The Australian stock market fell on Tuesday, despite gains on Wall Street, while European markets have been mostly lower.

Meeting minutes provided insight into the Reserve Bank's decision to pause rate hikes in April, revealing it was a close call.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:40pm AEST

By Stephanie Chalmers

- ASX 200: -0.3% to 7,360 points

- All Ords: -0.3% to 7,557 points

- Australian dollar: +0.5% to 67.32 US cents

- Hang Seng: -0.9% to 20,600 points

- Nikkei 225: +0.5% to 28,658 points

- NZ 50: -0.4% to 11,884 points

- Shanghai Composite: +0.2% to 3,392 points

- Spot gold: +0.2% to $US1,999/ounce

- Brent crude: +0.4% to $US85.11/barrel

- Bitcoin: +0.7% to $US29,668

Energy sector leads losses on ASX

By Stephanie Chalmers

The Australian share market has finished the session modestly in the red, despite a positive lead from Wall Street.

The All Ordinaries closed down 0.3 per cent, so off its lows of the session.

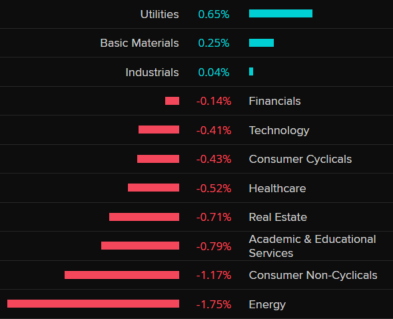

Looking at the ASX 200, the energy sector fared the worst during today's trade:

The major bank and iron ore mining stocks were a mixed bag, while lithium stocks made an appearance on both the best and worst performers list.

The Australian dollar gained some ground over the day, thanks to both some stronger-than-expected economic data out of China, which push iron ore futures to one-week highs, and the Reserve Bank's meeting minutes, which increased bets of a rate hike in May.

Major bank economists are now calling the RBA meeting in two weeks' time 'live'.

NAB and ANZ are still forecasting a pause but acknowledge the chances of a hike have increased, while Westpac and Commonwealth Bank economists expect a rate rise.

My colleague David Chau will be with you bright and early tomorrow with a wrap all the overseas market action, as US earnings season continues, plus through the local session.

In the meantime, enjoy your afternoon!

Tin prices surge after amid supply concerns in Myanmar

By Kate Ainsworth

The price of tin has substantially increased overnight, after the United Wa State Army, which controls the northern area of Myanmar, announced it would suspend mining operations from the beginning of August this year.

The decision by the Wa state will mean around 10% of global tin concentrate supply is sidelined, with the army group wanting to "protect the remaining mineral resources".

That has major implications for Chinese tin smelters, which only mines around 30% of the world's tin concentrate.

Last year alone, Myanmar accounted for around 77% of China's imports — meaning China, as the world's largest refined tin producer, is heavily dependent on Myanmar.

The suspension isn't due to start until August 1, but it's unclear whether the Wa state will follow through with it — they have reportedly made similar announcements in the past, without the suspension actually happening.

Market snapshot at 3:15pm AEST

By Stephanie Chalmers

- ASX 200: -0.5% to 7,346 points

- All Ords: -0.5% to 7,541 points

- Australian dollar: +0.3% to 67.20 US cents

- Hang Seng: -0.8% to 20,610 points

- Nikkei 225: +0.4% to 28,621 points

- NZ 50: -0.4% to 11,890 points

- Shanghai Composite: flat at 3,385 points

- Dow Jones: +0.3% to 33,987 points

- S&P 500: +0.3% to 4,151 points

- Nasdaq: +0.3% to 12,157 points

- FTSE: +0.1% to 7,879 points

- EuroStoxx 600: flat at 466 points

- Spot gold: +0.2% to $US1,997/ounce

- Brent crude: +0.1% to $US84.89/barrel

- Bitcoin: +0.3% to $US29,533

Watch: Why Deloitte believes Australia's economy is on a 'knife edge'

By Kate Ainsworth

If you've missed it this morning, Deloitte Access Economics has issued a bleak warning for the economy, forecasting a "consumer recession" for 2023.

Deloitte's Business Outlook report says that the Reserve Bank's interest rate increases in February and March were "unnecessary" and leave Australia "facing the weakest rate of economic growth outside of the pandemic since the recession of the early 1990s".

You can hear what Deloitte Access Economics partner Stephen Smith said about the report, and what it means for the economy, on ABC News Breakfast below:

China's economy boosted by pent-up consumer demand

By David Chau

China's economy grew by 4.5% in the March quarter, compared to the same period last year.

That's a faster-than-expected rebound for a country that recently emerged from some of the strictest COVID-19 lockdowns in the world.

Here's what economists are saying about it:

Iris Pang (ING Chief Economist, Greater China):

"This is a better-than-expected data report. We expect that the [Chinese] government will hold back extra stimulus plans and the yuan should strengthen.

"The main reason for the faster-than-expected growth was much stronger growth in retail sales, which accelerated to 10.6% [year on year] in March.

"Such rapid retail sales growth has not been seen since June 2021, when it grew 12.1% [year on year]. The growth in retail sales was mainly boosted by catering."

"Industrial production grew only at 3.9% [year on year] in March.

"We see fairly modest growth in industrial production as a result of the drag imposed by weakening external demand in the US and Europe.

"By categories, most electronic production recorded contraction in 1Q23 [the March quarter].

"Micro-computers, integrated circuits and smart devices fell 22.5%, 14.8% and 7%, respectively, and reflecting the burden of US export bans."

Julian Evans-Pritchard (Capital Economics, head of China economics):

"GDP rebounded more quickly than expected in Q1 [March quarter] thanks to a rapid return to normality following last year's virus disruptions. With consumer confidence on the mend and credit growth accelerating, there is still scope for a further pick-up in activity over the coming months.

Retail sales remained robust in March following a huge jump at the start of the year.

"This was partly due to favourable base effects from a year ago when several large cities entered lockdowns. But our estimates suggest sales continued to rise in seasonally adjusted terms too.

"The speed of the recovery has exceeded even our relatively upbeat expectations.

"We now think official GDP growth could hit 6% this year.

"And in practice, growth is likely to be even higher given that the official GDP figures understated the extent of last year's downturn."

Raymond Yeung (ANZ, chief economist of Greater China):

"Both credit expansion and construction PMI [purchasing managers index] hit a record high."

"There are upside risks to our GDP forecast of 5.4% for 2023.

"Second-quarter GDP could hit 8% [year on year]. If the property recovery is sustained, GDP may approach 5% in the second half of the year.

"Youth jobless rate (March: 19.6%) went up but the negative output gap will narrow gradually. The authorities will likely keep interest rates on hold."

RBA May meeting 'live' prospect for rate hike

By Stephanie Chalmers

Today's RBA meeting minutes show the central bank board discussed the case for a hike, and found some merit in the idea, before opting to pause in April.

Capital Economics say the minutes give weight to their view that another hike is coming, in just two weeks' time.

Next week's inflation reading for the first three months of the year will be key, of course.

"March labour force data released since the Bank’s April meeting clearly show that the labour market is running red hot.

"Meanwhile, there are few signs to suggest recent banking turmoil overseas has had major ripple effects for Australia.

"Admittedly, prospects for further tightening will still probably hinge on Q1 inflation data, which are due next week.

"However, we’re sticking to our forecast that the RBA will deliver one final 25bp rate hike at its May meeting, taking the cash rate to a peak of 3.85%," said Capital Economics economist Abhijit Surya.

NAB and ANZ economists both believe next month's meeting is now a 'live' one, with a hike very much on the table.

ANZ has been forecasting one final hike but not until August, but now sees the risks tilted towards a shorter pause.

The bank's head of Australian economics Adam Boyton noted that the discussion around the pause referred to observing data over the coming 'month' rather than 'months'.

"The above suggest to us that the decision to pause was a relatively close one –with a case able to be made for both an increase in interest rates and a pause.

"It further suggests that the May meeting is live –with the Board in a position to be persuaded either way based on the balance of the data and the updated set of forecasts they will receive at that meeting," he writes.

NAB's view is that the current cash rate of 3.6 per cent is the peak and the RBA will hold from here, but describes the May meeting as now 'very live'.

"The Q1 CPI on 26 April and the updated staff forecasts are very important as to whether the RBA sees the need to hike again.

"Whether it can forecast inflation being back to 3% by mid-2025 without further hikes will be important," NAB's Tapas Strickland said.

China's economy grows 4.5% in March quarter

By David Chau

China's economy is rebounding more quickly than expected from its pandemic slump, after the Communist nation abruptly scrapped its COVID-zero policy late last year.

The world's second-largest economy grew by 4.5% in the first quarter (compared to the same period last year), according to China's National Bureau of Statistics.

As for how strong this result was, it's higher than the:

- 4% growth for the March quarter, that was estimated by a Reuters poll of economists

- 2.9% annualised growth that China recorded in the December 2022 quarter

- 3% growth rate last year (which was far below Beijing's official target of 5.5%)

This year, China's government has set a more modest GDP growth target of "around 5%".

What drove China's rebound?

There was huge pent-up demand from Chinese consumers as they emerged from some of the strictest (and longest) COVID lockdowns in the world.

Retail sales jumped 10.6% in March (which exceeded the 7.4% increase that Reuters-polled economists were predicting).

However, industrial output rose 3.9% (slightly lower than 4% rise that economists were expecting).

Given that China is Australia's largest trading partner, this news bodes well for the local economy.

By 1:30pm, the Australian dollar was trading at 67.2 US cents (after a 0.3% increase).

Market snapshot at 1:15pm AEST

By Stephanie Chalmers

- ASX 200: -0.3% to 7,360 points

- All Ords: -0.3% to 7,557 points

- Australian dollar: +0.3% to 67.22 US cents

- Hang Seng: -0.8% to 20,615 points

- Nikkei 225: +0.6% to 28,675 points

- NZ 50: -0.4% to 11,883 points

- Shanghai Composite: flat at 3,385 points

- Dow Jones: +0.3% to 33,987 points

- S&P 500: +0.3% to 4,151 points

- Nasdaq: +0.3% to 12,157 points

- FTSE: +0.1% to 7,879 points

- EuroStoxx 600: flat at 466 points

- Spot gold: +0.3% to $US2,000/ounce

- Brent crude: +0.5% to $US85.14/barrel

- Bitcoin: flat at $US29,459

ASX lower at lunch time

By Stephanie Chalmers

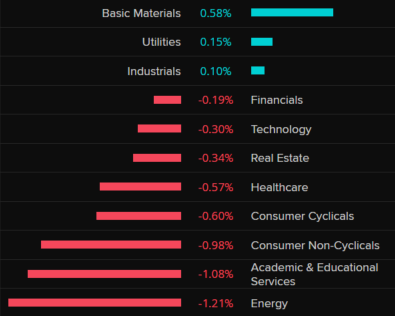

As we approach the middle of the session, the Australian share market remains in the red, but off its early lows — the All Ordinaries is down around 0.2 per cent.

More than 130 of the top 200 stocks are declining.

Here's a look at how the sectors are faring so far:

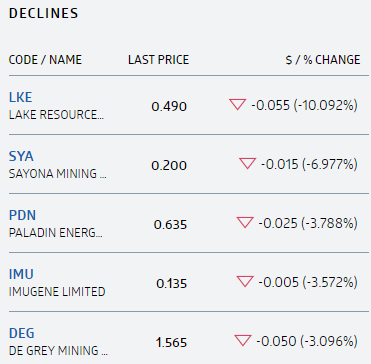

Taking a look at some of the biggest percentage changes, Telix Pharmaceuticals is leading the charge thanks to a quarterly update being well received.

And some lithium miners are also doing well.

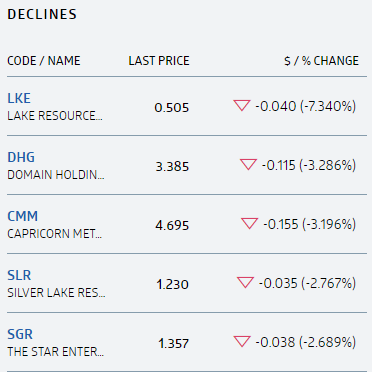

On the flipside, gold miners have fallen, alongside Domain and The Star, while lithium firm Lake Resources is giving back some of the 18% gain it made yesterday.

Chinese investment in Australia almost lowest on record

By Daniel Ziffer

Hi team, just jumping in with a new report about Chinese investment from consulting firm KPMG and researchers at the University of Sydney.

Remember that 'trade war'? The barley ban? The Ministers-of-both-countries-not-talking-to-each-other-for-years?

Yeah, well it's had an impact.

The report found:

- In 2022, Chinese investment in Australia increased by 142% to US$1.4 billion

- But that's the second lowest year on record since 2007, when it was US$16.2 billion

- Mining makes up for 86% of the total investment figure

The report tracks mergers, joint-ventures and new projects. It does not cover residential real estate.

Historically we've been the second largest home of Chinese investment, behind the US.

We are now 12th on the list of where China invests, behind countries like Hungary, Malaysia and Zimbabwe.

To hike or not to hike: RBA April meeting minutes

By Stephanie Chalmers

The minutes of this month's Reserve Bank board meeting have been released, and they're interesting reading this month, given the RBA left interest rates unchanged for the first time in nearly a year.

The minutes show it was a fairly close call in the end, and board members considered hiking rates before deciding to pause.

When it came to the case for another 25 basis point hike, high inflation and the tight jobs market were the major considerations.

Members noted that imbalances between demand and supply in the housing and energy markets may limit how quickly inflation declines.

Members considered the argument that, in these circumstances, it was better to continue to raise interest rates to ensure inflation is brought back to target faster, noting that monetary policy could be eased quickly if an adverse shock caused inflation and economic activity to slow by more, or more rapidly, than forecast.

Board members also discussed increased migration forecasts, which will put further demand on housing, and wage rises.

But the case for not raising rates, which won out, was put down to the significant tightening that's already taken place and the value in pausing to take stock of incoming data.

That includes next week's quarterly inflation reading and further monthly data on employment, household spending and business conditions — as well as updated economic forecasts RBA staff are due to provide before the May meeting.

Members recognised the strength of both sets of arguments, but, on balance, agreed that there was a stronger case to pause at this meeting and reassess the need for further tightening at future meetings.

On Twitter, IFM Investors chief economist Alex Joiner said one month of extra data is unlikely to be enough for the RBA to assess the economic impact of its rate hikes to date:

OZ Minerals to delist after being acquired by BHP

By Kate Ainsworth

Adelaide-based copper miner OZ Minerals will trade for the final time on the ASX today, after it was acquired by mining giant BHP.

Yesterday the Federal Court approved BHP's takeover of the company.

OZ Minerals told the ASX it has lodged a copy of the court's orders with ASIC today, meaning the takeover is now legally effective.

It's expected the ASX will suspend OZ Mineral shares from trading from the close of trade today.

Real household spending hits negative territory, CommBank report finds

By Kate Ainsworth

The latest CommBank Household Spending Intentions (HSI) index for March is out today, and shows the HSI jumped by 8% last month — but has continued to moderate.

That's thanks to an increase in the spending categories of: transport, entertainment, retail, and travel.

CommBank says the bump in transport spending intentions gained so strongly as more people returned to working from the office, leading to a greater spend on public transport, carparks and taxis.

"Spending on transport has almost returned to pre-pandemic levels," said chief economist Stephen Halmarick.

"The increase in transport spending indicates more people are working from the office, rather than from home and this should have a positive impact on CBD economies."

But despite the increases, Mr Halmarick said the RBA's rate rises have continued to have an impact on household spending.

"The slowdown in spending growth indicated the RBA’s consecutive interest rate increases are having a real impact on household spending," he said.

"Despite the decision to hold interest rates steady earlier this month, consumer budgets will tighten due to the lag in impact on both variable and fixed rate mortgages.

"Additionally, with inflation now running at an estimated 7 per cent for the March quarter real household spending is now negative.

"This reinforces the view that once you take into account inflation, taxes, and debt interest costs, real household disposable incoming is falling."

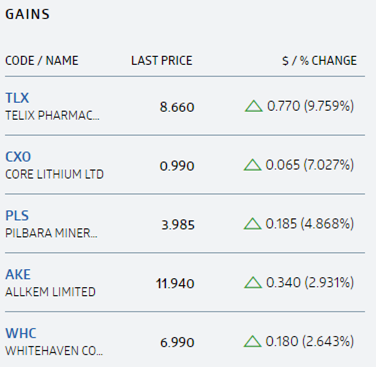

ASX opens lower, Core Lithium leads the pack early

By Kate Ainsworth

The ASX has opened lower at 7,347 points this morning, down 0.5%.

All sectors are in negative territory, minus real estate, which currently has a very modest 0.05% gain.

The top movers so far are:

- Core Lithium (+7%)

- Mirvac Group (+2.2%)

- Imugene (+1.8%)

- IGO (+1.4%)

- BlueScope Steel (1.2%)

Core Lithum's gains can be put down to its anouncement to the ASX this morning, saying it would be increasing the size of its Finniss resource near Darwin by 62%.

At the other end of the scale, resources are leading the early losses:

- De Grey Mining (-3.1%)

- Gold Road Resources (-2.8%)

- EVT (-1.7%)

- Credit Corp Group (-1.7%)

- Domain Holdings Australia (-1.6%)

Market snapshot at 10:20am AEST

By Kate Ainsworth

- ASX 200: -0.5% to 7,347 points

- All Ords: -0.47% to 7,542 points

- Australian dollar: flat at 66.98 US cents

- Dow Jones: +0.3% to 33,987 points

- S&P 500: +0.3% to 4,151 points

- Nasdaq: +0.3% to 12,157 points

- FTSE: +0.1% to 7,879 points

- EuroStoxx 600: flat at 466 points

- Spot gold: flat at $US1,994/ounce

- Brent crude: flat at $US84.72/barrel

- Iron ore: +0.7% to $US117.30/tonne

- Bitcoin: -0.2% to $US29,412

Decision not to freeze HECS-HELP indexation will hurt young Australians, unions say

By Kate Ainsworth

Student unions have criticised the looming increase to student loan debts, after a Senate inquiry rejected a proposal to freeze indexation yesterday.

The amount owing on HECS-HELP and vocational education loans is expected to increase by up to 7% on June 1st, in line with the increase to the Consumer Price Index (CPI).

General secretary of the National Union of Students, Sheldon Gait, told ABC News Breakfast it's a huge concern given many young Australians are already struggling.

"This goes to a huge issue of inter-generational wealth," he said.

"We're already going to be the most indebted generation in history, the first generation to go backwards in terms of economic outlooks and we've been struggled with this huge student debt which a lot of people in Canberra didn't have to face with the prospects of free education back in the day."

You can read more about the Senate inquiry rejecting the proposed indexation freeze from political reporter Shalailah Medhora below:

Renters handing over data to application apps

By Stephanie Chalmers

If you've applied for a rental property recently, first of all it's probably been a pretty stressful experience, thanks to the current state of the market.

And secondly, you've likely been asked to submit your application through a third-party app.

These tech companies, which includes apps like 2Apply and Snug, collect a slew of personal information and documentation, from pay slips to passports.

Consumer advocacy group Choice is sounding the alarm on the arrangements, saying applicants are left feeling they have little choice but to hand over their information, without being made aware of the commercial relationships in place or how long that data will be retained.

Melbourne renter Diana Robledo-Ruiz even paid for background checks through the apps, because she and her partner were worried about being left without a home after seeing queues of people at each inspection they attended.

"It feels very wrong. I am the kind of person that doesn't like sharing those kinds of data. But in this case, you have to do it."

You can read the full story from Emilia Terzon and Alison Xiao here:

Market snapshot at 8:45am AEST

By Stephanie Chalmers

- ASX SPI 200 futures: -0.2% to 7,376 points

- Australian dollar: flat at 67.01 US cents

- Dow Jones: +0.3% to 33,987 points

- S&P 500: +0.3% to 4,151 points

- Nasdaq: +0.3% to 12,157 points

- FTSE: +0.1% to 7,879 points

- EuroStoxx 600: flat at 466 points

- Spot gold: flat at $US1,994/ounce

- Brent crude: -1.7% to $US84.83/barrel

- Iron ore: +0.7% to $US117.30/tonne

- Bitcoin: +0.3% to $US29,539

Could Samsung dump Google search?

By Stephanie Chalmers

Shares in Google parent company Alphabet closed 2.7 per cent lower, after falling as much as 4 per cent on Wall Street.

Why? A report by the New York Times suggested Samsung was considering replacing Google as the default search engine on its devices… in favour of the Mircrosoft-owned Bing.

Earlier this year, Bing unveiled new AI-powered search functions, using the technology behind ChatGPT.

Today, Google told Reuters it was working on new AI-powered features of its own.

"Investors worry Google has become a lazy monopolist in search and the developments of the last couple of months have served as a wake-up call," Atlantic Equities analyst James Cordwell said.

So just how important is the Samsung deal to Google, which dominates over 80 per cent of the search market?

Here's some of the New York Times report:

"Google’s reaction to the Samsung threat was “panic,” according to internal messages reviewed by The New York Times. An estimated $3 billion in annual revenue was at stake with the Samsung contract. An additional $20 billion is tied to a similar Apple contract that will be up for renewal this year."