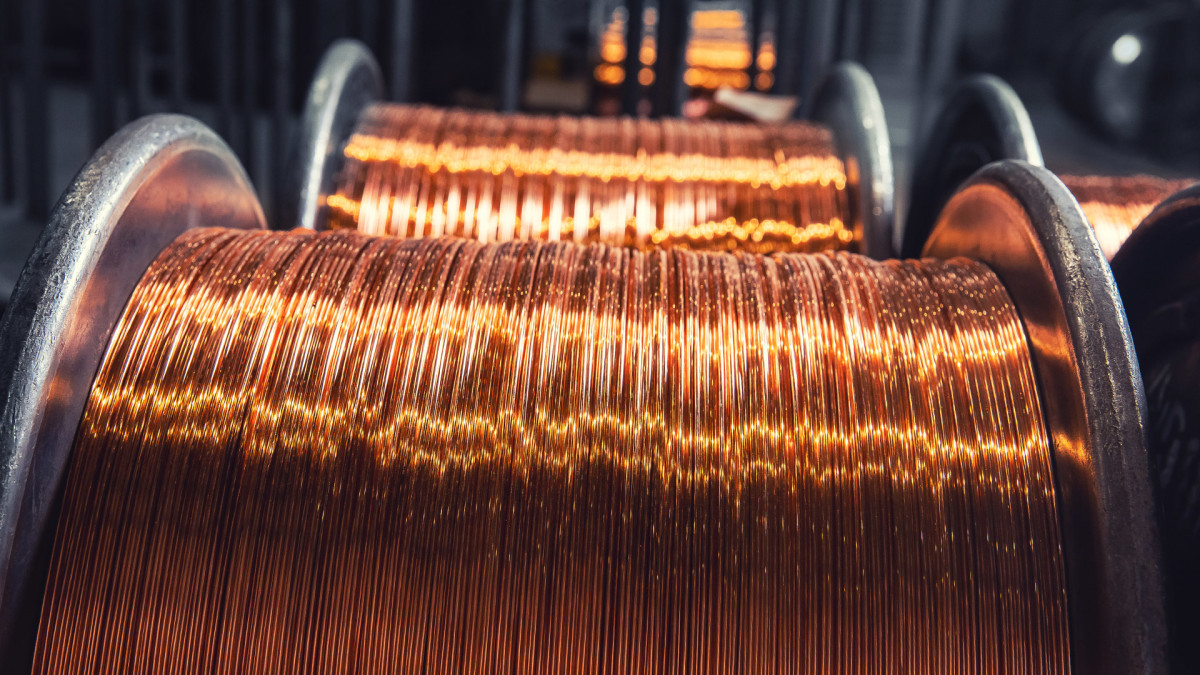

Copper has become an even higher demand metal in recent years with the expansion of the electric vehicle industry and the rise of artificial intelligence and other high-tech advances.

The metal is essential for manufacturing the wire necessary for power generation, and obtaining that needed copper requires the hard work of mining the metal from beneath Earth's surface.

Related: Essential retail chain files for Chapter 11 bankruptcy

The high demand for copper is reflected in its price as the metal's futures were priced at $4.51 per pound on June 11, according to CME Group, after dropping from its record high of $5.17 per pound on May 15, 2024.

The need for copper is expected to continue rising as the demand for copper exceeds global production this year, Citigroup analysts predict, with the shortfall lasting three years, the Wall Street Journal reported.

Despite the extraordinary need for high amounts of copper, some copper mining companies are still having problems generating revenue and profits after facing some unfortunate circumstances.

Yerington, Nev.-based Nevada Copper in 2019 began operating an underground mine, processing plant and an open pit that is in pre-feasibility stage of development at its Pumpkin Hollow project about eight miles southeast of its Nevada headquarters. The company's parent, Nevada Copper Corp., is a Canadian company that was publicly traded on the Toronto Stock Exchange.

The project contains substantial mineral reserves, including copper, gold, silver and iron magnetite. The underground mine is projected to produce an annual average of 60 million pounds of copper, 9,000 ounces of gold, and 173,000 ounces of silver over its first five years of operation and an annual average of 50 million pounds of copper, 8,000 ounces of gold and 150,000 ounces of silver over the life of the mine.

The underground mine is projected to have 1.8 billion pounds of mineral resources, while the open pit development has about 5 billion pounds of copper.

Related: Popular fast-food chain facing bankruptcy, takeover

Shutterstock

Copper miner forced to shut down production

Unfortunately, as the third quarter of 2022 began, geotechnical challenges restricted access to the underground mine, forcing Nevada Copper to suspend mining operations in the underground mine, eliminating its primary source of operating income.

The company reached an agreement with key stakeholders on a financing package in October 2023 that allowed it to restart and ramp up operations at the underground mine. Despite restarting operations, production was occasionally halted for repairs, which prevented the company from continuing its processing operations for commercial production and resulted in lower-than-expected production and revenues.

More bankruptcy:

- Bankrupt retail chain’s CEO pay package threatens its future

- Popular sporting goods chain faces Chapter 11 bankruptcy

- Popular restaurant chain shares bad Chapter 11 bankruptcy news

With limited financial resources, significant capital and operating costs and substantial debt from construction of the underground mine and the key stakeholder financing, the company sought a sale transaction in the fall of 2023 but was unsuccessful.

After failing to find a buyer for Nevada Copper, the company on June 10 decided it needed to file for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of Nevada to give it adequate time to pursue a sale process, according to court papers. The debtor is expected to seek recognition of its U.S. bankruptcy in the Companies' Creditors Arrangement act.

The debtor listed $500 million to $1 billion in assets and $100 million to $500 million in liabilities in its petition, which included $279.2 million in secured debt obligations, $226.6 million in unsecured and intercompany loans.

The debtor will a seek approval of up to $60 million in debtor in possession financing from two affiliates of Elliott Investment Management with $20 million available on interim approval and another $40 million available on final approval.

Related: Veteran fund manager picks favorite stocks for 2024