“Power prices are going up”, shadow treasurer Jim Chalmers declared last week. But according to energy minister Angus Taylor, “No one’s household power prices have gone up.” So who is right?

With the cost of living at forefront of the election campaign, the competing claims of the government and opposition are over a report showing wholesale electricity prices in Australia’s National Electricity Market surged 67% in the first three months of 2022, and by 141% in the year to the end of March.

Neither Chalmers nor Taylor were technically incorrect in their statements, but each focused on the facts that suited their preferred narrative. So let’s consider the full context.

Increases in wholesale prices

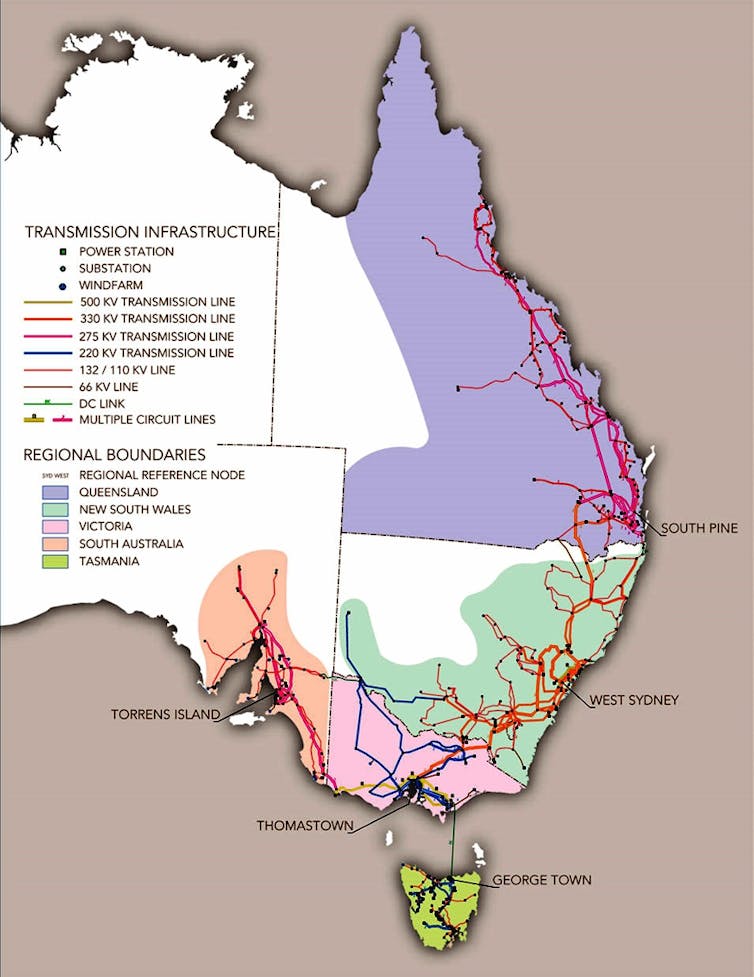

The National Energy Market supplies electricity to about 89% of the Australian population. Though it’s called a national market, it does not include Western Australia, the Northern Territory or western Queensland.

The following graph shows the average wholesale price in the NEM since the first quarter of 2019. Prices in the first quarter of 2022 rose by $35 a megawatt hour (or 3.5 cents a kilowatt hour). This put wholesale prices at their highest level since the first half of 2019.

The next graph shows prices by state since the first quarter of 2020. The three southern states – South Australia, Victoria and Tasmania – had similar increases. Queensland, already with higher average prices, had a bigger increase. New South Wales was in-between.

The report sets out various factors contributing to these price increases. Higher demand for electricity than in the corresponding 2021 quarter was one factor. Most of the other factors, however, relate directly, or indirectly, to the differing mixes of generation in the National Electricity Market’s five state markets.

Share of renewables

The next graph, based on calculations using very detailed operational data, show renewables’ share of wholesale electricity generation by state for the first quarter of 2022. (These numbers exclude rooftop solar’s contribution to total generation.)

Tasmania led the way, with renewables supplying 100% of the wholesale market. Next came South Australia (69%), Victoria (28%), New South Wales (24%) and Queensland (12%).

This clearly shows a correlation between higher wholesale prices and higher reliance on coal-fired generation. In Queensland, coal-fired power stations still account for 70% electricity generation, compared with 66% in New South Wales and 63% in Victoria.

Read more: 4 ways to stop Australia's surge in rooftop solar from destabilising electricity prices

In the first quarter, AEMO’s report notes there was “record low availability” from black-coal generators in New South Wales and Queensland – the lowest, in fact, “since at least 2002”. This was “due to increased outages (mostly unplanned)”. In other words, coal-fired generators broke down more.

A sudden, unplanned outage will cause the wholesale price to shoot up dramatically. Even though such events are usually short-lived, the prices reached are high enough to materially affect average quarterly prices.

Limited interconnectors between states

A second important factor is limited connection between the National Electricity Market’s five state-based markets.

Interconnector transmission lines allow generators in one state to bid to supply electricity in a neighbouring state. Victoria’s connectors with Tasmania and South Australia are why its prices aren’t more in line with New South Wales and Queensland.

But there aren’t enough connections to equalise wholesale prices across all states. In particular, AEMO’s report identifies the inadequate connection capacity between Victoria and New South Wales.

This is the main reason for such a price separation between the southern and northern states. Wind and solar farms in Victoria and South Australia simply can’t sell more to the higher-priced northern markets.

This is, of course, good for consumers in Victoria and South Australia, because the wind and solar generators must instead sell to their local state markets, driving down prices. But it’s not good for consumers elsewhere, or for the owners of those wind and solar generators.

AEMO says a further problem is insufficient transmission capacity within NSW itself. This means the market operator must sometimes intervene to instruct wind and solar generators in the state’s southwest to curtail output to avoid overloading local transmission lines, endangering system security. Reducing the supply from the lowest cost suppliers in the market will obviously push up average wholesale prices.

A third factor has affected black-coal generators in New South Wales and Queensland, which compete for coal with buyers overseas. (Victoria’s coal-fired generators use poorer quality brown coal, which isn’t exported.)

When international coal prices go up, as they have due to Russia’s invasion of Ukraine, the cost of generating electricity for Australian consumers at these power stations also goes up. Only some coal stations are affected but the effect is large enough to push up the general wholesale price.

Renewable generators, by contrast, are unaffected by volatile international coal prices.

Read more: War in Ukraine is changing energy geopolitics

What this means for household prices

Labor has promised to establish a public Rewiring the Nation Corporation to accelerate the construction of transmission lines connecting new renewable generators to major electricity markets.

However, Labor’s statements about power prices going up have blurred the distinction between wholesale and retail prices.

The price consumers pay for electricity is a commercial decision of the electricity retailer (with some regulatory constraints). It obviously includes the wholesale price the retailer pays to generators. But in 2021 the wholesale cost was just 35% of the average total price of residential electricity in the NEM.

Wholesale contracts between generators and retailers cover various periods and include various price change provisions, They do not directly mirror spot wholesale prices, which change every five minutes. Retail prices generally change only once a year.

If the increase of 3.5 cents/kWh in the wholesale cost component in the first quarter was passed on immediately and in full to consumers, it would mean a 13% increase in the average retail price.

That hasn’t happened yet, as Taylor correctly said.

However, unless wholesale prices fall dramatically over the next few weeks, they almost certainly will go up from the start of July.

Hugh Saddler does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.