Wall Street and the ASX bounced upwards as US President Joe Biden reassures his citizens that "America will not default". Meanwhile, jobs data is out in Australia. Find it how it unfolded on our specialist business and economics blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Here's where we ended up at 4:30pm AEST

By Emilia Terzon

- ASX 200: +0.5% to 7,236 points

- AUD: 66.60 US cents

- On Wall Street: Dow +1.24%, S&P 500 +1.2%, Nasdaq +1.3%

- In Europe: FTSE 100 -0.3%, Stoxx 50 -0.2%, DAX +0.3%

- Spot gold: 0.4% at $US1,985.70/ounce

- Brent crude: +2.5% at $US76.75/barrel

- Iron ore: $US108.10 a tonne

- Bitcoin: +1.7% at $US27,442

ASX closes up after another big day of data

By Emilia Terzon

The ASX 200 closed up 0.5 per cent, with the All Ords up similar.

The momentum picked up after the release of data at 11:30am AEST showing the unemployment rate has picked up very slightly from one of its lowest rates in years, to 3.7 per cent.

But after that excited investors, there was a bit of a cruise in the afternoon and an easing of the brakes.

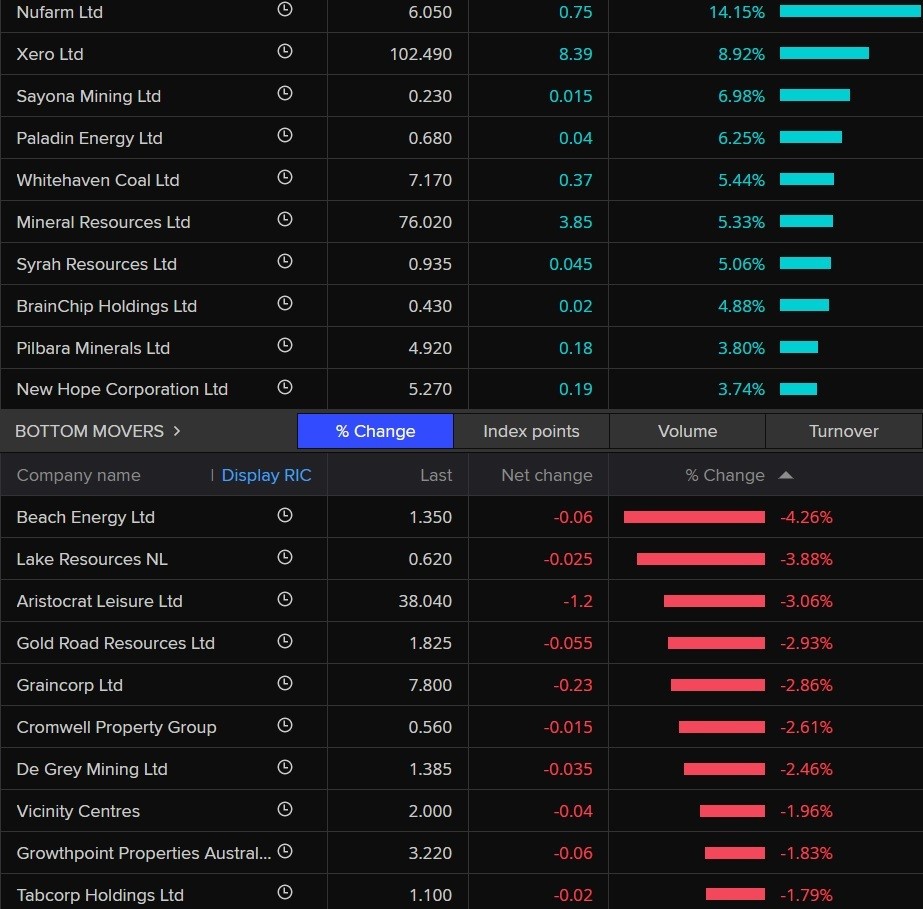

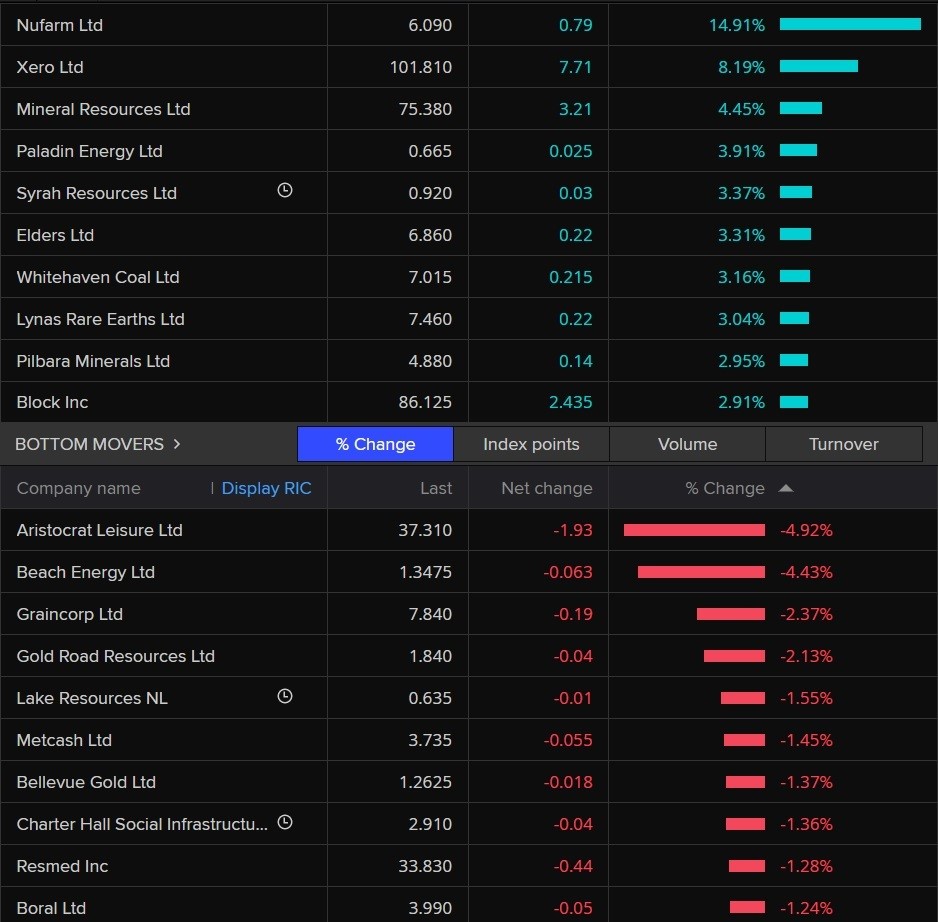

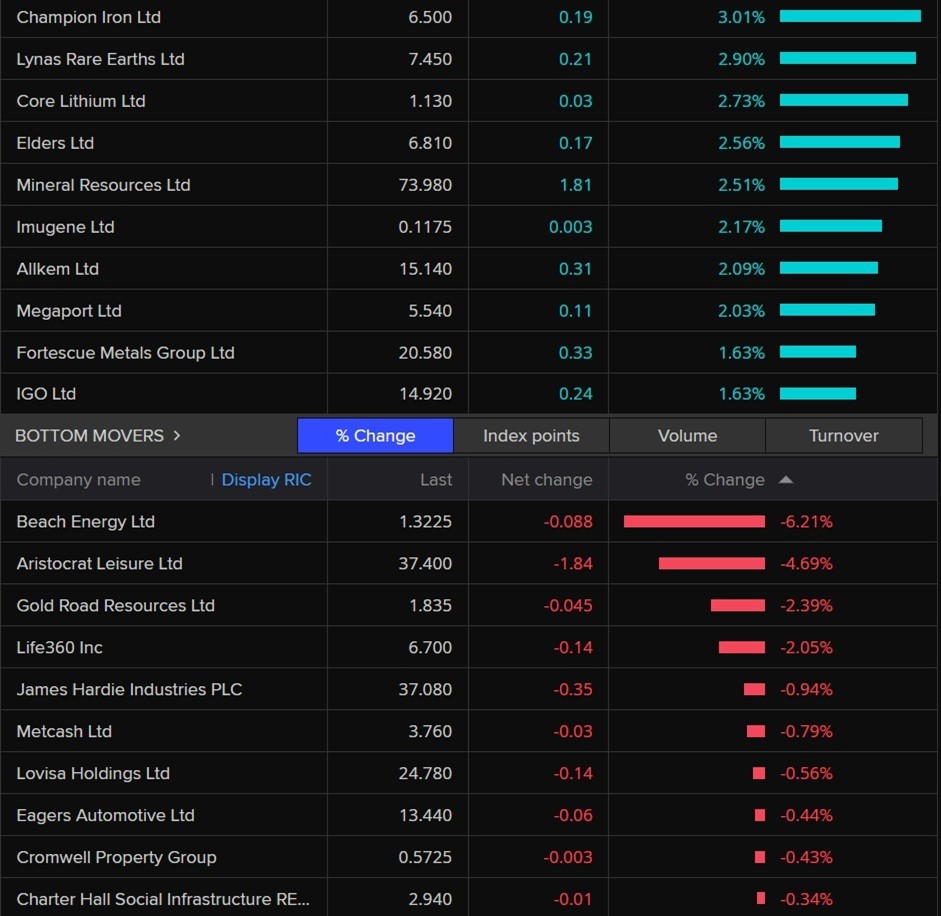

Among individual ASX 200 stocks, global crop protection and seed technology company Nufarm jumped 14% and was the biggest gainer on the benchmark, after it reported an increase in its underlying net profit after tax for half-year.

Beach Energy lost out, after the oil and gas explorer warned of delays in constructing its Waitsia Gas plant.

We'll be back here tomorrow!

Hope remains that Jenny Craig Australia won't go under

By Emilia Terzon

The administrators of the local wing of weight loss icon Jenny Craig are trying to find a new buyer for its operations here in Australia and NZ.

The US company announced earlier this month that its closing its stores in the US, and moving to an online model.

The icon of weight loss has been battling competition from other fitness franchises, and even weight loss drugs.

Its issues plunged its operations in Australia and NZ into doubt.

It has 91 centres across both markets.

Its administrators FTI say they met with creditors today, but didn't reveal how many there are or the extent of the debt.

But they did say they're hoping to find a buyer to save it.

“The sale process is well progressed and we are working with a number of parties who are interested in taking the

businesses forward," administrator Vaughan Strawbridge said.

"We are seeking to achieve an outcome quickly, which would provide certainty to our customers and staff about securing the future of the business."

#ICMYI PwC scandal shines light on industry practices

By Emilia Terzon

The PwC tax scandal is focusing attention on the consulting industry.

What implications could it have for the rest of the Big 4 firms?

The host of ABC's The Business Kathryn Robinson spoke to two industry expects about this ongoing saga.

What sectors are showing a rise in unemployment?

By Michael Janda

What sectors are showing an uplift in unemployment - retail, hospitality. Or across the board?

- Miriam moloney

Short answer, we don't know yet.

The ABS will publish the detailed labour force data for April on Thursday next week, which includes industry employment breakdowns.

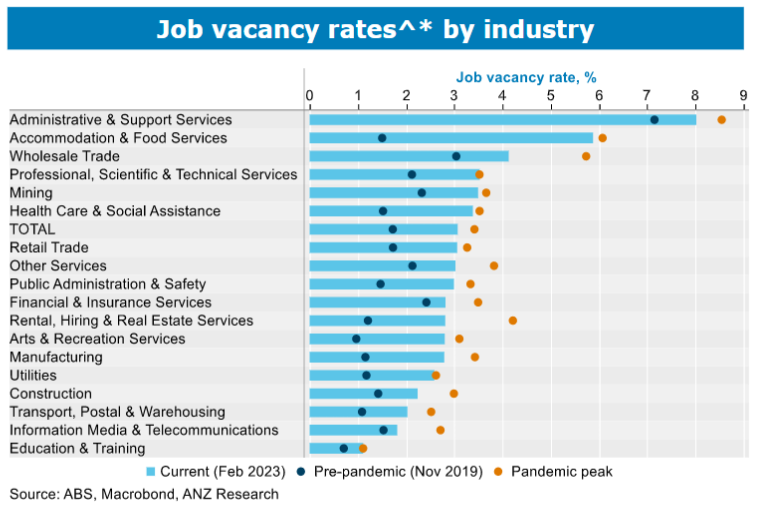

However, this chart from an ANZ economics report earlier this month gives some idea of the trends based on job vacancies.

Most industries are off from their peak hiring levels, but all are above pre-pandemic demand for labour (although, it's again worth remembering Australia was flirting with recession immediately prior to the pandemic).

COVID population stall behind a lot of the unemployment fall

By Michael Janda

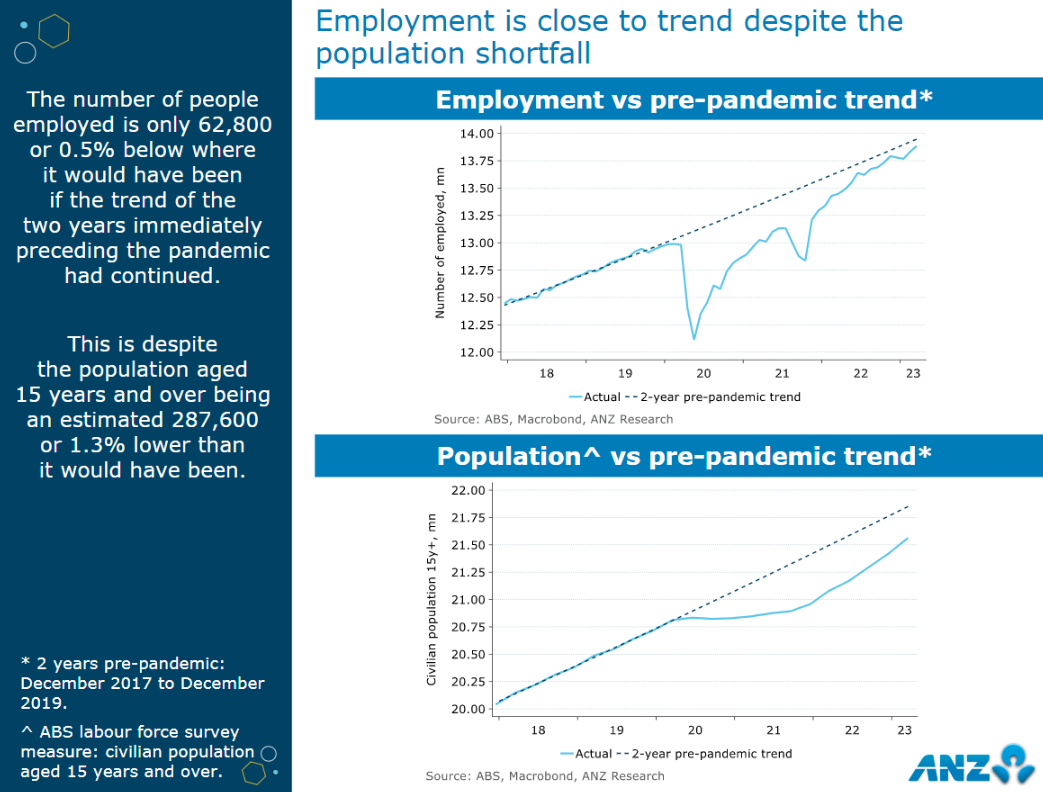

A really interesting graph from ANZ economists Catherine Birch and Madeline Dunk from earlier this month.

Basically, while the number of jobs created is back close to where it could have been expected to be if the pandemic hadn't happened, the population is still much smaller, despite last year's record net migration numbers.

"A likely record in net overseas migration in 2022 hasn't put much of a dent in unfilled labour demand," they wrote.

"This is because migrants not only add to supply of workers, they also add to the demand side. But higher interest rates are intended to slow demand growth, making it easier for supply to catch up."

Once again, Gareth Hutchens has also written about this topic. Clearly, the same forces can also work in reverse.

ANZ: Jobs data 'not a disaster' but will continue to slow

By Emilia Terzon

ANZ senior economist Adelaide Timbrell spoke to our business reporter Sue Lannin a short time ago.

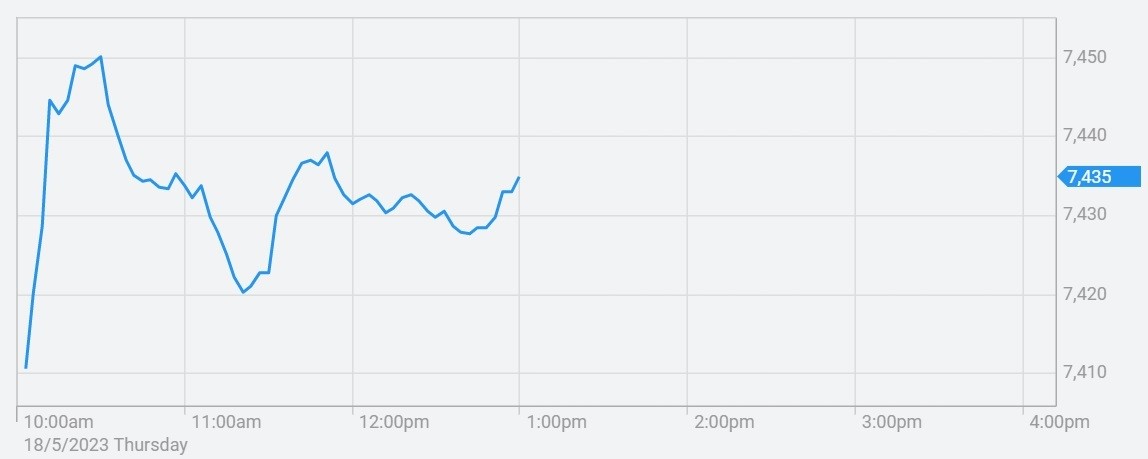

How the ASX reacted to the jobs data

By Emilia Terzon

If you take a look at this graph, you can see investors in the Australian sharemarket are feeling positive about the jobs data.

It went up noticeably as the data was released at 11:30am AEST.

So why would investors be feeling optimistic about a higher than expected uptick in Australia's unemployment rate?

Well, to paraphrase my colleague Michael Janda:

This is only one month's number, and the RBA would want to see more evidence that labour demand is slowing before totally backing away from further rate increases, but this data would reassure them that the rate rises they've already implemented are having an effect.

So we can only summise the ASX is also taking this data as a possible sign that turbulent times are over... for now.

Meanwhile, on other stocks today.

We have iron ore and lithium stocks still performing well, plus the financial sector index is pushing the ASX 200 up too.

The IT index was the biggest gainer with 3%. That is as the tech-heavy index the Nasdaq soared on Wall Street, amid optimism there that the US will find a path out of its debt woes.

Among individual ASX 200 stocks, global crop protection and seed technology company Nufarm jumped 14% and was the biggest gainer on the benchmark by lunchtime, after it reported an increase in its underlying net profit after tax for half-year.

Beach Energy is losing out, after the oil and gas explorer warned of delays in constructing its Waitsia Gas plant.

Is it unusual that unemployment has remained low in the face of surging rates?

By Michael Janda

Hey Michael, is it unusual that unemployment is so slow still when the RBA has really aggressively hiked interest rates in the past year? My basic high school economics memory from back in the 90s tells me they have an inverse relationship but that was a while ago! Thanks

- Paul

Great question Paul, like so many of the others that have come in. What a switched on audience this blog has!

It's unusual that unemployment is this low, full stop.

We haven't had unemployment below 4% since the early to mid 1970s, which was after governments started neoliberal, free market economic principles that came with a very different definition of full employment from the Keynesian era (the NAIRU, see posts below).

Is it unusual that unemployment hasn't risen more quickly in response to rising interest rates?

Internationally, no. Many other developed economies are still seeing strong labour markets after even larger interest rate rises than what we've seen.

NZ is a great example. Its central bank started hiking about half a year before the RBA, its cash rate is now 5.25%, house prices are down about 17% from their peaks and still falling, its economy contracted -0.6% in the December quarter (so there's a good chance it's already in technical recession) … and yet its unemployment rate has only edged up from a low of 3.2% last year to 3.4%.

The reason? Unemployment is a lagging indicator for the economy.

When there's a boom, hiring extra workers is usually one of the last things businesses do to cope with growing demand. Likewise, in a bust, shedding workers is not generally the first cost-cutting measure managers go for.

After all, redundancies are expensive and lay-offs are not only traumatic for those who lose their jobs but often for the whole enterprise.

We also know that rate rises take time to have a slowing effect on the economy more generally, with the lag often considered to be a year or more.

Australia only started raising rates in May last year, so it would be little surprise if the economy is only starting to slow now.

For more on the changing ideas around full employment, again, Gareth Hutchens has written some great articles.

Here's where we are sitting at 1pm AEST

By Emilia Terzon

- ASX 200: +0.6% to 7,244 points

- AUD: 66.60 US cents

- On Wall Street: Dow +1.24%, S&P 500 +1.2%, Nasdaq +1.3%

- In Europe: FTSE 100 -0.3%, Stoxx 50 -0.2%, DAX +0.3%

- Spot gold: 0.4% at $US1,985.70/ounce

- Brent crude: +2.5% at $US76.75/barrel

- Iron ore: $US108.10 a tonne

- Bitcoin: +1.7% at $US27,442

What does the latest jobs data mean for interest rates?

By Michael Janda

What does todays results mean for home owners and potential increase in interest rates?

- Ashleigh

Hi Ashleigh, you've asked the question that's on a lot of people's minds right now.

If you're a borrower then it's good news (as long as you weren't one of the 4,300 people who lost their jobs last month).

As discussed below, the RBA (and most economists) believe unemployment needs to rise for inflation to get back under control.

This is only one month's number, and the RBA would want to see more evidence that labour demand is slowing before totally backing away from further rate increases, but this data would reassure them that the rate rises they've already implemented are having an effect.

This is the view from Abhijit Surya from Capital Economics:

"The unemployment rate is now likely to overshoot the RBA's forecast of 3.6% in Q2 [the second quarter].

"Taken together with yesterday's data showing that wage growth remained sluggish in Q1, that should suffice to keep the Bank from lifting rates any further."

AMP's Diana Mousina agrees.

"Today's soft employment figures along with the wage price data yesterday which confirmed that there Australia does not face a wage breakout problem which means that there is no urgency for the RBA to lift the cash rate at its next meeting in June.

"The central bank has previously spoken about wanting to preserve the job gains it made during the pandemic, so if that remains the case then it should prefer to hold the cash rate steady for now and assess if further rate rises are necessary."

However, economists who were forecasting further rate rises ahead of today's data generally still are, like Sean Langcake from Oxford Economics.

"At the margin, these data weaken the case for another rate hike.

" But the labour market remains very tight and is delivering strong wage growth, which means a June rate hike will still be very close call."

How many jobs do we need to lose to tame inflation (according to the RBA)?

By Michael Janda

How many more people need to lose their jobs for inflation to calm down? What's Philip Lowe's target rate for unemployment if he wants inflation between 2 and 3%? Cheers

- Gary

Good question Gary.

The answer is based on the one I gave Tracey explaining the NAIRU.

Recent RBA modelling, both in the quarterly Statement on Monetary Policy and in research from earlier this year released under FOI, suggests the bank's economists believe an unemployment rate around 4.5% is needed for inflation to stay in the 2-3% target band.

Unemployment is currently 3.7%, with an estimated 521,800 people out of work from an estimated workforce of about 14.4 million.

Some very basic maths tells you a further 126,000 people need to become unemployed to get the jobless rate up to 4.5 per cent — that's assuming the labour force isn't growing.

If we add another 400,000 people to the labour force this year, say through net migration, then the number of extra jobless you need to get unemployment to 4.5% is 144,000.

Again, Gareth Hutchens has done some great writing on this.

The NAIRU is why (many) economists want people to lose their jobs

By Michael Janda

Hi, can you explain why economists want us to lose our jobs to reduce inflation? Seems counterintuitive to me??

- Tracey

This is a great question and comes down to something economists call the NAIRU — or non-accelerating inflation rate of unemployment.

Basically, the idea is that if unemployment drops below this level — which recently released RBA modelling shows its economists believe is somewhere around 4.5% — then the shortage of workers puts upwards pressure on wages, which in turn lifts business costs and thus consumer prices (inflation).

So, basically, orthodox economists don't think the Reserve Bank can get inflation back below 3% unless they get unemployment back to at least 4.5% — RBA modelling shows it basically shares that view.

The thing is, no-one knows, or can know, exactly what the NAIRU is, and it changes based on the structure of the labour market and the economy.

To put it bluntly, the RBA can only be more sure of the current NAIRU once they have put enough people out of work that inflation is back below 3%.

As an example, they used to think it was about 5%, but then we had an extended period of unemployment below that level with inflation below the 2-3 per cent target, so then estimates of NAIRU were cut by the RBA and Treasury.

Karl Marx discussed pretty much the same concept a long time before neoclassical economists started talking about the NAIRU — but he called it the reserve army of labour, which he argued capitalists rely on to keep control of their workforce.

Not all economists agree with the NAIRU obsession however, with many pointing to historical examples from the 1950s and 60s where inflation was under control even though unemployment was less than 3%. It was a very different, much more regulated, economic system back then.

Gareth Hutchens has done some great work on this if you want to learn more.

Breaking down the jobs numbers a little more

By Michael Janda

After 15 minutes to have a quick squiz, here are some key takeaways from the jobs data.

The ABS has not pointed to any statistical reason why employment fell and unemployment rose, so this seems to be a more genuine shift than the statistical blip where unemployment briefly hit 3.7% in January.

While unemployment rose, hours worked also increased strongly over April, so those of us with jobs were worked a bit harder.

Bjorn Jarvis who runs labour statistics for the Australian Bureau of Statistics had this to say about that:

"This was because fewer people than usual worked reduced hours over the Easter period," Mr Jarvis said.

"The last time Easter and the survey period aligned like this was in 2015, when around 60 per cent of employed people worked fewer hours than usual. This Easter it was only around 55 per cent of employed people.

"This may reflect more people taking their leave earlier or later than usual, or that some people were unable to, given the high number of vacancies that we're still seeing employers reporting."

However, working existing workers harder rather than hiring extra ones can also be an early sign that businesses are becoming nervous about the sustainability of demand — you don't want the cost of hiring someone only to make them redundant six months or a year later.

The rise in hours worked saw underemployment edge lower to 6.1 per cent, which is way below pre-pandemic levels that were closer to 9 per cent. So that's good news.

It's also worth putting these figures in some longer term context.

"The small fall in employment followed an average monthly increase of around 39,000 people during the first quarter of this year," Mr Jarvis observed.

All the labour market figures are much, much stronger than prior to the pandemic, although the economy was doing pretty badly prior to COVID and was at risk of falling into a technical recession even without the lockdowns.

But the unemployment rate is still around the lowest levels it's been in nearly 50 years, and will be for as long as it sits below 4 per cent.

Unemployment on the up as jobs lost in April

By Michael Janda

Economists have been caught off guard by a fall in jobs and rise in unemployment last month.

Unemployment rose just 0.1 of a percentage point last month (rounded to one decimal place), but rounding also meant the unemployment rate went from 3.5 to 3.7 per cent.

That's back to where it briefly was in January.

At the time, that was written off as a statistical blip on some known sampling issues.

This time, the loss of 4,300 jobs may finally be an indication the labour market is responding to higher interest rates cutting consumer demand, plus a large increase in the available workforce after international borders reopened last year.

You'd think we'd get better at this forecasting bizzo by now, but hey, it's tough to make predictions, especially about the future.

What do you want to know about today's jobs data?

By Emilia Terzon

Wondering what today's jobs data means for you, inflation, or the RBA's thinking ahead of next month's interest rate decision?

You're in luck — my colleague and all-round superstar, business reporter Michael Janda is here to answer your burning questions!

Use the big blue button up top to ask, and Mike will answer them shortly.

#ICYMI Highest wage growth since 2012 may mean another rate hike

By Emilia Terzon

Here's our take on the latest wages data from our business reporter Rhiana Whitson.

Australian shares follow Wall Street higher

By Emilia Terzon

Looks like that optimism in Wall Street has spread to Australia.

Both major indexes here are making strong gains on open, with both the All Ords and ASX 200 surging 0.8% on open.

The biggest gains are in mining, including iron ore and lithium.

A note from ANZ this morning speaks to why those stocks in particular are gaining, and it includes China.

Its analysts noted that new home prices in 70 cities across mainland China have risen slightly, according to its National Bureau of Statistics.

"Price gains for new homes in China (boosted) sentiment in the iron ore market. The market is hoping this is a harbinger to a pick-up in steel output," ANZ notes.

"Signs that the destocking cycle in China has passed has boosted sentiment across the lithium market.

"Lithium carbonate prices in China have jumped more than 15% this week amid signs of improvement in the electric vehicle (EV) sector.

"China will speed up the building of power charging facilities for EVs in rural areas so they will be available in every province.

"Tesla has also raised prices for some models in recent weeks, raising hopes the recent price war has ended."

Meanwhile, we have losses on the ASX in the gas industry and some retail stocks, including Lovisa.

This is all ahead of the jobs data set to be released by the ABS at 11:30am AEST.

We know that the Reserve Bank will be closely watching this data for signs that its ploy to tackle inflation is working or not.

Here's a take by our colleague Peter Ryan.

We'll also have my colleague Michael Janda on deck as the ABS jobs data is being released to answer your questions.

Start sending them through on the comments!

Where we are sitting at 10:15am AEST

By Emilia Terzon

- ASX 200: +0.8% to 7,258 points

- All Ords: +0.8% to 7,449 points

- AUD: 66.60 US cents

- On Wall Street: Dow +1.24%, S&P 500 +1.2%, Nasdaq +1.3%

- In Europe: FTSE 100 -0.3%, Stoxx 50 -0.2%, DAX +0.3%

- Spot gold: 0.4% at $US1,985.70/ounce

- Brent crude: +2.5% at $US76.75/barrel

- Iron ore: $US108.10 a tonne

-

Bitcoin: +1.7% at $US27,442

The rushed deal to buy Credit Suisse revealed in US filings

By Emilia Terzon

Regulatory filings in the United States have revealed that UBS told investors it had less than four days to conduct due diligence into its decision to buy up Credit Suisse.

This was given the "emergency circumstances," the filing said.

Switzerland's biggest bank agreed to buy its smaller rival after UBS endured a difficult year, and its spooked clients started withdrawing money.

The wave of deposit outflows and a major shareprice drop prompted UBS on March 15 to offer Credit Suisse liquidity assistance.

The next day, UBS and Credit Suisse signed a confidentiality agreement upon which the former began due diligence, the UBS filing showed.

Just a few days later, UBS announced it would buy up Credit Suisse for 3 billion Swiss francs (AU$5b).

It turns out this price was three times what UBS initially wanted to pay, the filing showed.

The filing also showed that UBS has started to become interested in buying up Credit Suisse in October, when the ad hoc Strategy Committee of its board of directors reviewed its rival's distressed situation.

It also estimated a hit of about US$17 billion from the takeover.

UBS shares are little changed since the deal was announced.