It was a monumental day for Australian finance with a review leaving the RBA facing its biggest shake-up in decades. But the share market was left unruffled, finishing broadly flat.

See how it all unfolded in our live blog — as it happened.

Disclaimer: This blog is not intended as investment advice.

Key events

Live updates

Time to shut the blog, turn off the lights

By Michael Janda

And that's it for a busy day that was all about the RBA, and not really about the share market at all.

Hopefully we've been able to shed some light on the main recommendations from the review and help make sense of them for you.

Kate Ainsworth will be with you for a more regular markets blog tomorrow.

Until then.

The Reserve Bank review could lead to higher interest rates

By Michael Janda

For those hoping that the RBA review would ultimately see lower interest rates, the ABC's business editor Ian Verrender has bad news.

Pretty much all the major central banks with a separate expert monetary policy board have higher interest rates than Australia.

Read more here:

Does the RBA have a communication breakdown?

By Michael Janda

Much has been made of the RBA's communication failings, but if there's any issue with transparency now, it used to be far, far worse.

Back when I started at the ABC 15 years ago, journalists hardly ever got any on the record access to the RBA's senior officials.

Now, in addition to readily available background briefings, the governor, deputy governor and assistant governors make frequent public appearances with Q&A sessions.

However, the review's recommendation that board members also make at least one public appearance a year about monetary policy would be very welcome, as would a press conference after RBA decisions (which Nine's Ross Greenwood has been lobbying hard on for years).

Here's a piece I wrote from earlier this week about what it's like inside the Reserve Bank's media lock-ups.

Interest rates and Lowe's future

By Michael Janda

Here's two questions for you...do you think the RBA will raise interest rates again next month and do you really think that Phil Lowe can possibly stay in this job after such a public humiliation?

- Jeff

Hi Jeff, sorry it took me a while to get to this question.

I'm no rates forecaster, but I do believe that a cash rate over 3 per cent for a prolonged period will probably tip Australia into recession, given the amount of debt a substantial group of people have.

Remember, the RBA has done modelling that estimates 15% of households with a mortgage, that's about 300,000 households, already have negative cashflows (they spend more on their mortgage and essentials than what they earn) at the current cash rate of 3.6%.

Now, some of them might have savings from the low-rate period and pandemic stimulus, many will not.

Either way, these households, and a lot of others not in quite as much of a bind but still feeling the pinch, will be dramatically cutting spending over coming months.

That's why Deloitte is forecasting a "consumer recession", and consumers account for more than half of economic activity.

The RBA wants to walk a "narrow path" and avoid recession, unlike the RBNZ which is forecasting one (and the NZ economy is halfway there already).

So I'm inclined to think they should stay on hold before cutting later this year. At least that's what I'd argue for at the moment if I was on the RBA board, not a forecast.

The financial markets generally agree with me, pricing in a 70%+ chance of rates staying on hold in May, and rate cuts later this year.

Economists are pretty divided, with many expecting one more rate rise to a peak of 3.85%. Very few are now forecasting a peak cash rate above 4%.

On the latter question about the governor's future, I do think it's hard to see how Philip Lowe will be appointed to another lengthy term.

By the time his current term ends in September, he will have been governor for seven years, which is a fairly lengthy time in charge of a large organisation.

My suspicion would be that if Mr Lowe is renewed, it will only be for a shorter term of one or two years to oversee the transition to the new structure. But that is conjecture, and not based on any inside information.

Market snapshot at close

By Daniel Ziffer

This is where the market finished up at the end of trade shortly after 4PM AEST

- ASX 200: Down 3.3 points to 7,362.2

- All Ords: Down 5.9 points to 7,555.40

- Aussie dollar: Up 0.1% to 67.2 US cents

- NZ 50: Down 38.1 points (0.3%0 to 11,879.68

-

Wall Street: Dow Jones down 0.2%, NASDAQ up 0.03%, S&P 500 down 0.01%

- Europe: FTSE 100 down 0.13%, Euro Stoxx 50 down 0.01%, IBEX 35 (Madrid) up 0.8%

- Spot gold: US$1996.82 an ounce, up 0.17%

Sharemarket barely moves higher or Lowe-r

By Daniel Ziffer

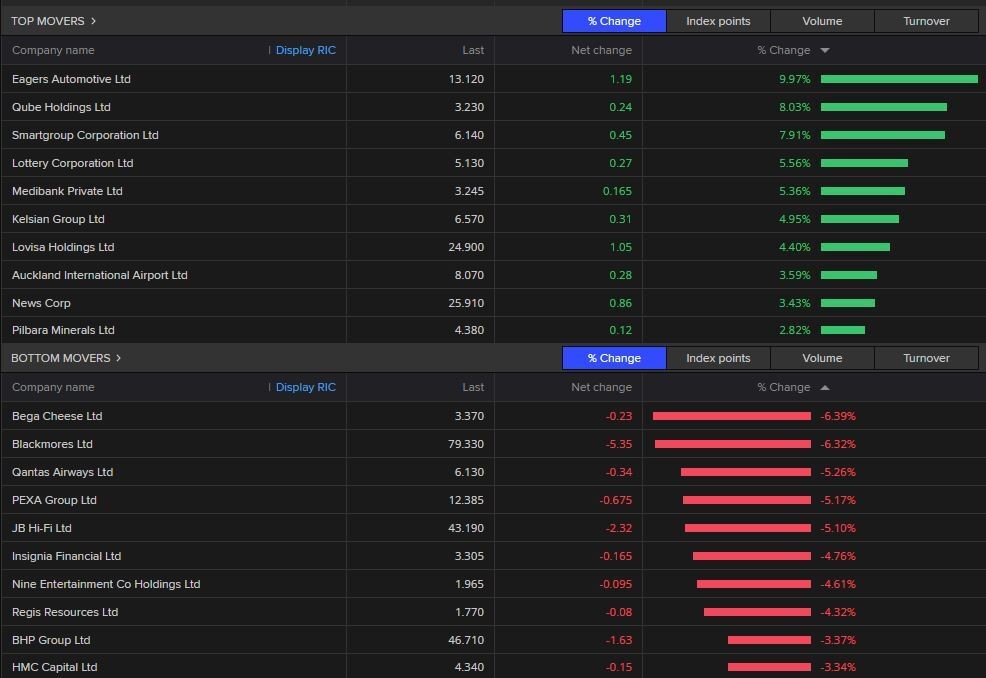

With everyone pretty much consumed by the release of the once-in-a-generation review of our central bank, it won't surprise you the stockmarket barely moved today.

The broad All Ordinaries Index that tracks the value of our largest 500 listed companies ended trading at 7,555.40 points, that a loss of 5.9 points or just 0.078%.

The ASX 200 Index of (I'll let you guess) companies was similarly static at 7,362.200 points, down 3.3 points or 0.04%.

Here's the biggest movers.

Another big day! Catch you here tomorrow.

Are bank shares linked to the RBA review?

By Daniel Ziffer

Hi Daniel. Do you think the share price of the four big banks would drop if Phil Lowe announced his resignation?

- Jeff

Nice question Jeff. This is a good time to remind you that this blog is not investment advice!

Giving personal financial advice in Australia requires you to work for someone with an Australian Financial Services licence, and undergo training yourself.

As much as the ABC has branched out into online, digital services and even social media like TikTok, we didn't have one last time I checked.

The broad point I would make is that industries like certainty from regulators and governments.

One of the key complaints of businesses in the past decade - particularly those involved in decarbonisation, renewable energy and green technology - has been the constant shifting of government policy and the seemingly random changes in direction that have been made.

When you're making long-term investments like building a wind-farm, winding down a coal plant or building an electric vehicle charging network, you try to plan for what might happen.

Our chaotic decade-and-a-bit of what's been called the 'climate wars' has made that very hard.

What the RBA review means for Australia's banks is something that an army of analysts at different firms and organisations are working on. We've brought you lots of their initial thoughts today and I reckon they've still got a bit to chew on in the 294-page report.

Key business group backs RBA review

By Daniel Ziffer

One of Australia's most powerful business lobbies has backed the recommendations of the review of the Reserve Bank of Australia - with a caveat.

In a statement, the national employer association Ai Group said the review was a "measured, and far from revolutionary blueprint" for strengthening RBA governance and how it sets monetary policy.

When we talk about 'monetary policy' we generally mean the way the central bank sets what's known as the 'cash rate'.

It's the interest rate banks use to settle debts overnight. Other rates like those charged to home loan customers are set at difference amounts above the cash rate. So when it goes up, so does the interest charged on mortgages.

Yeah, but

Innes Willox, Chief Executive said that "notwithstanding ardent criticism of the RBA from some in recent months and the fact that the Bank may have underestimated the strength and duration of the recent surge in input cost pressures, the Review rightly highlighted the quality and effectiveness of the RBA's performance over an extended period.

"The Government's in-principle agreement to accept all recommendations and to build support for the changes with stakeholders and across the parliament is very encouraging.

"The business community encourages the Government to consult closely and broadly as it sets up the Governance Board and the specialist Monetary Policy Board.

That's the kicker.

Workers' voice

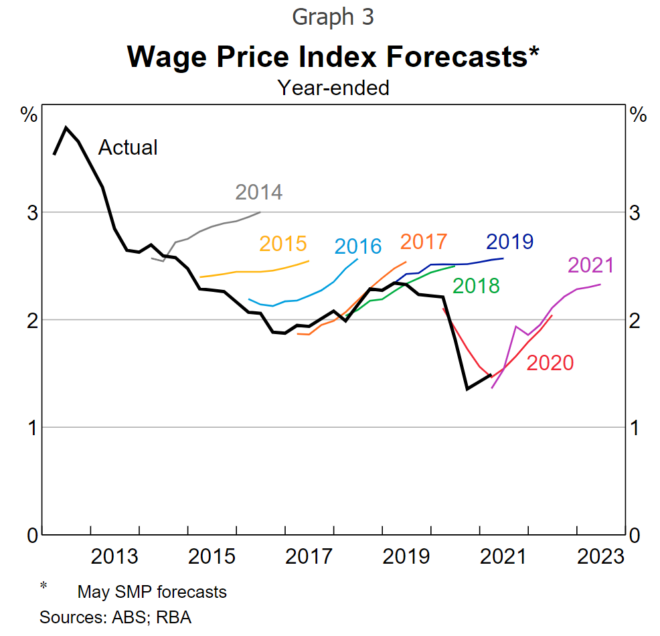

The board of the RBA has long been criticised for failing to understand how wages work because it doesn't have voices representing workers.

Incredibly, the board of just nine people includes two who are directors of right-wing think-tank the Centre for Independent Studies, but no-one involved in unions or organisations representing workers.

It's led to one of the most embarrassing failures of the RBA in the past decade: a consistently wildly-optimistic view of what would happen to wage growth.

The rainbow is what the RBA thought would happen to wages in each of those years. The black line is what actually happened.

But the business community doesn't necessarily want people connected to workers having an impact on RBA policy.

That's something it'll probably just have to deal with, because the tone of the review makes clear there needs to be change and it's something that's music to the ears of the federal government.

Here's the note of caution added by Mr Willox.

"Board independence and transparency and openness about appointments to the board, the decisions made and perspectives on economic trends are vital to further building confidence in a crucial institution".

Expect more to come on this aspect as the recommendations of the review hit reality.

Bank shares broadly up today

By Daniel Ziffer

The share prices of our big four banks have risen in harmony today, all up by around 1.6% in value.

It could be due to the removal of a fear about radical changes to the way the Reserve Bank of Australia sets interest rates.

It could be the RBA Review - recommending changes that bring our central bank into line with other global institutions - had investors thinking the good times for bank profits will continue.

Because the value of shares in a company rely on millions of transactions of huge numbers of shares by massive numbers of buyers and sellers we'll never really know...

Here's where they are as at 2.30PM AEST.

The boost means shares in our biggest lender, the Commonwealth Bank, are now back above $100.

- ANZ: $24.54 +0.40 (1.66%)

- Westpac: $22.62 +0.40 (1.78%)

- NAB: $29.06 +0.45 (1.59%)

- Commonwealth Bank: $101.02 +1.64 (1.66%)

Update

By Daniel Ziffer

Question for the brains trust. The NAIRU has been referenced by the review, with a recommendation to define the NAIRU, and presumably reviewing the rate on a regular basis. Given the NAIRU is notoriously hard to judge, would the economy and society be better served by a set unemployment rate goal of, say, 4%? And then use levers other than the number of people out of work to manage inflation?

- Dave

Dave's question is a good one. We know what the RBA's inflation target is: between 2-3% annually. Why don't we know what it thinks the unemployment rate should be?

The NAIRU is the 'non-accelerating inflation rate of unemployment' — which is jargon for how many people need to be unemployed to prevent wages and inflation climbing above the RBA's target.

There's been a lot of conjecture, particularly before the pandemic hit, that the setting the concept of 'full employment' at above 4 per cent was dooming workers to stagnant wage growth and bad outcomes for people left unemployed by design.

My colleague Michael Janda explained this is in an earlier post, and Gareth Hutchens great article goes further.

The RBA doesn't note what the 'number' of the NAIRU is.

One of the key recommendations is to put the priorities of 'keeping inflation to target' and 'full employment' on level pegging.

This suggests the reviewers think the RBA has been doing too much on keeping inflation low, without considering the broader impact on workers and society.

Reax: 'Unlikely the RBA review will materially change the outlook for the cash rate'

By Daniel Ziffer

More reaction coming in from the people who follow the markets and the Reserve Bank's impact on it.

Pradeep Philip, Head of Deloitte Access Economics has noted the key changes - giving control over changes to the cash rate to a new monetary policy board featuring six external members.

It's a "significant departure from the usual way of doing business at Australia’s central bank" but it makes the process for monetary decision-making closer to other key central banks around the world.

Mr Philip notes the changes won't make a difference to households and businesses suffering with rising mortgage payments and inflation, but it sets up the RBA to be better:

Today’s review will go a long way towards improving the analysis and decision making of the RBA and improve its operations and governance.

Something else worth noting: a focus on the impact of climate change.

It is good to see that the review also recommends that the RBA should take more account of climate risk by integrating the implications of climate change into its economic analysis. Nothing will have a larger impact on the structure of Australia’s economy and price volatility in the coming years than the adverse effects of climate change and the implications of the highly necessary energy transition. This is crucial to the RBA mandate of inflation, full employment, welfare of the Australian people, and financial stability.

Investment bank UBS also has thoughts. In a note, it found "no material surprises" in the Review's outcomes, but noted the major changes and their implications. It doesn't see anything in it that will change the trajectory of interest rate decisions.

Overall, it's unlikely the RBA review will materially change the outlook for the cash rate in the near-term, given the changes are not immediate. Hence, UBS still expect the RBA will hike rates by 25bps, to 3.85%, most likely at their next meeting in May, after Q1 CPI. We expect the RBA will still see inflation as 'too high', and project inflation to take too long to return to target (i.e. "only by mid-2025"). But even if April's pause is extended into May, the RBA's April meeting minutes argued they could still hike later, reflecting the increased risk of larger wage increases in the public sector.

How the RBA cash rate gets passed through to mortgages and other rates

By Michael Janda

Can someone explain like I'm 5, why do banks always pass the interest rate increases on in full, but they don't have to pass along the cuts in full?

- ELI5

Good question Eli. It's pretty complicated once you get into all the detail (I won't pretend to understand the complexities), but essentially the RBA's cash rate is like an anchor, and other interest rates (mortgages, savings, bonds, etc…) float around it.

The reason that the RBA acts as an anchor is that it offers an effectively risk free place for banks to park cash overnight in their exchange settlement accounts.

But these accounts offer less interest for deposits and charge more interest from loans than the cash rate target, so banks are encouraged to make short term loans to each other around that rate.

The RBA explains it in this article on its website.

Longer term rates, such as your mortgage, are loosely based on these low risk overnight rates, with a premium for the risk of default, costs of doing business, profit margins and also the length of any loan term factored in.

(Term risk is what killed Silicon Valley Bank, for example, because it tied up a bunch of its reserves in 10-year US government bonds, and the value of those low-interest rate bonds plummeted as rates suddenly rose).

The long and short of it is that the RBA cash rate and exchange settlement rate set a benchmark on which other rates are priced, based on commercial decisions — like how much profit margin a bank wants to make versus how much market share it wants to win.

You might be interested to know that the banks have not actually passed on the RBA's interest rate hikes in full, with discounts (mainly to new customers, but occasionally to existing customers who've asked) meaning that the average mortgage rate hasn't risen nearly as much as the cash rate … yet.

This from the RBA's assistant governor financial markets Chris Kent in a speech late last month:

"Since last May, the average outstanding mortgage rate across all loans has increased by around 110 basis points less than the cash rate.

"More than half of this difference owes to the effect of fixed-rate mortgages that haven't yet rolled onto higher interest rates.

"Also, the average outstanding rate for variable-rate mortgages has risen by around 40 basis points less than the cash rate as a result of competition among lenders for good-quality borrowers."

If you want more background on how the cash rate affects mortgage rates, I wrote this explainer many years ago:

Telstra cut off 1000s of customers without telling them: watchdog

By Daniel Ziffer

It's all RBA today, and we'll keep you up-to-date with more analysis and comment as it comes through this afternoon.

But in other news the Australian Communications and Media Authority (ACMA) has found Telstra broke consumer protection rules after it didn't give notice to more than 5,400 customers before restricting or suspending their services.

Between May and July 2022 Telstra limited customers’ services because they hadn't paid bills - but without providing at least five working days’ notice as required under the Telecommunications Consumer Protections Code.

ACMA Chair Nerida O’Loughlin said with phone and internet connections so key to work, education and lift telcos must take extra care when disrupting services.

“With the current cost of living pressures, many Australians are doing it tough. By limiting peoples’ services without notice Telstra likely caused these people significant additional stress”

Customers couldn't make or receive calls, except to emergency services or to Telstra.

If you're looking for a massive fine so that Telstra treats the issue seriously and the industry is on notice about the importance of treating vulnerable customers with care... you'll need to move to a country that treats corporate breaches of law with any gravity.

ACMA has issued Telstra with a formal warning.

Ms O’Loughlin did make the good point that - despite the finding - anyone struggling to pay their phone or internet bill should contact their service provider.

“Telcos are obliged to help people facing financial hardship and there are a range of options available to help customers manage their bills.”

There are programs telcos must follow if people are in 'financial hardship' and can't pay their bills. More info is on ACMA's website.

Got any questions?

By Michael Janda

There's been a few comments so far, some shall we say less than complimentary of RBA governor Philip Lowe and offering free advice to Treasurer Jim Chalmers about whether he should renew Mr Lowe's contract.

But I'm keen to know if anyone has any questions (rather than comments/opinion) about the review that myself, Gareth or the economic experts we can call on might be able to answer for you?

Hit us up with the comments button at the top of the blog and we'll do our best to get to as many as we can.

'Everyone is getting a bit excited over very little'

By Michael Janda

I think everyone is getting a bit excited over very little. EVERY major central bank is rapidly hiking rates. Even if this reform had happened 12 months ago, we would still be seeing the same lack of foresight and subsequent hikes. Plus, you have to match the global actions or your currency will drop and inflation will run rampant. Despite what people feel has happened here, its cost of living pressures (including house price cost of living) that caused the pain and not the efforts of the RBA. Sad we will focus here and not the true problem of no effort to make housing affordable.

- Paul

Hi Paul, great comment.

As someone who has covered the Reserve Bank A LOT over the past 15 years, I can't see anything here that will cause a dramatic shift in how it operates.

Most of the general public criticism of the RBA is that it's raised interest rates too far, too fast.

Yet most of the type of orthodox monetary economists that might be appointed to a more technocratic board currently believe the RBA should be raising rates quite a bit further to get inflation back below 3 per cent more quickly.

The proof is also in the pudding — central banks with such a dedicated, expert monetary policy committee generally have higher interest rates than Australia, such as the US (4.75-5%), UK (4.25%) and New Zealand (5.25%).

So this could prove to be a case of Australians needing to be careful what they wish for. If they're concerned the Reserve Bank is currently 'out of touch' with ordinary people, the review's recommendations are likely to make that worse rather than better.

ASX still trading flat with consumer goods up

By Emilia Terzon

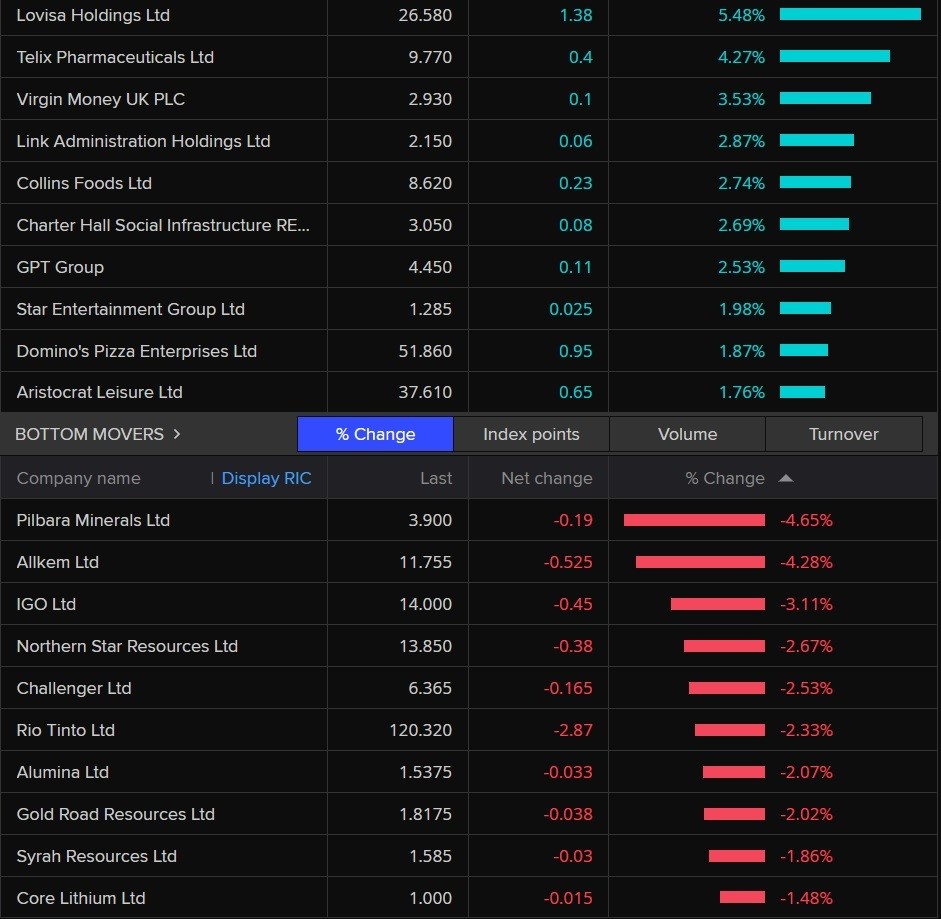

We've still got a flat Australian sharemarket.

Is it digesting the RBA review, taking the lead from a tempered Wall Street, or just not really feeling it today?

Lithium stocks are still among the stocks in the red.

Meanwhile, we have accessories chain store Lovisa in the lead. It's not entirely clear why as there's no market report out today.

The dollar is steady against the greenback, as investors remain cautious ahead of an expected 25 basis point hike in interest rates by the US fed next month.

Futures for Wall Street indexes have them slightly lower.

Investor focus in Asia today is set to be on earnings from Taiwan Semiconductor Manufacturing Co, with analysts expecting the company to post a 5% fall in first-quarter net profit.

'We don't always get it right but we always try to get it right': Lowe

By Michael Janda

RBA governor Philip Lowe says he doesn't take criticisms in the review personally.

When quizzed by reporters on how that could be the case, Mr Lowe said the bank is a big organisation and he is just one individual within it.

"I don't take this personally because I'm just one person on the board of nine and a staff of 1,500, and I know when I'm with the board and with the staff how dedicated we are to doing the right thing in the public interest," he responded.

"While there is a lot of focus on us making decisions, we really are making decisions on a global context and everyone is dealing with the same issues, so when I talk with the other central bank governors, we've got the same issues and we have dealt with the same problems.

"So I don't take it personally because I'm just one person in an institution that come every single day, tries to do the best job for Australians.

"We don't always get it right but we always try to get it right."

'Review panel didn't sit in the boardroom': RBA boss Lowe defends current board

By Michael Janda

While generally welcoming the RBA review and its recommendations, governor Philip Lowe was not convinced by its criticism of the current board structure.

"The review panel did not sit in the boardroom, and the description of how the board process works and the challenge in the boardroom that the panel has made doesn't particularly resonate with me," he told reporters.

"In the boardroom right next door, what I see are nine people who are deeply engaged, who bring a great deal of expertise to the issues we are dealing with, they are probing, they challenge me, and sometimes I speak last in the meetings.

"So the idea that the board members sit there meekly and accept the recommendations that I put to them is very far from the reality that I have lived as the governor.

"So that part of the review discussion didn't really resonate with me."

Where we are sitting at 12:15pm AEST

By Emilia Terzon

- ASX 200: 7,367 points (flat)

- All Ords: 7,561 points (flat)

- Australian dollar: 67.01 US cents (flat)

- Dow Jones: 33,897 points (-0.2%)

- S&P 500: 4,154 points (flat)

- Nasdaq: 12,157 points (flat)

- DAX: 15,895 points (+0.1%)

- FTSE: 7,899 points (-0.1%)

- Spot gold: $US2,007/ounce (-0.6%)

- Brent crude: US$82.87 (-2.2%)

- Iron ore: $US116.95 a tonne (-0.7%)

-

Bitcoin: $US29,035 (-3.8%)

Philip Lowe says he would accept another term as RBA governor

By Michael Janda

A question from ABC TV's The Business presenter Alicia Barry about whether Philip Lowe is planning to seek another term as RBA governor when his current one ends in September.

"It is a great honour and it is a great privilege to have the job that I have and I would also say it is a great responsibility," he responded.

"It is entirely up to the government whether I continue to serve in this role after September.

"If I was asked to continue, I would. If I'm not asked to continue I will find another way to contribute to Australian society."

So the answer is that Lowe would like to stay on, despite coping a lot of public and professional criticism.

When quizzed again on it later in the press conference, Mr Lowe clarified he also wasn't pitching for a contract renewal.

"All I said was if I was asked to stay, then I would," he replied.

"It's an important responsible honourable job.

"If the government would like me to stay then I'm happy to. If they want to have someone else for the reasons you are articulating, I perfectly understand that, and I have other things to do with my life.

"I'm not making a pitch. I'm saying if they want me to stay, then I'm happy to do it."

The ball is now firmly back in the Treasurer's court.