CVS Health (NYSE:CVS) has been analyzed by 18 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 8 | 5 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 4 | 2 | 0 | 0 |

| 2M Ago | 2 | 4 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

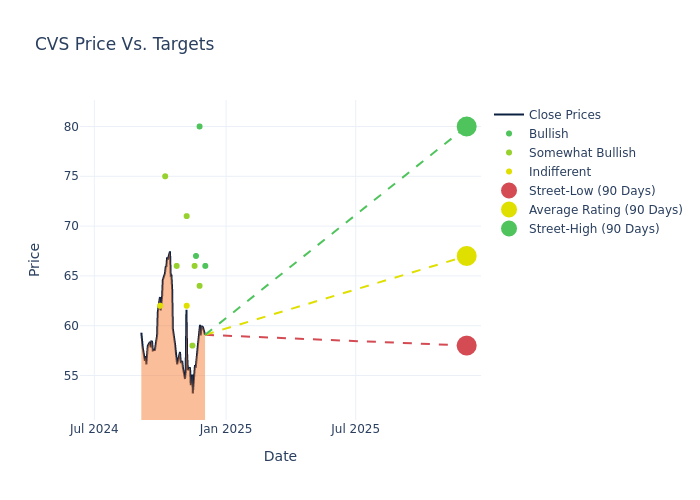

Analysts have set 12-month price targets for CVS Health, revealing an average target of $68.83, a high estimate of $85.00, and a low estimate of $58.00. Surpassing the previous average price target of $66.78, the current average has increased by 3.07%.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of CVS Health's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| George Hill | Deutsche Bank | Maintains | Buy | $66.00 | $66.00 |

| Charles Ryhee | TD Cowen | Raises | Buy | $80.00 | $73.00 |

| Jessica Tassan | Piper Sandler | Lowers | Overweight | $64.00 | $72.00 |

| David Macdonald | Truist Securities | Lowers | Buy | $67.00 | $76.00 |

| Stephen Baxter | Wells Fargo | Raises | Overweight | $66.00 | $60.00 |

| Ben Hendrix | RBC Capital | Lowers | Outperform | $58.00 | $68.00 |

| Kevin Caliendo | UBS | Raises | Neutral | $62.00 | $60.00 |

| Andrew Mok | Barclays | Lowers | Overweight | $71.00 | $75.00 |

| Stephen Baxter | Wells Fargo | Lowers | Equal-Weight | $60.00 | $61.00 |

| Ann Hynes | Mizuho | Lowers | Outperform | $66.00 | $73.00 |

| Andrew Mok | Barclays | Lowers | Overweight | $75.00 | $82.00 |

| David Macdonald | Truist Securities | Raises | Buy | $76.00 | $66.00 |

| Andrew Mok | Barclays | Raises | Overweight | $82.00 | $63.00 |

| Elizabeth Anderson | Evercore ISI Group | Raises | Outperform | $75.00 | $62.00 |

| Charles Ryhee | TD Cowen | Raises | Buy | $85.00 | $59.00 |

| Sarah James | Cantor Fitzgerald | Maintains | Neutral | $62.00 | $62.00 |

| Sarah James | Cantor Fitzgerald | Maintains | Neutral | $62.00 | $62.00 |

| Sarah James | Cantor Fitzgerald | Maintains | Neutral | $62.00 | $62.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to CVS Health. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of CVS Health compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of CVS Health's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of CVS Health's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on CVS Health analyst ratings.

Unveiling the Story Behind CVS Health

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

CVS Health's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: CVS Health's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 6.31%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: CVS Health's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 0.09%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): CVS Health's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 0.12%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.03%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 1.1, CVS Health adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.