The story between Nvidia (NVDA) and SoftBank dates back to 2017, when Masayoshi Son, the investment company's founder, acquired a $4 billion stake in the chipmaker.

At the time, Nvidia was already making waves with its cutting-edge graphics processing units, which were becoming essential in fields beyond gaming, including artificial intelligence and data centers.

The purchase was just after SoftBank’s $32 billion acquisition of Arm in 2016, both key parts of SoftBank’s strategy to invest in AI.

💸 Don't miss the move: Subscribe to TheStreet's FREE daily newsletter 💸

Son said in 2017 that he expected machines to reach IQs of 10,000 within the next 80 years or so.

“That is happening in this century, for sure,” Son said. “I would say there is no more debate, no more doubt. Will it be in 30 years? Twenty-five years? Thirty-five years? It’s just margin of error, in my view.”

Nvidia was struggling in 2019, with its share price nearly cut in half from its 2018 high. SoftBank sold its stake in Nvidia in 2019, just two years after the initial investment, pocketing more than $3 billion.

But if SoftBank had held on to its original investment in Nvidia, it would be valued more than $15 billion as the chipmaker soared 2600% over the past five years.

What Q3 Big Tech earnings show

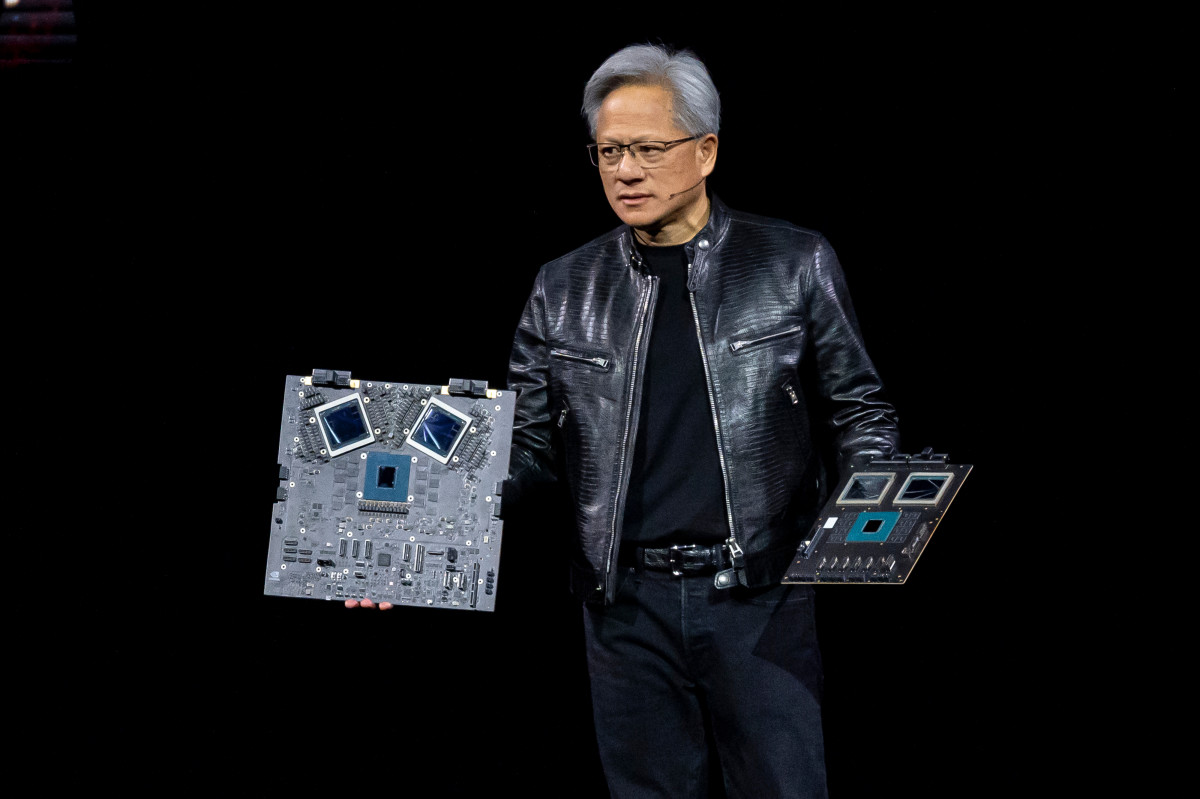

Widespread demand for AI-optimized chips, particularly the Blackwell GPUs, is fueling Nvidia's ascent. These graphics processing units are increasingly used in data centers as they handle the heavy lifting required to train and operate large AI models efficiently.

Nvidia's major clients include Google parent Alphabet, Microsoft, Meta, and Amazon. Each depends on Nvidia’s technology to develop AI-driven applications and services for cloud data center customers.

The demand for Blackwell chips is so intense that industry heavyweights are vying for a slice. In a now-famous dinner, Oracle’s Larry Ellison and Tesla’s Elon Musk reportedly urged Nvidia CEO Jensen Huang to “take more of our money.”

“Everybody wants to be first, and everybody wants to be most,” Huang said.

Related: Analyst revamps Nvidia stock price target after investor meetings

Nvidia’s production pipeline for Blackwell is fully booked through next year, with the first shipments anticipated in November and wider availability planned for early 2025.

Big Tech’s upcoming earnings reports will likely echo Nvidia’s direct or indirect influence. Google-parent Alphabet, Microsoft, Meta Platforms, Apple, and Amazon all report earnings this week. (Microsoft's Q1 report disappointed investors.)

Alphabet’s third-quarter earnings report pointed to rising capital expenditures — up 62% year over year to $13.1 billion. Alphabet is one of Nvidia's largest customers.

Related: Analysts overhaul Alphabet stock price targets as Google parent soars

Similarly, Meta, which owns Facebook, Instagram, and WhatsApp, boosted the low-end estimate of its capex spending this year to $38 billion when it reported third-quarter results. It may spend up to $40 billion, with more spending coming in 2025.

Nvidia's August earnings report set a promising tone, with revenue hitting $30 billion—a 122% increase from a year earlier and surpassing analysts' expectations. Nvidia forecasts “several billion dollars” in Blackwell revenue for Q4, a number likely to cement its position in AI dominance.

Related: Analysts revisit Microsoft stock price targets after Q1 earnings

AMD’s earnings could be concerning. While the results met analysts’ expectations, the company forecast slightly lower revenue for the December quarter. Nvidia investors may worry that this hints at a slowdown in AI-chip demand.

Nvidia's next earnings report is scheduled for Nov. 20.

Nvidia 'undervalued': SoftBank founder

SoftBank's Son recently described Nvidia as "undervalued," highlighting its potential to fuel future advancements toward artificial superintelligence.

Son added that the journey to superintelligence could require "hundreds of billions of dollars."

According to Reuters, Son estimated that achieving artificial superintelligence might require $9 trillion in investment and around 200 million chips, he said at the Saudi FII Summit.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

He also outlined plans to amass "tens of billions of dollars" for his "next big move."

In February, it was reported that Son was considering launching a $100 billion chip venture focused on supplying semiconductors for AI development.

Nvidia stock is up 180% year-to-date.

Related: Veteran fund manager sees world of pain coming for stocks