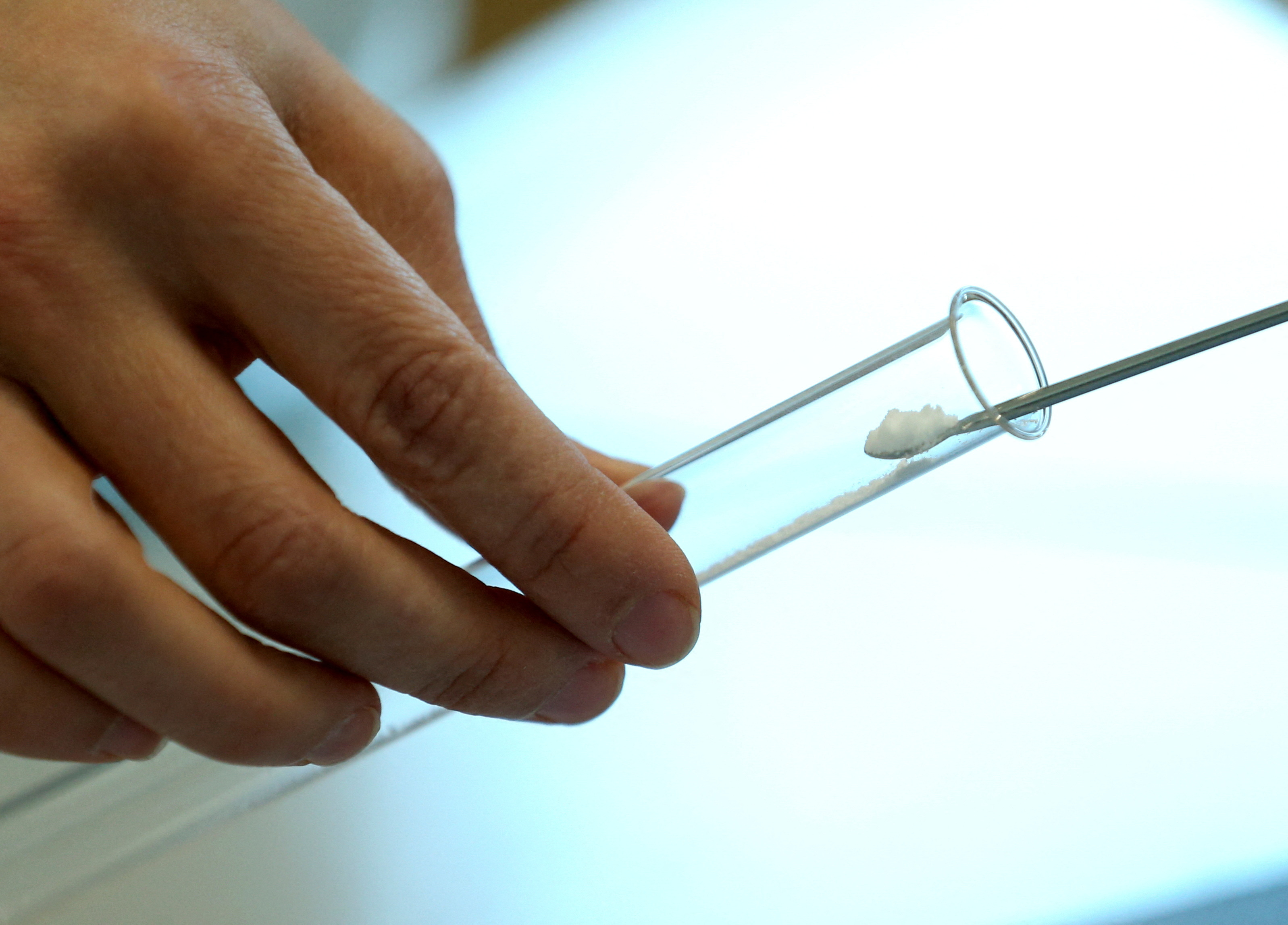

Lithium, the highly reactive silver-white metal that is a crucial ingredient in batteries used in electric vehicles (EVs), is becoming much more expensive – and fast.

In April, as prices hit a record $78,000 a tonne, Tesla CEO Elon Musk floated the idea of the electric carmaker mining and refining the lightweight metal itself due to the “insane” increase in costs.

For governments ranging from China to the European Union that have pledged to phase out combustion engines in the near future, the soaring cost and growing scarcity of the metal raise questions about how they will meet their deadlines, many of which come due as soon as 2035.

With combustion engines accounting for one-quarter of carbon emissions, according to the United Nations, a delay in transitioning away from petrol and diesel cars would deal a serious blow to efforts to reduce carbon emissions and avert the worst effects of climate change.

“As Elon Musk has said, ‘lithium will be the limiting factor,'” Joe Lowry, an expert on the global lithium market and the founder of Global Lithium LLC, told Al Jazeera. “It is very simple math.”

Despite retreating from its April highs, the price of Lithium has jumped more than 600 percent since the start of the year, from about $10,000 per metric tonne in January to $62,000 in June, according to Benchmark Market Intelligence. Citigroup has predicted more “extreme” price hikes on the way.

The soaring prices have been driven by surging demand for light-duty EVs, sales of which doubled to 6.3 million units last year and are projected to hit 26.7 million units by 2030, according to Platts Analytics.

A growing appetite for lithium from manufacturers of energy storage and 5G devices, spacecraft, submarines, and safety and cooling equipment has further put the squeeze on supply. FastMarkets, a commodity price reporting agency, has projected that lithium supplies could altogether collapse relative to demand as soon as 2026.

After years of falling prices, EVs are becoming more expensive, reversing a trend that had the environmentally-friendly vehicles on track to soon be cost competitive against gasoline-powered cars.

Tesla has raised its prices by more than 20 percent since last year, putting its vehicles out of reach of millions of potential buyers.

“The main takeaway here is that the EV market faces many decades of strong, compound growth,” Fastmarkets said in its most recent lithium report.

“For any supply chain that relies on getting raw materials out of the ground, it is going to be a supreme challenge to keep up with year after year of high compound growth.”

Lithium production will need to quadruple by 2030 to keep up with expected demand, according to Fastmarkets.

Mines in the pipeline

The lead time of three to seven years for new lithium mines and evaporation ponds to become productive means that any additional supply is likely to come from Australia, the world’s leading producer.

Two enormous new mines are already in the pipeline in Western Australia, the lithium mining capital of the world, and on the Cox Peninsula, near Darwin, where exploratory drillers have found 7.4 million tonnes of lithium concentrate – just shy of the 7.9 million tonnes of proven reserves in the United States.

China, the world’s largest EV market, is also ramping up production.

Despite holding only 5.1 tonnes, or 7 percent, of the world’s proven lithium reserves, China is now the fourth-largest producer, the number one refiner of processed lithium and the number one maker of lithium batteries, according to energy consultancy BloombergNEF.

Despite holding out the promise of a low-emissions future, lithium production itself comes with eye-watering environmental costs. More than 2.2 million litres of water is needed to mine one tonne of the metal, according to Fairfield Market Research. Extracting the metal is also associated with the release of borax, potassium, and manganese into local water supplies.

From Chile to Serbia, conflict has erupted between miners and people who live near lithium deposits. In North Carolina, residents in the town of Cherryville have railed against plans by Australia-based Piedmont Lithium to open a lithium mine, pointing to unsightly scars left in the landscape by previous miners during the 1950s.

Lithium mines in the Democratic Republic of Congo have become notorious for using child labour, while Amnesty International has documented violations of Indigenous rights by lithium miners in Argentina.

The looming lithium crisis has also unleashed a wave of resource nationalism, particularly in the lithium “triangle” of South America consisting of Argentina, Bolivia and Chile, which holds 60 percent of known reserves, according to the US Geological Survey.

Bolivia’s socialist government is hamstringing foreign investment in its vast reserves, which are the largest on earth. Stricter licensing requirements and nationalisation of water resources are on the cards in Chile, while Mexico is considering nationalising its lithium deposits.

Wealthier lithium-producing countries are hedging their bets by investing in technological innovations and lithium alternatives. In Canada, Salient Energy has touted its zinc-ion battery as the equal to lithium-ion cells and easier to supply.

Researchers at the University of Houston have used a high-energy ball milling process to create electrolytes using sodium-sulphur batteries that could be a viable alternative to lithium-based batteries for grid-level energy storage systems.

At the US Department of Energy’s Pacific Northwest National Laboratory, scientists are stress-testing a new technology that uses magnetic nanoparticles to capture critical materials like lithium from wastewater.

Preliminary results suggest if just a quarter of the lithium in water pumped in oil and gas extraction in North America is collected, it would equal all the lithium mined globally last year.

In Australia, Canada’s Graphene Manufacturing Group and The University of Queensland have used graphene, a carbon material, to develop a faster-charging and more sustainable lithium battery that lasts up to three times longer.

“This project has real potential to provide the market with a more environmentally friendly and efficient alternative [than lithium],” Dean Moss, head of UniQuest, the university’s commercialisation company, said in a statement.

Matthew Hill, deputy head of chemical and biological engineering at Monash University, said that while helpful, such innovations are unlikely to replace lithium completely.

“Different energy storage solutions will find different niches. Things like sodium will be part of the solution but can only operate at elevated temperatures,” Hill told Al Jazeera.

“There are plenty of applications where it is not possible to have a battery running at 130C. Cobalt, which is half the cost of an EV battery, is mined in areas with child labour concerns. These are common themes through all battery chemistry – there are advantages and disadvantages for different solutions, which is why there isn’t going to be an ‘either-or’ solution. But for any application where weight is important, lithium is impossible to beat.”

Hill believes recycling is the only way to solve the lithium crunch, pointing to the widespread use of recycled lead-acid car batteries.

“It is definitely harder as there are more metals to separate. But it is not impossible. The challenge will be about making it economical. It’s not just a scientific issue. It’s an industrial issue, too,” he said.

“Demand for lithium is not going to disappear any time soon. We are going into a commodity super-cycle as we electrify everything. So we’re going to have to find a balance between the environmental damage of mining lithium, compared to the environmental damage of putting more carbon into the air.”