It's Monday, and the stock market is taking another thrashing. But one of the few stocks vastly outperforming is Kohl’s (KSS).

Shares of the Menomenee Falls, Wis., department-store chain were up as much as 36% and are still 30% higher on the day.

When the S&P’s best day last week was a 0.97% loss, you know it’s been a tough stretch. That’s why Kohl’s bulls are smiling today.

The stock is ripping higher after a reported second takeover offer from activist investors. The latest offer was for $65 a share.

Prior to today, a mild rally in early December took place on similar news.

The question now becomes: Should investors take the money and run or should they hold out for potentially higher offers?

Trading Kohl’s Stock

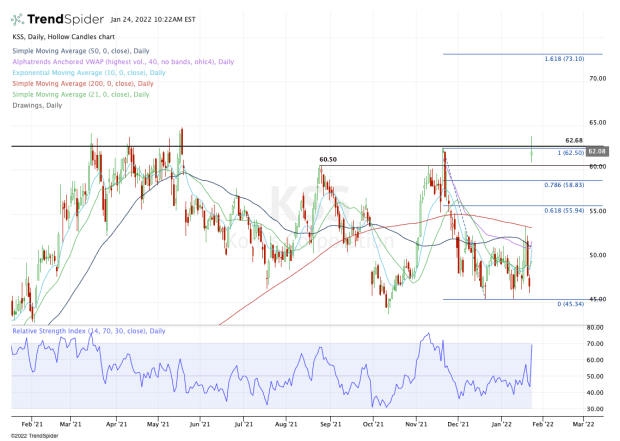

Chart courtesy of TrendSpider.com

Kohl’s stock trades at a reasonable valuation and has a decent dividend yield, but the value is apparently in the buyout. That leaves it open to headline risk on the upside, as well as the risk that the deal falls through.

If you zoom out to a monthly chart, you’ll see that $78 to $80 has been long-term resistance. Could a deal get done up there?

Playing the M&A game is tough because generally speaking the moves happen in a manner that gives investors no time to react.

Take today’s action, for example.

An Amazon-Kohl's Tieup Might Make Sense. Could It Happen?

The stock gapped up by 30%. There was no warning or tell that this was going to be the case, and unless you came into the session long, you had no way to capitalize on the move.

When I look at the daily chart, the $62.50 area has been resistance over the past year, while $45 has been support.

More conservative Kohl’s bulls may consider taking some profit in this area.

Not only is the most recent offer only slightly above this level at $65, but it has been active resistance for a year now.

If another offer comes in higher, these bulls will still have a position to ride higher. If the stock rolls over, at least they would have sold some at a higher price.

On the upside, a move above $65 opens the door to $73, then the long-term resistance zone of $78 to $80. Again, though, the moves to these areas may very well likely depend on takeover offers and/or speculation.

On the downside, I would be somewhat skeptical of Kohl’s stock if it loses the $60 to $60.50 area. Below the 78.6% retracement of the current range (at $58.83) and the stock could start to move lower.

I would hate to see today’s gains evaporate, but that’s the kind of environment we’ve been in lately. If it starts to lose ground, the mid-$50s could be on the table.

.png?w=600)