Throughout the last three months, 15 analysts have evaluated BlackRock (NYSE:BLK), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 10 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 4 | 1 | 0 | 0 |

| 3M Ago | 1 | 5 | 1 | 0 | 0 |

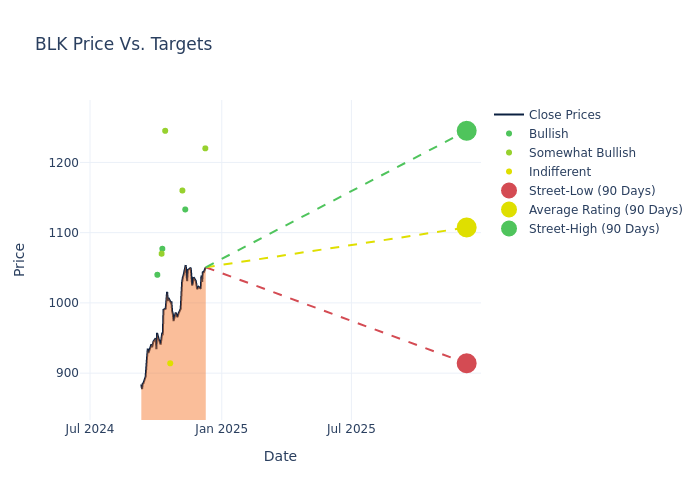

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $1069.2, a high estimate of $1245.00, and a low estimate of $864.00. This upward trend is evident, with the current average reflecting a 7.31% increase from the previous average price target of $996.36.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive BlackRock. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Benjamin Budish | Barclays | Raises | Overweight | $1220.00 | $1120.00 |

| Brian Bedell | Deutsche Bank | Raises | Buy | $1133.00 | $1105.00 |

| Glenn Schorr | Evercore ISI Group | Raises | Outperform | $1160.00 | $1040.00 |

| Kenneth Worthington | JP Morgan | Raises | Neutral | $914.00 | $864.00 |

| Benjamin Budish | Barclays | Raises | Overweight | $1120.00 | $1010.00 |

| Glenn Schorr | Evercore ISI Group | Raises | Outperform | $1040.00 | $995.00 |

| Mike Cyprys | Morgan Stanley | Raises | Overweight | $1245.00 | $1150.00 |

| Bill Katz | TD Cowen | Raises | Buy | $1077.00 | $960.00 |

| Michael Brown | Wells Fargo | Raises | Overweight | $1070.00 | $1000.00 |

| Benjamin Budish | Barclays | Raises | Overweight | $1010.00 | $990.00 |

| Mike Cyprys | Morgan Stanley | Raises | Overweight | $1150.00 | $1036.00 |

| Glenn Schorr | Evercore ISI Group | Raises | Outperform | $995.00 | $945.00 |

| Alexander Blostein | Goldman Sachs | Raises | Buy | $1040.00 | $960.00 |

| Kenneth Worthington | JP Morgan | Raises | Neutral | $864.00 | $774.00 |

| Michael Brown | Wells Fargo | Announces | Overweight | $1000.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BlackRock. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of BlackRock compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of BlackRock's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of BlackRock's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on BlackRock analyst ratings.

Discovering BlackRock: A Closer Look

BlackRock is the largest asset manager in the world, with $11.475 trillion in assets under management at the end of September 2024. Its product mix is fairly diverse, with 55% of managed assets in equity strategies, 26% in fixed income, 9% in multi-asset classes, 7% in money market funds, and 3% in alternatives. Passive strategies account for around two thirds of long-term AUM, with the company's ETF platform maintaining a leading market share domestically and on a global basis. Product distribution is weighted more toward institutional clients, which by our calculations account for around 80% of AUM. BlackRock is geographically diverse, with clients in more than 100 countries and more than one third of managed assets coming from investors domiciled outside the US and Canada.

Key Indicators: BlackRock's Financial Health

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: BlackRock's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 14.93%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 31.38%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.01%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): BlackRock's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.26%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.34.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.