Biotech isn't the only place investors in health care stocks have made money in 2022.

Although the biotech industry group is leading the medical sector, the Medical-Systems/Equipment group is no slouch. The group itself ranks No. 23 out of 197 groups that Investor's Business Daily tracks, putting it in the top 12% of the market today.

Five of those stocks trade above $10 per share and have Relative Strength Ratings of 96 and higher, out of 99, according to IBD Digital. This means they land in the leading 4% of all stocks in terms of 12-month performance. This year, those stocks have tacked on at least 36% growth.

A Leader Among Health Care Stocks

Sensus Healthcare leads its industry group of health care stocks. Its shares have a best-possible RS Rating of 99 and a matching Composite Rating. The Composite Rating is a 1-99 measure of fundamental and technical measures. As of Tuesday's close, Sensus stock had soared more than 75% this year.

Sensus provides radiation therapy for non-melanoma skin cancer and thick, raised scars known as keloids. In the second quarter, Sensus reported $12.1 million in sales, up 124% year over year. The company brought in 21 cents per share, minus some items, reversing from a year-earlier 2-cent loss.

Analysts following health care stocks expect growth to continue this quarter. They predict earnings growth of 120% and for sales to jump almost 73%.

The health care stock is currently consolidating with a buy point at 15.35, MarketSmith.com shows. On Wednesday, shares dipped below their 50-day moving average, however.

Shockwave, Haemonetics Have Strong Ratings

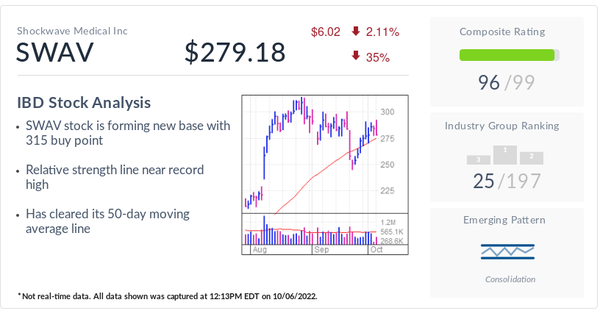

Trailing Sensus, Shockwave Medical has a strong RS Rating of 98. This puts the health care stock among the best 2% of all stocks, regardless of industry group, when it comes to performance over the last 12 months. Shockwave's tools use electrical pulses to break up calcifications in the blood vessels.

Haemonetics, Axonics and Procept Biorobotics have identical RS Ratings of 96. Haemonetics provides blood and plasma services while Axonics sells an incontinence device. Procept is in the robotic surgery segment.

Bullishly, health care stocks Shockwave and Haemonetics also have strong Composite Ratings of 96 and 94, respectively. Axonics and Procept have more middle-of-the-road ratings of 87 and 63.

Haemonetics recently broke out of a consolidation with an entry at 75.44. Shares dipped as much as 4% below their buy point in early September, but that wasn't enough to trigger a sell rule. Investors are advised to sell a stock that falls 7%-8% below its entry.

Promisingly, the four health care stocks have surged 36%-62% this year.

Follow Allison Gatlin on Twitter at @IBD_AGatlin.