from 5.5% to 6.25%.

The RBA now expects [underlying] inflation to end the year at 4.25%, up from 3.75% expected only three months ago.

At the same time, while the RBA has conceded that supply-side factors likely account for around 50% to 75% of the recent increase in inflation, it notes that demand factors have also played a role.

Given the tight labour market and already rising wage growth, the RBA is concerned that even a potentially transitory supply driven lift in prices could become entrenched as higher sustained inflation - through a rise in inflation expectations and a consequent lift in wage and price demands.

Given the ongoing war in Ukraine and the climate change driven change in weather patterns, there’s no guarantee that supply pressure on inflation will subside anytime soon.

At the same time, local consumer spending has remained fairly resilient over the past year in the face of interest rate increases – making it easier for business to pass on supply driven cost increases through to final prices.

And he has this to say about the consequences of relying solely on rate rises to tackle inflation:

The resilience of consumer spending (so far at least) reflects the tight labour market, a still substantial household saving buffer built up during the pandemic – and perhaps more controversially – the fact that rising interest rates have less direct effect on the two thirds of households that don’t have a mortgage.

The incidence of tighter monetary policy is narrowly directed to a sub-set of households with heavy debt burdens.

For a broader effort in slowing economic growth, more heavy lifting would need to come from fiscal policy, though so far it’s been missing in action.

So, a significant majority of the inflation is coming from supply-side factors, which monetary policy can't influence.

And these rising interest rates are only directly impacting the narrow subset of households with mortgages.

When will the rate rises end?

By Gareth Hutchens

My colleague Michael Janda has taken a look at the RBA's latest economic forecasts.

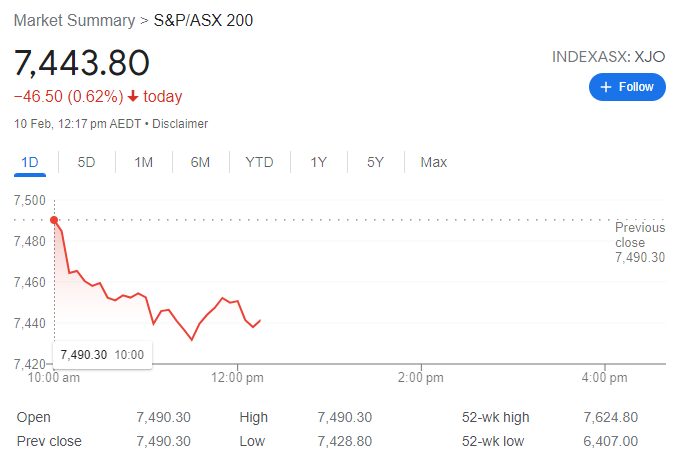

ASX down 0.6 per cent

By Gareth Hutchens

We're a little over a third of the way through today's trading session, and the index is down 46 points.

More rate hikes, no wages blow-out, and unemployment to rise this year

By Gareth Hutchens

Looking at the RBA's SOMP, it looks like Australians can expect at least two more interest rate increases.

The cash rate target is currently 3.35%, after it was lifted by 25 basis points on Tuesday.

The bank appears confident that global inflation has peak and is on the way down.

But a key uncertainty for the bank is how those global trends will play out in Australia.

Falling costs

According to the bank, much depends on how quickly local companies choose to pass on the reduction in costs that some are starting to see in their global supply chains.

"Given the importance of avoiding a price-wage spiral, the board will continue to play close attention to both the price-setting behaviour of firms and the evolution of labour costs in the period ahead,” the SOMP says.

"It will be closely monitoring how quickly declines in global costs are passed through to prices by businesses in Australia."

Wages

The RBA has marginally increased its pay growth forecasts, expecting the Bureau of Statistics’s Wage Price Index to show annual growth a little above 4 per cent by June this year.

Headline inflation is currently 7.8 per cent.

But it thinks wages growth will stabilise around 4 per cent, with its business liaison program indicating that labour shortages in some industries are easing.

Unemployment

The RBA thinks the unemployment rate has probably troughed around 3.5 per cent.

It thinks it will rise to 3.8 per cent by the end of this year and 4.4 per cent by the middle of 2025.

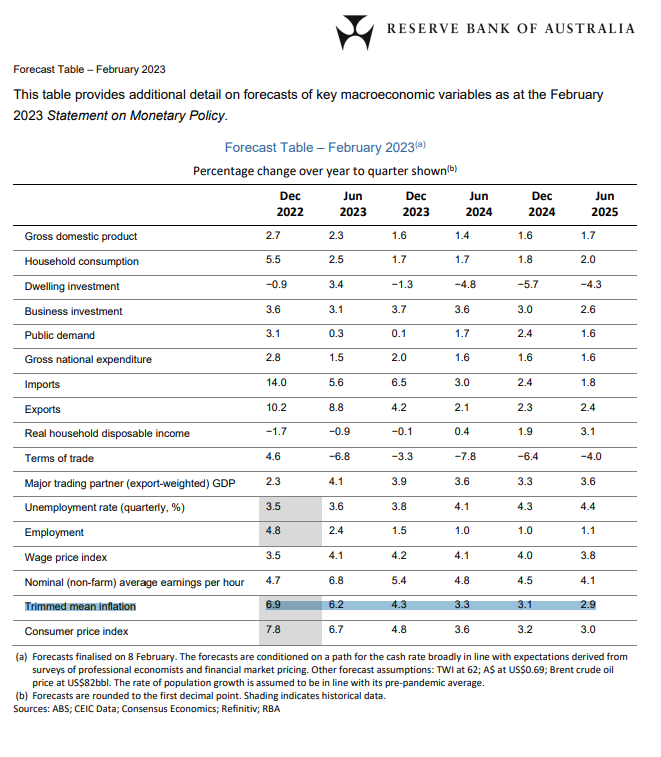

RBA's new forecasts

By Gareth Hutchens

The RBA's latest quarterly Statement on Monetary Policy has been released in the last 10 minutes.

It's forecasting underlying inflation to fall from 6.9 per cent to 6.2 per cent by the end of the June quarter.

Here are its brand new forecasts:

News Corp will shed 1,250 staff this year, a 5% headcount reduction

By Gareth Hutchens

Yesterday, News Corp told its staff that it was kicking off a cost-cutting drive.

This morning, it provided these details to the ASX.

After missed estimates for second-quarter earnings due to weakness in its news and digital real estate businesses, its cost cutting initiatives will include:

-

An expected 5% headcount reduction, or around 1,250 positions this calendar year.

- The Company expects this to generate an annualized cost savings of at least $130 million.

Adani faces fresh risk as MSCI examines free float of its stocks

By Gareth Hutchens

This story from Reuters has another update on Adani Group.

The Group is beset with problems and they seem to be getting worse.

This story is has to do with the free float status of some of the groups securities.

"Free float" is defined as the proportion of outstanding shares considered available for purchase in public equity markets by international investors.

India's Adani Group faced fresh concerns on Thursday after financial index provider MSCI said it was reviewing the free float designation of some of its companies' securities.

Billionaire Gautam Adani has seen some $110 billion wiped off the value of seven firms in the group he founded after U.S. short seller Hindenburg Research accused it of improper use of offshore tax havens and stock manipulation.

The Adani Group, which has denied any wrongdoing, did not respond to a Reuters request for comment on Thursday.

Analysts say a change in free float status could affect the weightings of MSCI index constituents, possibly triggering a shift by funds as many investments are aligned to such indexes.

"Some investors follow MSCI index as a gauge," said Neeraj Dewan, director at Quantum Securities. "Depending on the outcome of the MSCI review, we could see more pressure on select Adani group stocks."

The world's largest stock investor, Norway's sovereign wealth fund, said on Thursday it had sold out of the Adani Group since the start of the year, unloading stakes in three firms worth just over $200 million.

This story goes on.

MSCI has determined that the characteristics of certain investors have sufficient uncertainty that they should no longer be designated as free float," U.S.-based MSCI said.

"This determination has triggered a free float review of the Adani Group securities," it added in a statement.

In response to Thursday's MSCI statement, Hindenburg Research founder Nathan Anderson wrote on Twitter: "We view this as validation of our findings".