One of the more surprising developments in the big Bally Sports regional sports networks Chapter 11 meltdown this past spring has been the migration of the NBA's Phoenix Suns and their local TV rights to the place from which they started, free over-the-air broadcast TV.

In late April, the Suns and their siblings, the WBNA's Phoenix Mercury -- both operating under new ownership, billionaire mortgage lender Mat Ishbia -- announced they would not renew their distribution deal with Bally's operator, the bankrupt Sinclair subsidiary Diamond Sports Group.

Instead, the teams would embark on an OTA deal with broadcaster Gray Television, putting all their games on KTVK Phoenix and the newly launched KPHE Phoenix.

Digital video technology company Kiswe Mobile, meanwhile, would build a direct-to-consumer app-based platform for the teams, distributing their games across connected TV and mobile devices.

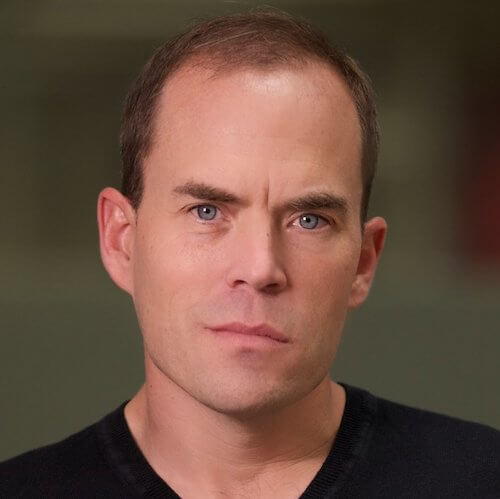

Speaking to Next TV on the phone last week, Mike Schabel, chief strategy officer for Kiswe Mobile, said the company remains in "build mode" on the new DTC service, still working out basic elements like price point, as well as many of the technology decisions that go into the app itself.

Indeed, we had a lot of detailed questions that Schabel just couldn't answer -- either because he wasn't allowed yet to discuss these specific issues ... or, at this point, he just simply doesn't know. (Schabel and his team have only until late October, when the Suns start their regular season, to figure this all out.)

But Schabel, a former Bell Labs worker bee (Ireland chapter) who earned a Ph.D in chemical engineering down the road from the Suns at the University of Arizona in Tucson, couldn't help but share his enthusiasm for a deal he thinks could lead to fundamental changes in local sports broadcasting.

For one, he believes the Suns won't leave any monetization points on the floor under their new TV configuration, which has them reaching more than three times as many households, 2.8 million, compared to the 800,000 tapped into by their previous Bally Sports Arizona arrangement.

"Those local ad spots are going to be highly valuable," Schabel said. "Local teams are really good at selling local ads."

Throw in subscription revenue from Kiswe, as well as innovations in things like e-commerce for team merchandise, along with intangible elements like improved arena attendance due to increased overall fan engagement.

"When you start to add all of that up, you're shifting the buckets of economics, but you're not shifting the overall money dramatically," Schabel explained.

Beyond monetization factors, Schabel believes Kiswe's vision for app-based monetization will provide the teams with a means of reaching younger consumers who simply aren't in the habit of leaning back and watching games on pay.

"We’re looking at the folks who are fundamental cord cutters and cord nevers," explained Schabel, who doesn't just limit that cohort to just younger sports fans.

The Suns Kiswe app, he said, "will have social interaction embedded into the experience."

Fans will be able to conduct a managed chat with friends and other fans who they haven't even physically met on their devices through the app as games unfold, contributing elements like selfie reaction videos.

"The fans can be part of the experience, showing off their merch, showing off their enthusiasm," he added. "They're part of the show."

The Suns and the Mercury aren't the only pro team to make this retrograde local TV journey recently.

In early May, the NHL Stanley Cup Champion Vegas Golden Knights bolted Warner Bros. Discovery's sunsetting AT&T SportsNet RSN system and entered a new OTA broadcast deal with Scripps Sports.

Similarly, the NBA's Utah Jazz also bolted the folding AT&T SportsNet to pursue a free OTA broadcast deal with the broadcasting company whose (not so) strategic decision-making started the whole RSN meltdown in the first place, Sinclair.