The Reserve Bank has increased the cash rate to 4.1 per cent at its June meeting — the highest rate since April 2012 — citing "persistent" and "ongoing" high inflation.

In response, the Australian share market finished 1.2 per cent lower, with all but one sector in the red, while Westpac became the first big bank to pass on the RBA's rate rise to its customers.

Look back on the day's financial news and insights from our specialist business reporters on our blog.

Disclaimer: This blog is not intended as investment advice.

Key events

Live updates

How the market ended after a day of trade

By Kate Ainsworth

With the trading day done for another day, here's how the markets looked at 4:50pm AEST:

- ASX 200: -1.2% to 7,129 points (live figures below)

- All Ordinaries: -1.1% to 7,319 points

- Australian dollar: +0.7 to 66.63 US cents

- Nikkei: +0.9% to 32,506 points

- Hang Seng: -0.2% to 19,077 points

- Shanghai: -1.1% to 3,195 points

- Dow Jones: -0.6% to 33,562 points

- S&P 500: -0.2% to 4,274 points

- Nasdaq: -0.1% to 13,229 points

- FTSE: -0.1% to 7,600 points

- Spot gold: -0.1 at $US1,959/ounce

- Brent crude: -0.9% to $US76.02/barrel

- Iron ore: $US104.65 a tonne

- Bitcoin: +0.5% to $US25,778

This is where we'll leave today's blog

By Kate Ainsworth

Thanks so much for your company throughout today.

If you're wanting to read more about the interest rate decision today, my colleague Michael Janda has pulled together a very thorough story which you can read here.

Gareth and I were completely overwhelmed by your comments today, and we read them all and tried to answer as many as we could.

But there is an overarching theme, which is many of you are really hurting right now, and are worried about what today's decision by the RBA is going to mean for you.

If you're experiencing financial distress, there are a number of support services available for you to access.

- National Debt Helpline: 1800 007 007

- Mob Strong Debt Help: 1800 808 488

- ASIC's Moneysmart website

- Australian Financial Complaints Authority

- Find a financial counsellor

- Lifeline: 13 11 14

- Beyond Blue: 1300 224 636

(This is general information only, and if you require financial advice, please seek out a professional.)

We'll be back tomorrow with the blog, but until then, look after yourselves and those around you.

Best and worst performers on the ASX today

By Kate Ainsworth

While we've been focused on the interest rate decision from the RBA this afternoon, the ASX finished lower today, down 1.2% — completely reversing its gains from yesterday.

The top five performers for the day were:

- Whitehaven Coal +4.4%

- New Hope Corporation +3.5%

- Pilbara Minerals +1.9%

- A2 Milk Company +1.9%

- AGL Energy +1.8%

And the worst performers of the day were:

- ASX Ltd -10.2%

- BrainChip Holdings -8.7%

- Domain Holdings -5.6%

- Imugene -4.8%

- Nanosonics -4.7%

All sectors finished the day quite heavily in the red, with utilities the only gain, up 0.6%.

Another perspective

By Gareth Hutchens

Dr Ken Henry, who was Treasury Secretary from 2001 to 2011, also gave an important speech recently about the structural changes that have occurred in Australia's economy in recent decades.

He's also pointing out that things need to change.

Too much power in too few hands

By Gareth Hutchens

Didn't the RBA foresee this crisis in the making years ago? How can we address the now entrenched major structural crisis in housing in this country when the RBA as a matter of policy, destroys any significant level of economic activity as soon as it appears? Why do certain key sectors maintain record profit levels while unleashing so many social evils on Australia? We need to ask ourselves, cui bono? (who benefits?).

- Substitute

The economics Professor Ross Garnaut gave an important speech about this recently.

He said the structure of Australia's economy had changed so much in the 21st century, and there were too many industries dominated by too few firms, that it meant monetary policy was having perverse impacts on peoples' lives.

As an example, he pointed out how rate increases were pushing rents and electricity prices higher, which was contributing to inflation.

When people like Professor Garnaut are sounding the alarm, it should be time to listen.

Expect to see 'forced and panicky selling' and falling house prices, analyst says

By Kate Ainsworth

SQM Research, which does lots of property and housing-focused research, has put out an interesting note about the impact of today's rate announcement on the housing market.

Last year SQM Research's managing director Louis Christopher published a "Housing Boom and Bust Report", which examined what the housing market might look like in each of the capital cities in the wake of ongoing inflation and rate rises.

At the time, he looked at four possible scenarios, with variations of the cash rate, inflation peaks and the unemployment rate.

Now he says given today's rise, there is only one scenario left, and it means we can expect to see more people selling their homes — and a fall in house prices from the second half of the year.

"While our numbers on distressed listings today remain largely benign (except for Tasmania) we can now expect distressed activity to rise based on a new round of forced and panicky selling starting sometime the 2nd half of this year," he said.

"This will particularly be the case if unemployment rises towards 5%. Naturally, the higher the unemployment rate, the more forced selling we will see.

"So, in our view, market participants need to be prepared for a new round of housing price falls starting in the second half of 2023.

"The price falls may not immediately occur, but the expectation is the spring selling season will be a tough one for sellers."

But if you're a prospective buyer, Mr Christopher says to exercise some caution.

"Buyers need to be very cautious in this environment, especially for regional areas which were already weakening," he notes.

"But I doubt our larger cities will be spared much given the massive mortgage debts outstanding.

"As a potential buyer, spending some time on the sidelines, researching the market, isn't a bad idea, right now.

"All this is my opinion and forecasting, of course. No one knows the future and I have been wrong in the past indeed I'm partially wrong now as I expected the RBA to peak the cash rate at no more than 4%."

The rate hikes were hard to imagine

By Gareth Hutchens

We will no doubt have those ‘you shouldn’t have bought in Sydney, and should have known the rates would increase’ comments..We live in Sydney, where our families are and where we have built our careers - when we bought only a few years ago it cost the same to rent as to buy. It would have been unwise to continue throwing money away than paying off a home for our family, and yes we knew interest rates wouldn’t be this low forever but 1.84 to 5.75 I doubt anyone could have predicted this.

- Rachel

Rate increases and buffers

By Gareth Hutchens

Taking into account the RBA's advice about interest rates, I took out a mortgage in Oct 2019. I understood APRA's 3% buffer, but I really had no comprehension of how significant interest rate rises would be. It's not just a now problem - it's affecting my ability to do much needed maintenance to the property, to pay off the mortgage before I retire, and to make extra contributions to my super. Are we really doing enough to ensure applicants understand the implications of taking out a mortgage?

- Jo

This is why, whether Philip Lowe likes it or not, his "rates will stay low until 2024" forward guidance will be part of his legacy.

Those comments were made in the midst of an unprecedented economic crisis when the future was more unknowable that it usually is.

But it's what people will remember, especially when major financial decisions were based on them.

Westpac are the first of the big banks to move on rate rise

By Kate Ainsworth

Sorry for jinxing it before — Westpac have just become the first bank to move on today's interest rate change.

They will increase interest rates for its new and existing variable home loan customers by 0.25% from June 20.

"We understand interest rate increases put more pressure on household budgets. The majority of our customers are managing okay, but we know with each rate change it's getting more challenging," said Westpac Chief Executive Consumer and Business Banking, Chris de Bruin.

"We're reaching out to some customers who may need additional support and have competitive rates available for those rolling off fixed loans to make the change easier.

"For customers in financial difficulty we are here to help and encourage them to call us early if they're concerned."

Westpac is also offering a special term deposit offer of 4.5% for savers, for between 12 to 23 months from June 9.

The bank hasn't announced any changes to its other savings rates, but says they are under review.

What will it take to get back to a world in which rates are normalised around 4-5%?

By Gareth Hutchens

A cash rate of 4.1% is still quite low, it's just that many have become used to "emergency" levels. A reasonable interest payment must be made to those who accumulated savings via productive work. That's a source of capital available to others for investment.

- Scott

Interest rates for the last fifteen years have been the lowest in human history. This is very bad for retirees and investors and why home buyers paid highly inflated prices for their homes. Interest rates need to be higher than inflation for an economy to function properly. The RBA got it totally wrong keeping interest rates below inflation rates, hence the current mess. Can we get back to 3% inflation and 5% interest rates . I don't think so. Therefore a lot more pain for mortgage holders for many years to come.

- Graham W

The feeling is pervasive

By Gareth Hutchens

I'm a professional, earning close to 100k, but we are a single income household at present. ALL of my income is going to the house, bills and groceries. I feel sick to my stomach as we we're already sailing close to the wind in terms of living costs. I am working a full load and as a teacher unpaid work on top of this. I haven't got the time to "get a second job". At this rate, I will have no chance of having a family or achieving any kind of happiness as I will be trapped in the cycle of working to survive. I also feel for those who are earning far less than I am, as I've been there and know that they will be feeling the effects of this really hard.

- TEACH

I'm so sorry. We hear you.

We are getting a lot of comments along similar lines and it's hard to know what to do with them.

Inflation expectations

By Gareth Hutchens

How does the RBA determine how entrenched expectations of high inflation are? Anecdotally, a lot of people seem to feel that's pretty entrenched.

- Steven

Hi Steven,

You can find that information here.

Scroll down to the subhead called "Inflation and Inflation Expectations."

Then click on "Inflation Expectations - G3."

That's an excel spreadsheet that shows you the latest inflation expectations from consumers, businesses, union officials, and market economists.

It tells you what they expect inflation to be in 3 months, 1 year, and 2 years.

Everyone's in a different situation

By Gareth Hutchens

I'm a Gen Xer with no mortgage and money in the bank. Yes, the interest rates are hurting my investments, but for the first time in my life I'm actually getting decent bank interest. For those of us without overpriced Sydney/Melbourne mortgages these hikes aren't all negative

- The other side

Rates increases impact people differently, depending on your life stage and financial circumstances.

What to do about home ownership?

By Gareth Hutchens

I understand that these interest rates are causing pain to a lot of mortgage holders, but I just find it a little frustrating that interest rate rises are getting so much attention and there are so many stories about the hardship being caused now that rates are rising. But when rates were constantly dropping, leading to the housing market booming at double digits every year while wages (and housing savings!) remained stagnant, nobody was pressuring the RBA and saying they were bad at their jobs or heads should roll. I know hindsight is 20/20, but I'm just wondering if there's anything the Fed and State governments should have been doing before now to try and stabilize the housing market, so that rates never got to such historic lows. Would love to get Gareth's input if his willing to wade into the political weeds!

- Matt

I think one of the really bad policy errors of recent decades was the decision to introduce "landlordism" to Australia, where hundreds of thousands of households have become private landlords, and they're providing shelter for so many other Australians.

There's no reason why governments can't be more involved in providing housing for people.

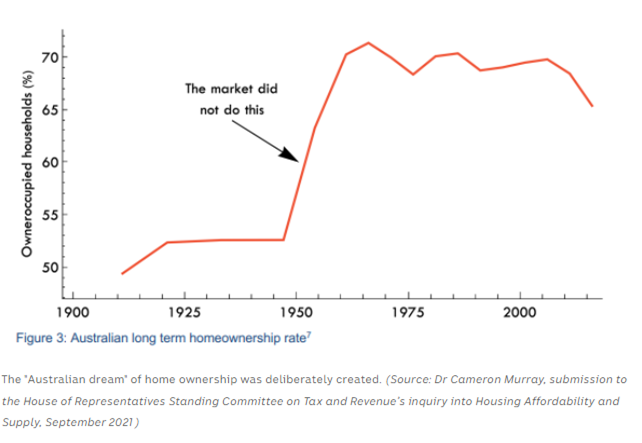

This graph below from the housing expert, Dr Cameron Murray, is really instructive. It shows how Australian governments in the post-war era deliberated created the "Australian dream" of widespread home ownership.

But in recent decades, that type of approach to governing in Australia has disappeared.

And when you combine it with the policy settings of the inflation-targeting era, which has coincided with a long-term decline in interest rates, and banks willing to lend far more to people, it's been a recipe for what we're seeing now - a huge build up of private debt, house prices worth 10x your annual income, and falling rates of home ownership among younger generations.

It makes one think fondly of cheap homes and Holden cars.

I don't think so?

By Gareth Hutchens

John Maynard Keynes - is he not the one who was the "father" of getting government into outsourcing projects and function to private enterprise? Look where that has got us? Now we have corrupted governments being dictated to via corporate donations, leading to policy friendly outcomes to said corporations. Little to no competition as a result and no reigning in of obscene profiteering. When your fortnightly grocery bill goes from approx $300 to $600 in the space of 18mths that's corporate gouging at its worst. Unfortunately we have to eat so upping interest rates does nothing to fix that inflationary problem

- Bob

Don't you mean Friedrich Hayek and Milton Friedman?

They were far more suspicious of government. They (and their colleagues in the Mont Pelerin Society) spent decades arguing for smaller government, and saying why government services would be better delivered by private enterprise.

Keynes was the "father" of macroeconomics, not neoliberalism.

Have the banks passed on the rate rise?

By Kate Ainsworth

Have the banks passed on the rise yet?

- Gordon from Canberra

Hi Gordon, I'm not Gareth but I can answer this for you.

None of the big four banks have passed on the increase juuuust yet — anecdotally, I've noticed they've been taking longer and longer to announce the changes the more rate rises we've had.

After last month's meeting, it took the big four banks two days before they announced their decision, with NAB moving first, followed by ANZ.

Meanwhile if you want to suss out what your mortgage repayments might look like if your bank increases their interest rates, scroll down the blog for a handy calculator (or to save your thumb the pain, I've also linked it here).

Interest rates and inflation

By Gareth Hutchens

To add to a previous question (as well as all the similar questions of others): Is the RBA even capable of determining whether or not interest rates is the right tool to use? Is there ANY point where they say, "actually, this obviously isn't working, the government needs to tackle this one"?

- Matt

This is a really important question.

Whenever you ask a question like this - could things be done differently? - you have to be prepared for some economists to jump on you.

They'll be very happy to put you back in your place, to tell you that this is the best way of doing things, there's a big literature on this, you clearly don't know what you're talking about, etc etc.

But why can't we ask?

Phil Lowe even told senators recently that there are obviously alternative ways of doing things. He said governments could increase taxes to combat inflation, as one example, but they'd obviously have to be prepared to deal with the political fallout.

The truth is, the current way of doing things has suited the major political parties for decades, because they can blame the RBA for causing you pain. It's not their fault. They're not in control of monetary policy!

Right now, the RBA's job is to manage inflation with monetary policy, so that's what it tries to do.

But can you see this type of system lasting forever?

As interest rates rise again, some are turning to multiple jobs to stay on top of bills

By Kate Ainsworth

Before today's rate rise, one small business owner in Torquay, south of Geelong has had to pick up hospitality shifts to make ends meet and pay off her mortgage.

Mia De Rauch bought her home with her partner 18 months ago, after the RBA infamously indicated that rates would likely not rise until 2024.

In the past year, her mortgage repayments have risen by $20,000, while her utility bills have jumped by about $400.

In addition to her full time work as a videographer, she has started working between 10 to 15 hours a week in hospitality to keep afloat.

"I'm now sitting here, stressed, thinking I have no more time to give," she said.

"I've cut back on non-essentials, like streaming accounts and brunch.

"I feel tired, I feel like there's a lot going on.

"I'm not getting to spend much time with my family."

You can read more of this story from Shannon Schubert below:

Savers are benefiting

By Gareth Hutchens

What will this mean for savings accounts? I'm trying to save for my first home but rent prices keep going up AND house prices keep going up. Do you have any advice on how I can maximise my savings or get into investing?

- Jane

One of the perverse outcomes of this critical rate hiking cycle is that, for the first time in years, savers are finally receiving some interest on their accumulated savings.

So they're finally getting something. It's a shame it only took a inflationary crisis to make it happen.

In your situation, those extra savings could be used to pay for your rent (if you're renting), which helps in a way, but not in the way you'd like.

We can't offer any financial advice I'm sorry. If I knew what I was doing, I would have bought Gamestop stocks back in 2020 and then sold them when Jim Cramer started showing some interest.

Some of your thoughts on today's rate rise

By Kate Ainsworth

Judging from our comments alone, a lot of people are hurting right now, and this rate increase announced this afternoon is only going to add to the pain.

Is raising the interest rate the only tool they have????

I feel sick. I can't afford this.

- Andy

Lots of people haven't come off their fixed mortgage rates yet. They're going to hurt when all of these cumulative rises hit at once....

- Robyn

So what I can glean from yet another rate rise, is that the market are better economists than the reserve bank. Their forecasts are certainly more accurate and reliable

-Helena

Economists predict this, economists predict that. But one thing is a constant - everything keeps going up.

- Andrew

What is going to take to stop these increases? Surely people can't take too much more.

- Home

Why is the RBA hellbent on destroying Australian's lives. Enough is enough already. If we go into recession heads should roll.

- Net

Interest rate rises don't seem to be working.

Also, none of this seems like rocket science. How do they keep getting it so wrong.- Nathan

Oh...not my day at all...the rates are catching up with my overpaying

- Natty

How are one third of the population, ie mortgage holders, expected to continually deal with these rises? Is there no other way to slow inflation? It seems to me this is not working, and yet we continue to be punished for owning a home!

- Infuriated home owner